Comparing January 2024 and 2025 Dividends

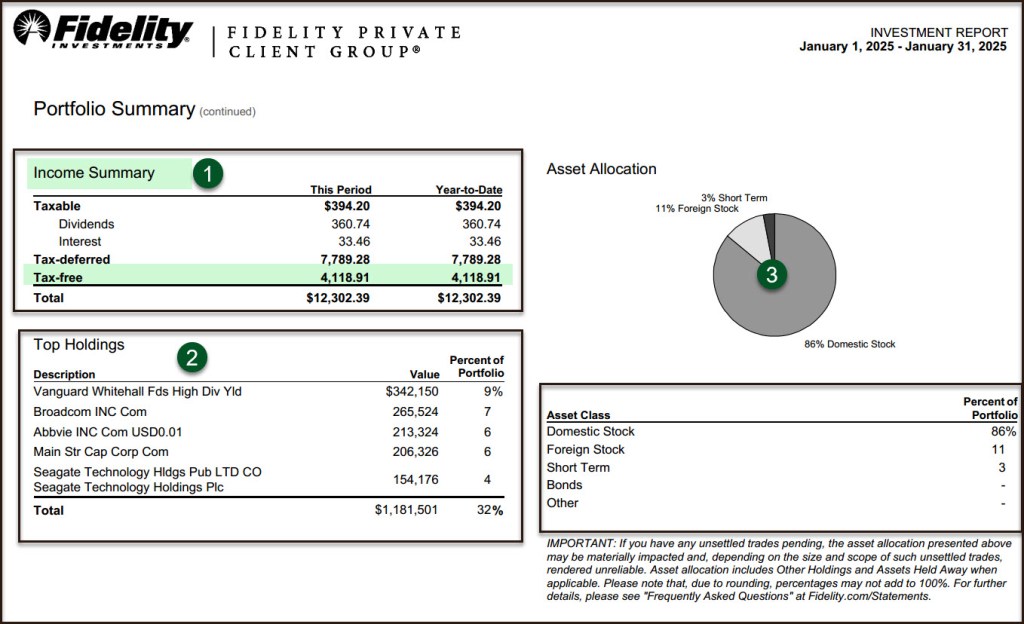

Our January 2024 dividend income was $11,880.80. Because I focus on dividend growth, I was curious to see how we did in January 2025. The total from the January statement was $12,302.39. That means our January income increased by $421.59 over last year. That is a 3.5% increase.

Why did this happen? It happened because since last January many of our holdings increased their dividends. It is also due to minor changes I made during the year in positions that we held.

Tax-Free Income Comparison

Because of my disciplined approach to convert traditional IRA holdings to my ROTH IRA, there is even better news on the tax-free income front. In January 2024 our total tax-free income was $3,563.31 (Wayne’s and Cindie’s ROTH IRAs combined.) In January 2025 this number increased to $4,118.91. That is an increase of $555.60 in tax free income for just one month. Said another way, our tax-free January income this year was 15.6% more than last year.

The best kind of easy income is tax-free income. I plan to continue our ROTH conversions after I finish my RMD withdrawals for 2025. The entire RMD will be tax-free, as we will give the entire amount to charitable organizations (see my posts about QCD giving). That gives me more leverage for 2025 ROTH conversions.

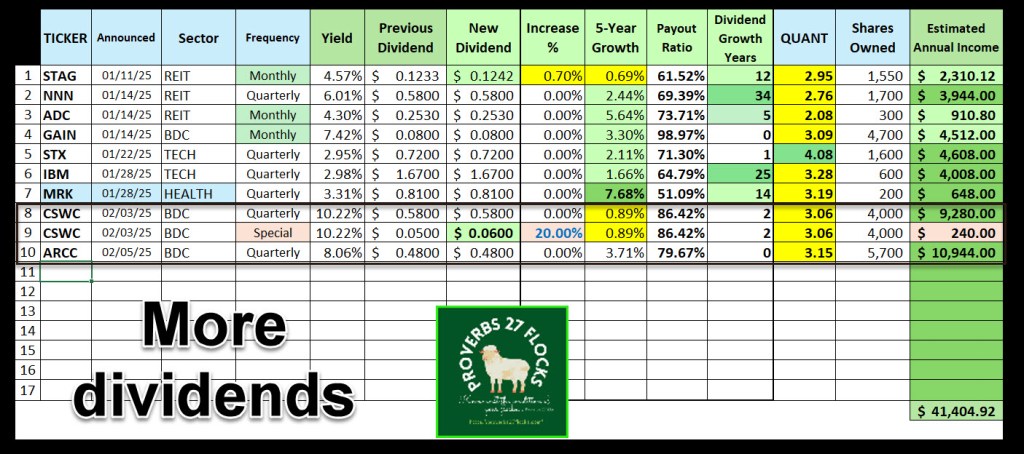

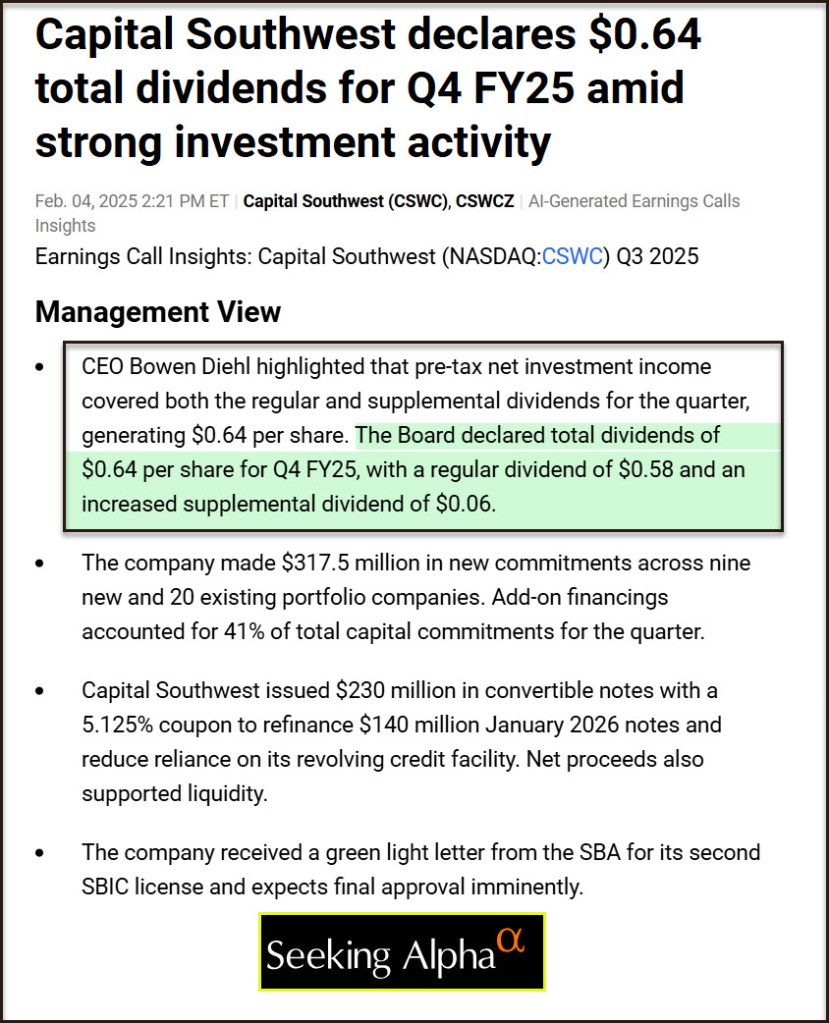

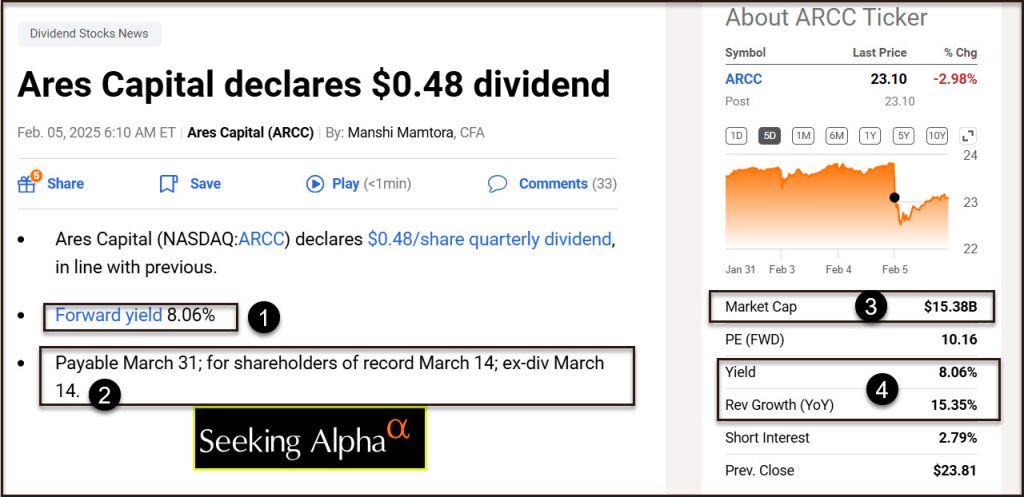

Dividend Announcements for ARCC and CSWC

It is still too early in the year to know which investments will offer dividend increases. However, it is always gratifying to see regular announcements from the BDC investments like ARCC and CSWC. They are a powerhouse of income. As always, I must caution you to be thoughtful about your own holdings. In yesterday’s blog post about MAIN, I noted that I sold our grandchildren’s BDC holdings in the stalwart MAIN BDC. That does not mean, however, that I won’t buy a different BDC for the grandchildren if the price per share makes sense.

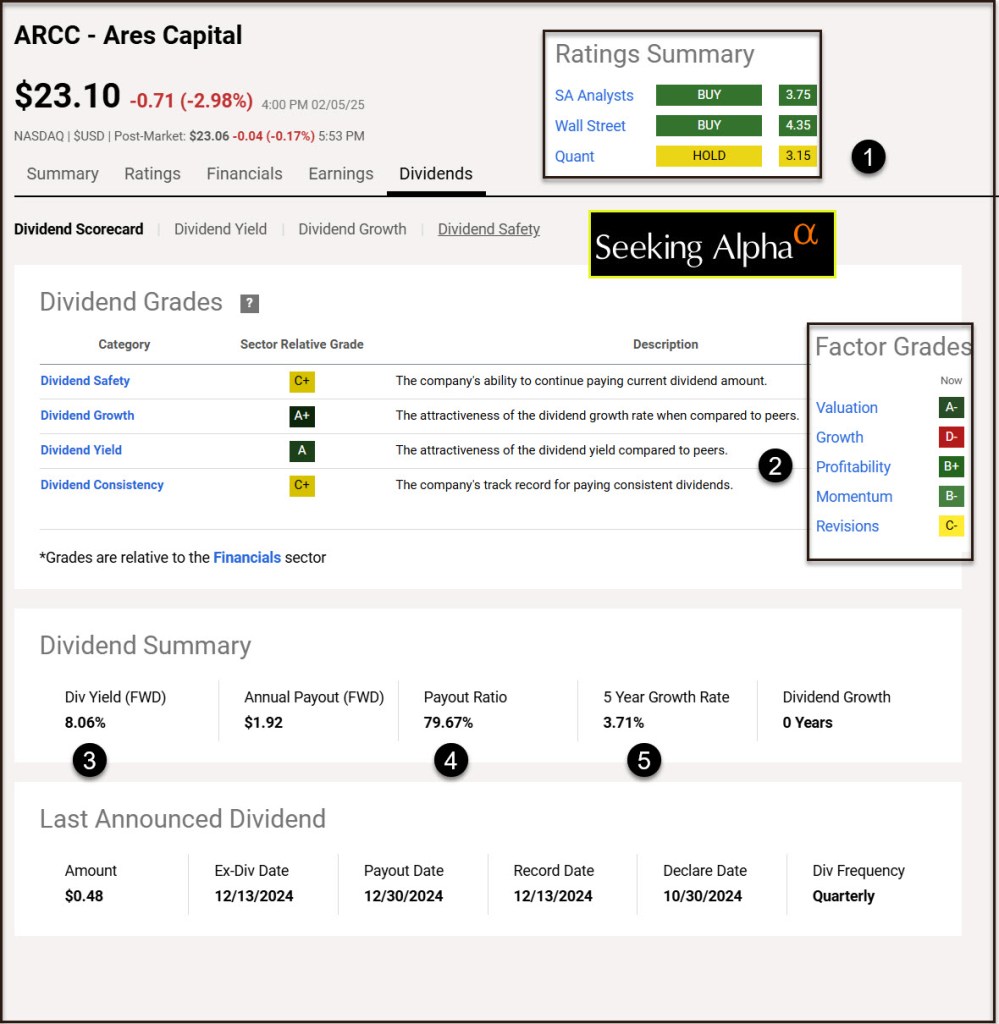

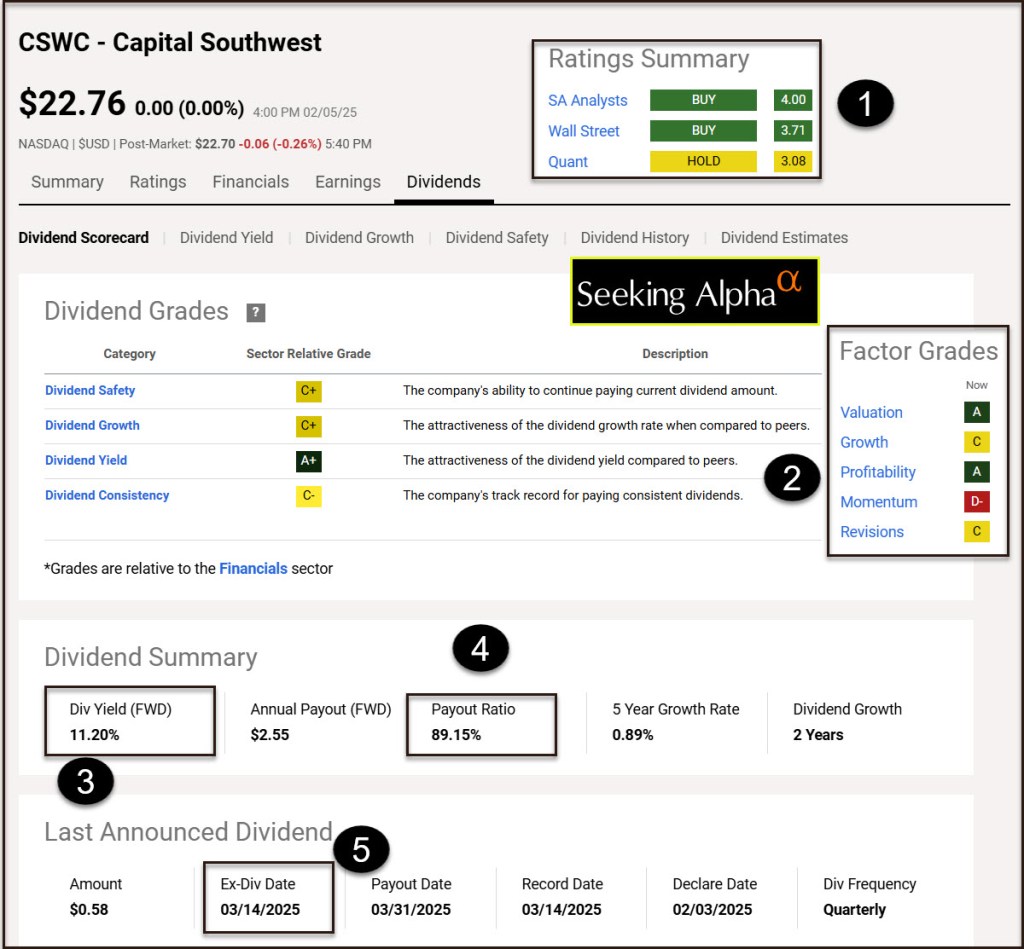

The following images show the Seeking Alpha Dividend Scorecards for ARCC and CSWC. Always keep your eye on the Dividend Payout Ratio. If you don’t understand this ratio it may hurt you down the road.

In these images note that CSWC announced both a quarterly dividend and a special dividend.

Three Recommendations

- If you own a traditional IRA, then it is prudent to carefully manage moving assets from your traditional IRA to your ROTH. This should be done in a way that doesn’t hit you with a surprise tax bill.

- Compare your January 2024 income from dividends with your 2025 income. Do you like what you see? If not, then you might not be a dividend growth investor. I encourage you to rethink your strategy.

- Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

Ares Capital Corporation Company Profile

Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle market companies. It also makes growth capital and general refinancing. It prefers to make investments in companies engaged in the basic and growth manufacturing, business services, consumer products, health care products and services, and information technology service sectors. The fund will also consider investments in industries such as restaurants, retail, oil and gas, and technology sectors. It focuses on investments in Northeast, Mid-Atlantic, Southeast and Southwest regions from its New York office, the Midwest region, from the Chicago office, and the Western region from the Los Angeles office. The fund typically invests between $20 million and $200 million and a maximum of $400 million in companies with an EBITDA between $10 million and $250 million. It makes debt investments between $10 million and $100 million The fund invests through revolvers, first lien loans, warrants, unitranche structures, second lien loans, mezzanine debt, private high yield, junior capital, subordinated debt, and non-control preferred and common equity. The fund also selectively considers third-party-led senior and subordinated debt financings and opportunistically considers the purchase of stressed and discounted debt positions. The fund prefers to be an agent and/or lead the transactions in which it invests. The fund also seeks board representation in its portfolio companies.

Capital Southwest Corporation Company Profile

Capital Southwest Corporation is a business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments. It does not invest in startups, publicly traded companies, real estate developments, project finance opportunities, oil and gas exploration businesses, troubled companies, turnarounds, and companies in which significant senior management is departing. In lower middle market, the firm typically invests in growth financing, bolt-on acquisitions, new platform acquisitions, refinancing, dividend recapitalizations, sponsor-led buyouts, and management buyouts situations. The investment structures are Unitranche debt, subordinated debt, senior debt, first and second lien debt, and preferred and common equity. The firm makes equity co-investments alongside debt investments, up to 20% of total check and only makes non-control investments. The firm is Industry agnostic, but it prefers to invest in Industrial manufacturing and services, value-added distribution, healthcare products and services, business services, specialty chemicals, food and beverage, tech-enabled services and SaaS models. The firm seeks to invest in energy services and products, industrial technologies, and specialty chemicals and products. Within energy services and products, the firm seeks to invest in each segment of the industry, including upstream, midstream and downstream, excluding exploration and production with a focus on differentiated products and services, equipment and tool rental, consumable products, and drilling and completion chemicals. Within industrial technologies, it seeks to invest in automation and process controls, handling and packaging equipment, industrial filtration and fluid handling, measurement, monitoring and testing, professional tools, and sensors and instrumentation. Within and specialty chemicals and products, the firm seeks to invest in businesses that develop and manufacture highly differentiated chemicals and products including adhesives, coatings and sealants, catalysts and absorbents, cosmeceuticals, fine chemicals, flavors and fragrances, performance lubricants, polymers, plastics and composites, chemical dispensing and filtration equipment, professional and industrial trade consumables and tools, engineered solutions for HVAC, plumbing, and electrical installations, specified high performance materials for fire protection and oilfield applications. It may also invest in exceptional opportunities in building products. The firm seeks to invest in the United States and North America. The firm seeks to make investments ranging from $5 million and $25 million in securities. Its typical financing size is between $5 million and $75 million, target hold size is between $5 million and $45 million, and the firm is willing to backstop up to $55mm with an active network of co-investors. It seeks to invest in the firm with minimum EBITDA is $3 million and $25 million. In addition to making direct investments, the firm allocates capital to syndicated first and second lien term loans in the upper middle market. It prefers to take a majority and minority stake. The firm has the flexibility to hold investments for very long period in its portfolio companies. It may also invest through warrants. The firm prefers to take Board participation in its portfolio companies. Capital Southwest Corporation was founded on April 19, 1961 and is based in Dallas, Texas.

Hi Wayne, sorry if you receive this twice. But i left a comment earlier and it seems to have kicked me out.

We are thinking its time to sign up and use Seeking Alpha. Just a few questions.

1. The Dividend information with the payout ratio, is that part of the basic package for $299.00 (or $269.00 with discount).

2. The Quant score that you talk about. Is that part of the package as well? I know you have said you prefer this rating vs the Weiss ratings.

3. If we follow your link, then will you get the referral?

Thanks as always, Dave & Jackie

LikeLike

Hi Dave,

1. Yes, the dividend payout ratio and other dividend information is found in the “Dividend” Tab. Lots of helpful information there including dividend scores for dividend safety, yield, and growth.

2. Yes, the QUANT rating is visible. You can try the product without the subscription if you like, but you won’t get the QUANT ratings or dividend scores. The QUANT rating is very useful.

3. Yes, if you follow the link in my post I will get the referral. 🙂

You are most welcome, Wayne

LikeLike