Why Worry?

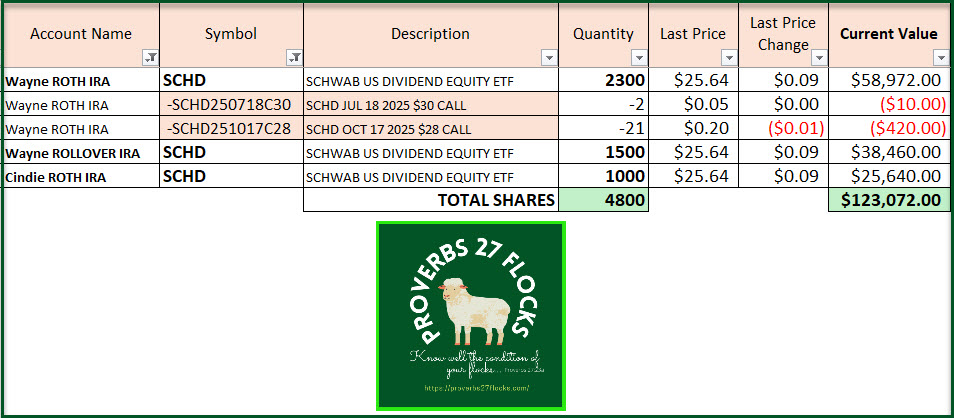

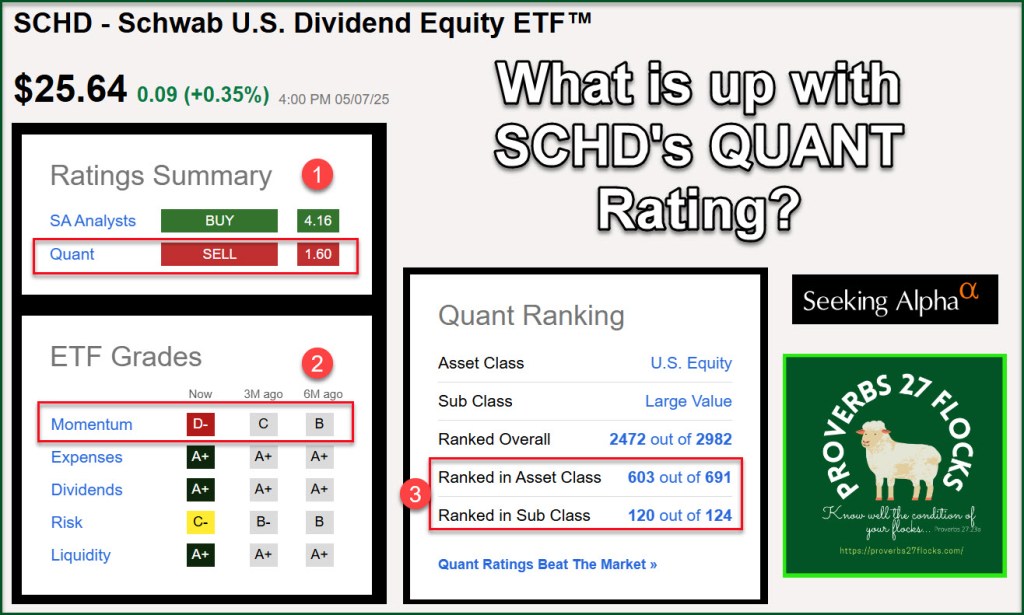

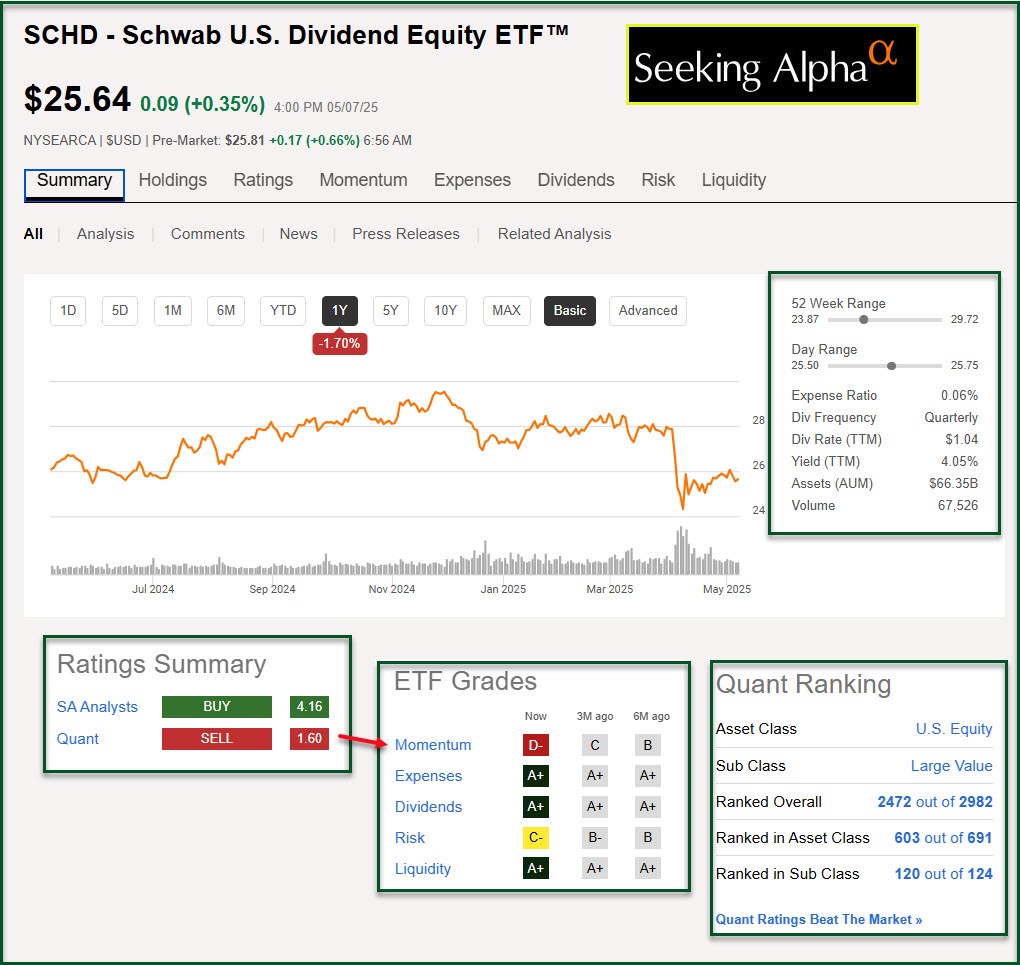

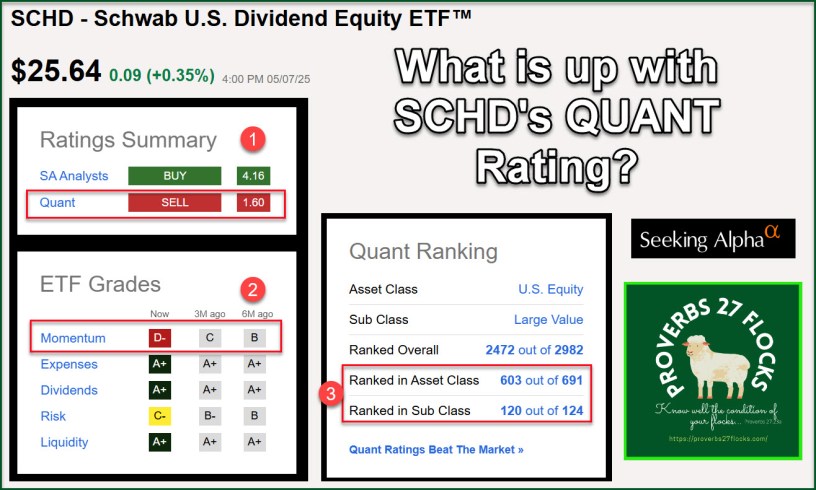

Rarely do I think that a “SELL” QUANT rating is a good thing. I am always on the lookout for stocks and ETFs that have a Seeking Alpha QUANT rating of “BUY” or “STRONG BUY.” Therefore, one must ask the question, “Why will Wayne continue to buy SCHD?” We already have 4,800 shares. I will be buying more.

Under the QUANT Covers

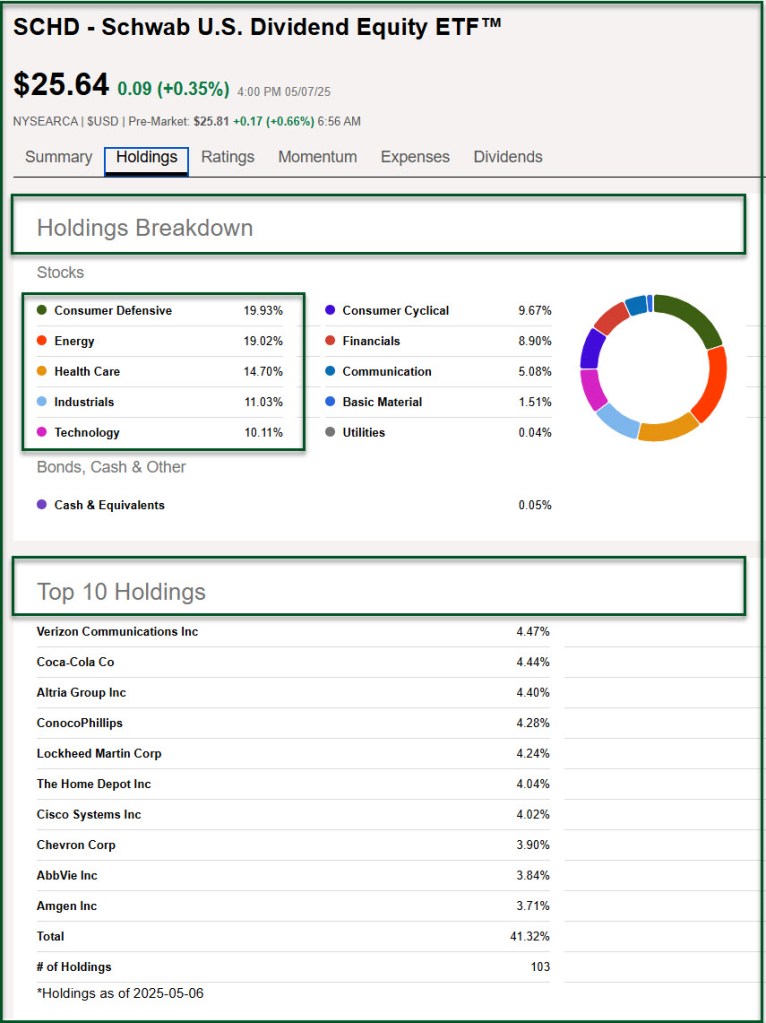

SCHD’s fund is reconstituted each year. The holdings change. Some stocks are removed, and others are added. That happened recently, and some sectors boiled to the top: Consumer Defensive, Energy, Health Care, and Industrials. The impacts of the tariffs and other noise is, I believe, a short-term opportunity for wise, long-term investors. When others are fearful I buy more.

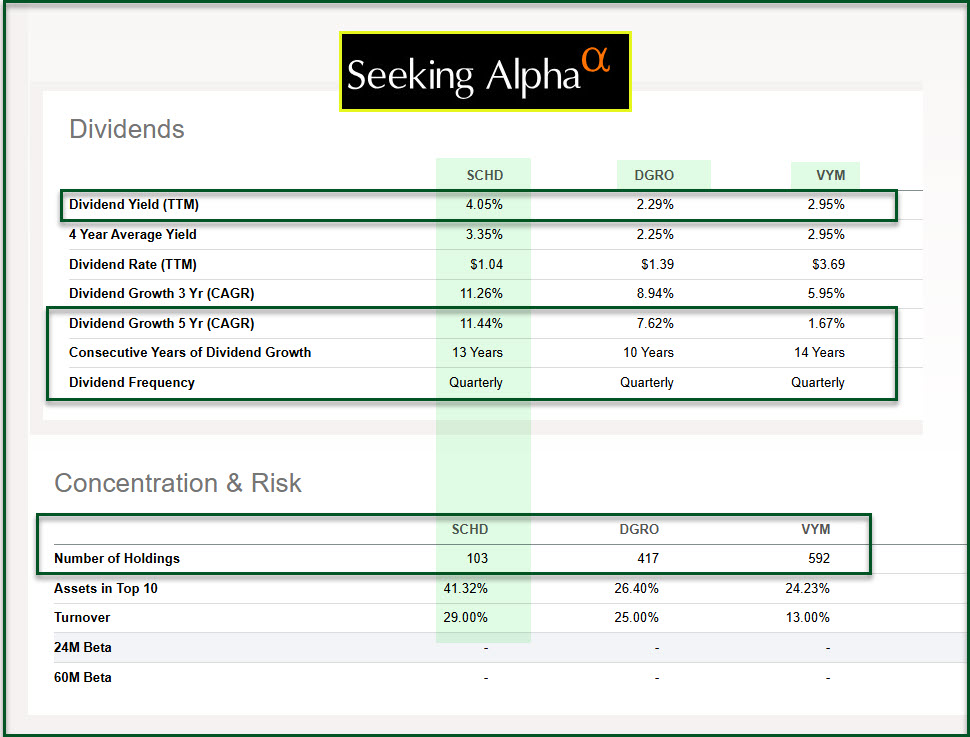

The real issue with the current QUANT rating has nothing to do with the low expenses, high dividend yield, or liquidity. Those all feed into the QUANT rating as a positive. However six months ago SCHD’s price momentum was a “B” and then three months later it was a “C.” Now it is a “D-“, which is about as close to an “F” (Strong Sell) that you can get. Of course, as a result the “Risk” has also increased to a C- rating.

To make the investment even less soothing, the current “Ranked in Subclass” rating for SCHD is almost as low as it can go: 120 out of 124 similar ETFs. That is due, again, to the momentum issues.

Taking A Long-Term Approach

The best time to buy a car is when the inventory is high and no one else is buying,. The best time to buy a new home is when the rest of the buyers are afraid to buy. The best time to buy anything of quality is when it goes on sale. I think SCHD is currently “On Sale!”

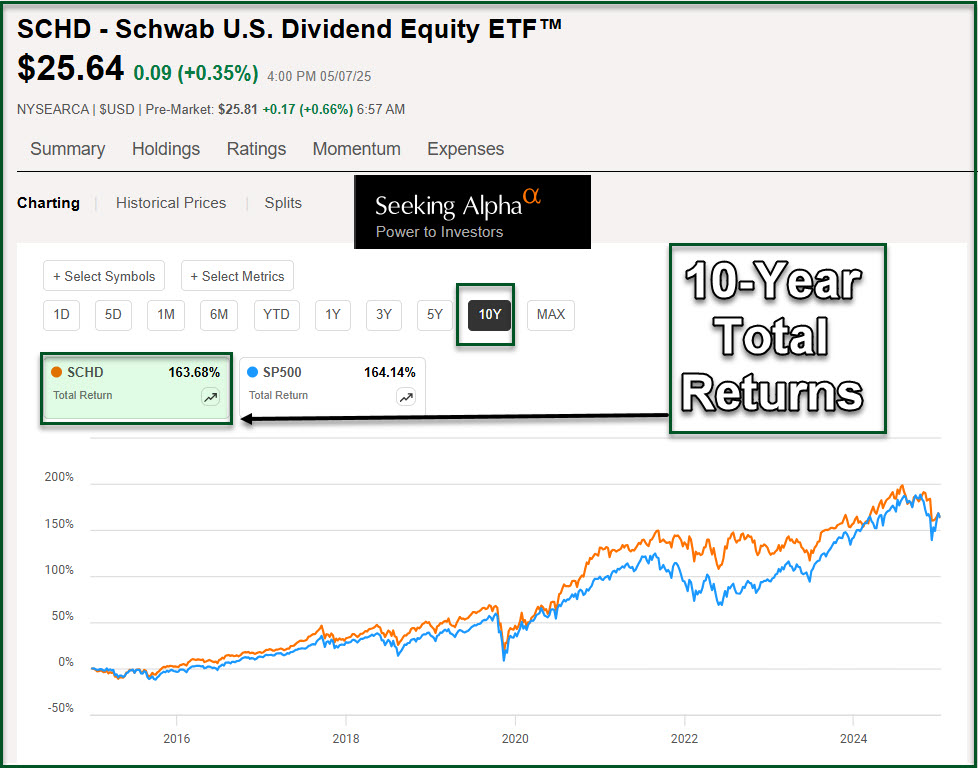

One way to quiet the natural tendency to panic is to look at the total returns of SCHD over the last ten years. Look at the graph. The current “plunge” is just a minor blip on the long-term radar.

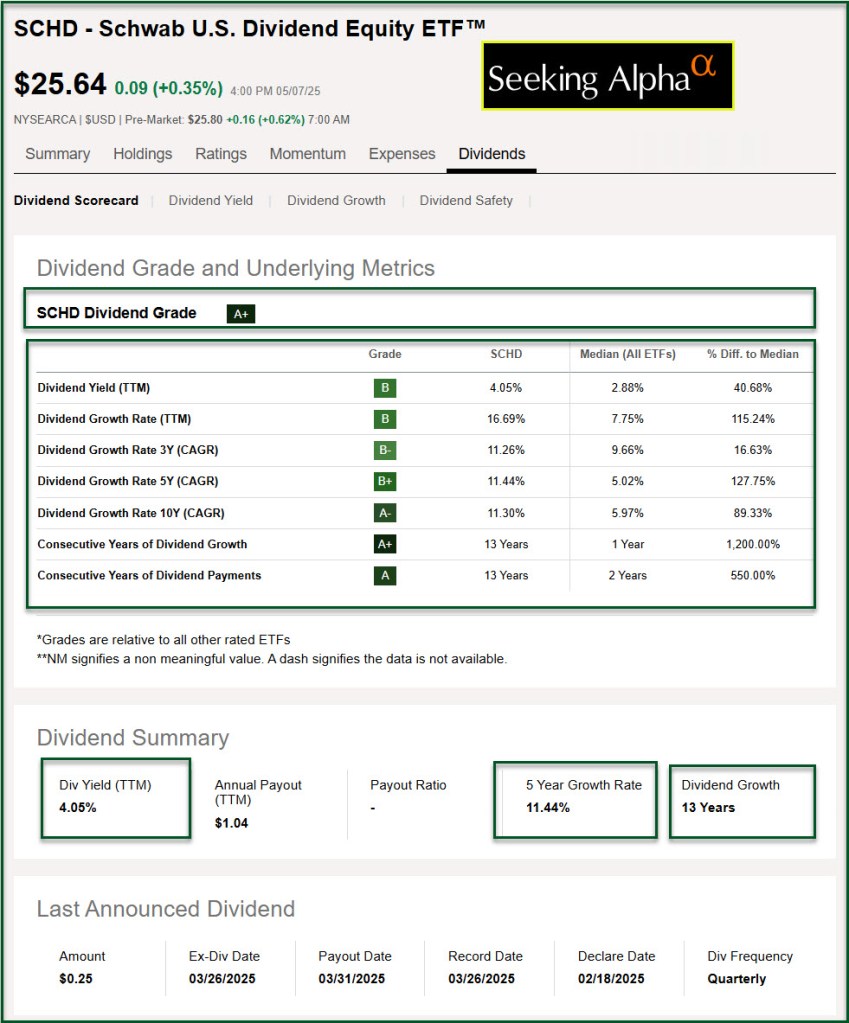

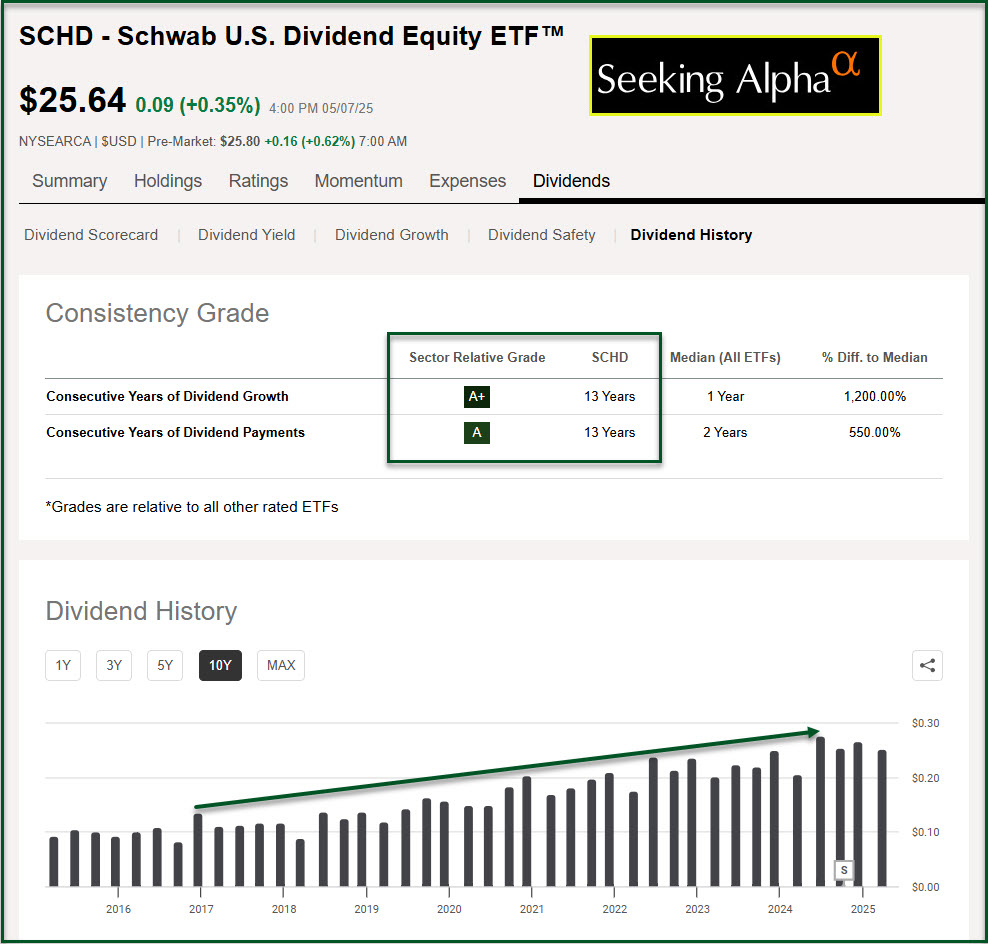

Therefore, there are times when I think it is best to ignore the QUANT rating. However, if other key components of the QUANT rating are unfavorable, then it would be time to sell. For example, if Schwab increased the expense ratio from 0.06% to 0.50% or if they dramatically reduced their dividends it would be time to sell. Neither of those is likely to happen. If it does happen, then the sky is falling.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Love the title of this post. I had been thinking the same thing, but related it to the addition of energy stocks and subsequent tariff fears.

LikeLike