Easy Income Keeps Cruising Along

Not long ago I wrote a post that talked about CSWC – Capital Southwest. This investment is in the Financials sector with an industry focus of “Asset Management and Custody Banks.” That is a fancy way of saying it is a Business Development Company (BDC).

Capital Southwest Corporation Company Profile

Capital Southwest Corporation is a business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments. The firm does not invest in startups, publicly traded companies, real estate developments, project finance opportunities, oil and gas exploration businesses, troubled companies, turnarounds, and companies in which significant senior management is departing.

That is because they have a conservative view of the types of investments that will generate ongoing cash for shareholders. I like conservative or prudent management.

Dividend Changing From Quarterly to Monthly

The last dividend announcement from CSWC was a quarterly dividend and another supplemental dividend of $0.06 per share. This time the announcement is encouraging.

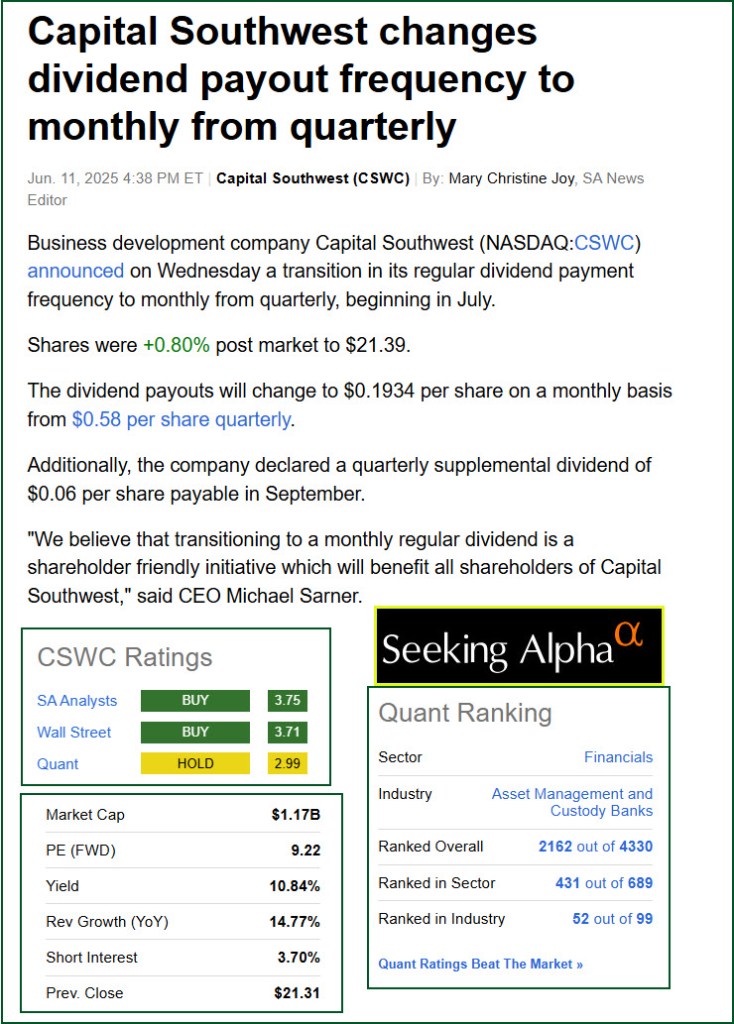

Here are some bits from Seeking Alpha’s June 11th CSWC news. “Business development company Capital Southwest (NASDAQ:CSWC) announced on Wednesday a transition in its regular dividend payment frequency to monthly from quarterly, beginning in July. Shares were +0.80% post market to $21.39.” – SEEKING ALPHA

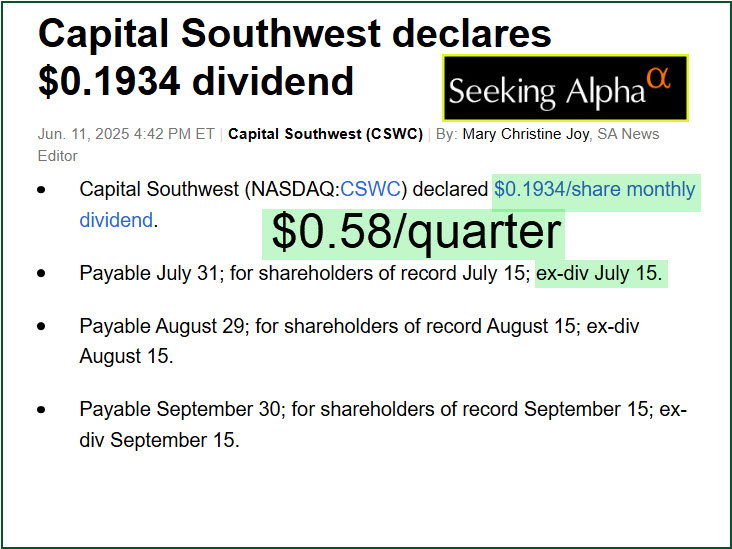

They go on to share that “The dividend payouts will change to $0.1934 per share on a monthly basis from $0.58 per share quarterly.” The good news also is that “the company declared a quarterly supplemental dividend of $0.06 per share payable in September.”

Finally, “’We believe that transitioning to a monthly regular dividend is a shareholder friendly initiative which will benefit all shareholders of Capital Southwest,’ said CEO Michael Sarner.”

Our 4,000 Shares Generates Monthly Income of $773.60

Assuming they don’t reduce the dividend, those dollars can buy a lot of groceries. To put this in perspective, my net Social Security monthly income is $2,411.30. In other words CSWC’s monthly dividend income is 32% of my Social Security. But it gets better. Because 1,700 of the shares are in ROTH IRAs, Cindie and I will earn $328.78 per month in tax free income. The other shares are in our traditional IRAs, so ultimately we will pay taxes on withdrawals for those dividends.

Our 4,000 Shares Generates Supplemental Income of $240.00

In September, as a bonus, there is a supplemental dividend. This is the third $0.06 supplemental dividend of the year for CSWC. It isn’t a guarantee, but $240 buys a lot of plants for Cindie’s flower gardens (or inside gardens) when we go to the Home Depot and use my 10% veteran’s discount!

Seeking Alpha Dividend Grades

Because I am a dividend growth investor, I want to keep my eyes on various dividend factors. Seeking Alpha does a good job helping me do just that. (More information about their summer promotion is shown at the end of this post.)

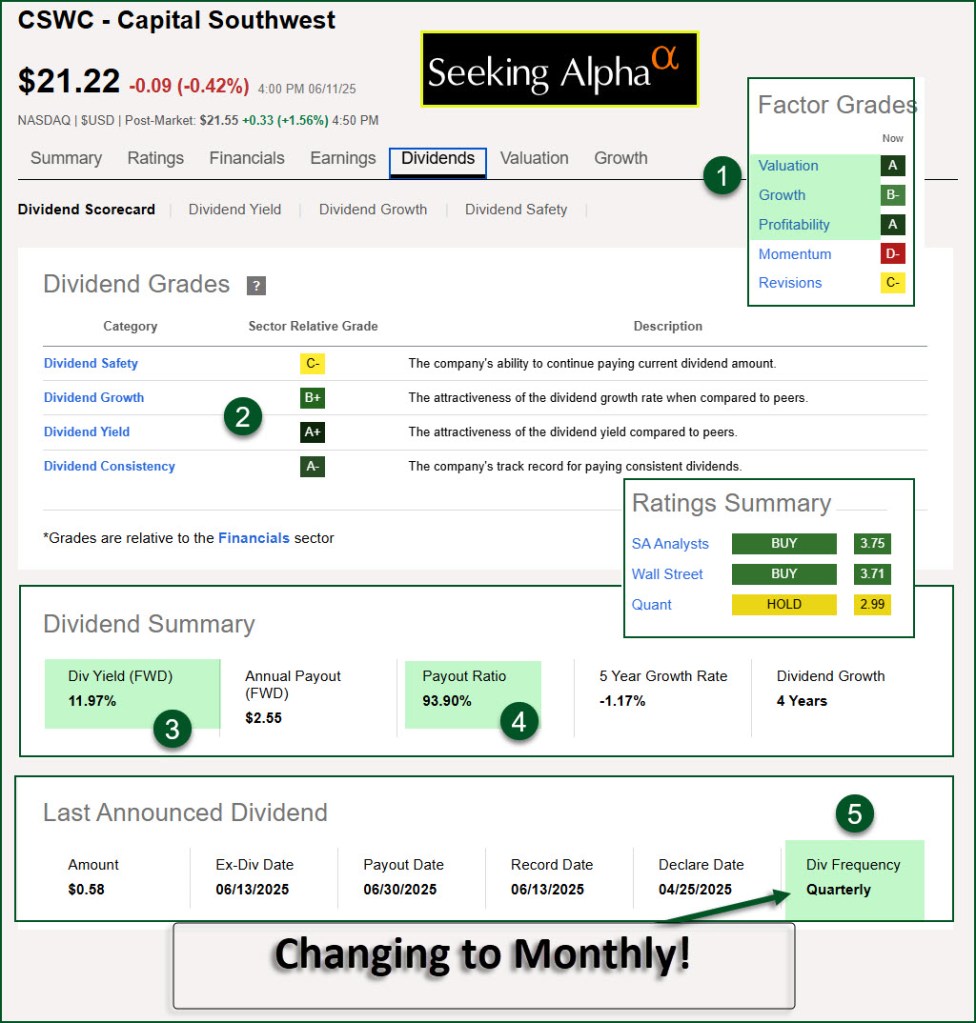

Seeking Alpha breaks the dividend picture into four pieces: Safety, Growth, Yield, and Consistency. In addition, they give you what their grades were three months ago and six months ago. This is helpful, as you want to know if the picture is improving or becoming more “dangerous.” Still, six months is not much history if you are a long-term investor.

For CSWC, the “Safety” rating has declined from C+ to C to C- at present. However, for “Growth” the score is now B+. Three months ago it was B- and six months ago it was B.

One thing is certain, at a dividend “Yield” of 11.97%, the yield grade is A+ and it has been A+ for six months. That isn’t necessarily good. Bear in mind that the yield goes up when the stock price goes down. One year ago CSWC shares were trading at $26.20 and they are now down to $21.22. If you believe in CSWC, now might be a good time to buy shares.

The final dividend grade is called “Consistency.” Consistent dividends are like a consistent Social Security payment. You want consistency. CSWC’s current grade is A-. It had been C and six months ago it was C-.

Seeking Alpha QUANT Evaluation

A good mix of investments continues to make sense for a reliable income stream. I usually like to know the status of the QUANT ratings for our investments. They are usually “HOLD” sometimes I buy more even if the rating is HOLD. I trade covered call options on my stock holdings and sometimes even on ETFs like SCHD. BDC’s, however, are usually not as profitable for options trading.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

Seeking Alpha is running a major sale from June 11 to July 4, 2025. Sale Prices: All prices are 20% off.

Premium: $299 → $239/year ($60 off) – this is the one I use

Alpha Picks: $499 → $399/year ($100 off)

Premium + Alpha Picks Bundle: $798 → $638 ($160 off)

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

My goodness, Wayne, me thinks that you’ve become an influencer!!

— Jerry

>

LikeLike