My Opinion is Expressed in Our Holdings

When using Seeking Alpha to evaluate investments, I want to know some key values. The QUANT score, the historical ten-year total return on the investment, and some specific dividend-centric values are crucial in my analysis.

SG’s BDC Questions

One of my readers, SG, asked a question I am often asked. It has to do with choosing BDCs as an investment. SG is going to sell some shares of LQD (iShares iBoxx $ Investment Grade Corporate Bond ETF). LQD, a bond ETF, has the kind of performance I have come to expect from bonds and bond funds. The total return (share price plus dividends) for the last ten years has been 25.02%. Yuck! Compare that to the ten-year return of VOO (Vanguard S&P 500 ETF), which is 245.82% and you will see why I dislike bonds.

For another comparison, consider BDC MAIN. MAIN is “Main Street Capital Corporation” and it is one of our top ten investments. MAIN’s ten year total return (share price plus dividends) is 332.52%. Assuming that MAIN will continue to perform well, it is the clear winner in this simple comparison.

Now let’s compare the QUANT ratings for LQD, MAIN, and VOO. LQD has a SELL QUANT Rating of 2.02. VOO has a BUY QUANT rating of 4.12 and MAIN’s is HOLD at 3.15. In other words, if you own LQD, it is time to say goodbye. If you own VOO, you may want to add shares. If you are thinking about MAIN, you might want to enter a buy limit order to add shares if the price drops to $59-60 per share.

What SG Currently Owns

“I already have MAIN, HTGC & OBDC in my ( T-IRA) portfolio.” I like these BDCs, and we own MAIN shares (3,330 shares), and 5,550 shares of OBDC. I have owned HTGC in the past, but don’t currently own shares. OBDC’s current QUANT rating is 3.23 and HTGC is at 3.27. Neither of these is a growth stock, but they have fantastic dividend yields.

To look at this another way, Cindie and I have $85K invested in OBDC and $204K in MAIN shares. Therefore, I will not be buying more of either of these, but I don’t have plans to sell either.

What SG is Considering

“I am thinking to add with the sale of LQD to complement the above in my T-IRA portfolio: CSWC, TSLX, BXSL, FDUS, FSK & MSDL.” He then asks the question: “Out of the above what is your opinion/suggestions – which ones or all I should consider adding in my portfolio?”

BDC Investments We Own

Let me start by telling you what we own of these six. First, CSWC clocks in at 4,000 shares worth about $94K. The QUANT rating is 3.22 (Hold).

We own 2,800 shares of TSLX that are currently valued at $64K. The QUANT rating for this BDC is 3.28 (Hold).

ARCC is another large holding for us. We own 5,700 shares worth $133K. The quant rating is 3.24. There is a common theme here. Any QUANT rating in the threes is a HOLD, fours are a buy, and five or the high fours is a strong buy.

We do not own shares of BXSL, FDUS, FSK or MSDL. I would eliminate FDUS and MSDL simply because they are tiny. The enterprise value of FDUS is $1.21B (compared to ARCC’s enterprise value of $28.78B). ARCC is preferrable in my opinion. MSDL is very, very, very small and has very little history.

Some Helpful Comparisons

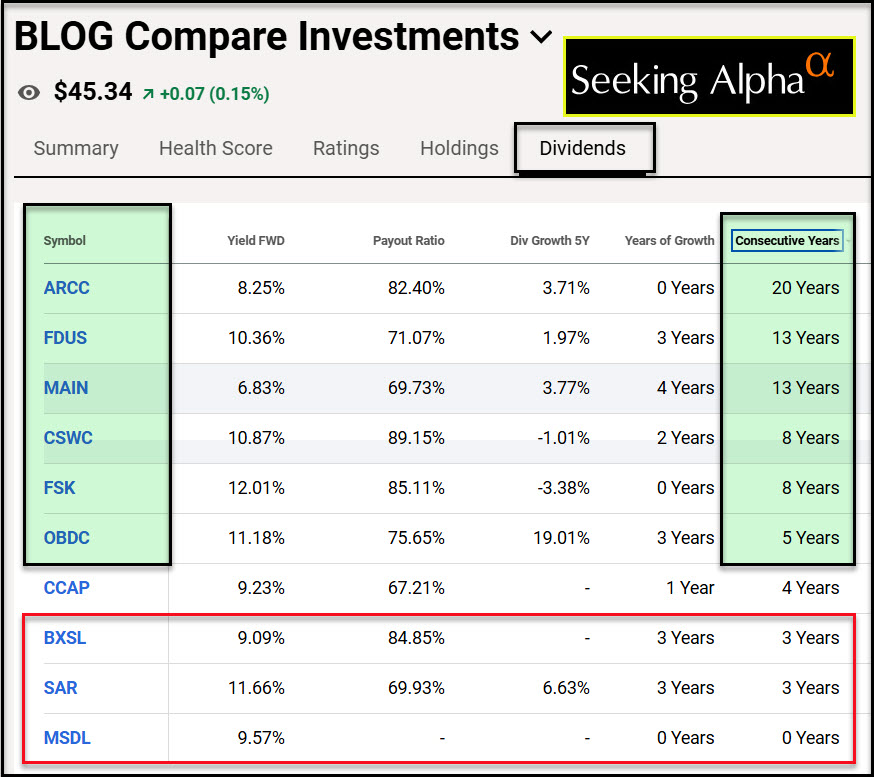

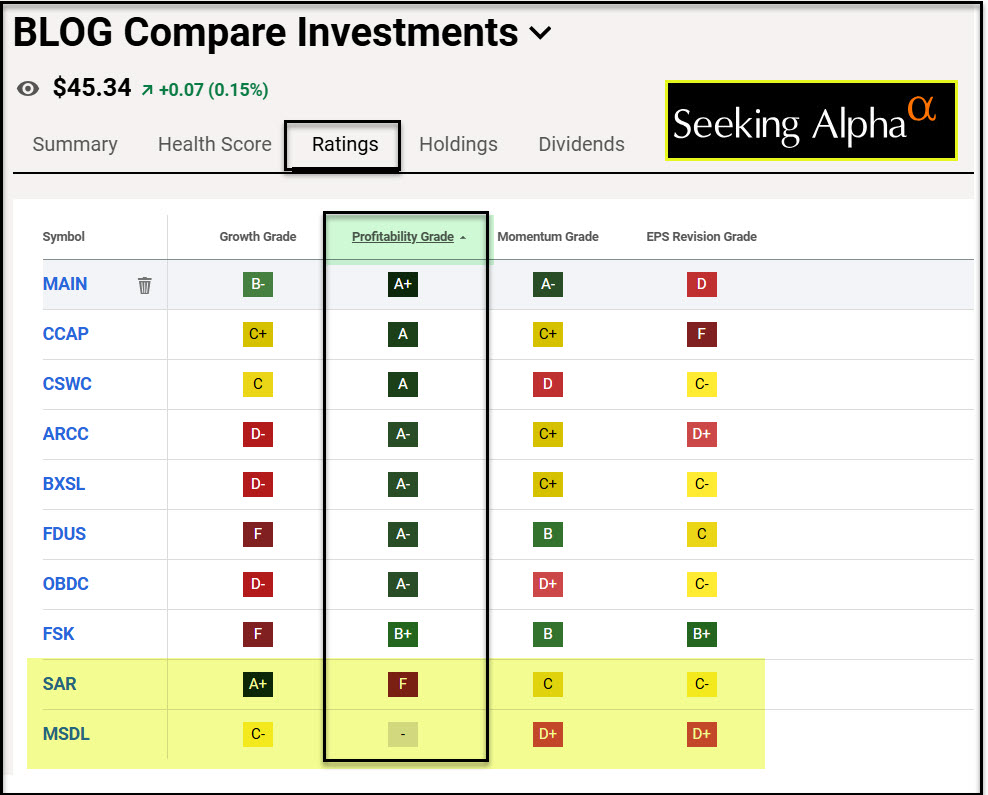

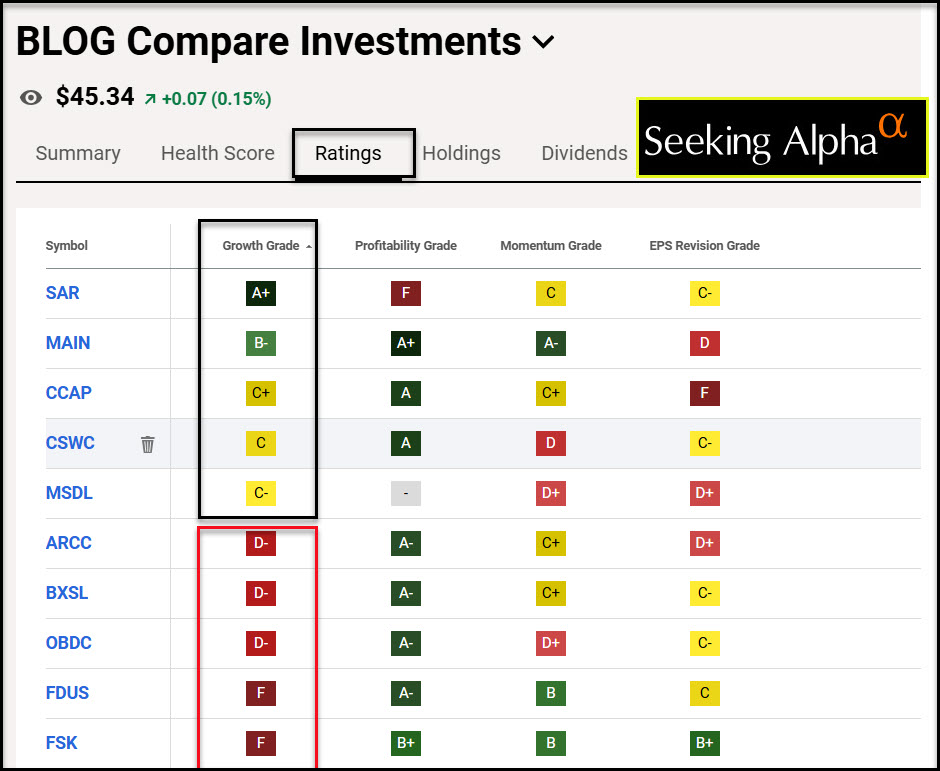

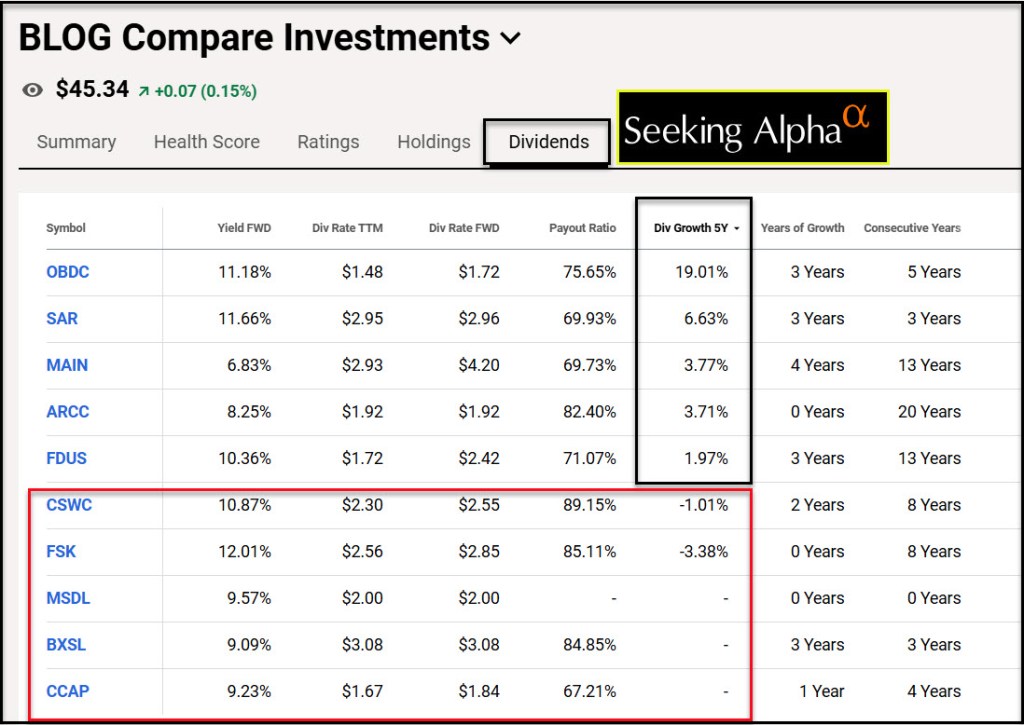

The first is the consecutive years an investment has paid a dividend. ARCC, FDUS, and MAIN lead the pack. Perhaps FDUS is worthy of consideration.

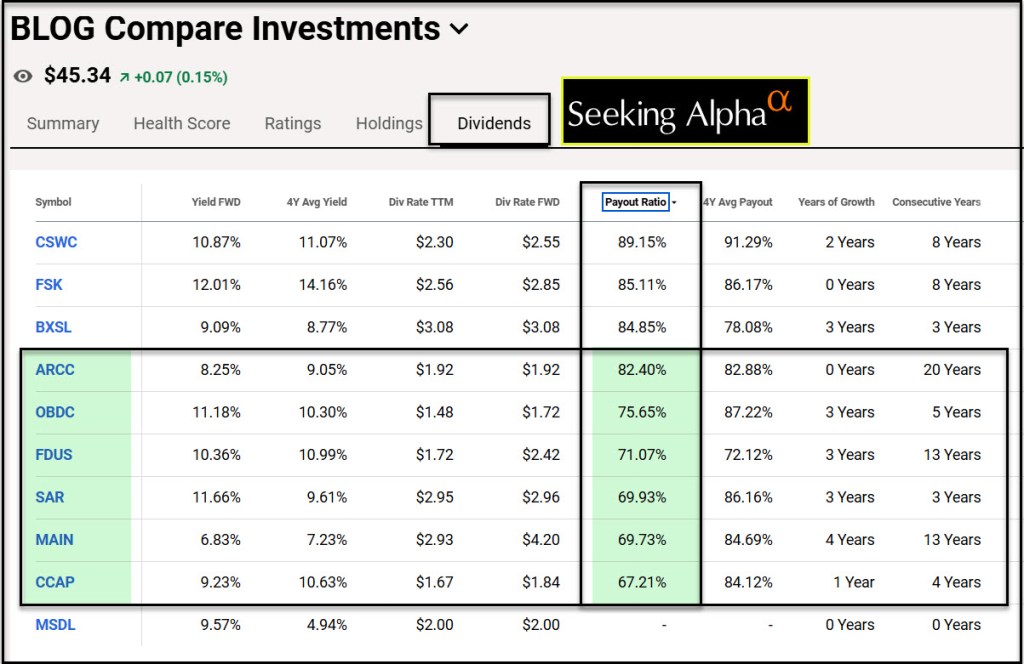

The second is the dividend payout ratio. I prefer the ones shown in green. Again, FDUS is in the green.

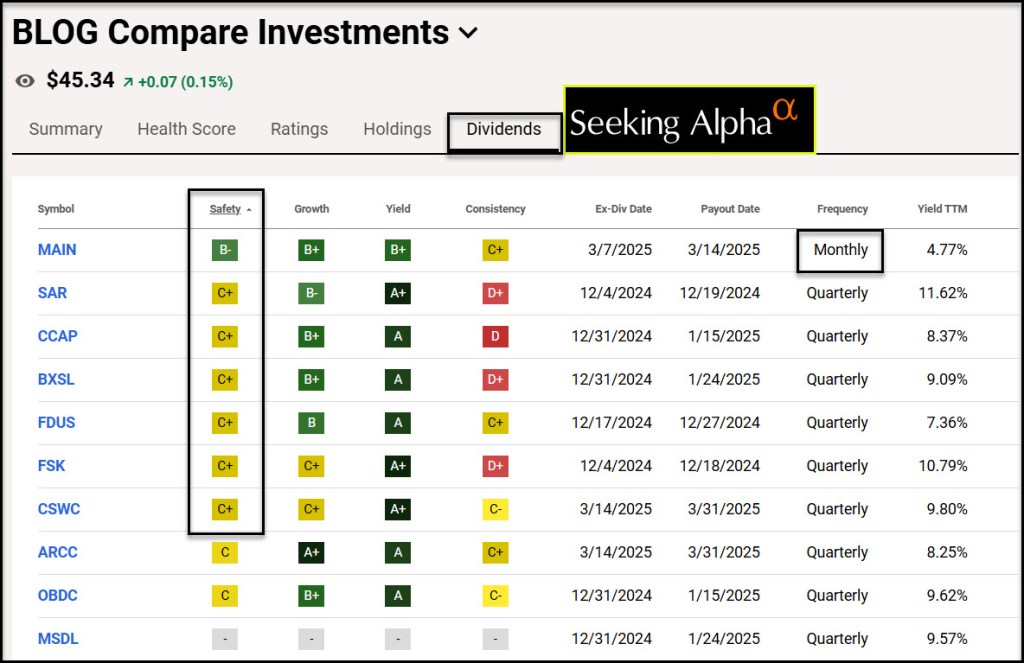

The third is dividend safety. While they are all reasonable, the B- and C+ would be most attractive for the long-term investor.

It also pays to look at growth. Although ARCC has a low score of D-, it has a high profitability grade. I believe it is OK to overlook growth when considering BDC investments. Remember, the goal is sustainable income based on profits.

Finally, I am interested in the 5-year dividend growth of any investment. OBDC, SAR, MAIN, ARCC, and FDUS lead the pack.

My conclusion is that I will stick with MAIN, ARCC, OBDC, and CSWC as primary BDC investments. FDUS is certainly worthy of consideration.

How About a BDC ETF?

SG had another follow-up question: “One additional follow up question/comment for you to consider when you write up your blog post on this subject. The question/comment is: I looked into BDC ETFs like BIZD & PBDC . Are these good alternatives compared to the individual BDC? . Although on the surface, it looks good, I was discouraged by their outrageous fee ( appx. 12%-14%)!”

The short answer is that neither of these is a good solution, in my opinion. I will talk about PBDC first.

PBDC is very small with AUM of $189.72M. Having said that, with 22 holdings and the top ten making up 71.83% of the total fund, the yield of 8.80% is decent. A problem, however, is that it pays the dividend quarterly. This means you wait three months to get the monthly MAIN dividend from this investment. There isn’t a lot of history for this ETF. It was started in September 2022 and it does have a good representative sampling of decent BDCs like ARCC, OBDC, and MAIN.

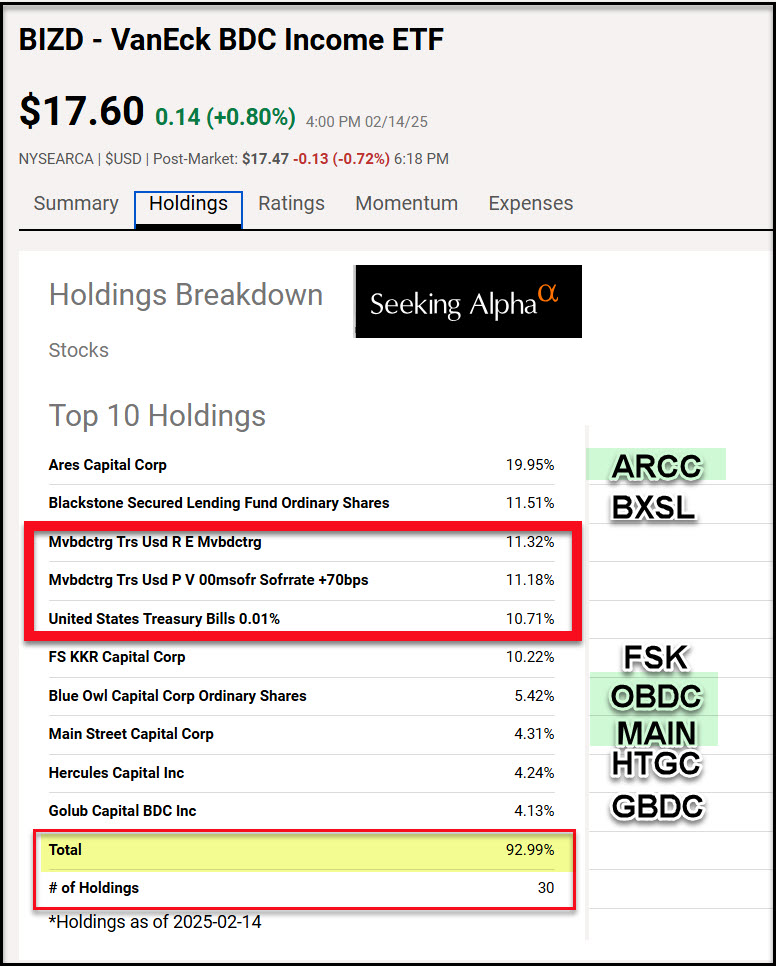

BIZD is a bit less desirable, in my opinion. The reasons are simple. First of all, it has investments in the top ten that are not BDCs. Secondly, almost 93% of the dollars are in the top ten. In looking at the top ten, as shown in the following image, it would make more sense to buy shares of the BDCs that I already own rather than buy shares of a strange ETF.

Four Recommendations

- Avoid BDC ETFs unless you are happy with the weaknesses. Be certain you understand the top ten investments in any ETF, including investments like BIZD. (The same can be said for REIT ETFs.)

- Pick four or five top-tier BDCs. I certainly like MAIN, ARCC, and OBDC.

- Understand that total returns matter. Therefore, bond funds and bonds are anathema or an abomination for most investors who understand inflation and total returns.

- As always, of all of the resources I use, the most helpful and informative is Seeking Alpha.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Hey Wayne — What words of wisdom do you have about investing during the current and future chaos and mayhem in society? I’ve got lots of cash on the sidelines, and am jittery about jumping into the market, with so many uncertainties. It’s hard to ignore the noise…

— Jerry Uhlman

>

LikeLiked by 1 person

There will always be wars and rumors of wars and other calamities in the world. I try to ignore the noise and invest in quality assets. Cash and bonds won’t stand the test of time for inflation. Having said that, there is no need to jump into the market. Gradually buy more shares of quality investments like VYM, DGRO, and SCHD. A selection of BDCs and REITs is also a good idea, in my opinion.

LikeLike