Why It Matters

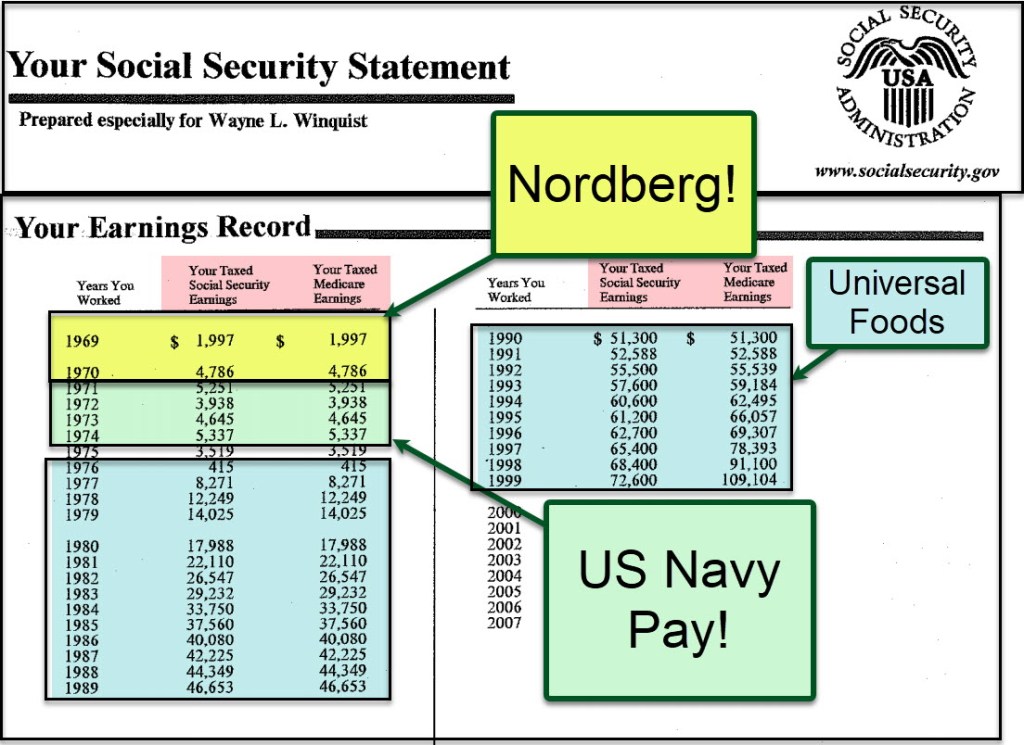

In one word: Tax. Taxes in retirement surprise far too many. Medicare taxes, IRMAA, RMD taxation, and taxes on Social Security income all can be a huge surprise. Do you remember your first paycheck as a teen? I made $3 per hour at Nordberg Manufacturing. I don’t remember what the taxes were, but I learned early in my working years that the government had its hand in my pocket to help me “save for my retirement.”

It never ends. From that first job to the last one, and then on into retirement the taxman cometh. (To put my $3/hour wage in perspective, gasoline was less than thirty cents per gallon and my 1964 Ford Thunderbird only set me back $900.) Even when I was serving my country in the US Navy taxes were withheld from my income.

Question from The Fidelity Investor Community

One participant in the community asked a question about ROTH IRA conversions. He wondered if we should have a “New Senior Strategy” due to the “Big Beautiful Bill” related to taxes. Here is his post: “Now that the BBB has passed and the lower 2017 tax rates are permanent, should we change our plans for Roth IRA conversions? We have more time to convert our IRA’s to a Roth, so does it make sense to take advantage of the new $6k Senior bonus deduction and other tax credits (Energy Efficiency upgrades, New Car loan interest deduction, etc) since we have more runway to make Roth IRA Conversions? I realize that there’s a lot of details missing here, but I’m curious of other’s thoughts!” – krempert

Here was my response: I’m not changing my strategy. Because my T-IRA is a huge tax ghost waiting to haunt my younger wife, I want to pay the taxes for the conversions. I continue to have a strategy at 74 years old:

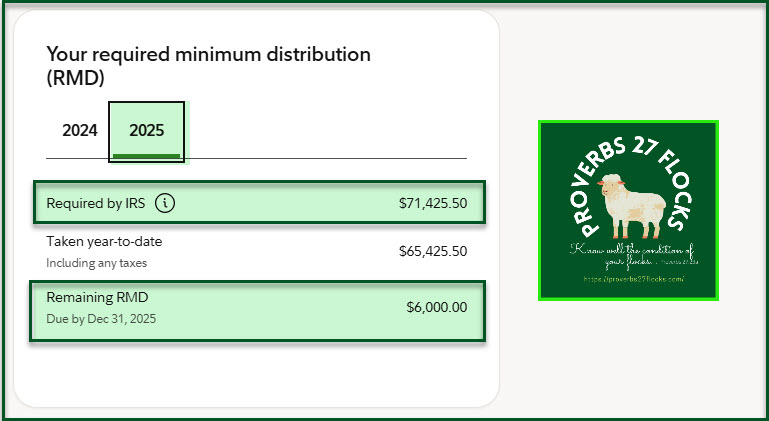

1) Take my RMD using QCD giving. That is being completed this week with a check I am mailing today to help purchase a generator for a seminary in northern India.

2) Start moving stocks/ETFs from my T-IRA to my ROTH looking at ones that the market has punished for the wrong reasons, in my opinion.

3) Disregard the IRMAA burden. It is small potatoes compared to the taxes my wife would be paying as a single filer.

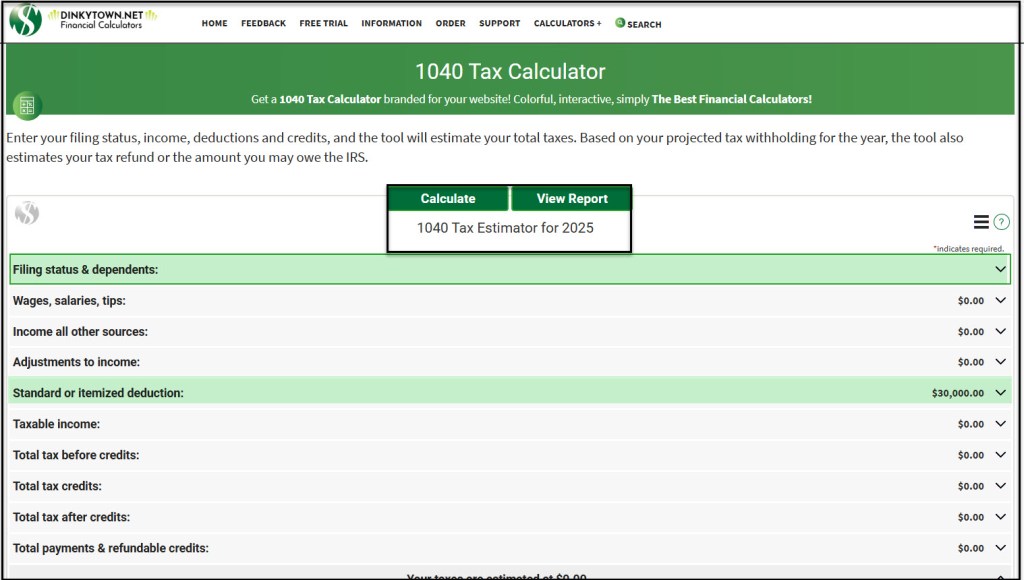

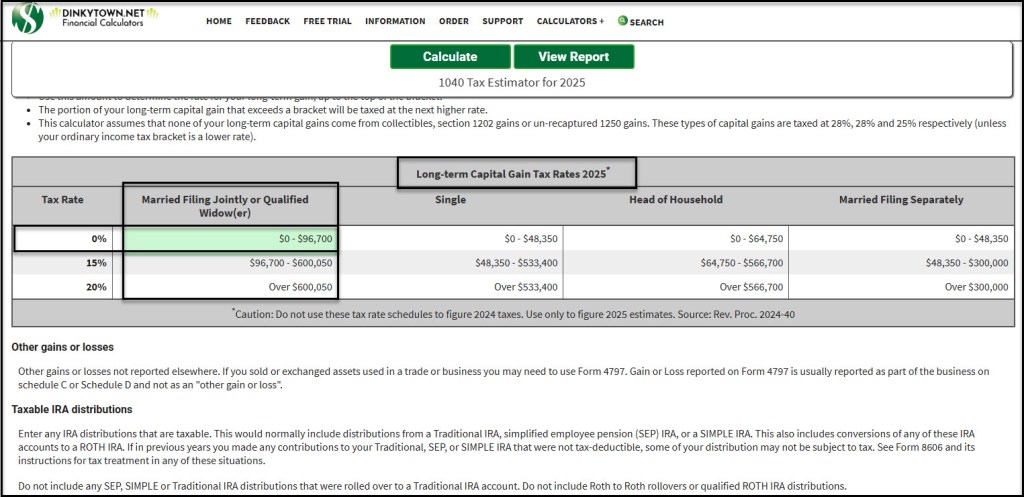

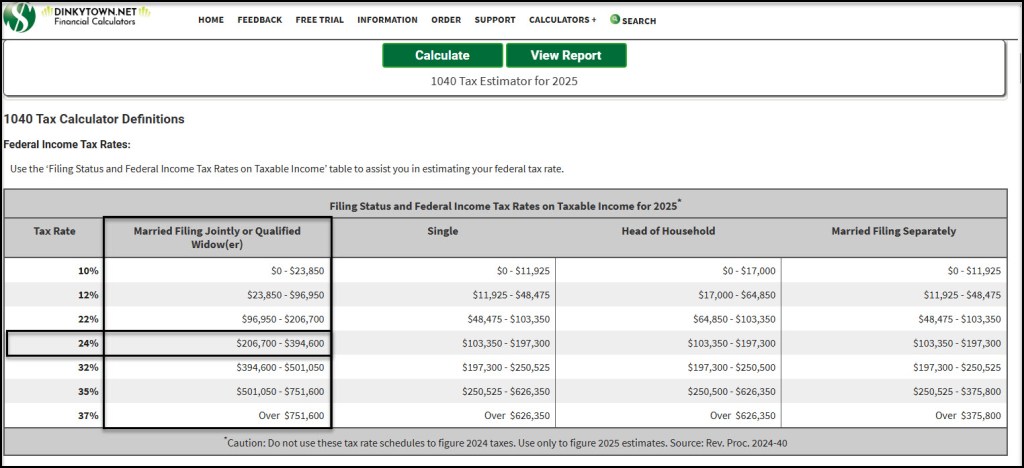

4) Use my spreadsheet and Dinkytown to validate the taxes due to ensure I do sufficient estimated quarterly tax payments.

Think Long-Term Regarding Taxes

Because dividends received in the T-IRA are taxed as regular income when withdrawn, and because I am a dividend growth investor, the tax-free dividends are a snowball of wealth building power when reinvested. Furthermore, when we want to make a large purchase, I prefer to use tax free dollars rather than withdraw cash from my T-IRA. We tend to pay cash for new cars and for the trips we take with our grandchildren.

As icing on the retirement income cake, I trade covered call options and cash covered puts on my T-IRA and ROTH. Again, the income is sweeter in the ROTH. Because my T-IRA is larger than my ROTH, I am able to do more options trades with those positions. However, someday I will be paying a large tax bill on the assets that grow in my T-IRA

It Pays to Pay Attention to IRMAA

Medicare Part B and Part D (drugs) cost retirees every month. In our case we pay both the government and Physicians Mutual for supplemental Part B coverage. This is just another tax. If you don’t pay attention, you might feel some extra pain with higher premiums.

“The 2025 IRMAA income brackets and Parts B and D surcharges have been announced. This year, Medicare beneficiaries with income over $106,000 (for single tax filers), $212,000 for joint filers and $106,000 (for married people who file separately) will pay the surcharge. For these beneficiaries, total Monthly Part B premiums will range from $259.00 to $628.90.” – Kiplinger

“There are five IRMAA-related MAGI brackets for Part B for those filing single as well as for those who are married filing jointly. In the latter filing scenario, Part B premiums are $238.10 for couples with a MAGI of over $182,000 to $228,000; $340.20 for couples filing jointly with a MAGI of over $228,000 to $284,000; and so on up to a maximum Part B premium of $578.30 for those married filing jointly with a MAGI of $750,000 or more. For single filers, the highest Part B premium is $578.30, which is for those with a MAGI of $500,000 or more.” – Kiplinger

Excessive Roth conversions in one year

Doing Roth conversions to reduce taxes in retirement is a smart idea. Traditional IRAs and 401(k)s just are delay tactics. You will pay income taxes someday. Roth IRAs and Roth 401(k)s are tax-free when the money is withdrawn after age 59½. There is a cost to moving the money from the T-IRA to the ROTH, but it is worth it. Conversions themselves are taxable in the year they happen, driving up your taxable income and perhaps putting you in a higher Medicare tier.

To avoid that, your Roth conversions should be handled in a smart way, over a series of years to fit your tax return. This means you should take into account your IRMAA calculation. A retirement planner can help you determine how much you can convert to a Roth without jumping up to a higher IRMAA tier. You can also just use a spreadsheet.

RMD’s and the QCD Tax Savings

The taxes on my RMD are a big chunk of our total income taxes in retirement. I have been leveraging the IRS solution: Qualified Charitable Distributions. My entire RMD is going tax-free to qualified charities and our church. We love to give, and we don’t like paying income taxes on the money we give to charities.

“In 2025, individuals aged 70½ or older can make qualified charitable distributions (QCDs) of up to $108,000 from their IRAs to eligible charities, which will not be subject to income tax. These distributions can also count toward required minimum distributions (RMDs) for those aged 73 and older.” – Schwab

What Can You Do with Your RMD?

Fidelity has some suggestions for what you can do with your RMDs. “Donate to a charity through a QCD or DAF. One of the most tax-efficient ways to manage your RMD is through qualified charitable distributions (QCDs). A QCD allows you to transfer assets directly from your IRA to a qualified charity ($108,000 per individual in 2025). The amount transferred counts toward your RMD but is excluded from your taxable income, thereby fulfilling your philanthropic goals while reducing your tax liability.” – FIDELITY.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

thanks for sharing a beautiful american success story. Love it. Jack H. Jack (Yankel) Miller Telephone: Cell 215-805-6238

LikeLiked by 1 person