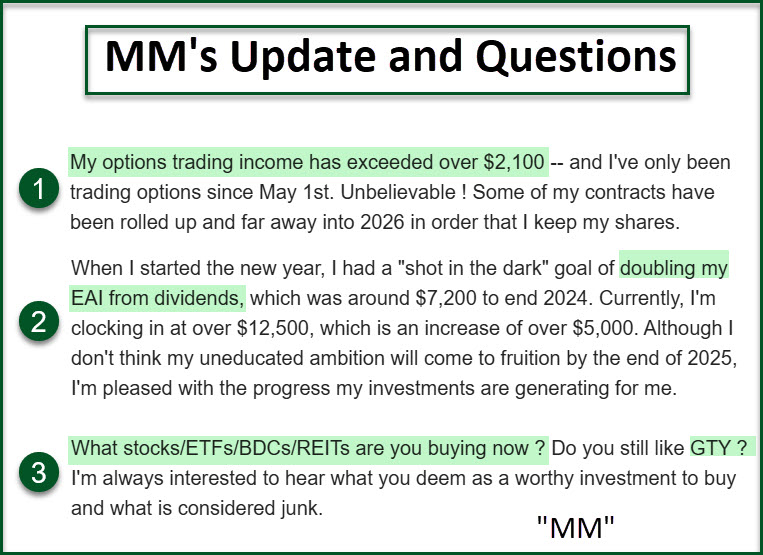

Are There New Easy Income Investments?

This is part four of the Q3 update. It was part of my plan to talk about the stocks and ETFs I sold and those that I purchased in the last three months. I decided to move this topic up to the top because one of my loyal readers (MM) asked some questions. One of her questions was “What stocks/ETFs/BDCs/REITs are you buying now? Do you still like GTY?” I will answer a portion of the questions in this post and follow it up with a second one about other ETFs and BDCs on my radar. This one will focus on REITs and GTY (Getty Realty Corp.)

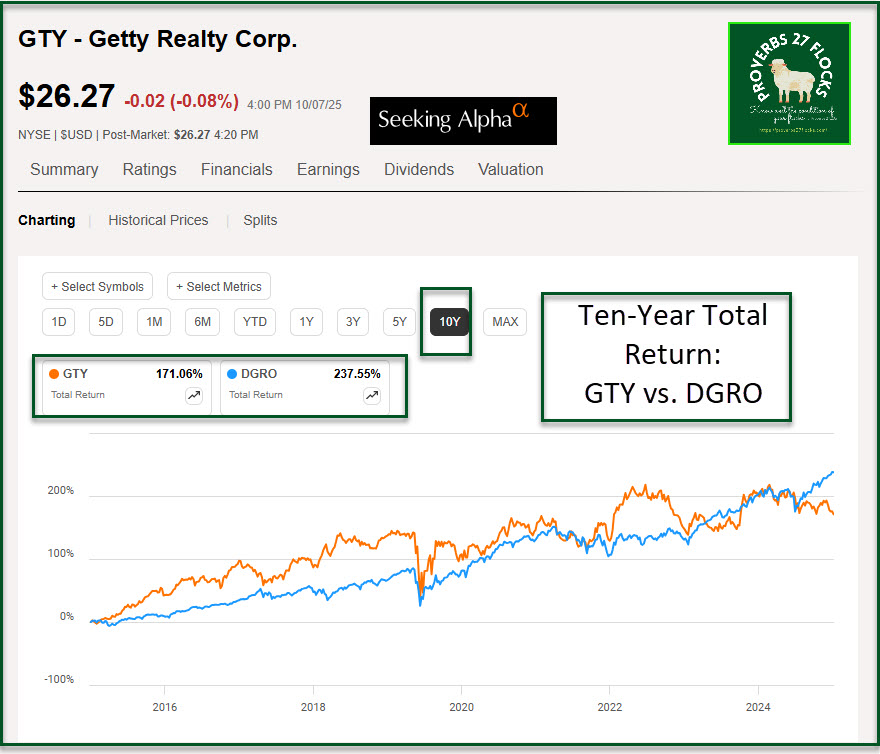

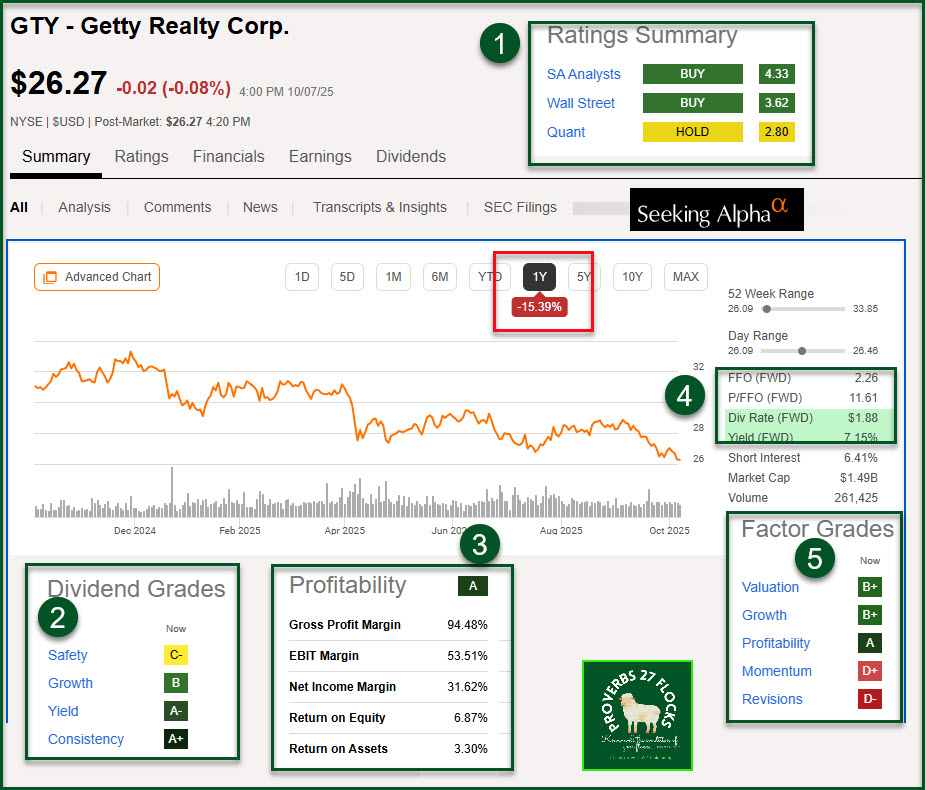

The short answer to the question, “Do you still like GTY?” is “Yes.” However, because of the winds of change in the economy, REITs have fallen out of favor for many investors. I believe when something is out of favor, and the long-term prospects are good, it is wise to buy more.

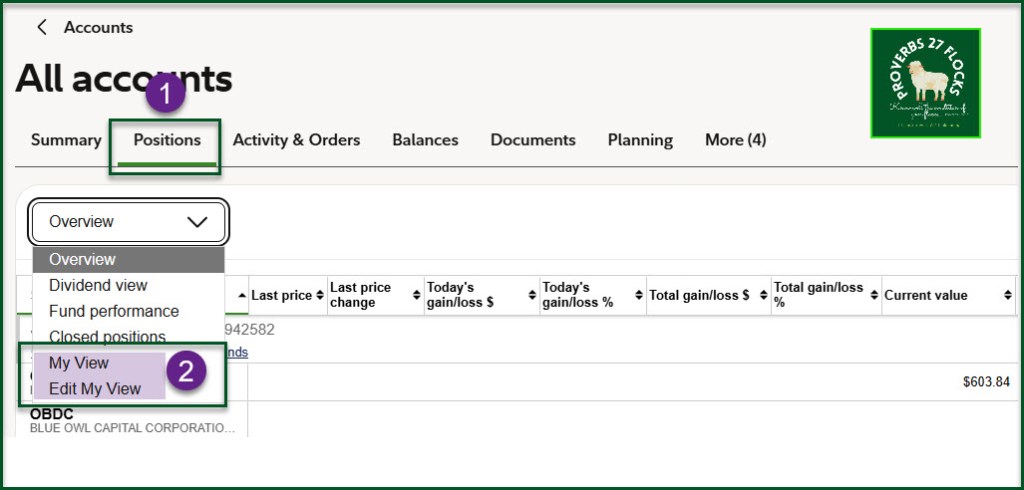

Fidelity “My View”

Fidelity recently added a new feature to their website in the “Positions” tab. It is called “My View.” This is a very helpful feature because you can pick the data elements that you want to see. I am refining my data choices and plan to delete some columns and add in some others. However, the following is an extract of the REITs from the My View csv download.

Six Things to Notice

- We still own shares of GTY, and I have no plans to sell the shares. As you can see, the value of my GTY shares in my ROTH IRA is down more than six thousand dollars. Ouch! But this is only a part of the story. Some of these shares were originally in my traditional IRA and I rolled them into my ROTH. Furthermore, the total dividends we have received from our GTY shares since 2016 is $11,928.75. I purchased the first 100 shares on 04/26/2016 for $19.98 per share. In addition, we have received $814 in options income from our GTY shares. Therefore, GTY is a decent income-generating real estate investment. I am unconcerned about the current price of the shares, and I am content to just collect the dividends.

- We have started to acquire shares of PSTL. Postal Realty Trust, Inc. is an “Office REIT” because it has a unique focus: properties primarily leased to the United States Postal Service (“USPS”). The current Seeking Alpha QUANT rating for PSTL is 4.84 (Strong Buy.) It yields 6.5% and pays quarterly. However, it is a micro-cap stock, and this introduces more risk.

- The estimated annual income (EAI) for the REIT investments is almost $18K. That covers all of our homeowner’s insurance policy costs and Fitchburg Property taxes with money left over for Cindie to buy tulip bulbs, trees, fertilizers and gardening tools.

- The estimated current yield of the cash tied up in REITs is 6.3%. That is more than sufficient for patient investors.

- The current loss for the REIT shares is $35.7K. That should give you pause. This is an income investment, so there will be times when other investments will certainly outshine those in the real estate sector. In fairness, however, I made a terrible mistake in buying shares of MPW (Medical Properties Trust, Inc.) That is the source of the real loss because that makes up $33.8K of the total loss.

- Finally, all of these investments are either micro-cap or small cap investments. That also means there is higher risk associated with the REITs we own.

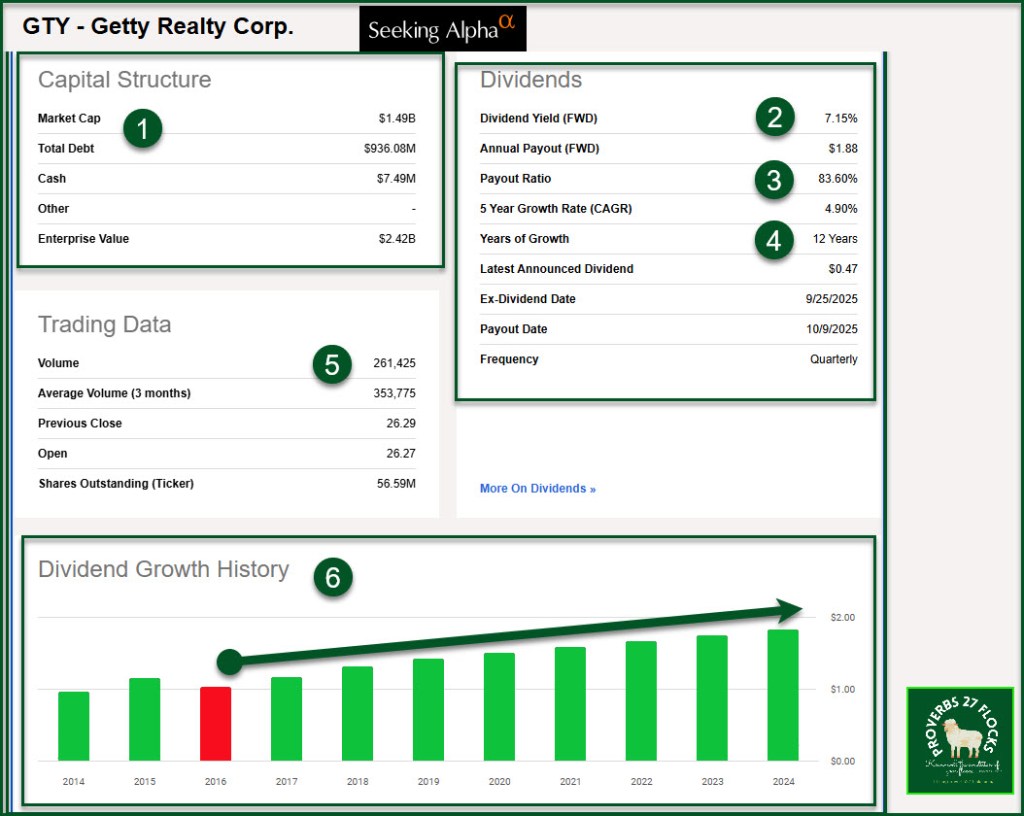

Getty Realty Corp Details

I will share some images from Seeking Alpha to help you understand why I won’t be selling our shares. Notice the dividend growth history, the ten-year total returns, the likely growth of FFO (Funds from Operations), the growth of sales, and the profitability of the GTY business. CAUTION: Don’t chase REITs as your only focus. It is also wise to diversify into multiple REITs. My experience with MPW bears this out.

Progress Is Important

What makes a good student great? Application of the things they learn. In recent weeks I have done some training both in-person and via Zoom. What really encourages me is when a student applies what they learn. I have seen a couple of students make some good progress in trading options. One couple (D&L) made over $10K in their first month of options trading. That is three times more than I made the entire first year I traded options – in 2020.

My Florida friend “MM” has also continued to apply what she has learned. Although I have never met MM in person, we have had some Zoom calls, and she is also a great student. She said, “My options trading income has exceeded over $2,100 — and I’ve only been trading options since May 1st. Unbelievable!” That is great progress. My first year of trading options I made $2,579.62. Way to go MM!

Stay Tuned: More 2025 Q3 Updates to Come for Easy Income

PSTL is not the only investment we have added in Q3 2025. That will come in a future edition of this series. One REIT I am watching and might add back into our portfolio is Realty Income Corporation (Ticker symbol O). It currently has a QUANT rating of 3.81 (Buy).

The updates will include an Options income update, an EAI update showing easy income growth, additional updates regarding the stocks and ETFs I sold and those that I purchased, some new cryptocurrency ideas, and leveraged ETF investments. Bear in mind that some of what I share is not for everyone’s investment portfolio. I will put “cautions” on the things that are higher risk for beginners to consider.

Successful investing starts with a goal, followed by a strategy, that is then supported by tactical decisions. My primary goal has two elements: 1) To grow our dividend income with minimal work and 2) to have sufficient income in my traditional IRA to cover each year’s RMD withdrawal. One additional goal helps keep income taxes low: I use QCD giving (Qualified Charitable Distributions) to minimize the income taxes on my IRA RMD withdrawals. I want everything to be “easy.”

Closing Thoughts

All investing has risks. I share my successes and my mistakes like MPW. The mistakes are reminders that you can lose money in more than one way when you invest. However, proper diversification can help prevent a real investment portfolio mess.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. It can help you find good growth and dividend growth investments. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Thank you for covering my questions ! I’m putting in a limit order to establish a position in GTY now.

LikeLiked by 1 person