Every Time a Dividend Is Announced I Remember…

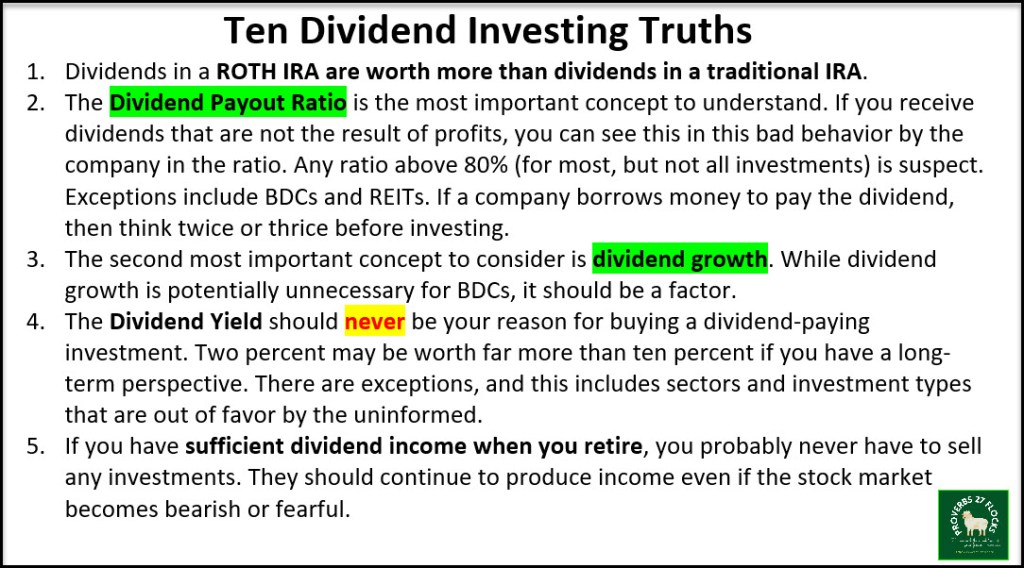

1. Dividends in a ROTH IRA are worth more than dividends in a traditional IRA.

2. The Dividend Payout Ratio is the most important concept to understand. If you receive dividends that are not the result of profits, you can see this in this bad behavior by the company in the ratio. Any ratio above 80% (for most, but not all investments) is suspect. Exceptions include BDCs and REITs. If a company borrows money to pay the dividend, then think twice or thrice before investing.

3. The second most important concept to consider is dividend growth. While dividend growth is potentially unnecessary for BDCs, it should be a factor.

4. The Dividend Yield should never be your reason for buying a dividend-paying investment. Two percent may be worth far more than ten percent if you have a long-term perspective. There are exceptions, and this includes sectors and investment types that are out of favor by the uninformed.

5. If you have sufficient dividend income when you retire, you probably never have to sell any investments. They should continue to produce income even if the stock market becomes bearish or fearful.

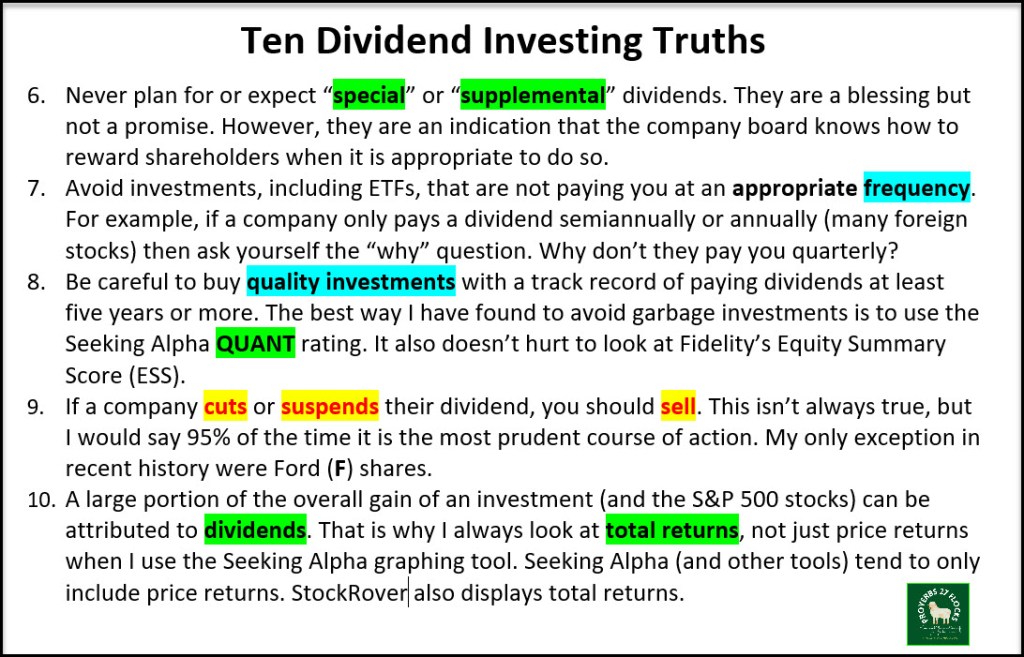

6. Never plan for or expect “special” or “supplemental” dividends. They are a blessing but not a promise. However, they are an indication that the company board knows how to reward shareholders when it is appropriate to do so.

7. Avoid investments, including ETFs, that are not paying you at an appropriate frequency. For example, if a company only pays a dividend semiannually or annually (many foreign stocks) then ask yourself the “why” question. Why don’t they pay you quarterly?

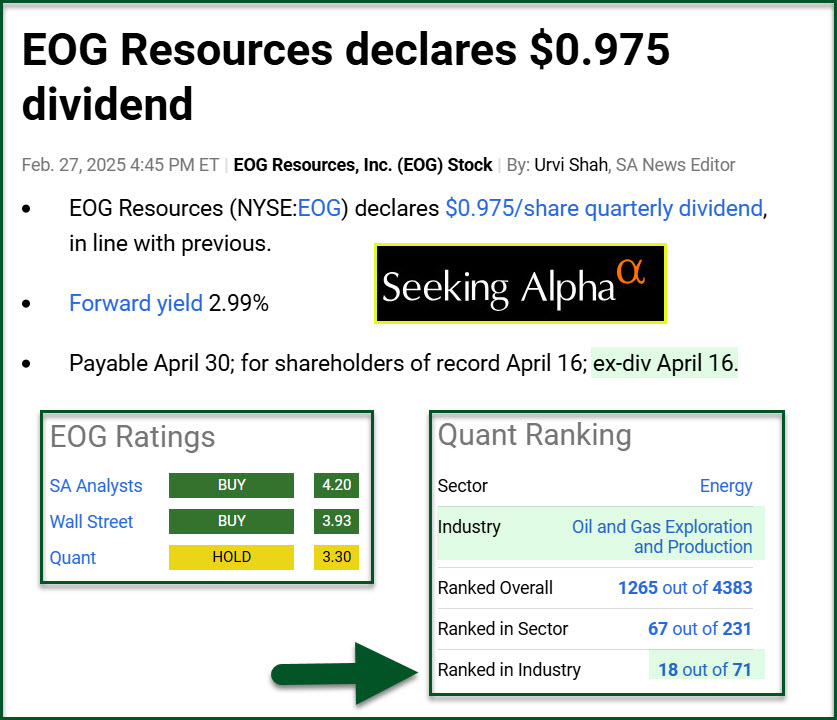

8. Be careful to buy quality investments with a track record of paying dividends at least five years or more. The best way I have found to avoid garbage investments is to use the Seeking Alpha QUANT rating. It also doesn’t hurt to look at Fidelity’s Equity Summary Score (ESS).

9. If a company cuts or suspends their dividend, you should sell. This isn’t always true, but I would say 95% of the time it is the most prudent course of action. My only exception in recent history were Ford (F) shares.

10. A large portion of the overall gain of an investment (and the S&P 500 stocks) can be attributed to dividends. That is why I always look at total returns, not just price returns when I use the Seeking Alpha graphing tool. Seeking Alpha (and other tools) tend to only include price returns. StockRover also displays total returns.

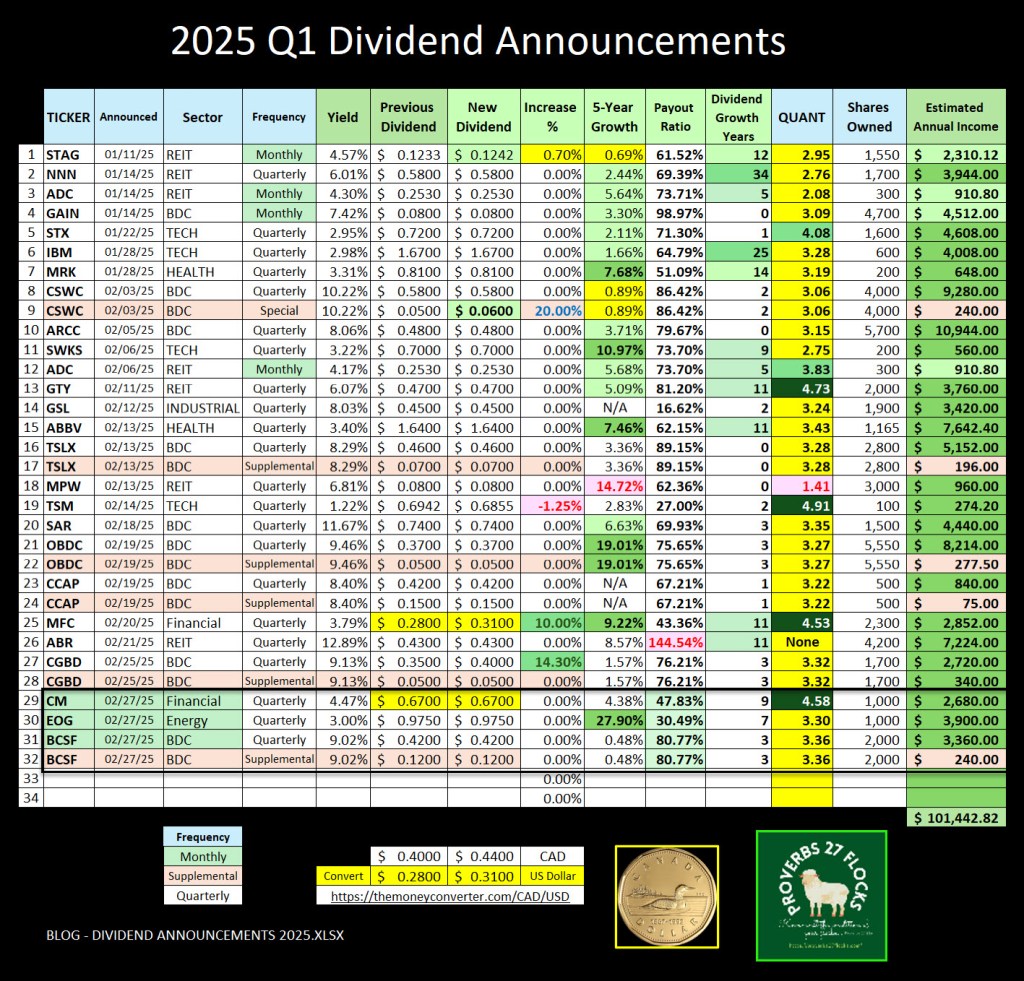

Some More Dividend Declarations

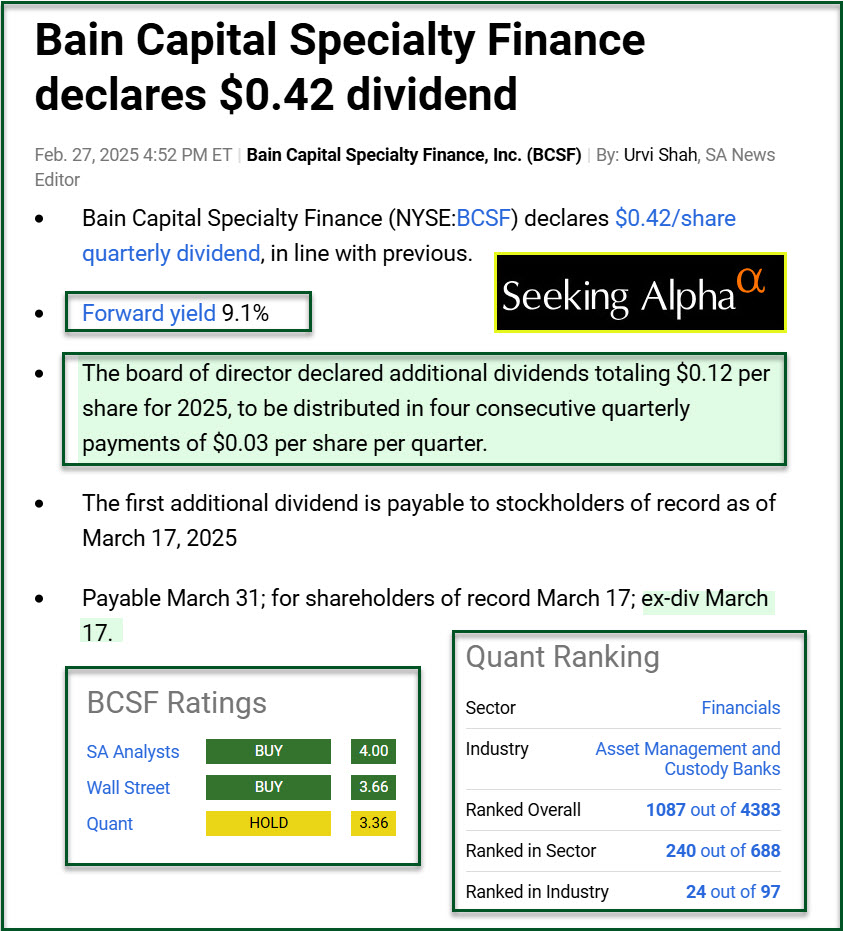

Without further commentary, there are three more investments that announced dividends. One (BCSF) also announced a special dividend to be paid over four months. That way there is quarterly income and monthly income.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Great graphs ! Thank you for always sharing your wisdom.

LikeLiked by 1 person