A Snapshot of Three Pieces

One of the reasons I use Excel for our investment portfolio analysis is that a pivot table does a nice job of summarizing our eight Fidelity Investments accounts. There are some investments that appear in several accounts. For example, we hold shares of VYM, SCHD, and DGRO in multiple accounts. We also have shares of PFE, ABBV, MAIN, EOG, and F in multiple accounts.

For today’s blog post, the three pivot tables help me see vital information about our investments. I want to see which holdings are contributing to our annual income. I want to be certain that the income comes from good investments and that there is broad diversification.

I also want to know where we stand with our ETF investments and which investments make up the top fifteen by current value.

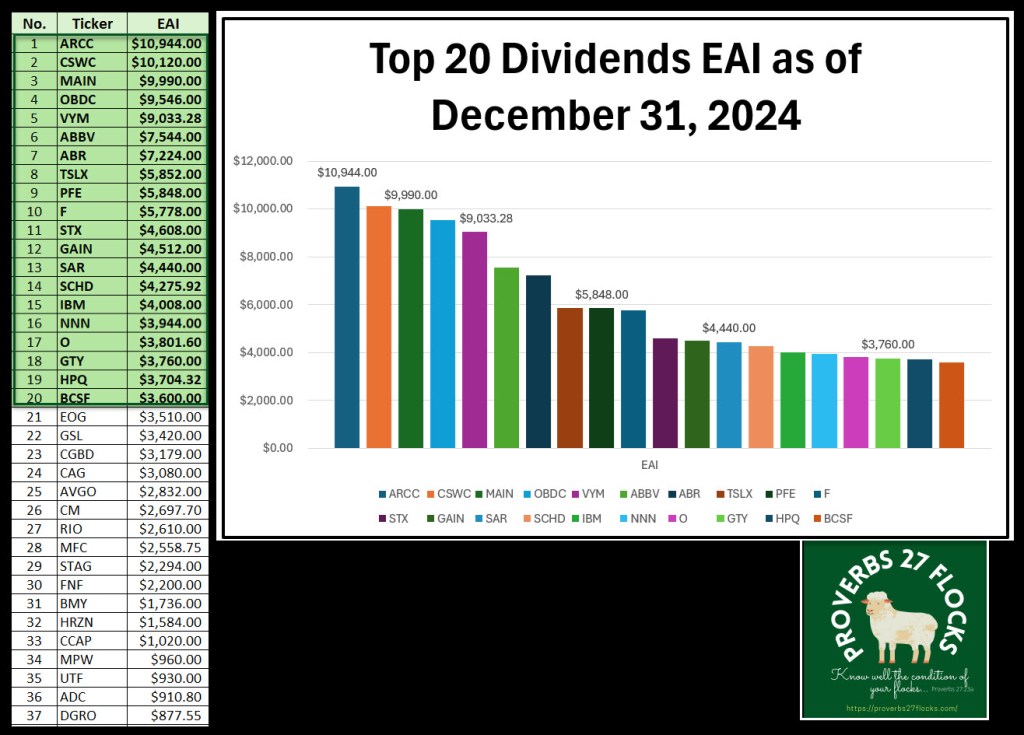

Top Twenty Investments by EAI

Estimated Annual Income (EAI) is a good way to understand what is reasonably possible for incoming cash during the next twelve months. It is likely that our dividend income will easily reach $164K during 2025, but this number is very conservative because it does not include dividend increases or special dividends. It should not be surprising that the top five contributors are business development companies (BDCs) and VYM.

The top twenty include a variety of investments: health care, technology, consumer discretionary, and REITS. BDCs and REITs are especially powerful income-producing investments.

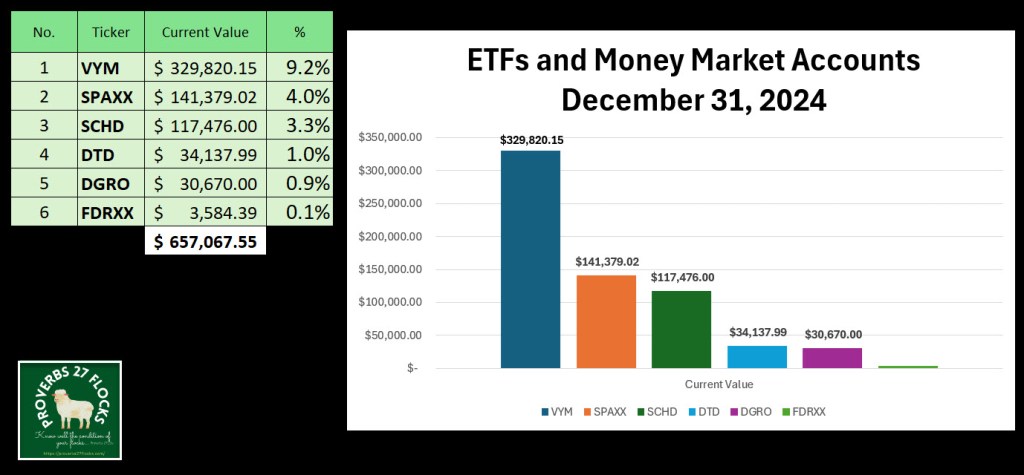

Top Six ETFs and Money Market Funds

The primary reason for this analysis is to help me determine which ETFs I want to grow during 2025. I have been adding shares of SCHD and plan to continue to do so. SCHD makes up $117K while VYM is a hearty $330K. I doubt that I will buy more VYM. That isn’t because I don’t like it, but because there is a better yield for SCHD at this time.

SCHD’s current yield is 3.64% while VYM is currently yielding 2.74%. To help you understand why I like SCHD, it has a 4 Year Average Yield of 3.28%. I think it is rational to believe that SCHD’s share price will increase as more investors add to their dividend growth portfolio as interest rates decline.

The $141K in SPAXX is for QCD giving and RMD withdrawals for 2025. The good news is that my RMD for 2025 is less than what it was for 2024. This was accomplished by increasing my ROTH conversions and by doing most of our charitable giving directly from my traditional IRA.

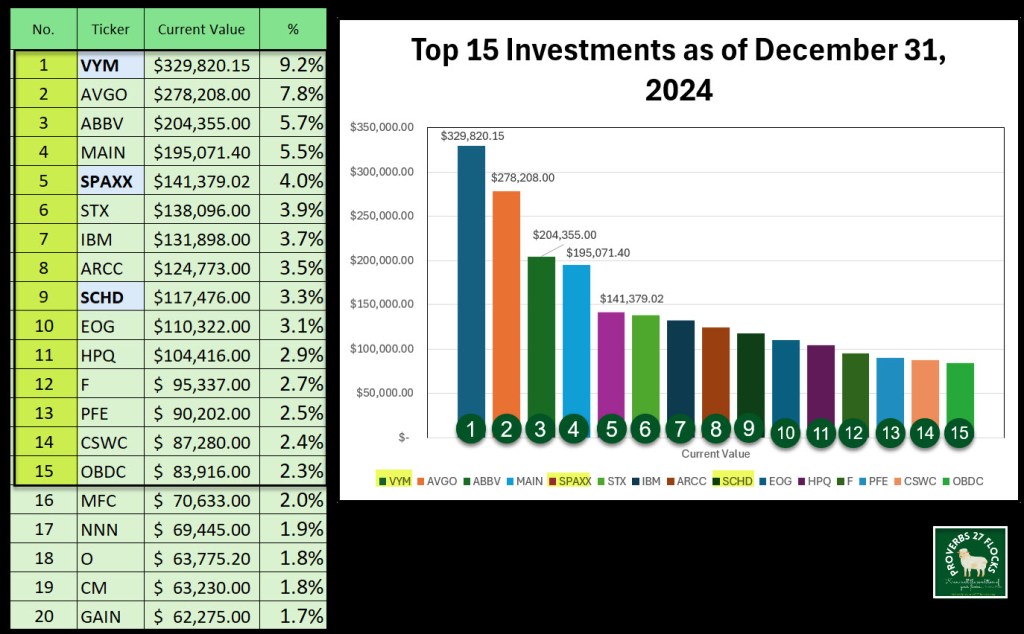

Top Fifteen Investments By Current Value

At the end of the year, our top five investments haven’t changed much. VYM is still at the top, followed by AVGO (technology), ABBV (biotech healthcare), MAIN (a BDC that pays a monthly dividend), and SPAXX (cash). Technology investments play an important role in the top fifteen. I hold shares of AVGO, STX, IBM, and HPQ. ETFs make up sixteen percent of our total investments at the end of 2024.

This view helps me quickly see if there are any investments that have exceeded five percent. As you can see, AVGO now has 7.8% of our total investment dollars. I plan to reduce our AVGO holdings by using covered call options during 2025.

2024 Included a Gift from Investor Pessimism

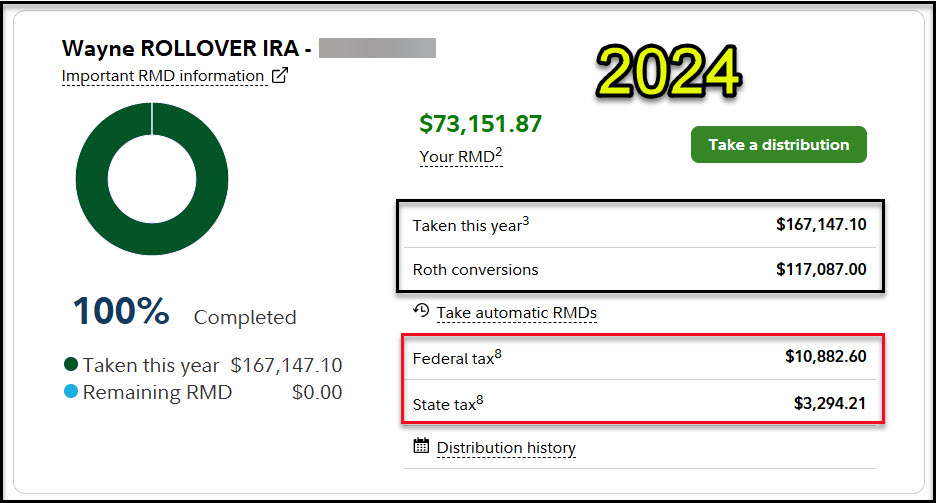

Much to my delight, the market was down when the year ended. As a result of that, and our QCD giving and ROTH conversions, the 2025 RMD will be $71,425.50. This is excellent. Normally the RMD will increase each year. 2024’s RMD was $73,151.87. Given our current income levels, it is highly likely that I can exceed $100K in ROTH conversions in 2025.

My goal is to continue to keep the RMD below $75K as long as possible. Bull markets make that a bit more difficult, but a bear market would be welcome in 2025. It makes it possible to buy more investments at a lower price.

Another great article with great information as i try to duplicate the same investments that you have in your portfolio. I have been trying to time my buys and sells to minimize any loss due to current market pricing and that does not always work out the way you want. However i am steadily moving in that direction. I also wanted to learn how you download the data from Fidelity investments and calculate the EAI and the analysis you do using pivot tables.

Thanks again for providing great financial information !!

LikeLiked by 1 person

I use the POSITIONS page on Fidelity. In the upper right there are three dots. If you click on them you can download your positions. If you select all accounts you will get all positions in all accounts. If you select just one account, it will download just that account.

Before you do the download, select OVERVIEW or DIVIDEND VIEW. Each spreadsheet contains the relevant data.

The file name will look something like this for the download: Portfolio_Positions_Jan-02-2025.csv

There are helpful videos on Youtube for creating pivot tables. Most of them are overly complicated, so I just might create may own video to share.

Here is one that covers a lot of the bases with very little extra baggage: https://www.youtube.com/watch?v=wEDGdxtcEoE

LikeLike