Most Remarkable

The last three dividend announcements each had a bonus. Two of them, OBDC and CCAP announced quarterly and supplemental dividends. One of the three, MFC, announced a dividend increase of ten percent.

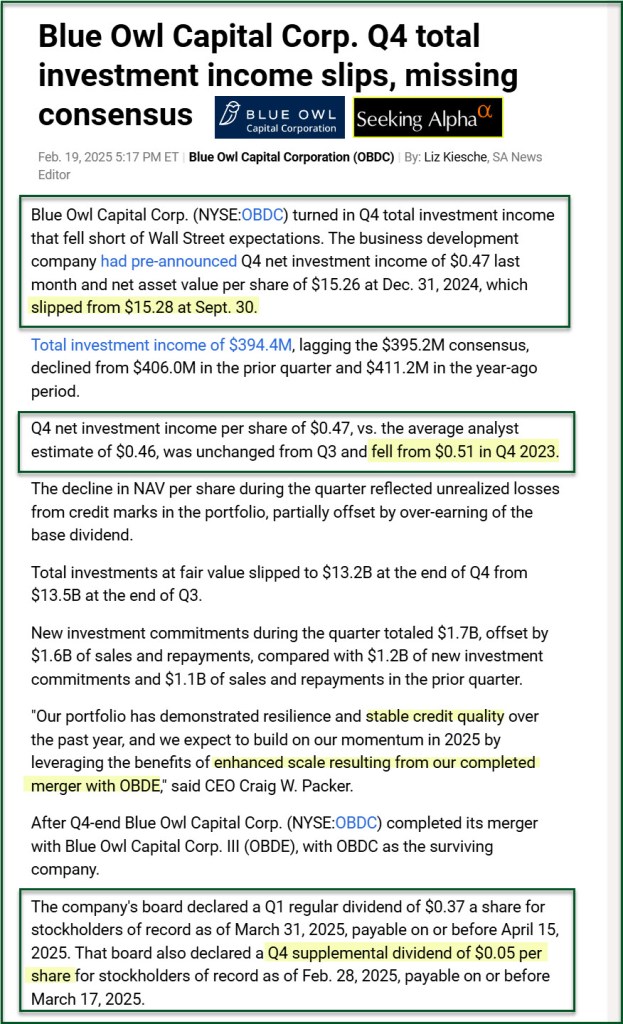

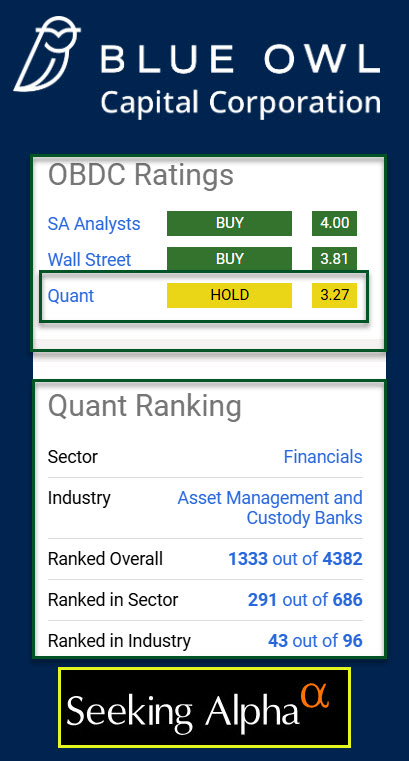

OBDC Quarterly and Supplemental Dividends

Blue Owl Capital (NYSE:OBDC) declared $0.37/share quarterly dividend. This is the same as last quarter’s dividend. The yield for this investment is 9.46% and it is payable April 15 for shareholders of record March 31 with an Ex-dividend date of March 31. OBDC’s board also declared a fourth quarter 2024 supplemental dividend of $0.05 per share for stockholders of record as of February 28, 2025, payable on or before March 17, 2025.

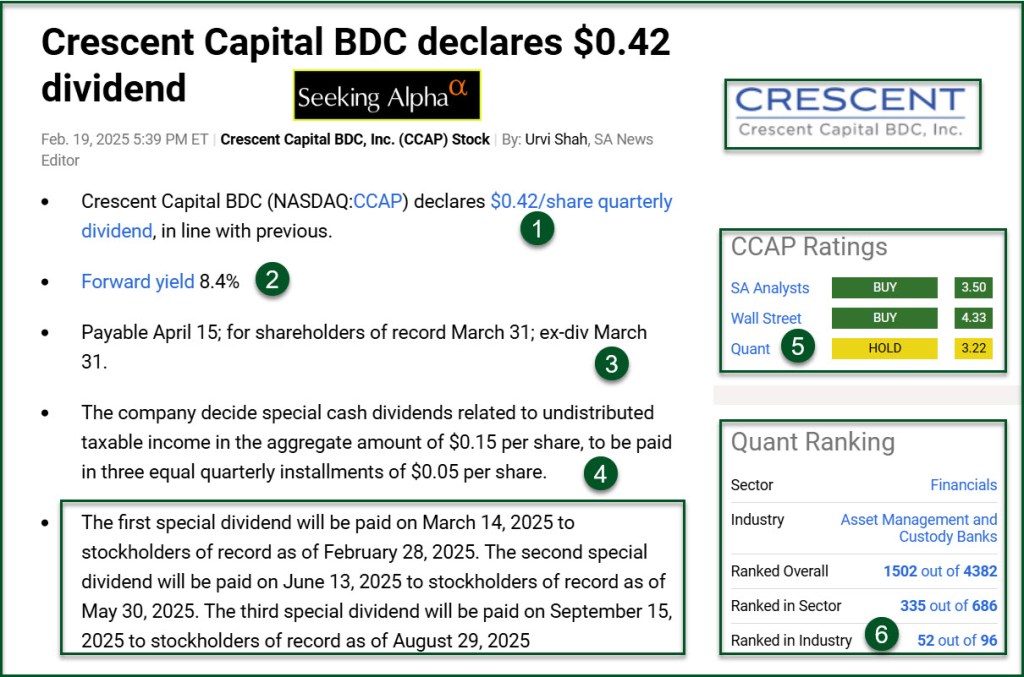

CCAP Quarterly and Supplemental Dividends

CCAP, another BDC, declared a first-quarter 2025 regular dividend of $0.42 per share and announced a series of three $0.05 per share special cash dividends to be distributed in March, June, and September 2025. No supplemental dividend was declared for Q4 due to measurement test limits. CCAP’s forward dividend yield is 8.4%.

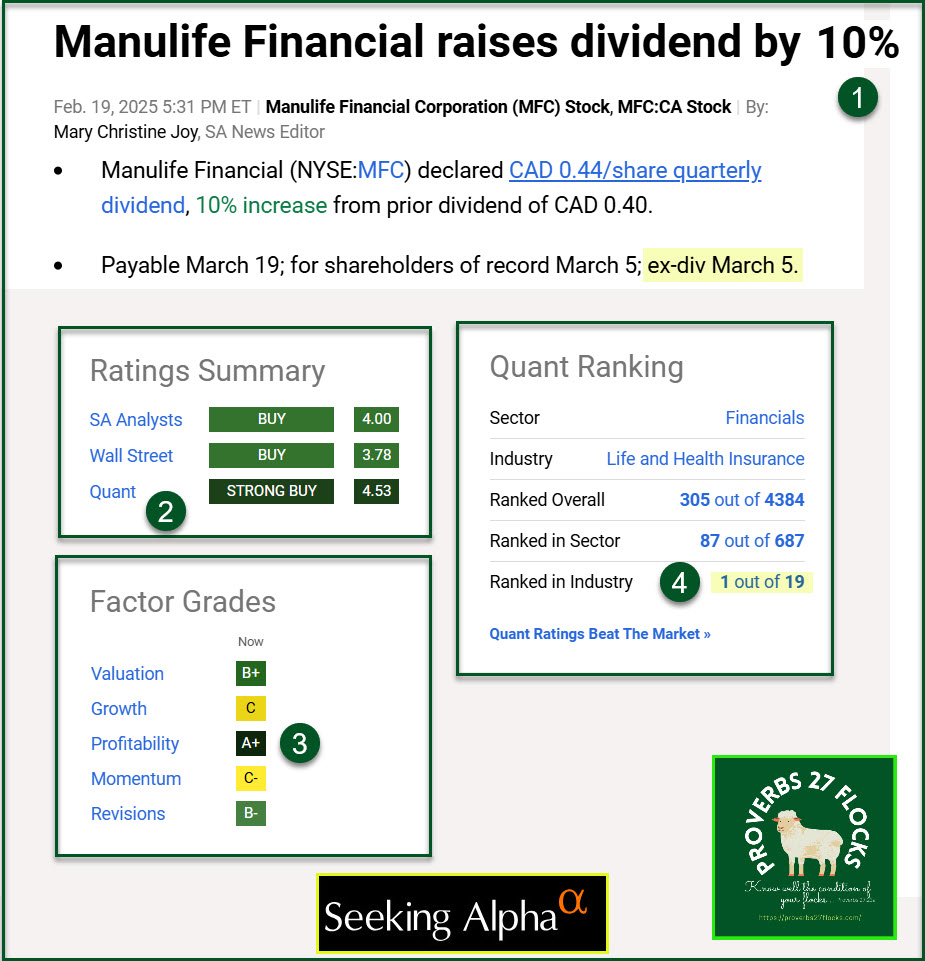

MFC Dividend Increased

Manulife Financial Corporation is a financial company in the Life and Health Insurance industry. MFC, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. It is a Canadian firm, so it declares dividends in Canadian dollars (CAD). It is easy to convert those dividends to US dollars using many different websites. I put the US dollars in my spreadsheet for comparison purposes.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Wayne, are there any tax considerations to investing directly in Canadian firms?

LikeLike

I don’t believe there are tax considerations, but most of our assets are in traditional and ROTH IRAs. In all of the reading I have done I have never seen anything mentioned about issues with Canadian investments. The same is not true of other countries. Some have very punitive tax policies. For example, I sold our shares of ZIM (Israel-based) when I got hit with some ridiculous tax withholding by Israel. The shares were held in the traditional IRA. I also avoid investments that pay dividends in France. That is another country that likes to ding investors.

LikeLike