Real Estate Does Not Have to be Difficult

Do you want to invest in real estate? Perhaps you don’t because you think it is risky and expensive. You also probably don’t want to deal with tenants, fix plumbing, or replace the roof on the building. I don’t want the headaches, but I do want the income from real estate that is properly managed with good-to-great tenants.

One investment I like has the ticker symbol NNN. It is a retail REIT. I am featuring this REIT today because I added 150 shares on Friday. This brings my total NNN holdings to 600 shares.

Company Profile

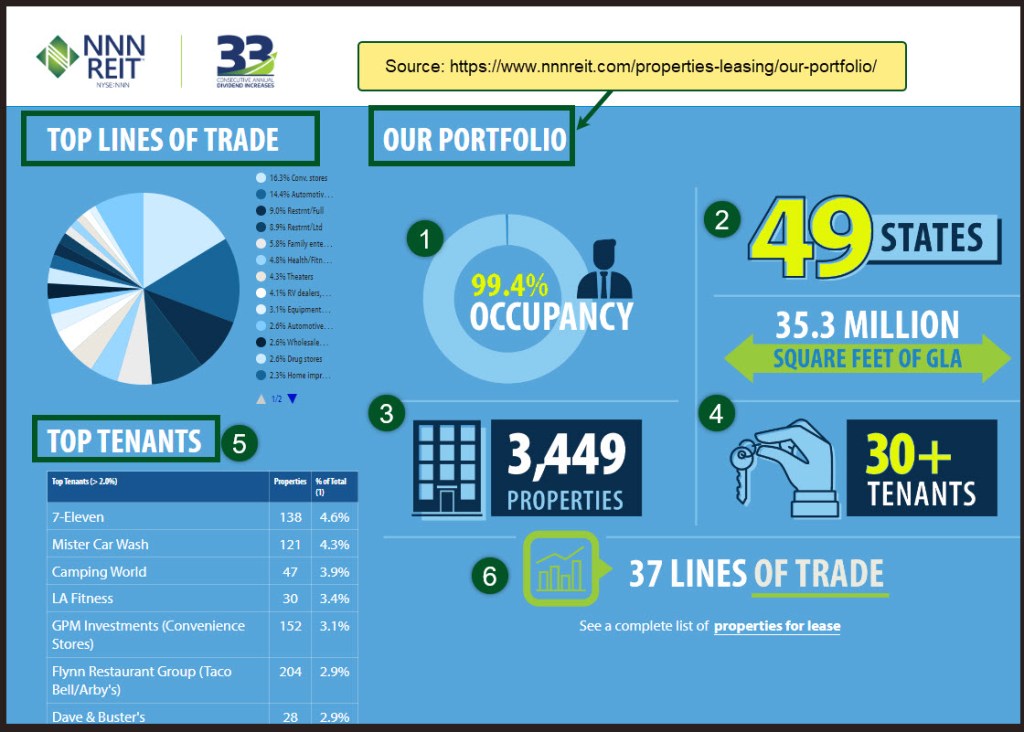

NNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases. As of March 31, 2023, the company owned 3,449 properties in 49 states with a gross leasable area of approximately 35.3 million square feet and with a weighted average remaining lease term of 10.3 years. NNN is one of only three publicly traded REITs to have increased annual dividends for 33 or more consecutive years.

Stock Rover Analysis

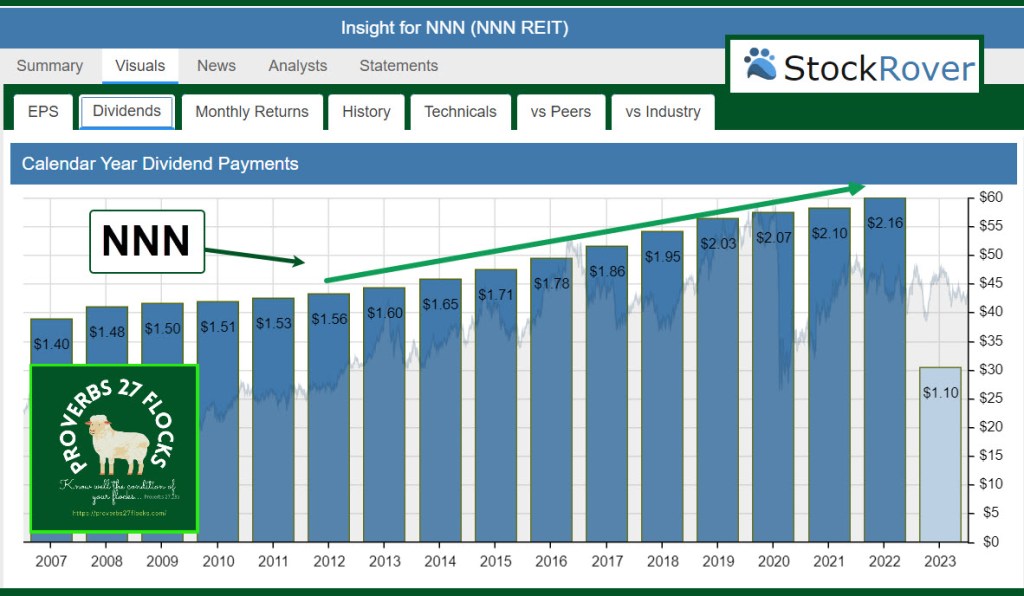

I usually don’t use the investment research on Fidelity’s web site. It is too cumbersome to navigate, at least for me. Therefore, I have two paid subscriptions for stock-related information. One of them is Stock Rover. I used to use Weiss Ratings, but their service was not as robust as Stock Rover or Seeking Alpha. The following three images tell a story about NNN.

The first one shows the dividend history from 2007 to the present. Bear in mind that 2023 is still underway, so it is not a certainty that the dividend will reach $2.20 annualized. However, I think it is highly likely.

The second one is equally important, because it shows total returns for the same timeframe. In other words, wise investors want to know not only the dividend income returns, but the share appreciation as well. Since 2007 dividends with reinvestment increased NNN’s return from 84% to 211%. So if you only look at dividend returns you would have cause to be skeptical.

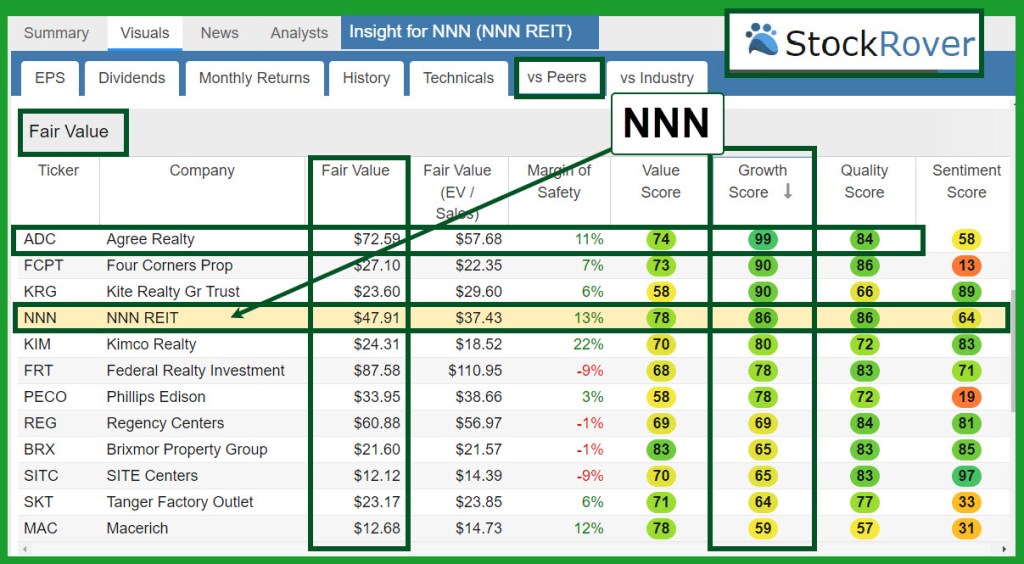

The third image shows the fair value of NNN compared to other similar REIT investments. What I am most interested in is the “Growth Score.” Notice the top three are ADC, FCPT, and KRG. NNN comes in fourth place, which really isn’t bad. I own shares of ADC, FCPT, and NNN.

A Second Opinion: Seeking Alpha

Seeking Alpha, as you might expect, presents information in some different views. I find their website helpful for finding comparable investments and I like the QUANT rating as a way to gauge the quality of a potential investment. I will talk about the five images so that you can see what I look at.

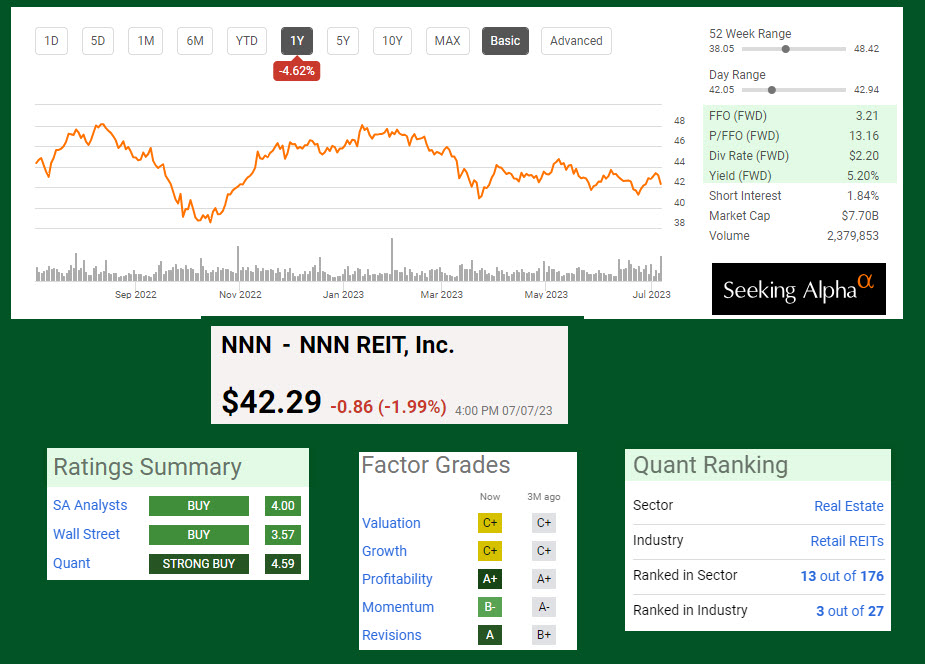

The first image is the main screen for the investment in question. I look at the graph to understand the price fluctuations. When I enter my buy limit order I want to get the best possible price. For a REIT I also compare the Dividend Rate ($2.20) with the P/FFO FWD). The FFO must be a number greater than the dividend rate. For NNN the FFO is $3.21. This is important. I don’t recommend buying a REIT if the FFO number is smaller than the dividend rate. That is asking for trouble. As you can see, the current QUANT rating is a “Strong Buy” and NNN is rated 13 out of 176 Real Estate REITs. In other words, it is at the top of it’s class – in the top 10%.

Dividends

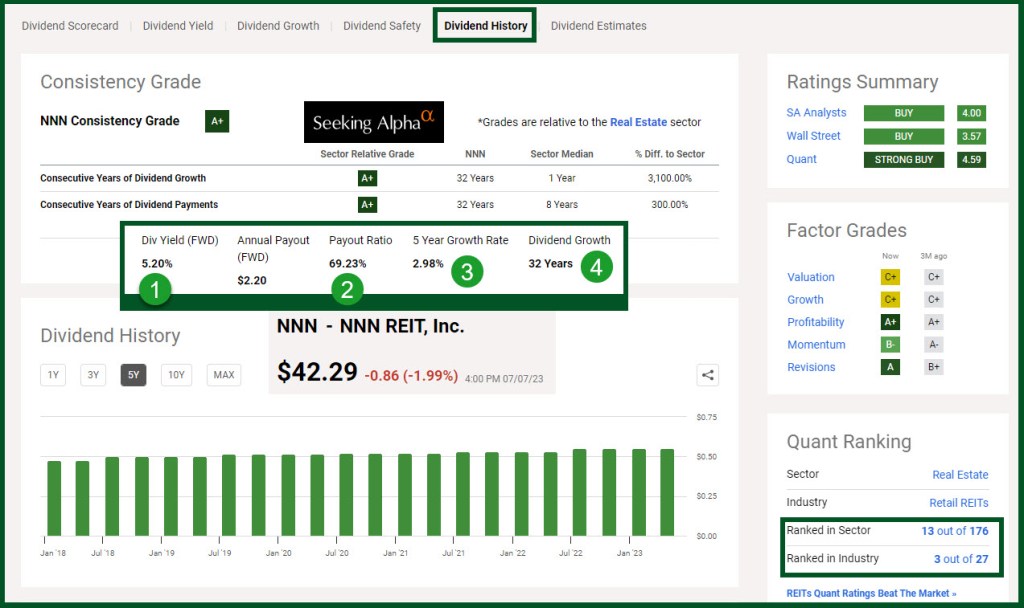

Just like Stock Rover, I want to examine the dividends. Because I am a “dividend growth” investor, I like to see dividend growth over time. NNN has 32 years of dividend growth history, although the rate of the increase is only 2.98% per year over the last five years. That, however, is better than many other types of investments.

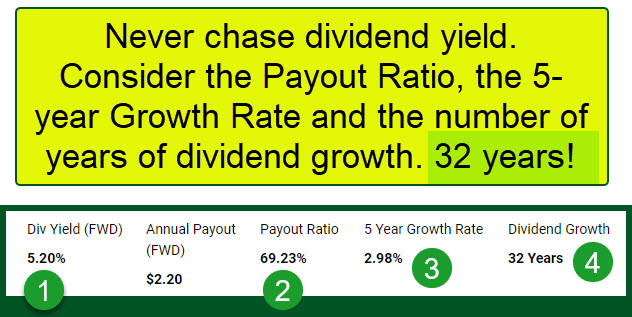

To help you focus on the key metrics, the following image gives you a helpful reminder of the things that matter. The yield is decent at 5.20%. The Payout Ratio, based on FFO and the dividend rate is a sensible 69.23%. The five-year growth rate and the years the dividend have been growing round out the top four things I want to see when I choose an investment. Now I just sit back and collect the dividend. Because we have 600 shares of NNN, and the annual dividend rate is $2.20, I can expect, on an annual basis to receive $1,320 in dividends in the next twelve months. That is an average of $110 per month. $110 buys a decent amount of groceries.

Top Retail REIT Stocks

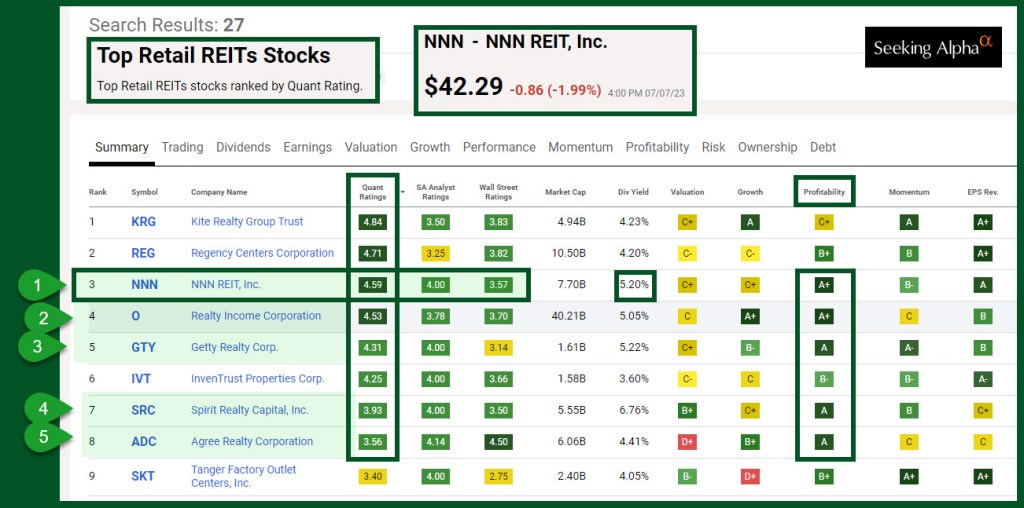

Another helpful view in Seeking Alpha is shown in this next image. Five of the top 9 investments (by QUANT rating) are in our stock portfolio. They are NNN, O, GTY, SRC, and ADC. One thing a wise investor does is evaluate a company’s profitability. The easy way to do that is to look at the ratings in the Profitability column. Now, it is true that most of these do not have high growth, so these REITs, for the most part, are not for the growth investor. I buy other investments for growth. I buy REITs for easy income.

Revenue and FFO Trends

If a company is growing revenue, that is generally a good thing. FFO, or Funds From Operations, is the REIT way of saying what money is available to pay the dividends. As you can see in this graph, the FFO estimate has been beaten by NNN each quarter since Q1 2022.

Recommendation

Whether or not you invest in real estate, keep diversification in mind. Also, if there was a good ETF that was focused on real estate, I would tell you. To date I have not found one that meets my requirements. If you want to allocate $30,000 of your retirement assets to real estate, then I suggest you start by purchasing $10,000 of NNN using a buy limit order.

Full Disclosure

Cindie and I own a combined total of 600 shares of NNN in my traditional IRA and ROTH accounts. These shares are worth over $25,374 as of the market close on Friday. NNN is not our biggest REIT investment. For example, we have $71,484 invested in O (Realty Income Corp) and $39,066 in shares of ADC (AGREE Realty Corp). Another large REIT holding is GTY (Getty Realty Corp) with $60,291 invested.

Psalm 23 – The Lord My Shepherd

I don’t usually post about investing on Sunday. However, I wrote this on Saturday and decided to schedule it for Sunday morning, as I know some of my readers aren’t church goers. This morning, July 9, 2023, I will be preaching on Psalm 23 at Memorial Baptist Church in Verona, WI. If you can’t get to church and would like to hear and see me, then go to our website for the live stream. Our website address is LINK.

You can also search the past sermons at LINK for the ones I have recently preached. We are currently going through the Names of God.

Really like your approach to investment Wayne. Thanks for sharing

LikeLiked by 1 person