Options Income Provides Synthetic Dividends

On the third Friday of every month I look forward to something called “expiring options.” Like most contracts, there is an expiration date. For example, we have a warranty service contract with Ford for our 2020 Ford Escape. It has an end date. The same is true for our homeowner’s and auto insurance. Our Spectrum internet service expires every month unless I pay the amount due. Expired contracts make it possible to do another round of options trades on the underlying shares.

Thoughts About Expired Contracts

It is always delightful when cash-covered PUT options and covered CALL options contracts expire. There are four reasons for this delight. This means:

- We get to keep the shares that were optioned. If those shares are earning dividends, they will continue to provide dividend income.

- We already received income from the options trades, so those synthetic dividends cost me nothing. This is significant additional income that requires minimal time and effort. It also means that I can get additional income with essentially no risk.

- I can create new CALL options contracts and earn even more income on the shares that were being held for the covered calls.

- Cash that was being held for cash covered PUT contracts is now available to either buy shares of stocks or ETFs or to do some more cash covered PUT option contracts.

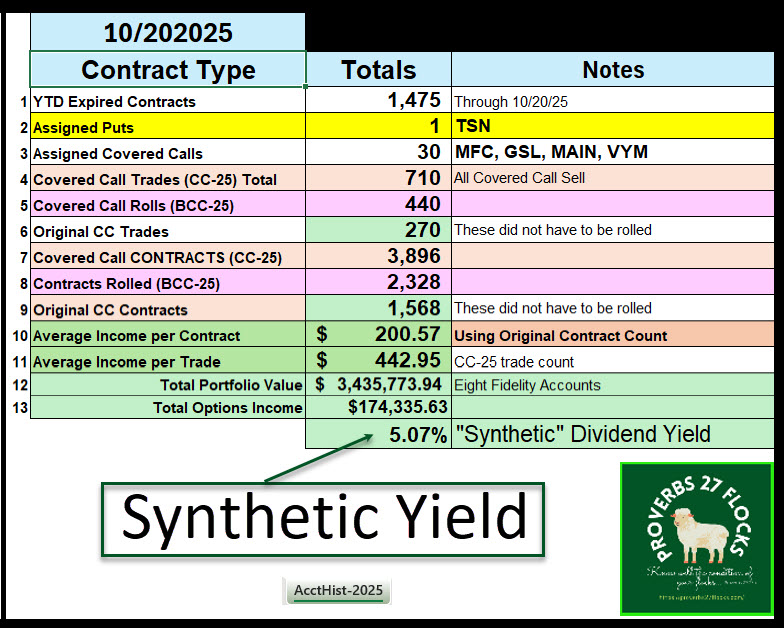

The contracts that expired totaled 89. This represents 8,900 shares in the following stocks: ABR, AMD, AVXL, ETHA, FNF, GAIN, IMMP, MAIN, OBDC, OKE, PR, RPD, SHLS, and TSM. I am most interested in cash covered put contracts for SHLS and TSM at this point.

Synthetic Dividends

Synthetic dividends refer to a financial strategy that allows investors to create the economic equivalent of receiving dividends without actually holding the underlying stock. I certainly include this type of “dividend” in my strategy. This is accomplished using cash covered PUT options.

But the second even more lucrative source of this type of dividend is from selling covered call options. The vast majority of my 2025 trades are either covered CALLs or rolls of covered call options.

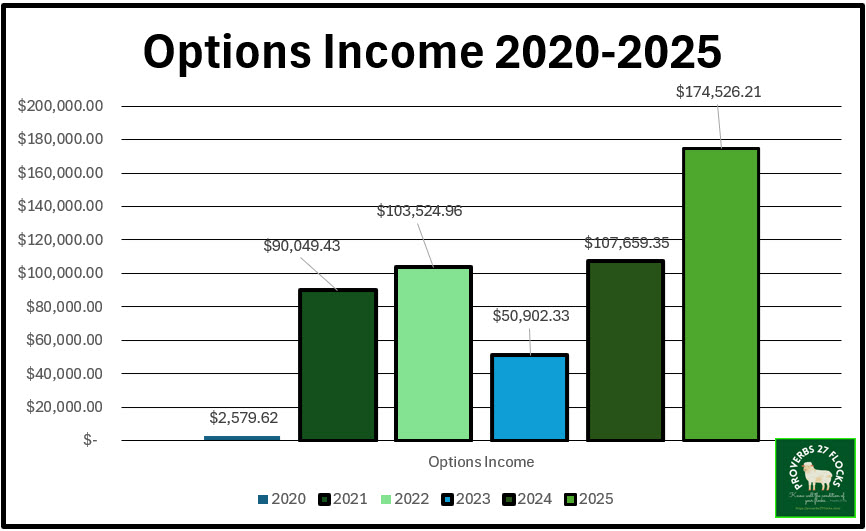

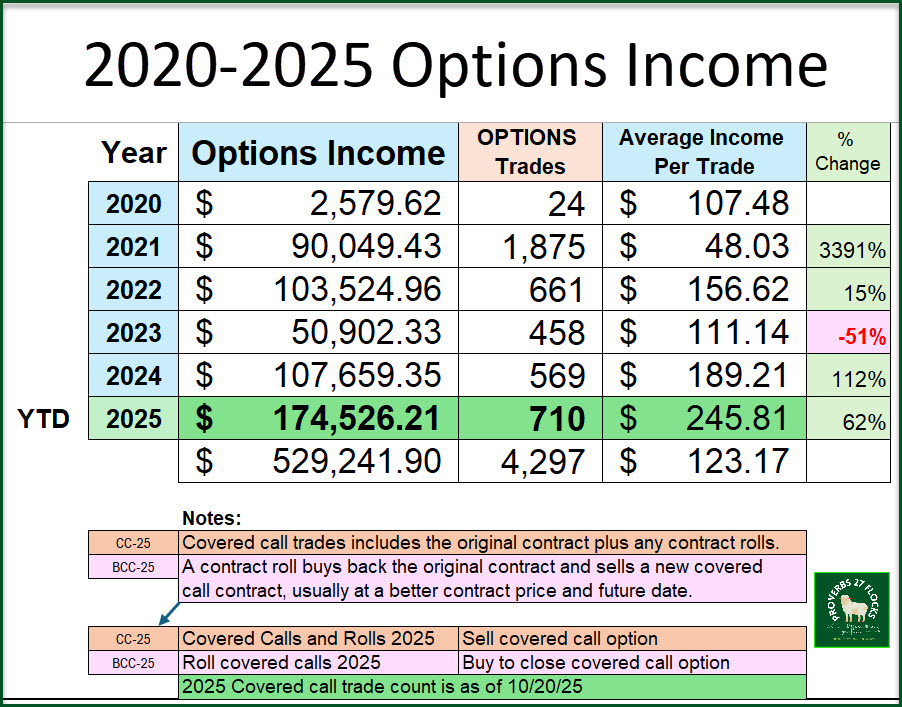

Synthetic Dividend “Yield”

If you could earn a 5.07% yield from trading options, would you consider it a win? Based on our current account balances of $3.4M, and synthetic dividends of $174K, we are seeing a yield of 5.07%. That is well worth the hour or two per week that I trade options.

We have just completed week 41 of 2025. If I only spend four hours per week trading options (some weeks maybe more, but most are less) then I probably have devoted 164 hours trading options. If you look at that in terms of working weeks, I have worked a tad over four weeks to earn $174K.

By just about any measure that is great part-time work. Because some of the options are traded in our ROTH IRA accounts, that income is totally tax-free. YTD tax-free income from synthetic dividends is $51,878. That is on top of the YTD tax-free income from dividends in those same accounts.

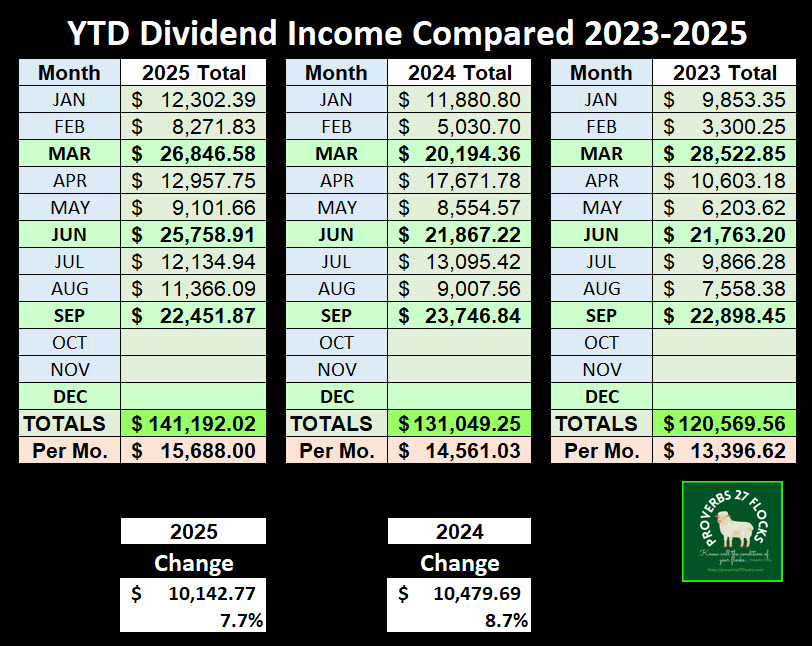

Options Income Plus Dividend Income

Because options income is $174K and YTD dividend income is $141K, our total income (excluding Social Security and Cindie’s income as a part-time baker) is $315K. This becomes amazing fuel for charitable giving and other gifts we like to give to family and friends.

Recommendation

One of the wise investors who is also on the Fox Business Channel is Charles Payne. He has a “The Power of Options Masterclass” this week. It is an online class, and it is scheduled for Wednesday, October 22, 2025. If you are interested, here is a link to register: Charles Payne

Another “option” for learning about options is to schedule some time with me. I have trained several individuals and one couple. So far they seem to be doing just fine. Have they made a few small mistakes? Yes they have. But so have I. The risk, if you can even call it that, is minimal. The potential rewards are significant.

I always use Seeking Alpha to determine which stocks or ETFs to buy for covered call options. I also pay attention to Seeking Alpha for cash covered PUT trades.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It can help you find good growth and dividend growth investments. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com

Would you please elaborate on how to use Seeking Alpha to determine which stocks/ETFs are available for Options trading ? Thank you !

LikeLike

I use Seeking Alpha to see if the investment has the attributes I want for any position. So, for example, I won’t enter a cash covered put contract if I’m not willing to own the shares.

LikeLike