QUANT Buys are ABBV and GTY

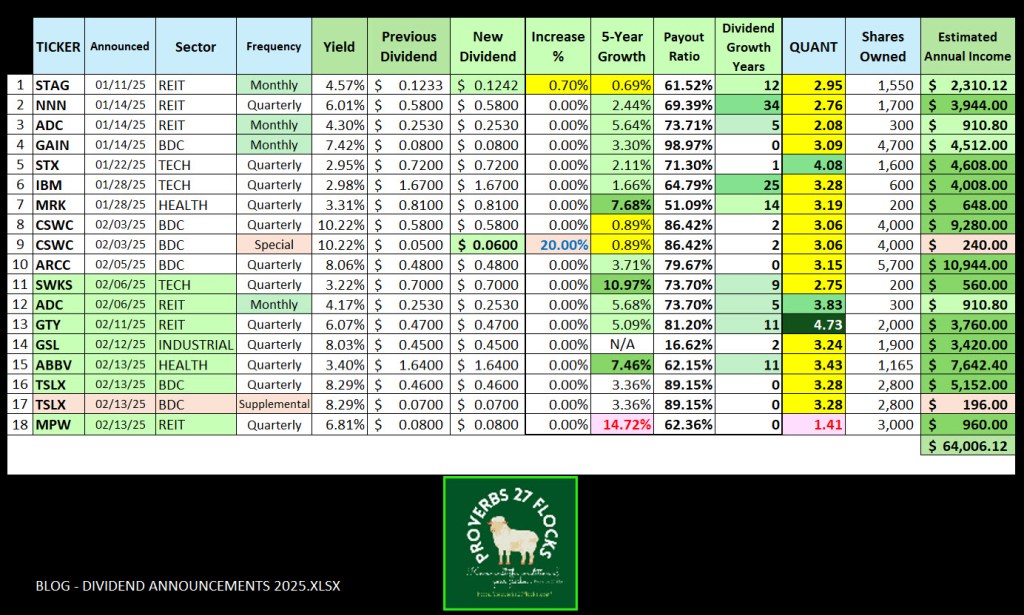

This has been a busy week for dividend announcements. While there have not been any dividend increases, each announcement is a reminder of why I like to own easy income investments.

Two Are Worthy of Consideration

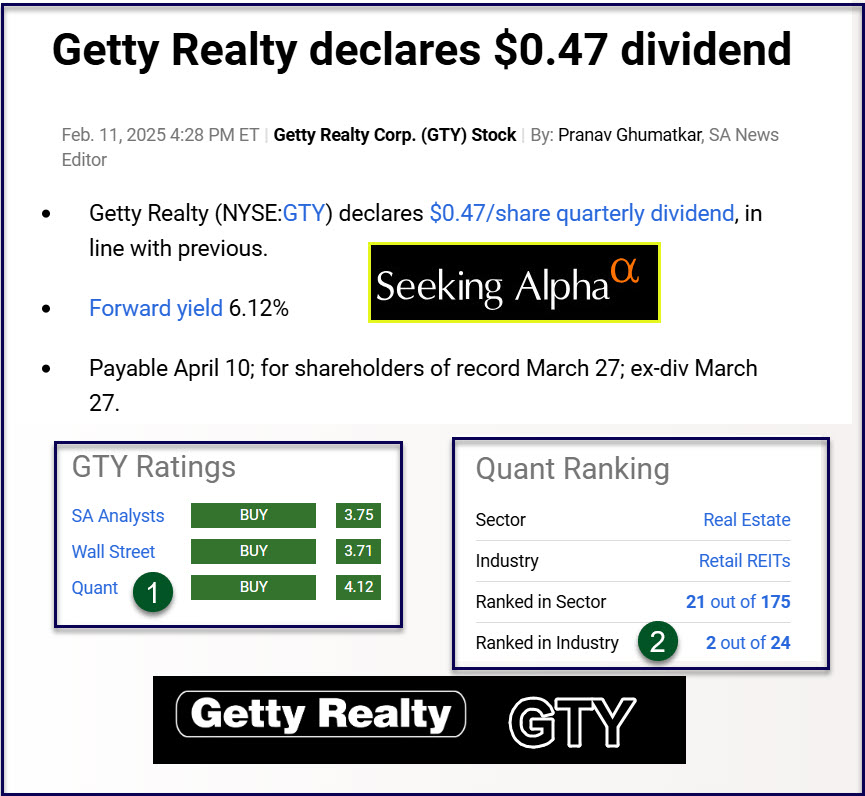

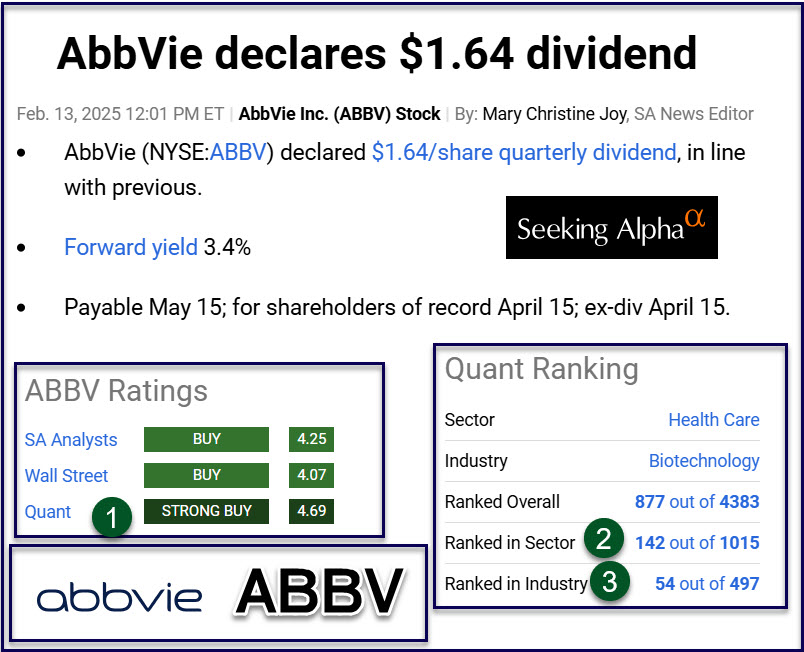

Of the six announcements, there are two that stand out. They are ABBV and GTY. ABBV is a biotechnology health care company and GTY is a retail REIT. Although I own shares of PFE, BMY, and MRK in the healthcare sector, ABBV is my distinct favorite. I have been adding shares of ABBV to Cindie’s ROTH IRA. ABBV is also a good stock for trading covered call options. In 2025 I have already made $2,261 trading options on some of our ABBV shares.

Some Investments are VERY High Risk

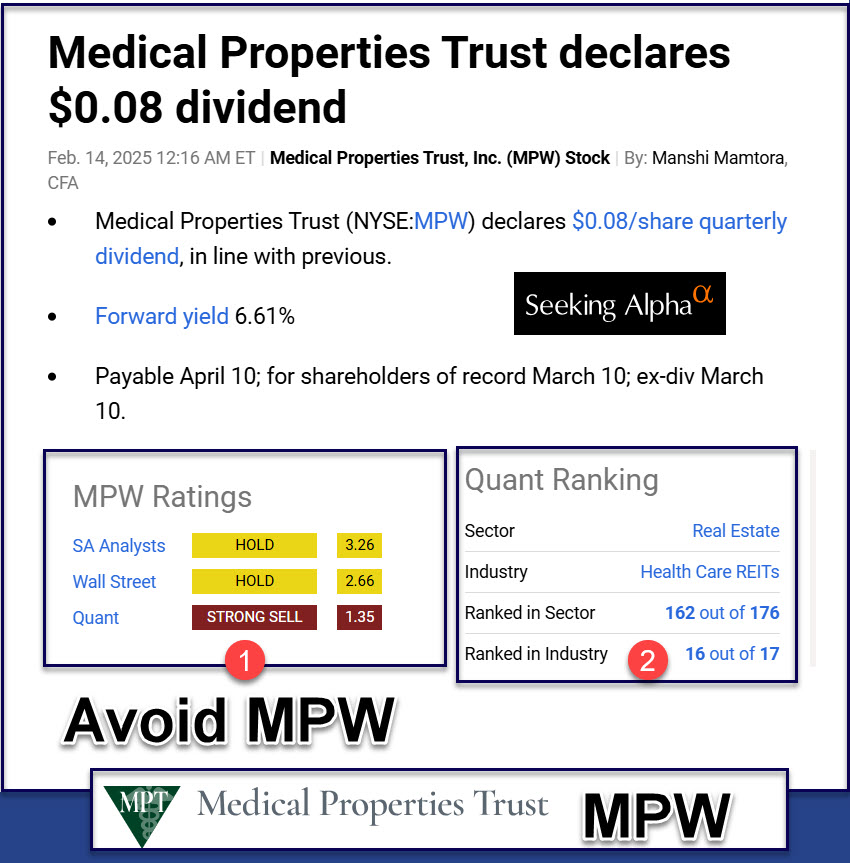

Just because I own shares of a company doesn’t mean you should. For example, Medical Properties Trust Inc (MPW), a REIT that owns hospitals, has struggled due to hospital failures. As a result, I sold most of our MPW shares. The exception was the shares I held in my traditional IRA account. I am trading covered call options on those shares. I do not recommend that you buy MPW unless you are ready to accept some greater risks.

Own Properties without the Headaches

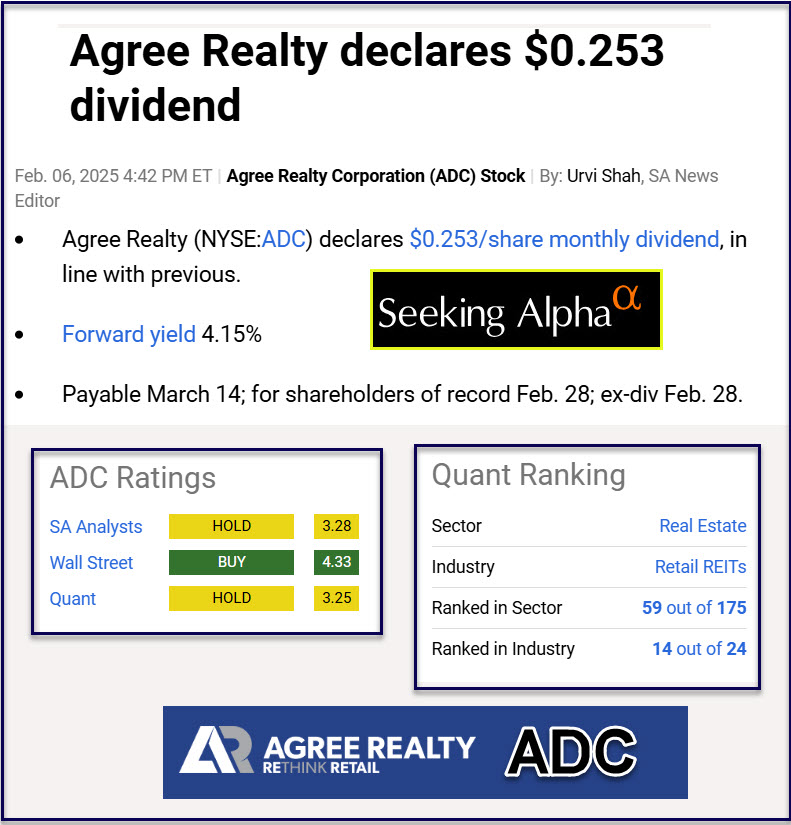

I don’t want to take calls from tenants or pay property taxes. I also don’t want to fix plumbing or replace the roof on any property. I do, however, like real estate income. Therefore, REITs have a place in our portfolio of investments. You probably noticed that three of the six are REITs. They are MPW, ADC, and GTY. I have found that owning individual REITs is better than buying any REIT ETF I have reviewed. My favorite REITs include GTY and O (Realty Income Corporation.) I also like NNN (NNN REIT Inc) and STAG (STAG Industrial, Inc).

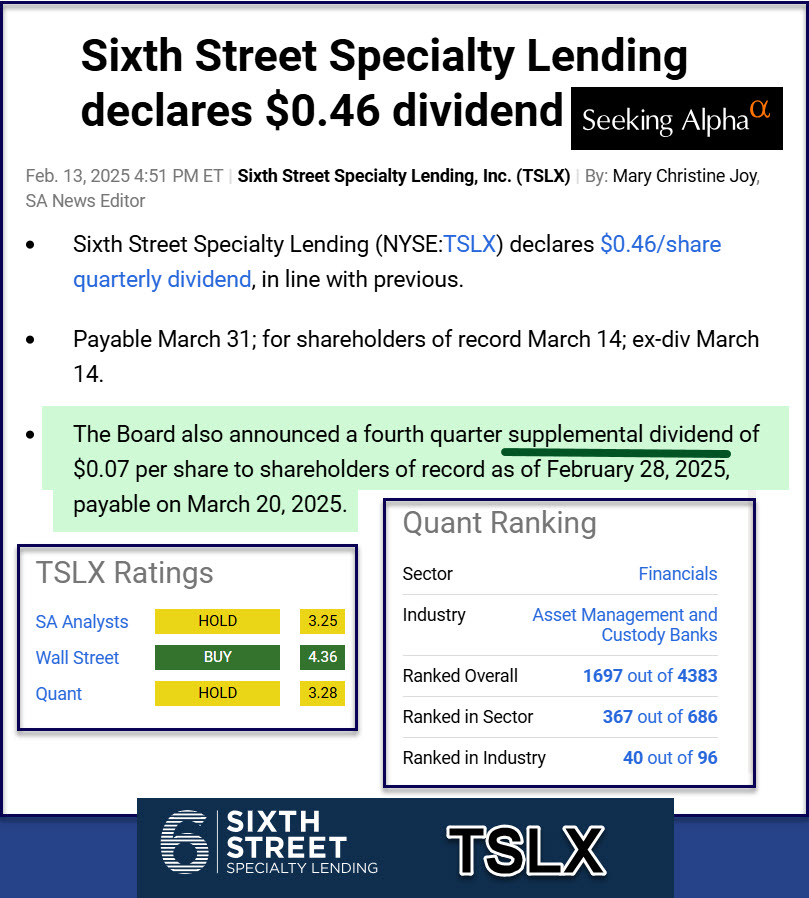

Extra Frosting is TSLX

Another supplemental dividend from a good BDC.

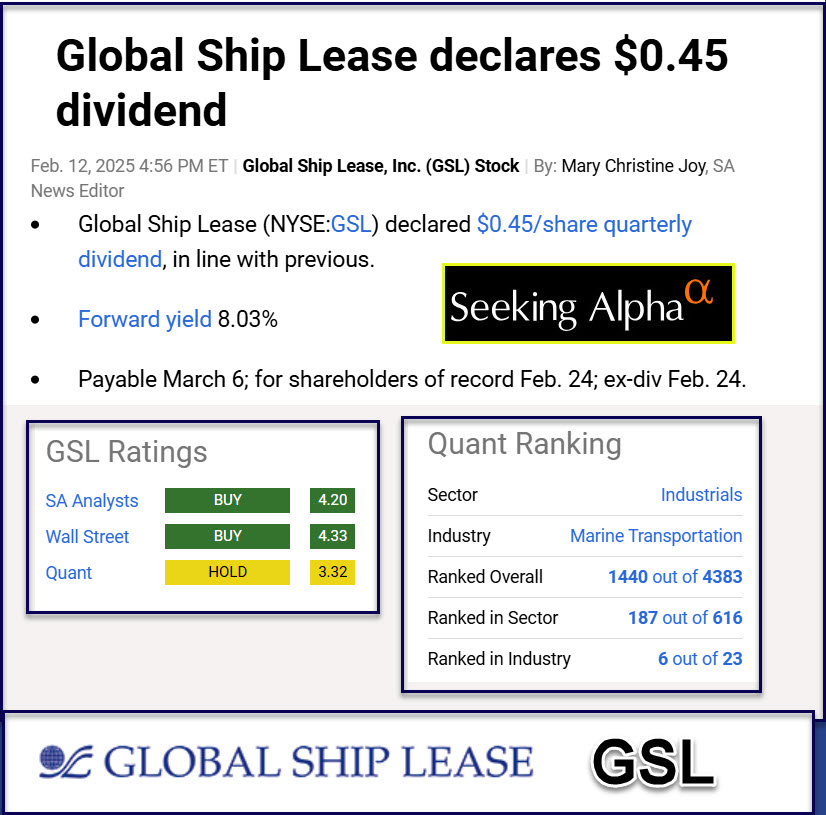

Other Announcements

Four Recommendations

- If you want to buy shares of ABBV, do it slowly. I have been adding small numbers of shares to Cindie’s ROTH IRA each week. There is no need to buy shares in one big purchase. Any day the share price drops is an opportunity to buy more.

- Be careful about which account you use to buy REITs. This type of investment is best owned in the traditional IRA or a ROTH IRA. Avoid buying REIT shares in taxable brokerage accounts. You will save on income taxes if you take this advice.

- Recognize that some REITs are not good investments for the average investor. Only buy quality REITs and be willing to accept the roller coaster ride that some provide. The main reason to own REITs is the same as the reasons many buy rental properties: income and a hope that the property will grow in value.

- Of all of the resources I use, the most helpful and informative is Seeking Alpha.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

I sure do appreciate my investment guy’s wisdom in adding layers of financial frosting to my accounts.

LikeLiked by 1 person