Plus a Brief Review of ABBV – A Top Five Investment

Most investors set up their portfolios for what I view as difficult income. There are a couple of reasons I think this way. The first is that most investors don’t own investments that offer meaningful income without selling their investments to lock in gains (or losses). The other problem is often that the income from those investments is not increasing in a meaningful way. As you get closer to retirement, or when you are living in retirement, the ongoing threat of inflation eats away at each dollar’s buying power. Difficult income includes income from bonds. That is one reason our current allocation to bonds is zero percent.

If inflation, on average, will be three percent per year, having investments that continue to deliver three percent growth is like standing still while everyone else is running towards higher income. Of course you can just cut expenses when inflation charges upwards, but there comes a point when that won’t work. That is especially true of food, utilities, insurance, and healthcare costs.

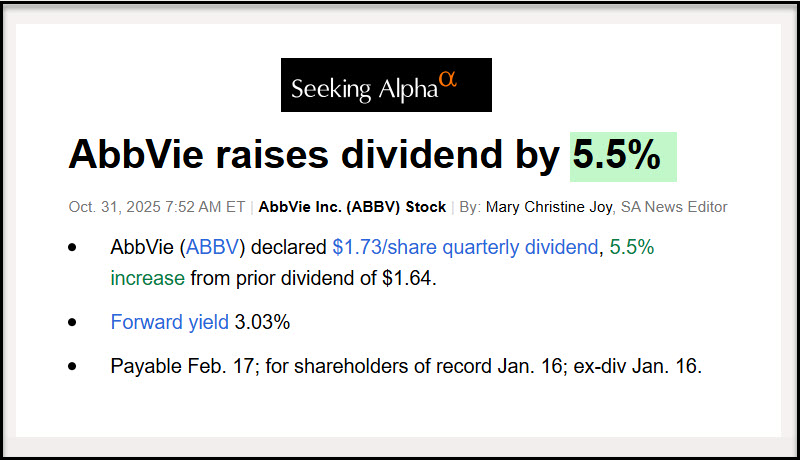

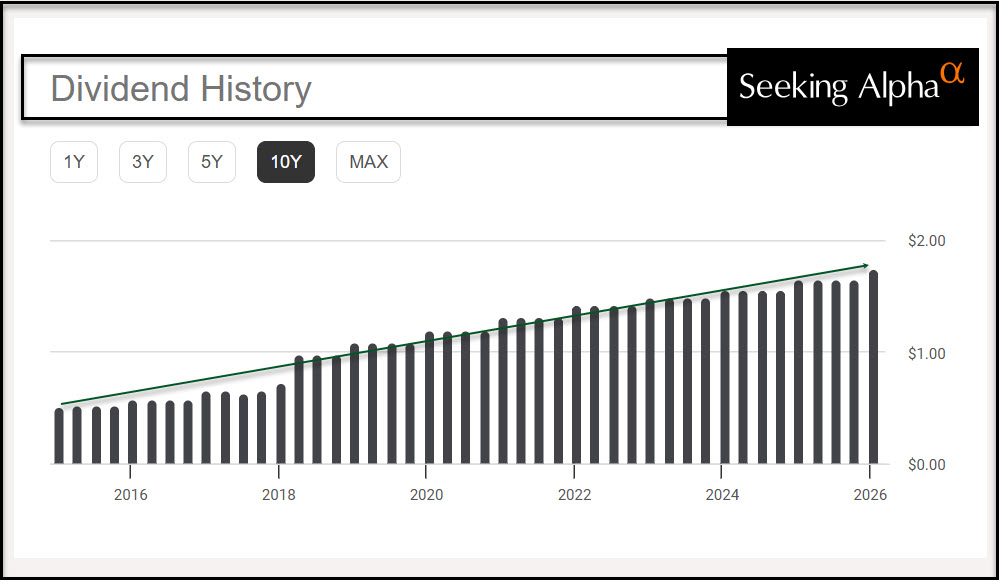

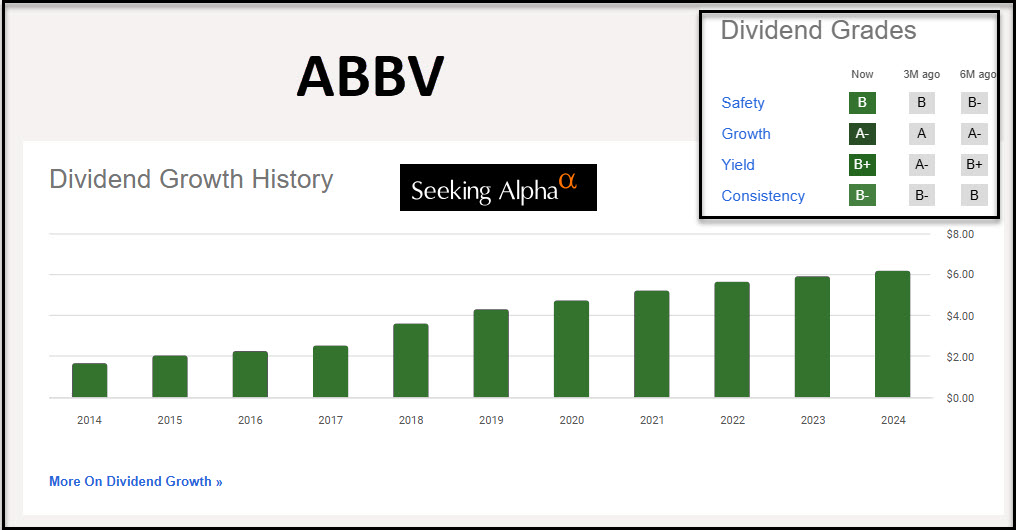

Increasing dividends is one way to fight inflation. That is why I like holding shares of ABBV. By the way, if you own shares of VYM, you also hold ABBV, as ABBV is one of VYM’s top ten investments. ABBV also shows up in ETF DGRO’s top ten. Even more interesting, ABBV is number one in SCHD’s top ten investments. That should tell you something.

ABBV is a TOP FIVE Investment

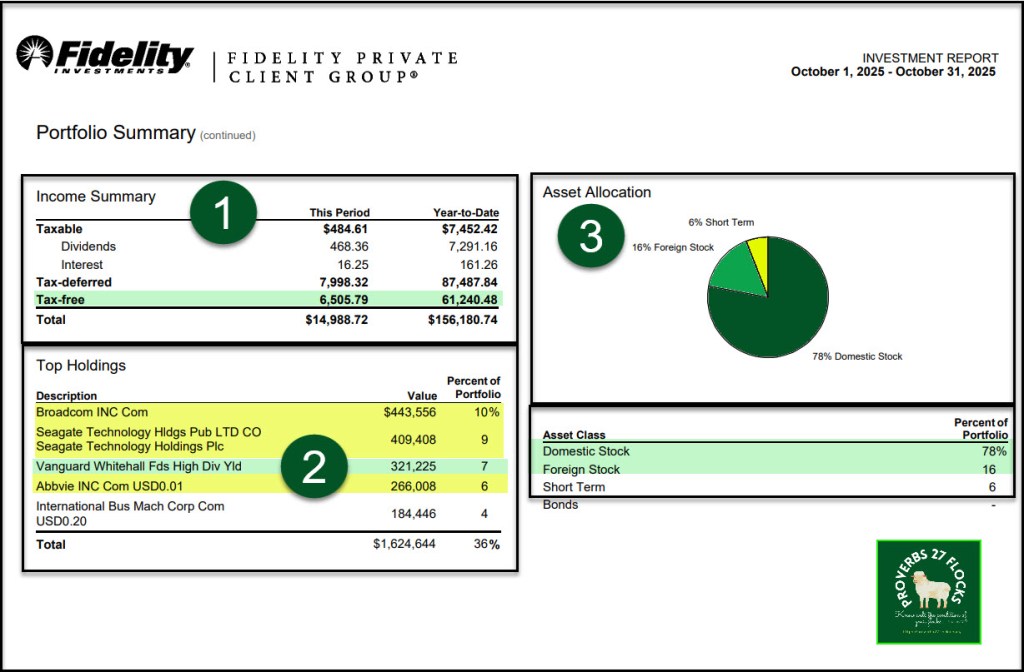

Our current top five investments are AVGO (Broadcom), STX (Seagate Technology), Vanguard High Dividend ETF (VYM), ABBV, and IBM. It should be noted that all of these investments pay a dividend and all of them are a good source of options income. Each of these holdings currently have open options contracts. I expect some of the AVGO shares to be called away in December. When that happens it will drop out of the top five. To have $443K invested in a single company with a $3.5M portfolio is high risk, but not crazy high considering the nature of the investment. Here is a snapshot of our Fidelity Investments statement that shows the income summary, to top holdings, and our asset allocation.

Good News from ABBV

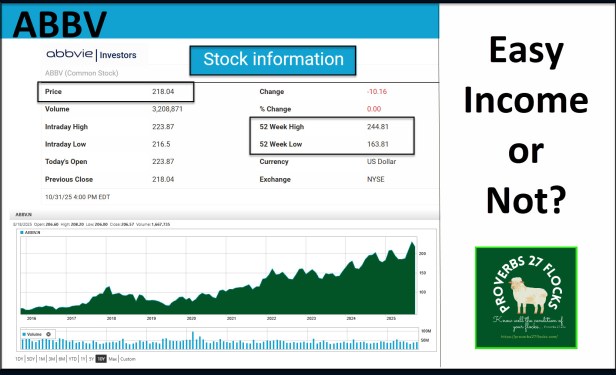

You should not be surprised by good news. When earnings increase it is highly likely that dividends will increase. When the news is good it can also fuel share price appreciation. Sometimes, however, the share price drops because of multiple factors or investor concerns. On Friday ABBV’s share price declined $10.16 (-4.45%).

I love fear. It is often irrational. It sometimes offers options trading opportunities in the form of selling cash-covered PUT options or opportunities to convert shares from a traditional IRA to a ROTH IRA.

A 4.45% drop in ABBV’s share price resulted in a “loss” of $12,395 in our portfolio value on Friday. I don’t care. Anyone who makes investment decisions based on share price on one day is only a day-trader or someone who hasn’t really understood the implications of buying low and selling high (or dollar cost averaging.)

ABBV ROTH IRA Tax-Free Dividend Income 2019-2025

Since August 2019 I have received $20,981 in tax-free dividends in my ROTH IRA. Since October 2021, when I first started trading options on ABBV shares, I have received $21,820 in “synthetic” dividends. That brings my total income from my ROTH shares to at least $42,801 in five years, or about $8,500 per year. Of course, the income is all tax-free.

The options trades, including covered call rolls, totaled 76. Therefore, my average income for five minutes of work per trade was $287. That makes this essentially easy income. It should be noted that of the 900 shares in my ROTH IRA, 700 were due to a ROTH conversion from my traditional IRA to my ROTH. I did this at a time when the share prices were depressed, so the tax burden was significantly less. This is one of the reasons that I am looking for market fear to make ROTH conversions more tax efficient.

Cindie also holds shares in her ROTH IRA, and those are collecting both dividends and synthetic dividends from options trades of about $1,700.

ABBV IRA Tax-Free Dividend Income 2019-2025

The ROTH income is only one part of the picture. I have also received dividends from ABBV shares in my traditional IRA. From 2017 to the present the ABBV dividends in the IRA total $4,551. The option income on those shares has resulted in synthetic dividends of $3,955. That is a total of $8,506 in tax-deferred income.

Should Increasing Dividends Be Trusted?

You can never really be absolutely certain that a company will continue to pay increasing dividends. However, there are some key metrics to consider when buying any investment. One of them has to do with earnings growth. If earnings are growing it is highly likely that the dividend will grow as well

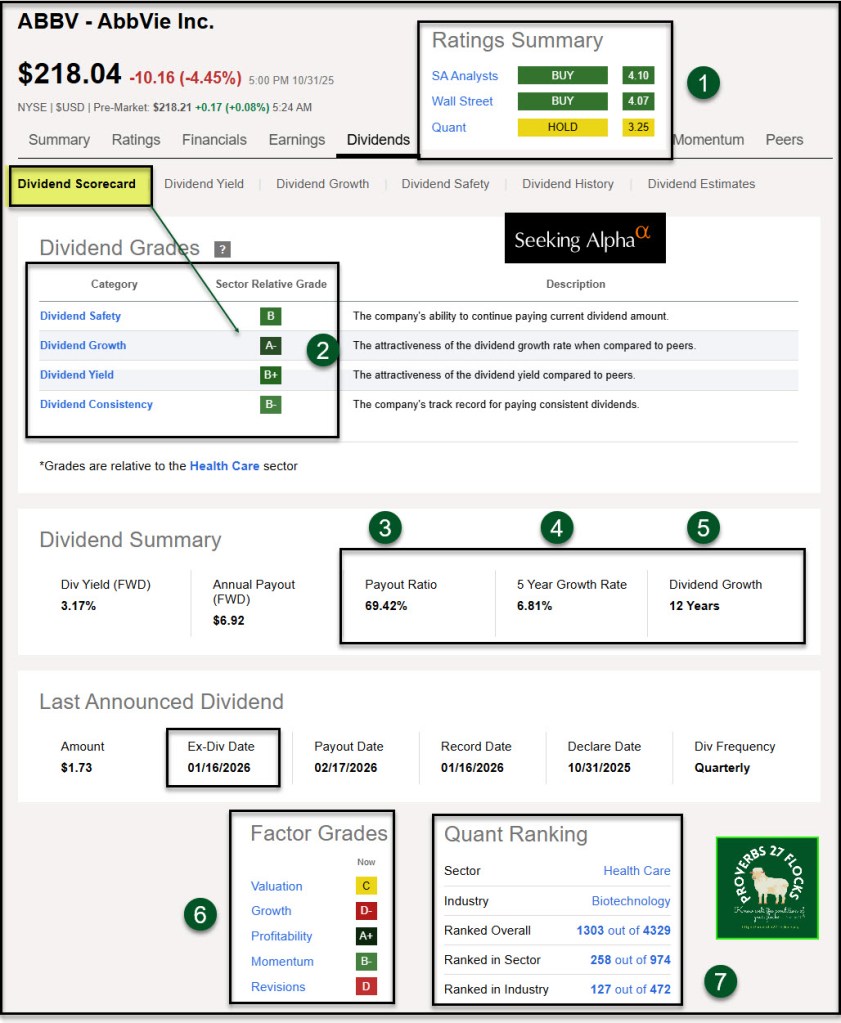

The second piece has to do with the dividend payout ratio. ABBV’s current dividend payout ratio is 69.42%. This means that the company is giving investors $69.42 of each $100 in earnings. I consider a good payout ratio (excluding REITs and BDCs) to be in the 30-70 range. ABBV falls in that range.

REITS and BDCs – Dividend Payout Ratios

Real estate and business development companies are different animals. Therefore, like many things in life it is not helpful to set the same parameters on those investments. Realty Income Corporation (Ticker: O), has a dividend payout ratio of 75.45%. That is acceptable. MAIN (a BDC) has a ratio of 73.88%. That is not a problem. GLAD (Gladstone Capital) has a payout ratio of 99.00% and a declining dividend. I wouldn’t buy GLAD, but I would buy shares of O or MAIN.

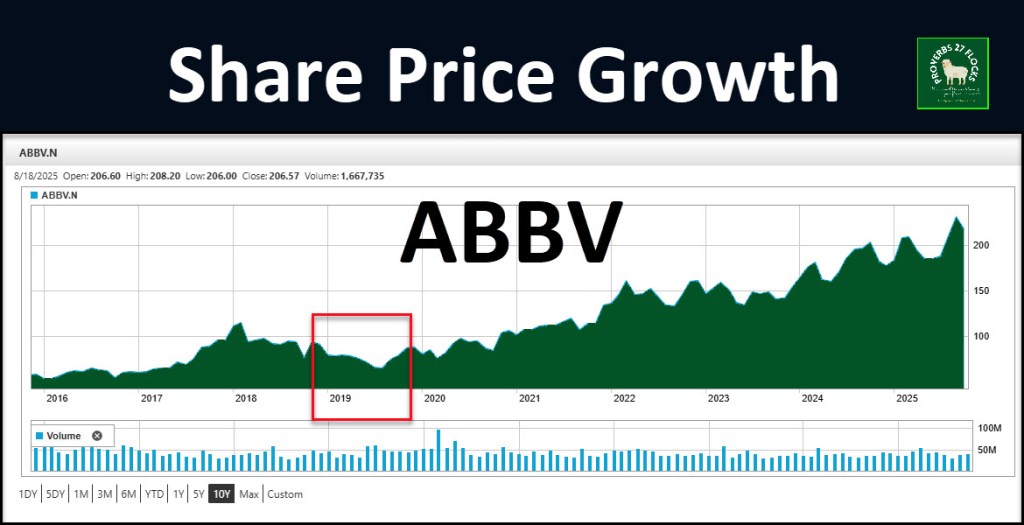

ABBV Share Prices and Total Returns

It is a mistaken notion to think that dividends mean you sacrifice share price growth. That is true of some investments, but certainly not all investments. The share price return is 240% over the ten-year period as shown in this graph. The total return (price plus dividends) is 415%. Patient and wise investors pay attention to both pieces of the puzzle if they want easy income that doesn’t sacrifice on the share price altar.

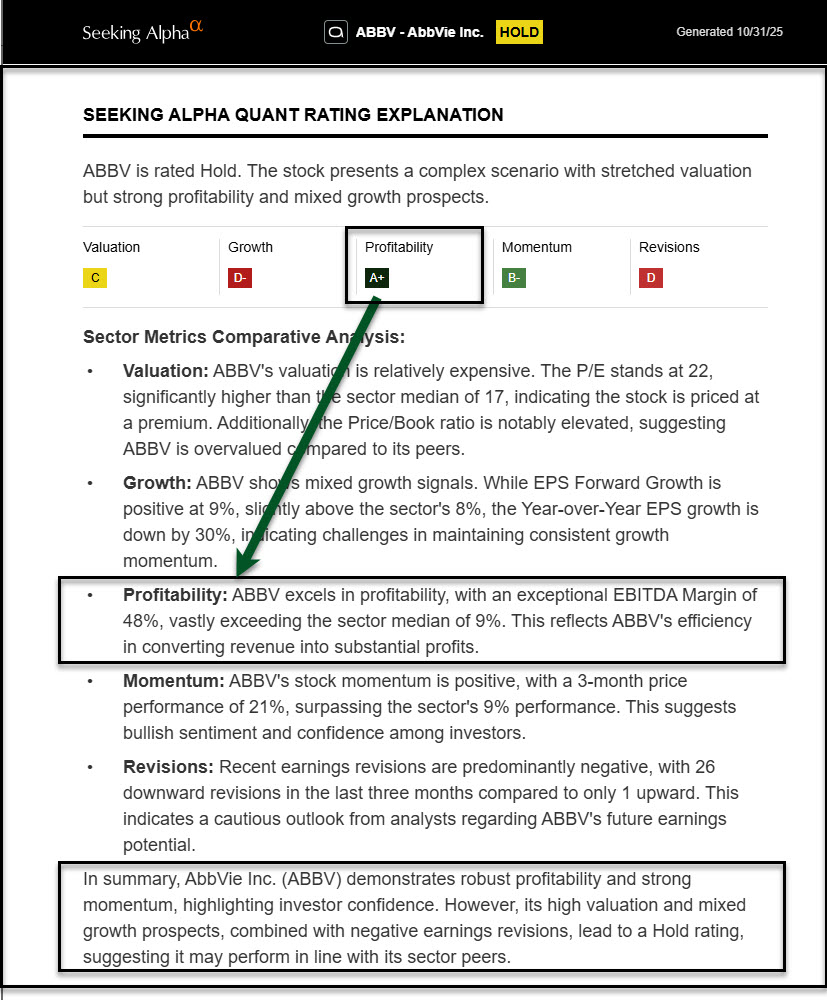

Seeking Alpha Sector Metrics Comparative Analysis

Below (in italics) is a helpful summary of the potential risks along with the positives of owning ABBV shares. This is from the Seeking Alpha website. For me the most critical pieces (for ABBV) are growth and profitability. However, I would be a bit cautious about buying shares of ABBV in big chunks. If you wait for dips and buy ten shares at a time you will benefit from dollar cost averaging.

- Valuation: ABBV’s valuation is relatively expensive. The P/E stands at 22, significantly higher than the sector median of 17, indicating the stock is priced at a premium. Additionally, the Price/Book ratio is notably elevated, suggesting ABBV is overvalued compared to its peers.

- Growth: ABBV shows mixed growth signals. While EPS Forward Growth is positive at 9%, slightly above the sector’s 8%, the Year-over-Year EPS growth is down by 30%, indicating challenges in maintaining consistent growth momentum.

- Profitability: ABBV excels in profitability, with an exceptional EBITDA Margin of 48%, vastly exceeding the sector median of 9%. This reflects ABBV’s efficiency in converting revenue into substantial profits.

- Momentum: ABBV’s stock momentum is positive, with a 3-month price performance of 21%, surpassing the sector’s 9% performance. This suggests bullish sentiment and confidence among investors.

- Revisions: Recent earnings revisions are predominantly negative, with 26 downward revisions in the last three months compared to only 1 upward. This indicates a cautious outlook from analysts regarding ABBV’s future earnings potential. (SOURCE: Seeking Alpha)

Caution Regarding Allocations

Just because ABBV has a great history doesn’t mean it has a great future. Therefore, with about $265K of our retirement portfolio allocated to ABBV shares, it is one of our top ten investments. If and when some of the shares are called away (covered call options contracts) I won’t be disappointed. In the meantime I’m more than happy to collect the increasing dividends.

Summary

If you want to stay ahead of inflation during retirement then you should add investments (stocks and ETFs) that have a history of increasing the dividends you receive. That is what I like to call “Easy Income.”

“Difficult Income” is income you have to create by selling investments or by other more complex and time-consuming strategies. I’d rather focus on other things.

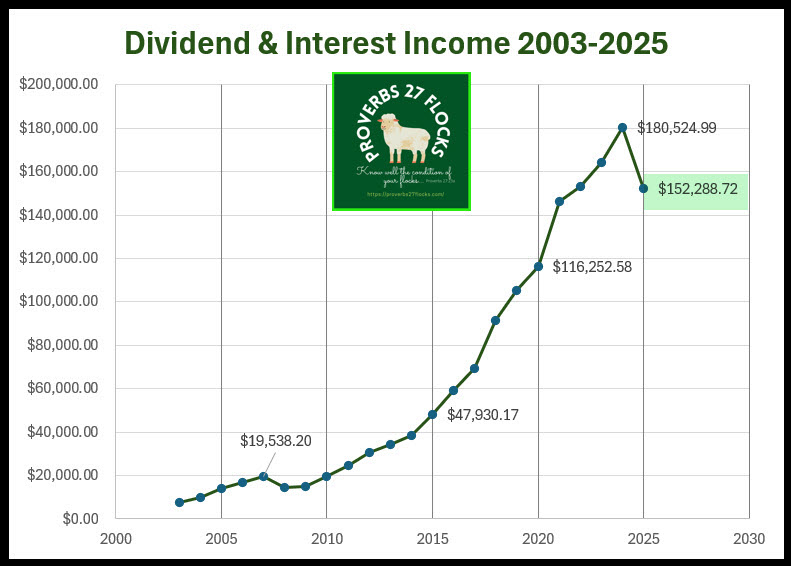

By the way, this graph does not include the $179K of options income we have received this year. Also, the books aren’t closed on 2025 yet. I expect dividend income to be at least $190K for the year.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Well done ! Great post.

LikeLike