The Horizon Looks Clouded with Little Fruit

In April I wrote a post titled “Why I am Selling O.” The reason I gave was, “It boils down to risk based on the holdings within Realty Income. Although I like O’s yield and monthly dividends, the total returns have been disappointing.” The same can now be said about HRZN. Both “O” and HRZN pay a monthly dividend, but that isn’t enough to win my loyalty.

Review of HRZN Results

During the time we have owned HRZN shares we have received a total of $4,957 in dividends. Covered call options income was a measly $120.09, so total income was just over $5,000. Sadly, the total loss on this investment is $4,108, so while we did not “lose” money, this investment did not meet my requirements.

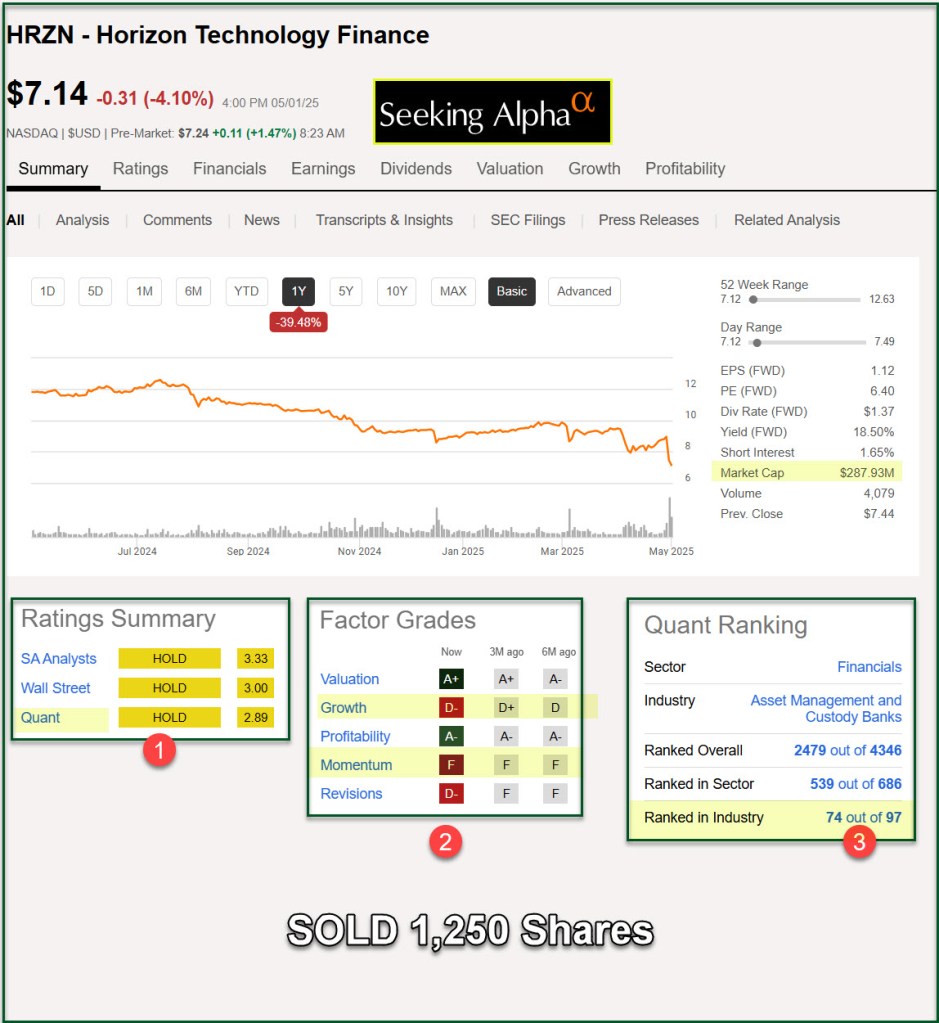

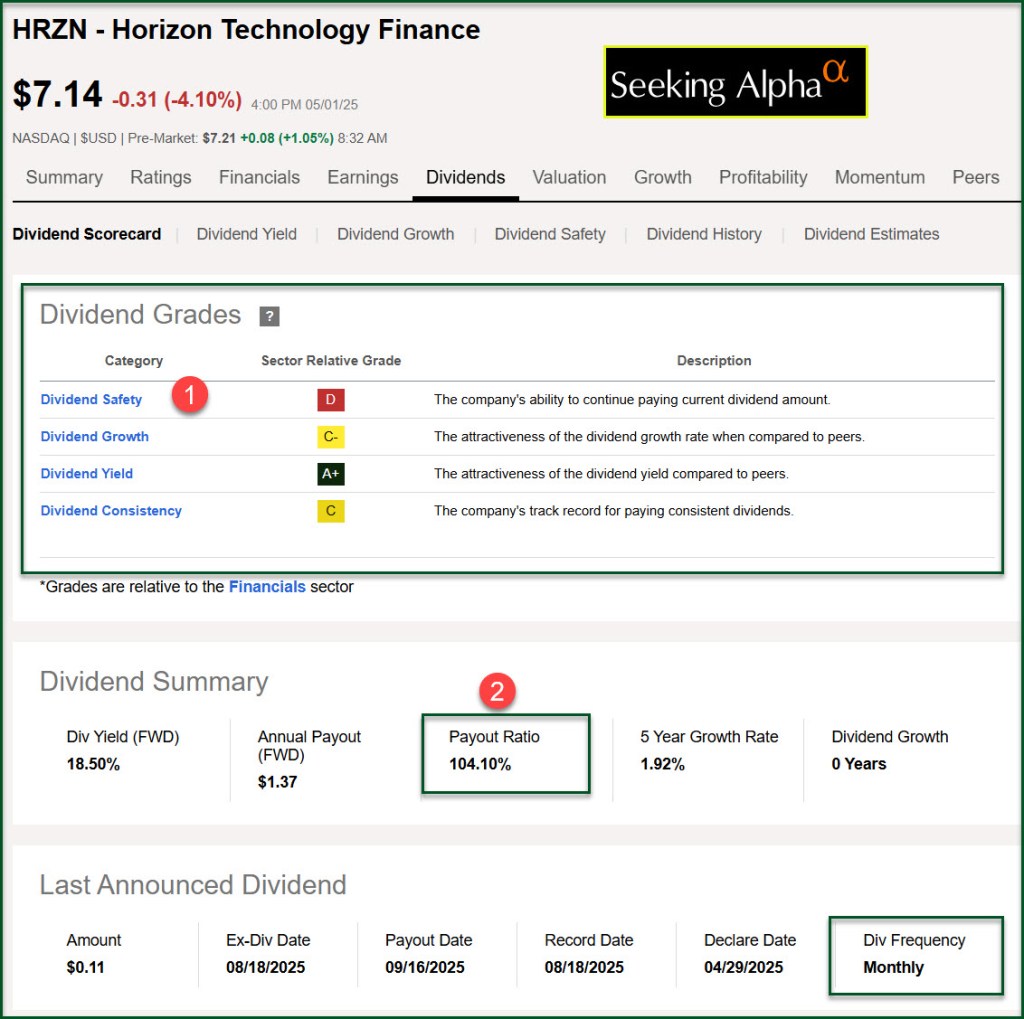

Therefore, I sold all 1,000 shares in my traditional IRA and 250 shares in Cindie’s ROTH IRA account. I want to find investments with a better ROI. There are a couple of reasons for this, not the least of which is that the dividend payout ratio is greater than 100%. That is not sustainable.

In addition, HRZN is a very small BDC. The market cap is less than $300M. Furthermore, HRZN is ranked number 74 out of 97 Asset Management and Custody Banks. That is a warning flag.

By way of contrast, BDC MAIN has a dividend payout ratio of 71.32% and also pays monthly. MAIN is ranked 33 out of the same 97 companies.

GECC (Great Elm Capital Corporation) is ranked number one out of 97, but it is even smaller than HRZN. I would avoid it or only buy a limited number of shares.

Being a Realist

Some investments just don’t measure up when compared to others that have more growth and dividend growth potential. One plant will grow much faster and produce better fruit. Select the investments that have the potential to bear more stock price growth, dividend growth, and options trading potential.

Recommendation

If you hold shares of HRZN, I strongly suggest that you consider selling them. It is better to have the cash earning 4% than to ride HRZN. It is unlikely that you will be pleased with the results if you hold the shares. If you have to take a loss, I think you should take it.

HRZN Business Description

Horizon Technology Finance Corporation is a business development company specializing in lending and investing in development-stage investments. It focuses on making secured debt and venture lending investments to venture capital-backed companies in the technology, life science, healthcare information and services, cleantech and sustainability industries. It seeks to invest in companies in the United States.

Another Seeking Alpha Benefit

As always, Seeking Alpha helps me make decisions. Sometimes those decisions are painful, because at one point an investment seemed like a good idea. I tend to be a buy-and-hold dividend growth “Easy Income” investor. However, there are times when it is good to say goodbye to an investment.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Hi Wayne…thanks for advising us on HRZN and O….what are your thoughts on SCHD …Seeking Alpha Quant shows a strong sell?

Thanks again for your insight.

LikeLike

The “Strong Sell” for SCHD is due to MOMENTUM. For the long-term investor, that is not the value we care about. Rather, look at the other pieces of the QUANT rating. By the way, this was an excellent question!

LikeLike