3 Percent Rule: Inflation Plus…Three Investments That Will Disappoint

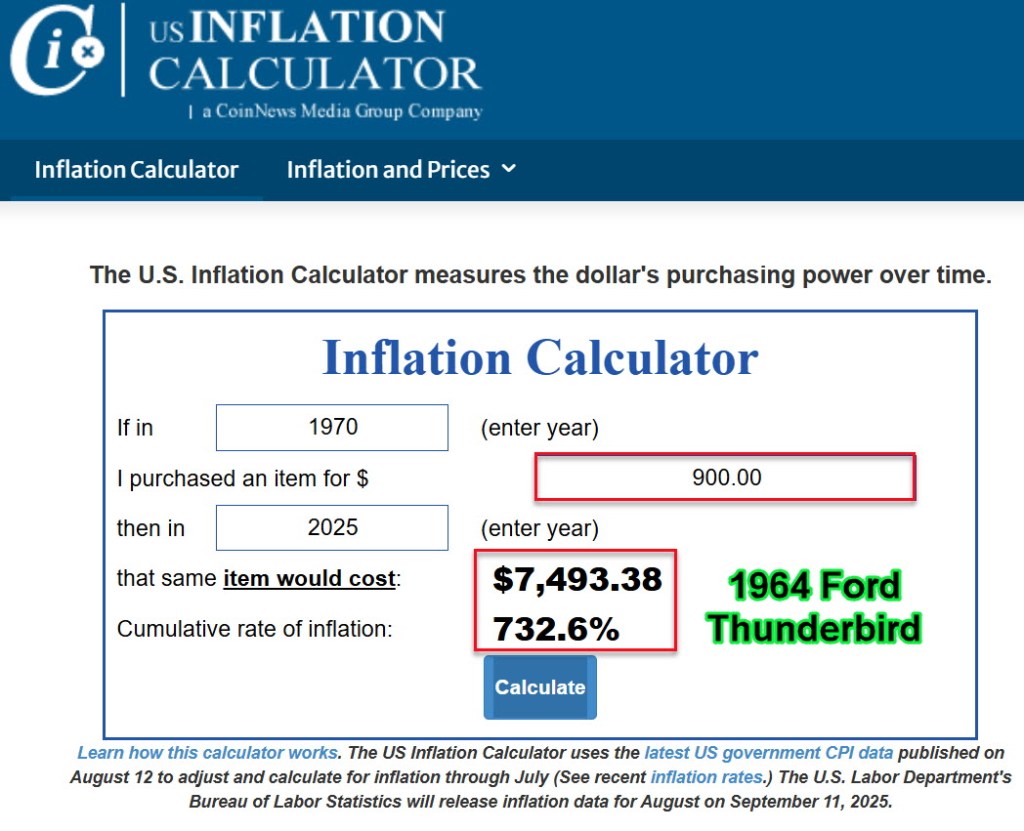

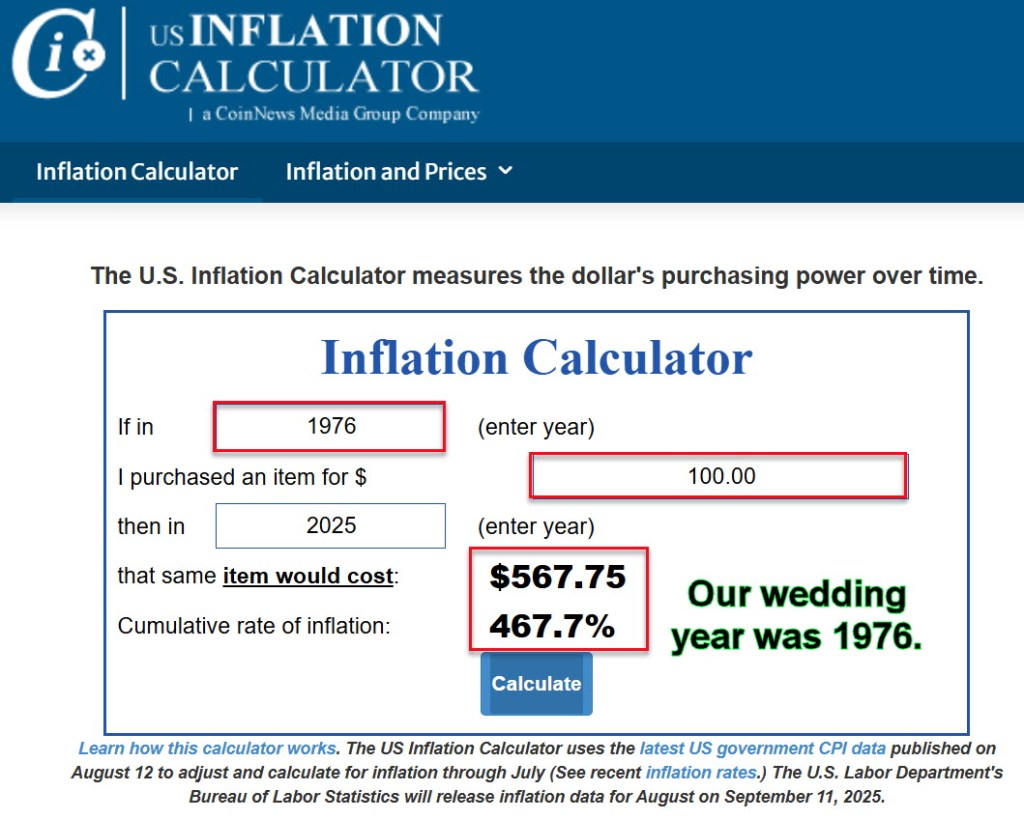

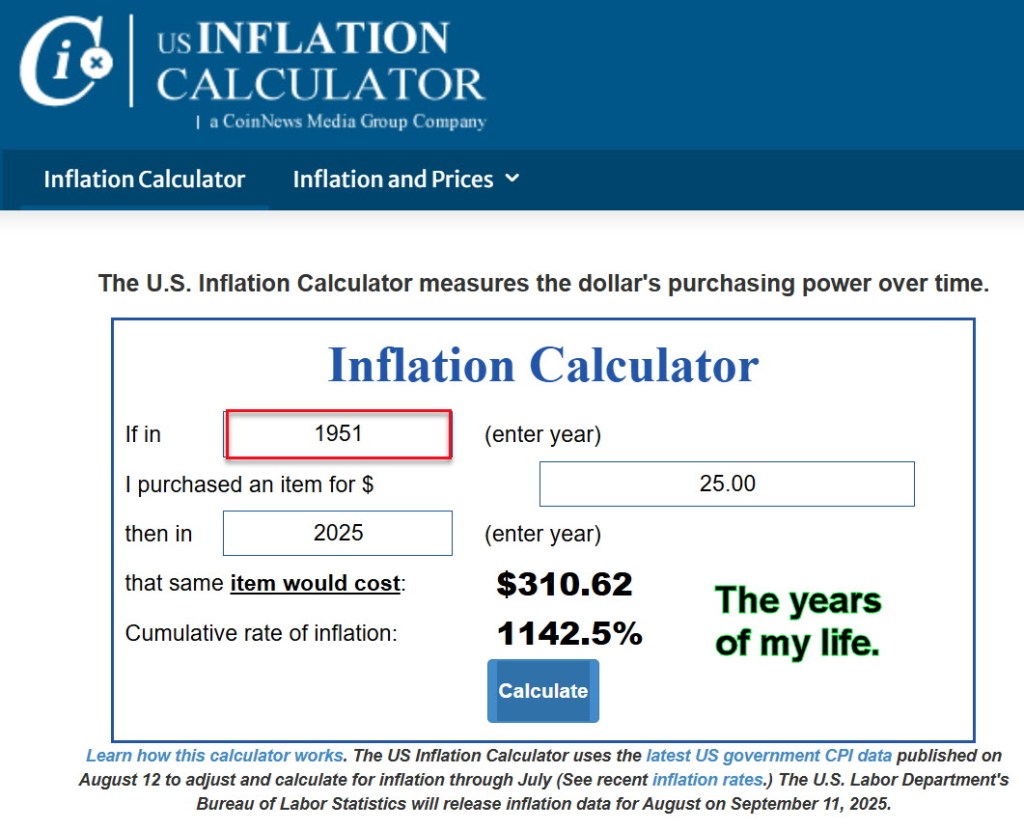

The number three is instructive. In this post I want to show the dangers that lurk when you select investments that ignore the realities of inflation. There is a rate of inflation that must be included in your decisions unless you are satisfied that you will buy less when you are in retirement. There are also three investment classes that I believe hinder you from achieving both your long-term goals and from providing sufficient income in retirement. Here is the reality: over time, due to inflation, the number of groceries you can buy will be less and less if you don’t understand how your buying power is reduced.

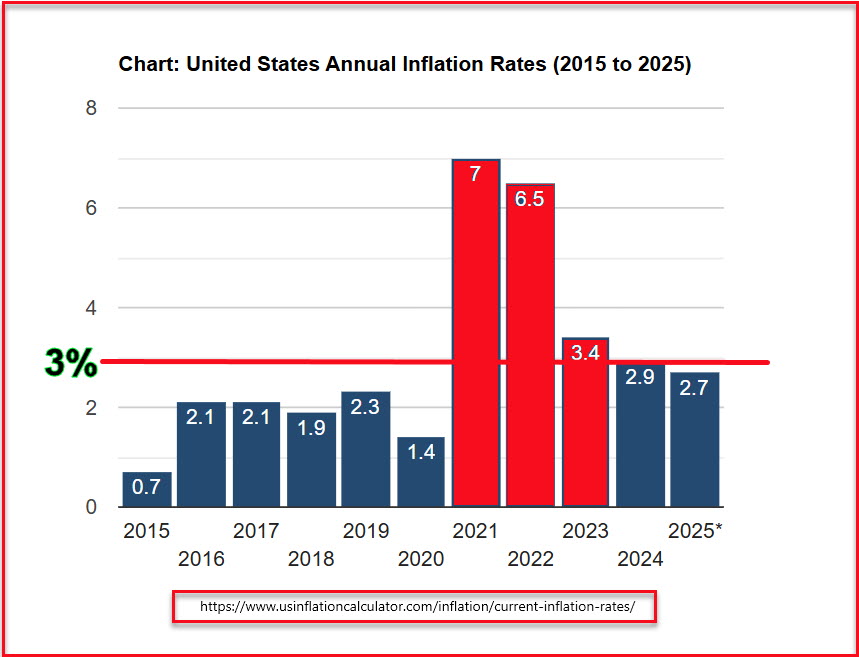

Any investment that fails to at least match inflation is destined to slowly or quickly erode your purchasing power. If the total ten-year returns of any investment is less than 3% on average it is failing to measure up. The problem is even greater when you consider the compounding effects of inflation. If inflation increases 3% in the first year, the second-year inflation is actually far more damaging on the value of the dollar than just another x%. That is because inflation fluctuates. From 2020-2025 (5 years) inflation grew to a total of about 25%. So you cannot depend on the three percent value for each period of years. From 2000-2005 it was only 13.4% in total, but that isn’t likely to be the case going forward.

Inflation impacts families by increasing the cost of essential goods and services, which can strain household budgets, especially for lower-income families who spend a larger portion of their income on necessities. As prices rise, families may need to make difficult choices about spending and savings to maintain their standard of living.

Inflation reduces buying power by causing prices to rise, meaning that a fixed amount of money buys fewer goods and services over time. As prices increase, consumers find that their money does not stretch as far as it used to, leading to a decrease in purchasing power.

“One way to understand purchasing power is to imagine that you worked the same job that your grandfather worked 40 years ago. Today, you would need a much higher salary to maintain the same quality of living. By the same token, a homebuyer looking for homes 10 years ago in the $300,000 to $350,000 price range had more and better options to consider than people have now in the same price range.” Investopedia

“What can investors do to protect against inflation?

To protect against inflation, investors can consider allocating a portion of their portfolios to assets traditionally viewed as hedges against inflation. These may include real estate, commodities like gold, or inflation-protected securities such as TIPS (Treasury Inflation-Protected Securities). Such investments typically retain value or appreciate during inflationary periods, helping to preserve purchasing power.

Additionally, investors may also look into dividend-paying stocks, as companies that consistently grow dividends can help shield investors from the eroding effects of inflation. Investing in businesses with strong pricing power enables them to maintain profit margins in the face of rising costs. Ultimately, a well-diversified portfolio can mitigate risks associated with inflation and ensure more stable long-term returns.” – Guide for Investment

“How can inflation impact fixed-income investments?

Inflation can pose significant risks to fixed-income investments, particularly for traditional bonds. As inflation rises, the purchasing power of the fixed interest payments received from bonds diminishes. This can lead to a decrease in demand for existing bonds, as newer bonds may offer higher yields to keep pace with rising prices. Consequently, investors may see the market value of their bond holdings decline, especially if they are locked into lower yields that do not adjust for inflation.

Investors can mitigate these risks by considering inflation-linked bonds, such as TIPS, which adjust their principal based on inflation rates. By doing so, investors not only receive an interest payment but also benefit from the protection of their principal against inflationary pressures. Additionally, diversifying into other assets, including equities and real assets, can help investors maintain a balanced portfolio that is resilient to inflation’s impact on fixed-income investments.” – Guide for Investment

Three Bad Categories of Investments – BAT

The easy way to remember what assets to avoid is to remember the BAT. BAT is bonds, annuities and target funds. The worst of the three, in my opinion is the annuity. Bonds are next in line and the “least worst” are “Target Date Funds” or “Retirement Date Funds.” Let’s examine why I dislike BATs.

B is for Bonds

Bonds have terrible CAGR performance. Most of you will ask, “what on earth is CAGR, and why should I care?” The Compound Annual Growth Rate (CAGR) is the average annual growth rate of an investment over a specified time period, assuming that profits are reinvested at the end of each year. It provides a smoothed annual rate of return, making it useful for comparing the performance of different investments over time. (My thanks to a reader who spotted an error in my previous post in this series. As a result, that post was corrected to show an accurate CAGR.)

It is worth knowing the CAGR for any investment over ten years. While you cannot know that history will be what the future holds, history can help illuminate the path forward. If the CAGR is less than 3% you are losing against inflation. If it is less than 5% you are not really gaining much ground. I believe it is best to shoot for CAGR’s of 8-10% over ten years.

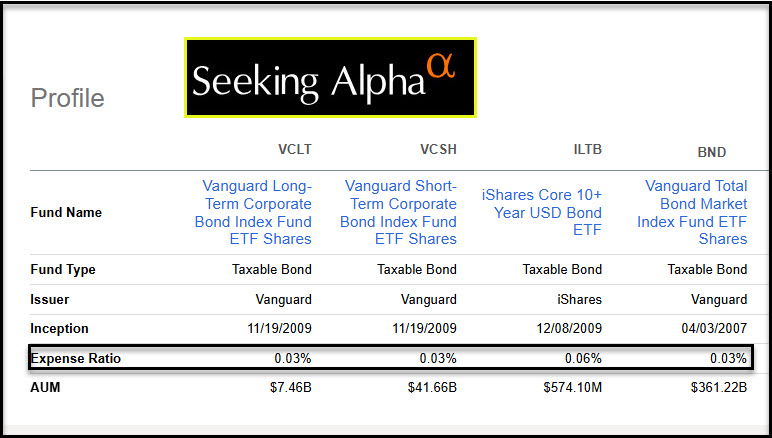

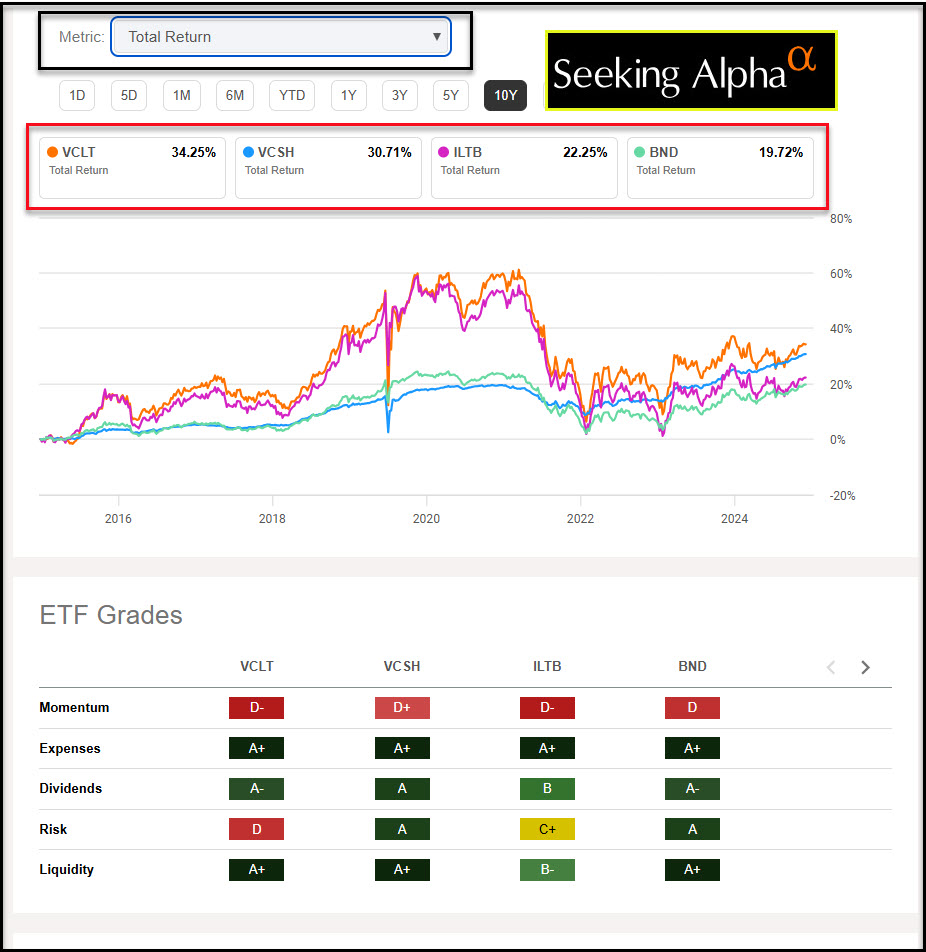

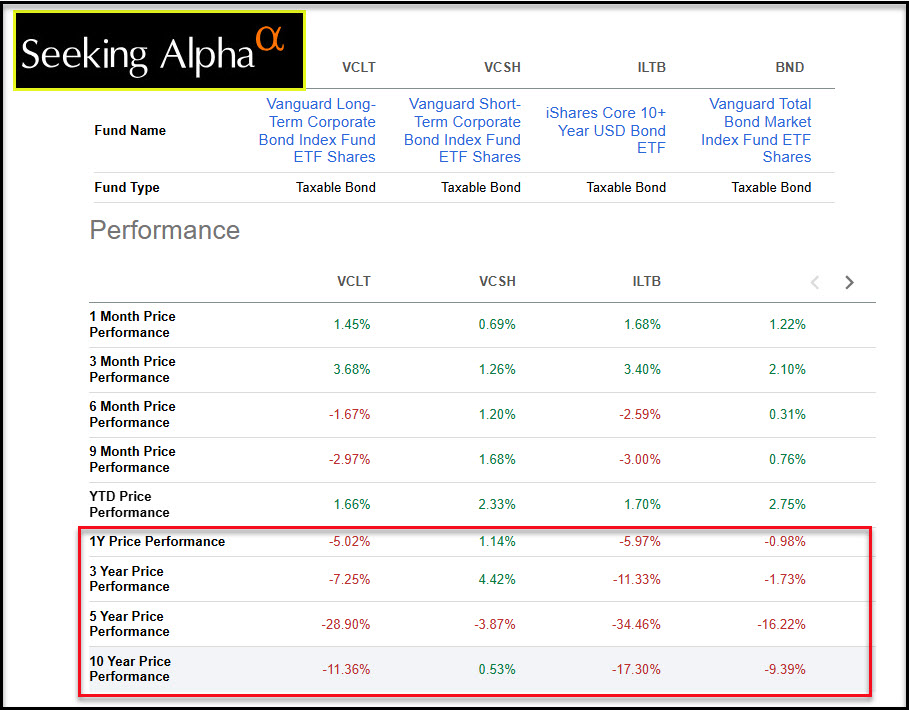

I compared four popular bond funds: VCLT, VCSH, ILTB, and BND. The total returns over ten years for all of these is simply disastrous. The best of the bunch is VCLT with a ten-year total return of 34.25%. Before you think “that sounds OK,” understand that the CAGR for that fund over ten years is approximately 2.98% per year is the annual rate of return over 10 years for a total return of 34%. (ChatGPT)

In other words, you might stay even with inflation. The operative word is “might.” If inflation is seven percent you are losing ground.

Consider ETF VYM. VYM’s ten-year return is 205%. Therefore, VYM’s CAGR is 11.8%. SCHD’s CAGR is 12.7%. Both of them beat bonds and help you stay ahead of inflation.

A is for Annuities

Annuities are expensive insurance contracts. An annuity is a financial contract you purchase—typically from an insurance company—that’s designed to provide you with a stream of income, usually during retirement. You give the insurer either a lump sum or periodic payments, and in return, they promise to pay you back either immediately or in the future, often in monthly installments for life or a set period.

Here are SIXreasons why I consider annuities to be a nutty investment.

1) High fees & commissions: Variable annuities especially can carry multiple layers of expenses: mortality and expense (M&E) charges, rider fees, fund management fees, surrender charges, etc. These can eat up 2–4% of returns annually.

2) Complexity & lack of transparency: Contracts can be extremely complicated, with lots of fine print. Most buyers don’t fully understand what they’re committing to.

3) Illiquidity: If you need your money back, surrender charges can be steep (often 7–10% if you pull out early). You lose flexibility compared to keeping your money in stocks, bonds, or even a simple index fund. A bond fund is often better than an annuity.

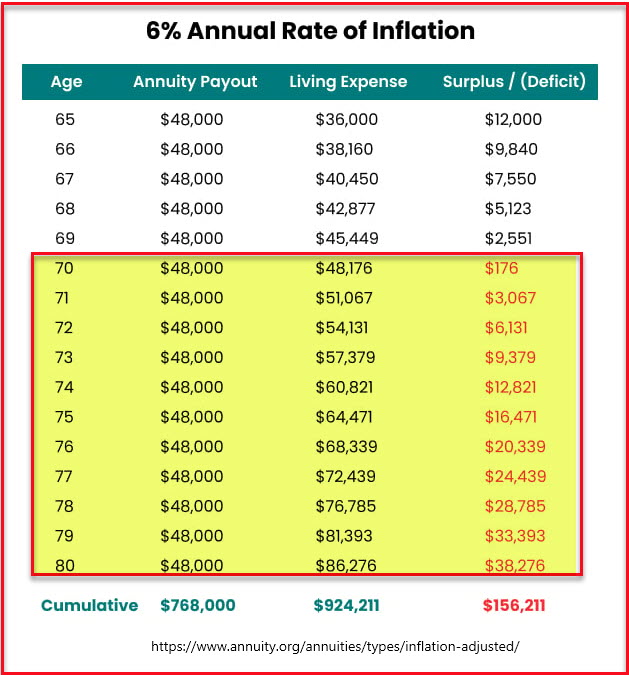

4) Poor growth potential: Fixed annuities often don’t beat inflation. Indexed annuities may cap your upside (e.g., if the market rises 15%, you might only get 5%).

5) Far better alternatives exist: A diversified portfolio of low-cost index funds generally offers higher long-term returns, greater liquidity, and lower costs.

6) Tax inefficiency: While annuities grow tax-deferred, withdrawals are taxed as ordinary income, not at the lower capital gains rate. That means you can end up paying more tax than with investments in taxable accounts.

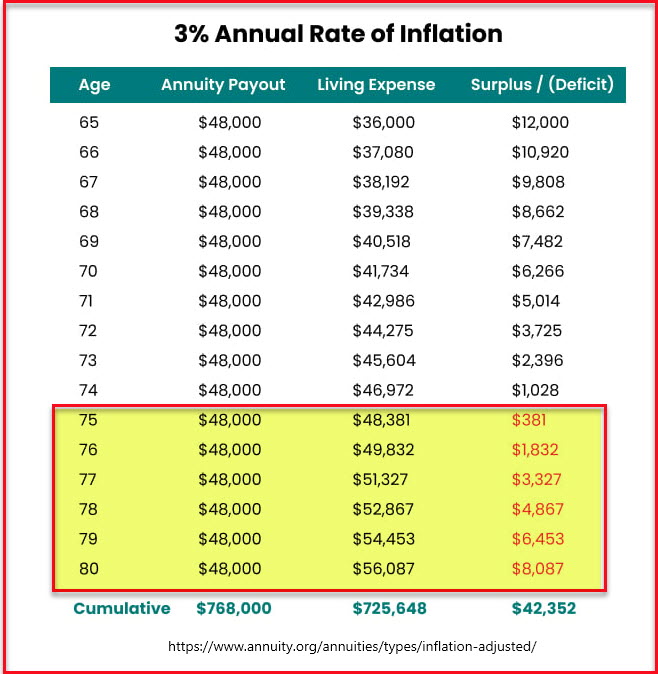

Annuity inflation protection refers to features in certain annuities, like inflation-protected annuities (IPAs) or inflation-adjusted annuities, that ensure payments increase with inflation, helping to maintain the purchasing power of the income received during retirement. This is particularly beneficial for retirees who rely on fixed incomes, as it helps counteract the effects of rising prices over time.

Annuities can be considered bad investments due to their high fees, complex contracts, and the potential for poor management. Additionally, if you need to access your money early, you may face significant surrender charges.

Some annuities can come with exponentially higher fees than other investment vehicles. Annuities can have sales commissions, administrative charges and investment expenses. In addition, sales agents might not discuss an itemized list of fees upfront, obfuscating how much the contract will cost. These fees can erode a significant portion of your potential returns, making other investment options more cost-effective.

Annuity Mistakes

The 7 Biggest Mistakes Americans Make When Buying An Annuity – And How To Avoid Making Them

“Trusting the hypothetical illustrations – A friend of mine is an expert in the annuity industry. Hypothetical illustrations are often best-case scenarios. They’ve repeatedly said, “I’ve never seen an illustration come true.” Find out what assumptions were built into the “too good to be true” illustration.” – Annuity Resources

“Not asking the right questions before buying. What type of annuity? Are there fees? Surrender charges? Is there an MVA? What riders are available, and at what cost? What is the rating? How much can you withdraw penalty-free? How long is the rate guaranteed? How is the gain calculated for index annuities? Is there are surrender charge assessed if I die? How long is the contract term? Is it RMD-friendly? Competitive renewal rates? That’s just some of what you should ask.” – Annuity Resources

T is for Target Date or “Freedom Funds”

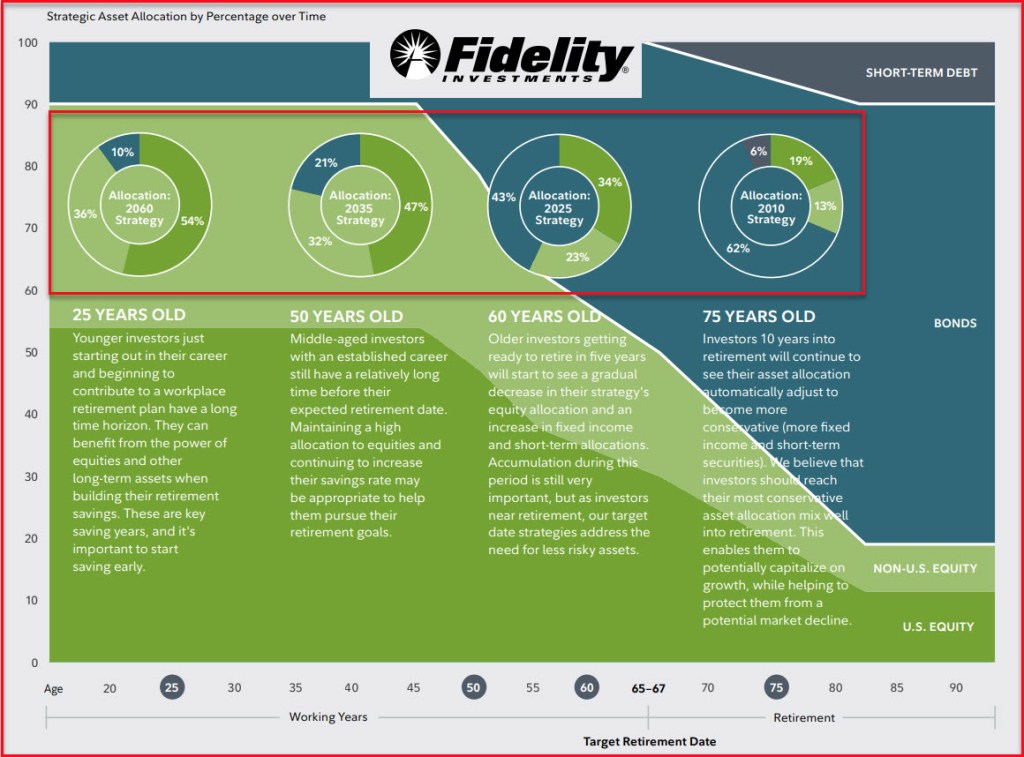

I often see “Retirement Date” or “Target Date” funds in 401(k) statements. This is the “least worst” of the three in the BAT lineup. The double-edged sword: high expense ratios and increasing bond allocation as you get older. In other words, you start out with a fund that can make sense and then it degenerates over time.

Fidelity suggests the following logic: “Why consider target date investing with Fidelity? Investing for retirement, simplified: Choose the fund that best aligns with your planned retirement year to get a complete portfolio in a single investment.” They note that there is diversification and “professional management.” That sounds better than bonds and annuities, but there are downsides.

Investments are diversified: Each fund invests in a mix of different types of assets, offering growth potential while helping reduce risk.

Ongoing professional management: Fidelity’s investment team gradually shifts and regularly rebalances the asset mix of each fund, providing a hassle-free way to invest.

The reality is that Target date funds invest in groups of funds. This makes it very difficult to know what you really own. This increases complexity. Take for example FFFHX (Fidelity Freedom 2050 Fund with an expense Ratio of 0.68%. Why pay that much for a fund that just contains other funds? Did you know that the funds in the fund also have expense ratios?

It is true that the ten-year total return for FFFHX is 170%. But stop and think about this for a moment. The thinking is that you will retire in 25 years (2050.) The ten-year return is based on a mix of investments that is primarily stocks, not bonds. However, over time this mix changes to more-and-more bonds. The fund includes Fidelity Series Growth Company, Fidelity Series Large Cap Stock, Fidelity Series Emerging Markets Opps, Fidelity Series International Value, Fidelity Series International Growth, Fidelity Series Overseas, Fidelity Series Stock Select Large Cap Value, Fidelity Series Opportunistic Insights, Fidelity Series Value Discovery, and Fidelity Series Blue Chip Growth. Do you know that you could just buy these funds or the best of the mix?

Six More Tickers: FFFHX, FFFGX, FDEEX, FDKVX, FFFFX, FFFDX

These all of expense ratios that range from 0.55% – 0.68%. In English these funds are just different mixes of stocks and bonds. They are: Fidelity Freedom 2050 Fund, Fidelity Freedom 2045 Fund, Fidelity Freedom 2055 Fund, Fidelity Freedom 2060 Fund, Fidelity Freedom 2040 Fund, and Fidelity Freedom 2020

Sustainable Target Date Funds from Fidelity

To make matters even more complex, Fidelity offers “sustainable” target date funds: FSUYX, FSVNX, FSWDX, FSWOX, FSXAX, FSXKX, FSXVX, FSYHX, FSYWX, FSZHX, FSZSX, FTGPX, FRCQX, and FSUDX. Some don’t yet pay dividends. The rest only pay semi-annually. Expense ratios vary from 0.41% to 0.49%. That is unsatisfactory.

SUMMARY

The number three is an important number. If you understand the impact of three percent inflation, then I would encourage you to avoid the BAT trio. Look at the CAGR and Expense Ratio of every investment. Also bear in mind that you cannot trade options on any Target Date Fund because they are all mutual funds. You might not want to trade options today, but someday you might want to earn extra income from options trades.

Do you want both income and simplicity? Then as stated earlier, consider ETF VYM. VYM’s ten-year return is 205%. Therefore, VYM’s CAGR is 11.8%. SCHD’s CAGR is 12.7%. Both of them beat bonds and help you stay ahead of inflation. Both have very low expense ratios, so you keep more of your money for future growth and growing dividends.

Full Disclosure

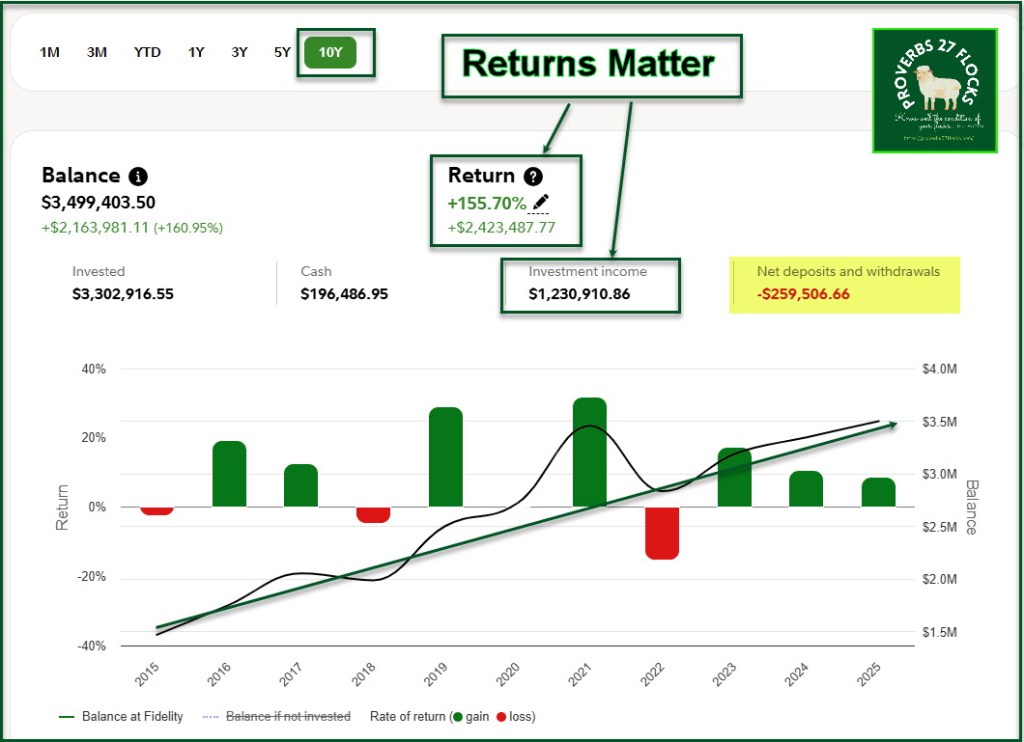

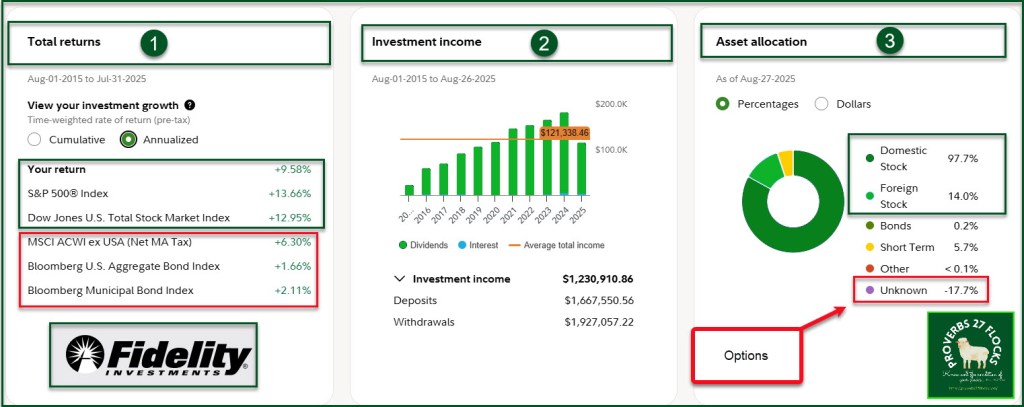

In the interest of full disclosure, here are some images that show our investment account results. Our annualized returns are about 9.6%. This is far better than bonds or international funds. Furthermore, our returns include a hefty dividend that far outpaces the S&P 500 dividend yield. You cannot live off of capital appreciation. You need to earn income in retirement. That will come either from dividends or from selling investments to generate cash.

The next post will dive into another important number. I welcome your questions and suggestions!

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Wayne delivers a masterclass in investing—clear, grounded, and refreshingly free of fluff. While many financial writers lean on vague generalities or recycled advice, Wayne speaks from years of personal study and practical experience, offering readers straight-up facts without the sales pitch. If you’re anything like me, you read critically, compare against what you know, and decide for yourself. And if I were to study the three BAT categories—bonds, annuities, and target funds—it would take hours of deep reading across top-tier sources to arrive at the same conclusions Wayne lays out in just a few pages.

I don’t claim to be an expert, but I know clarity when I see it—and Wayne is spot on. Of course, no single strategy fits everyone, and circumstances matter. But the value here is undeniable: his insights are free, his intent is genuine, and his writing outperforms much of what people pay for. If I had to choose between his ten best pieces and the bulk of paid content I’ve seen, I’d take Wayne’s work every time. High-quality, responsible, and deeply useful—I applaud his efforts

LikeLiked by 1 person

Those are such kind words. I try to provide useful and actionable advice. Thanks for the reminder that focus and clarity are important!

LikeLike