Money Numbers Matter

Over time it is easy to see why investing is a skill that was neglected in high school and then on into college or university. Someone must have thought only some people need to know the basics about some of life’s most important decisions. These are decisions that will have an impact for many for twenty or more years after retirement. I’m glad that I was given the basics about history, the sciences, English, and “social studies” in high school. But I could have been spared many mistakes and delays by knowing some fundamentals about money. This includes both practical fundamentals and biblical fundamentals.

With this in mind, I will do a series of posts to correct the oversights of our school systems. These posts will all have a number. The seven numbers are 3, 4, 5, 10, 22, 72, 100. I won’t cover them in ascending order. Rather, I want to start with an important one; “10” and I will end with the most important one: “100.”

The Number 10: The Ten Percent Rule

The number ten is a good baseline for three “money” things: saving, giving, and growth. It is a helpful number when budgeting, blessing others (via the tithe), and buying investments.

One of many things I was not taught in high school was budgeting. I did gain some insights from a study we forty years ago when we were members of Garfield Baptist Church in Wauwatosa, Wisconsin. The book we used was HOW TO MANAGE YOUR MONEY by Larry Burkett. The book was revised in 1982, and that is the version we own. The book is still available with a different cover on Amazon. Most Christians are aware of the 10% tithe idea from the Old Testament. The New Testament principle is one of generosity and cheerful giving. That, for many, is far more than 10%. However, for beginners, thinking ten percent for giving management is a helpful start.

Also, while I think Dave Ramsey offers some good general advice and his Financial Peace University training is useful and helpful, the thoughtful Christian should also read Larry Burkett’s book. For the student of the scriptures, you will find more biblical wisdom and guidance in Burkett’s book than you will find in Ramsey’s book The Total Money Makeover.

Ten Percent for Saving

The ten percent that I am thinking about is saving ten percent of every dollar earned. Therefore, if you earn $2,000 per month, it is a wise beginning to think about how you can be generous and then also budget to set aside one-tenth of that $2,000 for investments. In the course of a year you will have saved $2,400.

While that may not seem like much, in a future numbers post I will use that number to illustrate the power of that first year of savings. Of course, that means you don’t spend the $2,400 in year two, or five, or year ten. You invest the dollars saved. That is where the third ten appears.

Ten Percent for Growing Over Ten Years

The third piece of the puzzle is selecting investments that average, at a minimum, ten percent of growth per year. Most people pick investments ignoring the ten percent baseline. I always look at the total ten-year returns. Total returns include the dividends you received and the increase or decrease in the price of the shares during the specified period of time.

Let’s look at a couple of examples. We will look at the stock of Cracker Barrel, Target, IBM, VYM (dividend growth ETF), and MSFT (Microsoft). The ten-year total returns of the S&P 500 is about 235%. That translates into an annual average return of almost 12.85% per year. While that is no guarantee of future returns, it tells you something about the overall stock market, or at least the top five hundred USA companies. Here is a Seeking Alpha Link with the comparison: SEEKING ALPHA.

Let’s say we invested in Cracker Barrel ten years ago. Our $2,400 is now worth $1,368. That is because CBRL’s stock has not offered a good total return on the dollars you saved. If, however, you wanted to be diversified and receive dividends on a quarterly basis (VYM), your $2,400 would be worth about 20% more (on average) each year. That happens by doing nothing.

Of course, if you had put the dollars in Microsoft’s stock, you would be very pleased. However, investing all of your eggs in one basket is not the most prudent approach for most investors. Nevertheless, $2,400 invested in Microsoft stock ten years ago would now be worth over $30,000.

This is an important concept. Once you understand the “rules of ten” you will want to save, give, and invest differently. You will have a long-term perspective, and you will make short-term decisions about your budget that can result in gigantic future rewards.

When to Start

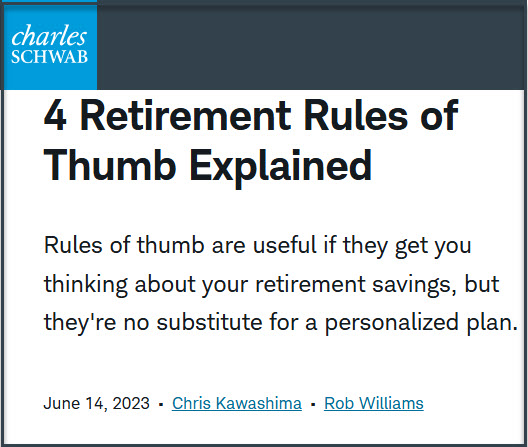

Start now and start early. Savings in your twenties are worth far more than the dollars you save when you are sixty, unless of course, you buy Cracker Barrel (or bonds) as an investment. Schwab includes this in their “4 Retirement Rules” post.

“The detail most people miss here is that a 10% to 15% savings rate—which includes any match from your employer—makes sense only if you start saving in your mid-20s or early 30s. If you start later, you’ll likely need to save more to maintain your current standard of living in retirement.” Schwab

The next post will dive into another important number. I welcome your questions and suggestions!

All scripture passages are from the English Standard Version except as otherwise noted.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

The total return of 235% over 10 years computes to 12.85 % percent per year.

LikeLiked by 1 person

Thanks. Good catch, I found an Excel formula I should use for this, but I’m wondering what formula you used?

LikeLike

Chat GPT provided the answer. But here is a way to check in Excel (1+.1285)^10=3.35. Since you started with 1 and you now have 3.35, your return is 2.35 or 235%. The .1285 is your 12.85% per year and 10 years is the period.

Take care Wayne and God Bless You and Your Family!

LikeLiked by 1 person

/

LikeLike

Taking me back in time with the Larry Burkett study. I once had a notebook with a page for each of Larry’s “envelopes,” which I updated to a set of linked Excel spreadsheets tracking each envelope (mid-1990’s). Because MS Money and Quicken only counted UP what you spent, rather than subtracting DOWN from what you allocated to envelopes, I manipulated them with some category things that no one but me (unfortunately) could manage. The software “Envelopes” worked for a while, but the best I’ve found that mirrors Larry’s manual spreadsheets (or cash in envelopes for the really, REALLY beginner!) is You Need a Budget (ynab.com) which we’ve been using probably six years. Many, MANY people (including my wife and me) owe their financial sanity to Larry Burkett.

LikeLiked by 1 person