What is a Dividend Champion?

There is a difference between a Dividend Champion stock and a Dividend Aristocrat. Aristocrats are companies in the S&P 500 that have increased their dividends for at least 25 consecutive years. They must have a minimum market cap of $3 billion, and an average daily trading volume of at least $5 million.

Champions are a different set of companies. This list looks at a set of Stocks whose dividends have increased for at least 25 consecutive years, which is the same as the Aristocrat. However, they don’t have the same restrictions as to market cap or trading volume. Smaller companies can appear in this list.

Why Increasing Dividends Matter

There are many companies that pay dividends, but some just pay the same amount year-after-year. When you are in retirement it is important to have a steady flow of income, but it is equally important to have an increasing flow of income. The evil twins of income taxes and inflation will hurt anyone who thinks that this year’s income is sufficient for ten years from now.

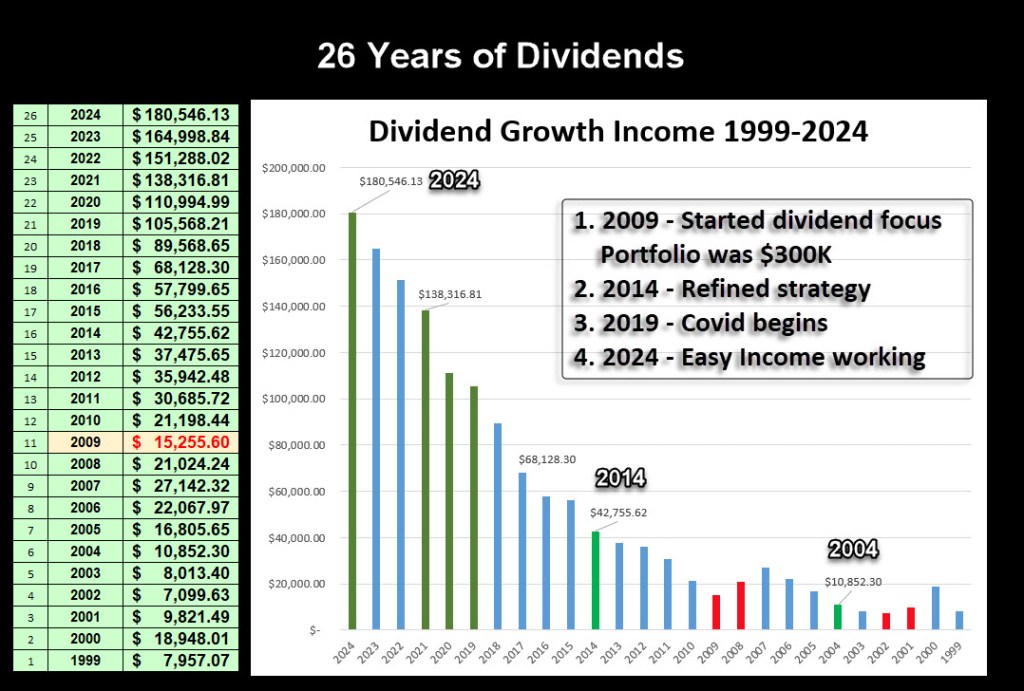

It is possible to achieve the goal of increasing income if you choose the right ETFs and stocks. The following image illustrates the reality. From 1999-2024 my results varied based on the nature of the investments I made. From 1999-2014 my choices were not disciplined for both easy income and increasing income. However, from 2014-2024 I had a more disciplined approach to choosing investments like VYM, SCHD, and DGRO – and individual stocks that pay increasing dividends without the expense of owning the ETF or mutual fund.

Dividend Income 2025 (YTD), 2024 and 2023

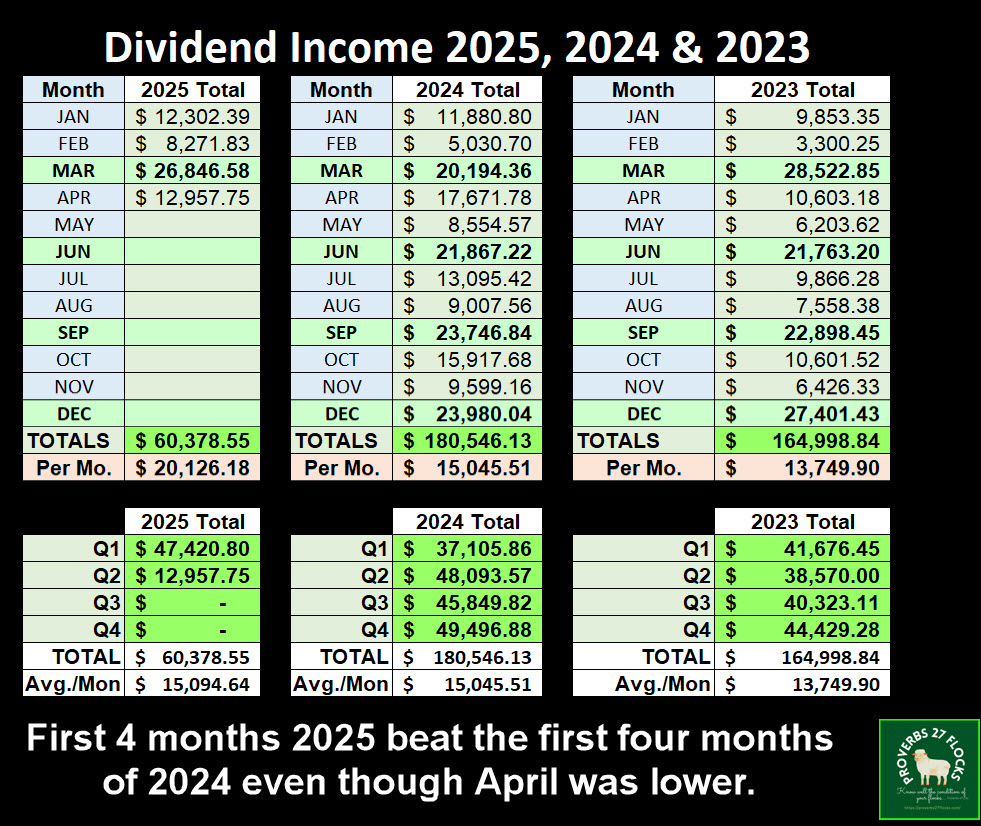

Do you measure the progress of your investments? If you use Fidelity Investments it is easy to see how much you earned in dividends each year for the years you have invested at Fidelity. The following image compares this year with the two previous years. The total dividend income in 2023 was about $165K. The 2024 number was about $180.5K.

If we compare the first four months of each year, we will see that 2023 provided $52.3K in dividend income, 2024 provided $54.8K in dividend income, and 2025 clocked in at $60.4K in income. That is what I mean when I talk about a dividend growth strategy. The best part is that this is easy to achieve. You don’t have to be a day trader or try to time the market.

You also don’t have to trade options. However, if you could make $10K trading options that would give you $10K to buy more shares of another dividend growth investment. To illustrate this, lets consider my traditional IRA. It currently has a balance of $1,758,213.38. Thus far in 2025 I have received $85,221 in options income in this account alone, primarily from covered call options. That is an additional 4.9% of income. If you have an IRA balance of $50,000, using 5% as a possible options income value, you could have earned $2,500 in the same time period. Of course, it really depends on your investment mix.

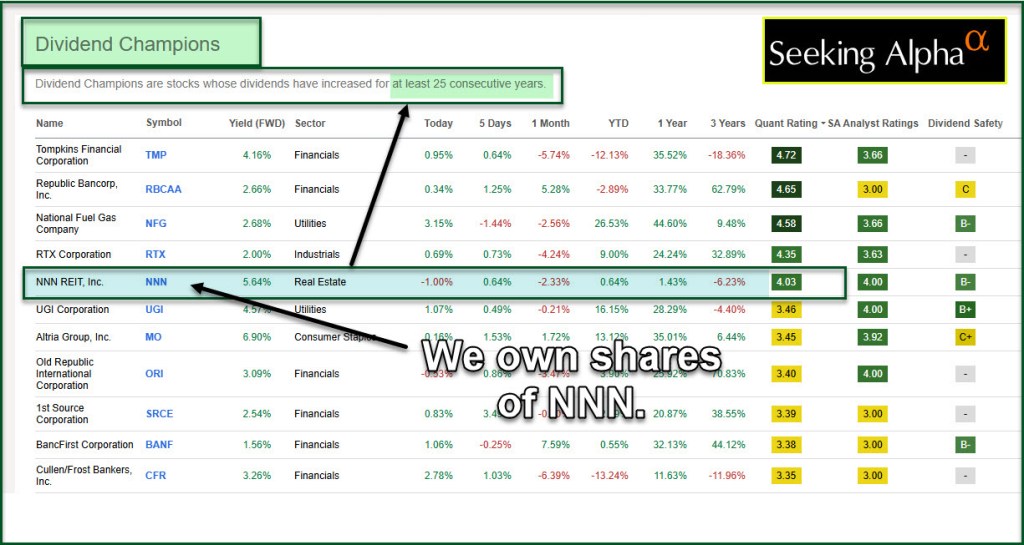

The List of Forty-Three Champions

There are 43 Champions in the Seeking Alpha list of companies that hit the 25 consecutive years of increasing dividends. To simplify my search, after clicking on the link, I sorted the positions by QUANT rating. Using that approach I don’t have to waste my time looking at all of the positions. The top ten are NFG, TMP, RBCAA, NNN, EPD, RTX, UGI, MO, ORI, and SRCE. The first three all have QUANT ratings that are “STRONG BUY.” We own shares of NNN, which has a “BUY” QUANT rating.

Twelve of the 43 are utilities, which is a sector I tend to avoid due to limited dividend growth. Only one is energy, and it is not a good investment for IRA or ROTH IRA accounts due to the K-1 income tax consequences. There are 12 Financial Sector stocks and six in the Industrials. Materials has five and real estate as one: NNN. There are also companies in the Communication Services, Consumer Discretionary, and Consumer Staples sectors. NOTE: The top ten in the image above have changed since I took this screen shot. EPD does not appear in the image, but it does appear in the current spreadsheet.

Bear in mind that the Champions and the Aristocrats can be found in ETFs like VYM, SCHD, and DGRO. Don’t think you have to be a stock picker to participate in the Aristocrats or the Champions.

Conclusion

When people ask me how I find the investments I buy, the answer is usually “I compare investments on Seeking Alpha.” I don’t want to spend hours reading a company’s annual reports and I don’t want to have to do a ton of calculations to determine what fits and what doesn’t fit with a dividend growth easy income strategy. It has to be easy to find and then provide easy income.

Spreadsheet of Dividend Champions

If you would like my spreadsheet of the Dividend Champions, send me an email and I will attach it in my response.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Wayne — Please send me your spreadsheet of dividend champs. Thanks– Jerry

LikeLike

Hello!Thank you so much for your insight and guidance

LikeLike