Lots of Paydays

There are many standard ways to get income, and there are some creative ways as well. Our standard income includes Social Security and income from Cindie’s part-time job as a baker. The first requires no effort, but Cindie works on Mondays and Thursdays to get the baker income.

Some income can be gained with little or no effort. In our case, that includes dividends and interest income. It also includes income we receive from our normal use of the Fidelity VISA Rewards and Chase Amazon VISA cards. We also receive monthly interest income from the Fidelity Fully Paid Lending Program.

Some income requires a bit more effort. This includes income from trading covered call options and cash-covered put options. I also receive small amounts (Amazon gift cards) from the Schwab Investor Community for my participation in that community.

There are at least nine sources of income that flow into our investment accounts. The two biggest sources of income are dividends and options income.

The Big Two

The two biggest sources of income are dividends and options income. The final total for 2024 options income was $107,137.39. That was a new record since I started about five years ago.

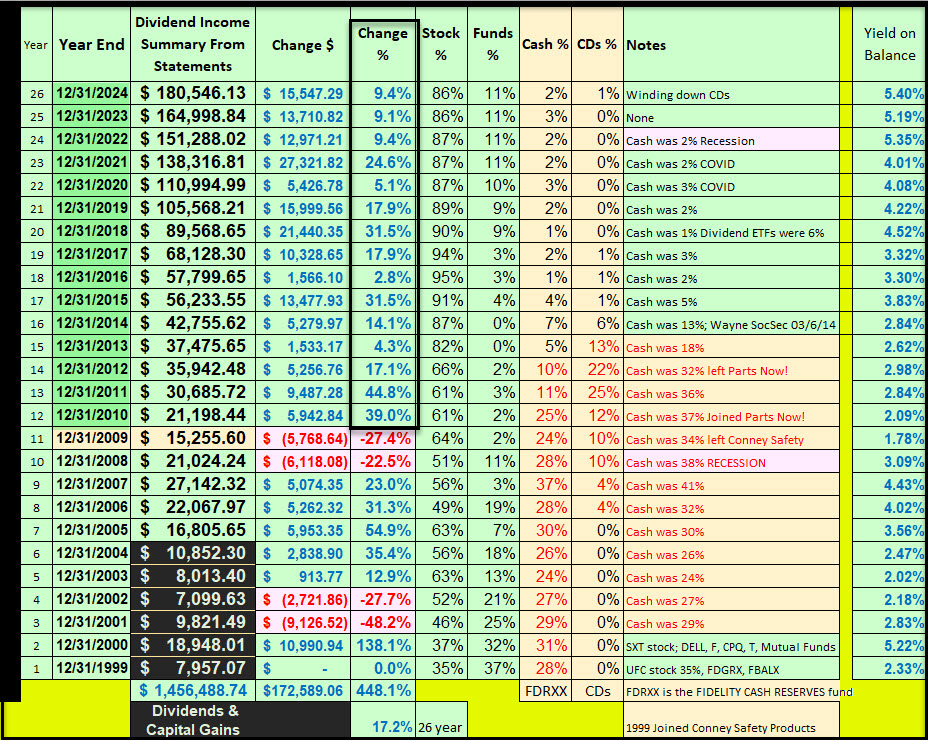

The total income from dividends and interest also reached a new record. The total income we received from this source was $180,546.13, which was a 9.4% increase over 2023’s dividend income. The best part of this is that a growing percentage of the dividend income is completely tax free because it is in our ROTH IRA accounts.

Some Small Pieces of Income

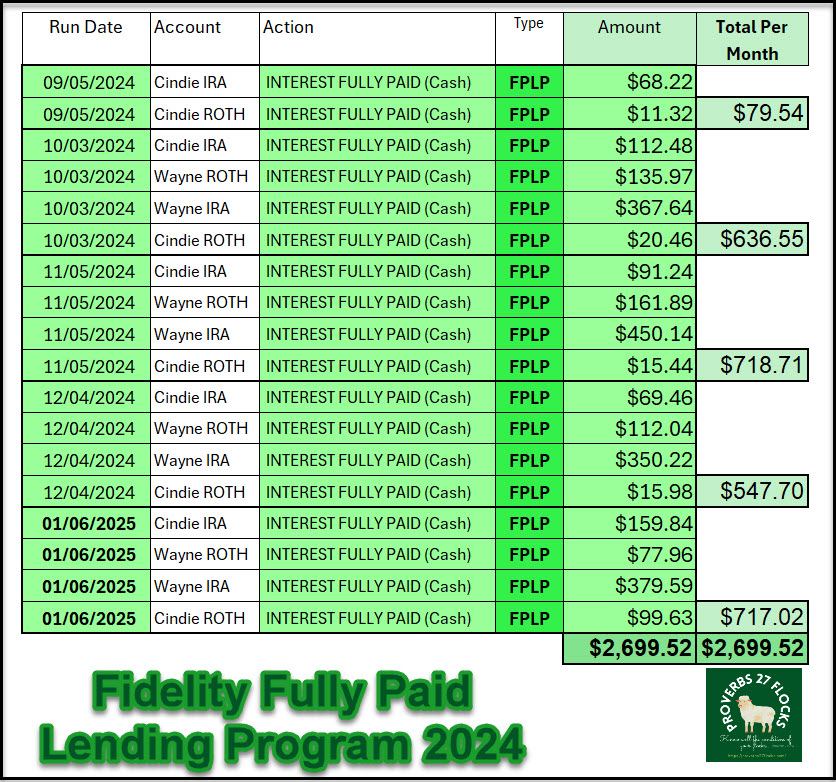

The Fully Paid Lending Program Interest

A surprisingly large amount of income was derived from our participation in Fidelity’s Fully Paid Lending Program. We have stocks that qualify for this program. They are ABR, AVXL, GAIN, IMMP, and MPW. It generally isn’t a good idea to buy investments just to get interest income from this program, but if you hold shares like GAIN, you might benefit from this program. During the five months we were in the program, we received an additional $2,699.52 income. $650 of that was in our ROTH accounts, so that is also tax free. Some of it was in the traditional IRA accounts, so that is tax-deferred.

VISA Rewards

During 2024 we received two percent back on all purchases made with the Fidelity VISA card. This adds up quickly, especially when we travel to places like Hawaii or Montana. The total income from this activity was $1,588.25. It is a bit harder to estimate the rewards we received from the Chase Amazon VISA card, but it was more than $1,000.

So What?

We all have opportunities to earn income. However, there should be a higher purpose in this activity. Earning income to meet basic needs is sensible living. Anything above that should be apportioned carefully to those who have needs or to be a blessing to others.

I remember my mom consistently used paper coupons she clipped from the newspaper. There were no smart phones, no internet, and no easy way to get discounts on groceries.

She was always looking for deals, even when it was no longer necessary for her to do so from a financial perspective. She had a higher purpose for the money she saved. She wanted to give it to missions or share resources with those who had needs. Her extra effort to save pennies was an act of love to give dollars to those God placed on her heart. She understood that it is not wise to get too caught up in the earning without thinking about the giving.

Wayne-Do you really like the Fidelity Fully Paid Lending Program? Thanks!

LikeLiked by 1 person

Yes, I do like it. It doesn’t require any effort once you get it set up. It is just free income and it can be significant with some stocks.

LikeLike

Thanks Wayne for pointing us to the different sources of income that can together account to be more than several thousand dollars. Some of these just requires participation in the program. Options trading i would like to learn more ( i am educating myself on this as well).so will reach out to you if you have some time in the near future.

Giving Back is key to happiness..after all you cannot take it with you!!

LikeLiked by 1 person

Mom Winquist was a fantastic example to use in this post. Giving brought her SO much JOY.

LikeLiked by 1 person

Happy New Year Wayne. To God be the glory. Your method of investing and willingness to mentor and share is amazing. Congratulations on the goals you have achieved. Best regards,

David Krebs Lannon Stone Realty, llc Cell# 262-212-2152

LikeLiked by 1 person

Thanks Wayne, great post! I was wondering if you looked into the newer ETFs, since you focus is Easy Income. These are ETFs that use covered calls to return a high yield to investors. One example from JPMorgan is JEPI, I think it yields 8%. Any thoughts?

LikeLike

I have owned shares of this type of fund and have written about it in a couple of previous posts. I think I would favor QYLD or XYLD over JEPI based on my quick review this evening. I might revisit this topic. Here is one post where I talked about ETFs with options as a base: https://proverbs27flocks.com/2021/07/02/instant-pudding-and-instant-covered-call-mix/

LikeLike