Don’t Get Hung Up on the Size of Your Investment Nest Egg

One of the chief mistakes new investors (and seasoned investors) make is to focus on the dollars. While dollars do matter, for most of life a percentage should be the priority. Of course, once you know the percentage, you should look at the dollars.

Percentages to Love

There are several I adore. I love investments with a high five-year dividend growth rate. I love ETFs that have a low expense ratio. I love the high returns of cash I receive from our Fidelity VISA Rewards card and our Amazon Chase VISA. I love our easy income dividend increase percentages.

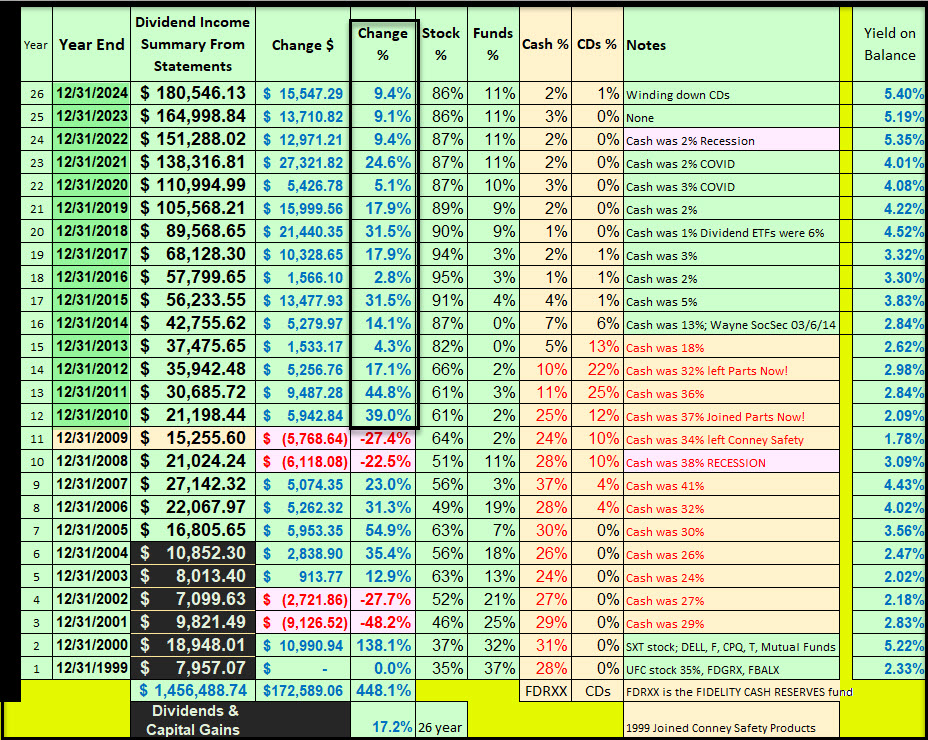

In the following summary of our dividend income, notice the “Change %” year after year. Beginning in2010 my approach and investment strategy changed. Does our income keep pace with inflation?

Percentages to Hate

There are several you should “hate.” They include low return on cash deposits, poor total yields on bonds, high costs on mutual funds and ETFs, the cost of consumer debt, and fees charged by your advisor that are a percentage of your total balance. I also hate the 60/40 rule for investing: having 40% of your assets in “safe” investments is a recipe for inflation disaster.

For example, if the fee charged by your financial advisor totals one percent each year, and you have $500,000 in assets, you should calculate the total cost of that advisor’s work and advice. Did you get $5,000 of advice and solid returns that beat the S&P 500?

If you have $1,000,000 and the fee is still one percent, ask yourself some questions. Did you get $10,000 of advice and solid returns that beat the S&P 500? One question is, “why am I paying the same person twice as much for the work he or she is doing as someone who has half the assets? In the same way, if the mortgage rate is five percent and you are buying a home that costs $500,000, you want to look at the total cost of the loan in dollars. Those numbers can be wakeup calls.

Investment Strategy

If you create an investment strategy, then it is better to consider percentages than it is to consider the current total dollars. This is true when you have $5,000 to invest and when you have $1,000,000 to invest. You should understand the “Rule of 72.” (I’ve written about this rule in the past.) You should understand the concept of compounding interest.

One percentage value that I care about when looking at a new investment is the 5-year dividend growth rate. This is expressed as a percentage. If the rate is greater than five percent and the dividend is adequately covered by earnings, I am interested.

Another percentage I care about is the rate of inflation. If the rate of inflation is three percent, I know that each dollar is worth less at the grocery store and the gas pump. It is also worth far less when buying insurance in recent years.

Dividend Growth Strategy – 9%

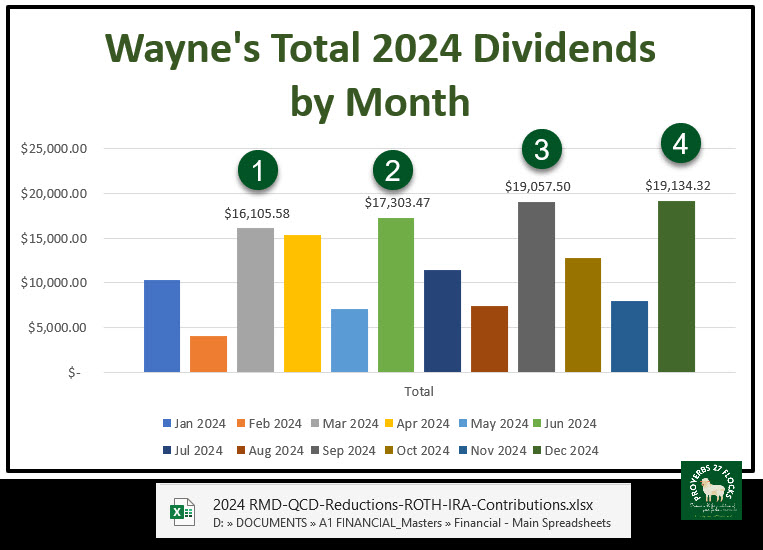

While it is certainly good to look at the total growth of your investment portfolio in both dollars and percentages, I prefer to focus on something else. I want our dividends to grow each year. This is a key component of the “Easy Income Strategy” that is foundational to our success. I am pleased to report that 2024 exceeded my expectations. In fact, the last three years have all seen dividend growth above nine percent.

How is this possible? Some of it is due to reinvesting dividends in more dividend growth stocks. Some increases are created by selling underperforming assets and replacing them with better investments. Some of it is from investing the income I receive from trading covered call options. But most of it is just the simple underlying strategy. Buy dividend growth investments and let them do the work for you.

Now Look at the Dollars

Because of a focus on dividend growth, the growth of our income has far outweighed the growth of inflation.

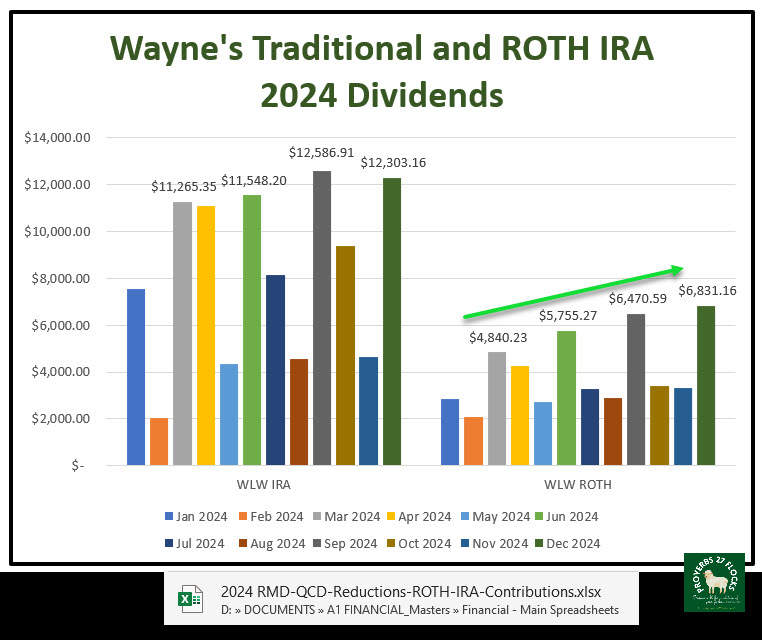

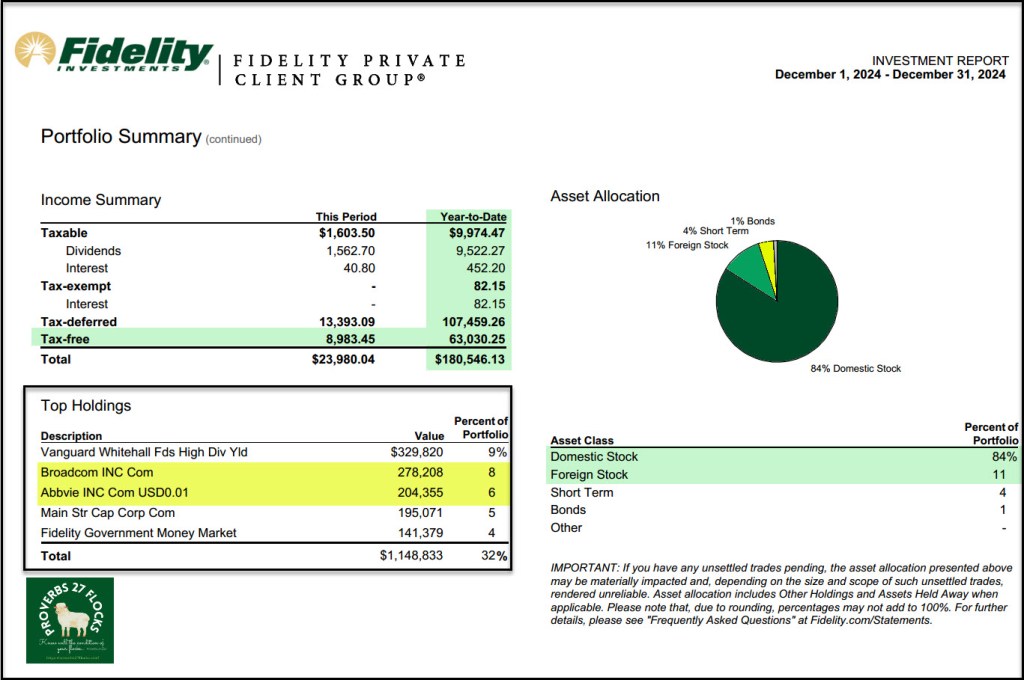

The December 2024 Fidelity Investments statement helps illustrate the power of wise choices in percentages.

Suggestion

Ask yourself how much of your investment total is being removed from your account every year by the bad percentages? Look at that with a very critical eye.

When building your investment strategy set a goal. But focus more on percentage rather than a specific dollar goal. One example would be to set a goal of increasing your dividend income using a focus on investments (stocks and ETFs) that have a history of growing dividends.

Finally, what percentage of your income in 2024 did you set aside for retirement? If it was less than 10%, consider what you might want to do differently in 2025.

Wayne you not only a great investor/owner but you are also a great teacher – love the way you stress the importance of simple but key statistics that should guide a long term investment decision.

Where do you get the 5 year dividend growth rate…is it calculated or is this data available from somewhere else?.

Thanks again for your words of wisdom!!

LikeLiked by 1 person

I usually use Seeking Alpha. I believe you can see that information with the free version. I have a paid subscription that is worth every dollar.

LikeLike

Thanks Wayne…yes i did purchase SA and will analyse my stocks based on the metrics you suggested…thanks again.

LikeLiked by 1 person