Don’t Miss an Opportunity to Act

Some people are procrastinators and postpone decisions and actions. This is a reminder that some investment decisions can wait until January or even April, when it comes to your traditional IRA or ROTH IRA. But there are some actions you may want to take now rather than later. In my case, the window of opportunity is quickly coming to an end to maximize our 2024 ROTH conversions.

The Benefits Outweigh the Costs

If you have not yet reached the age when you must take RMDs from a tax-deferred retirement account, then you have a much greater opportunity to maximize your long-term tax-free income. The reason is simple, when you reach age 73 and must start taking your RMDs, those withdrawals have to be done before you can do any ROTH conversions.

While there is certainly an extra income tax to be paid on a conversion (the value of the investment you convert is a taxable event) there will be no ongoing future regular income tax on the amount you move to a ROTH for you and your heirs. Furthermore, remember that your spouse, if you are married, will probably have to at some point in the future pay taxes as a single person. Their tax burden is likely to be significant.

If you are younger than Medicare age (age 65), there is another reason to consider the ROTH conversion sooner rather than later. If your income rises too much you may have to pay extra premiums due to something called IRMAA. I’ve talked about this before, but IRMAA is the income-related monthly adjustment amount sliding scale of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. That is a fancy way of saying you will pay more for Medicare premiums if you aren’t proactive and careful about ROTH conversions before age 65.

My After RMD Conversions

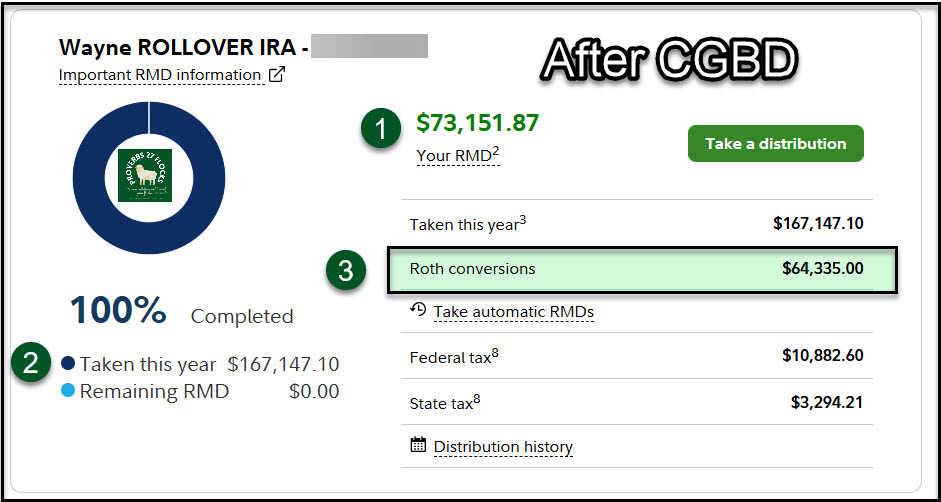

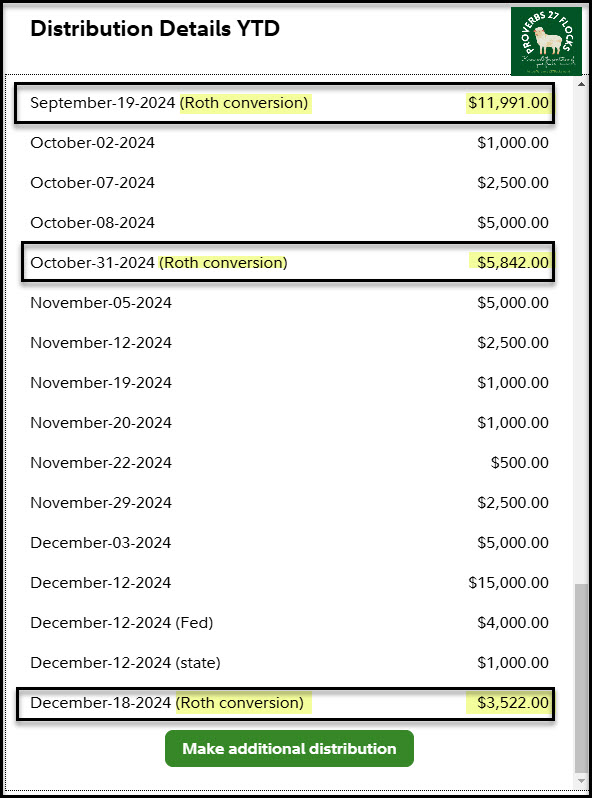

I completed my RMD withdrawals earlier this year using QCD withdrawals and some cash withdrawals from my IRA. Cindie did the same for her IRA. Therefore, even though I will exceed the base Medicare amount due to IRMAA, I plan to do extra ROTH conversions before December 31.

The reason is simple. I want to reduce the future tax burden my wife and I will have because the IRA continues to grow in value. I also want to minimize the taxes for my wife if and when she is a widow. I also want to minimize the income taxes for our heirs.

The other reasons are just common sense. By paying regular income taxes now in a planned manner, all capital gains, dividend income, and options income in my ROTH IRA will forever be tax-free.

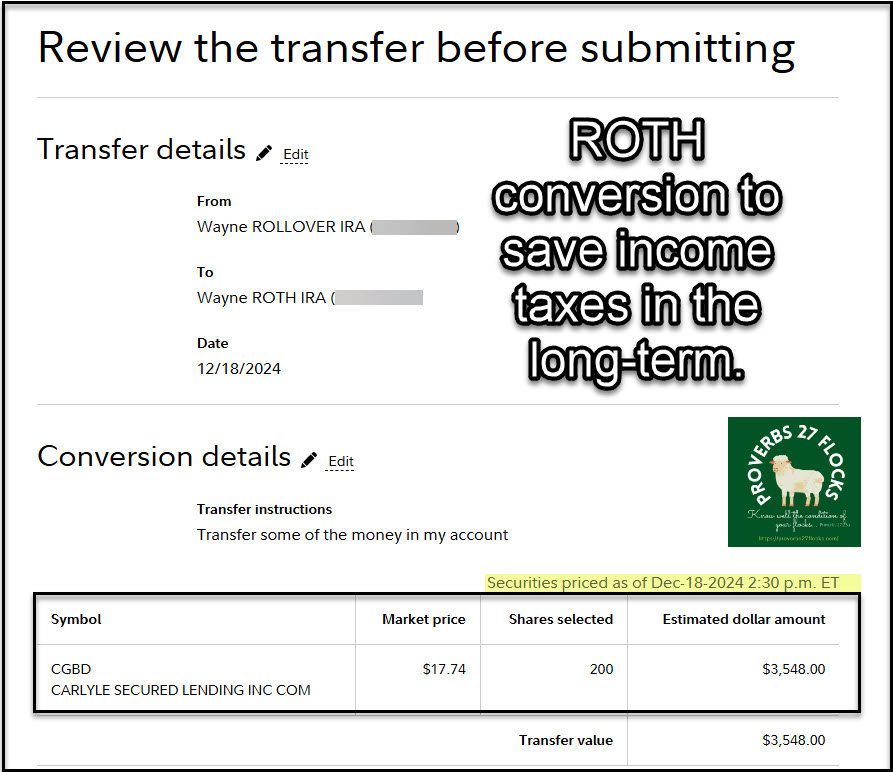

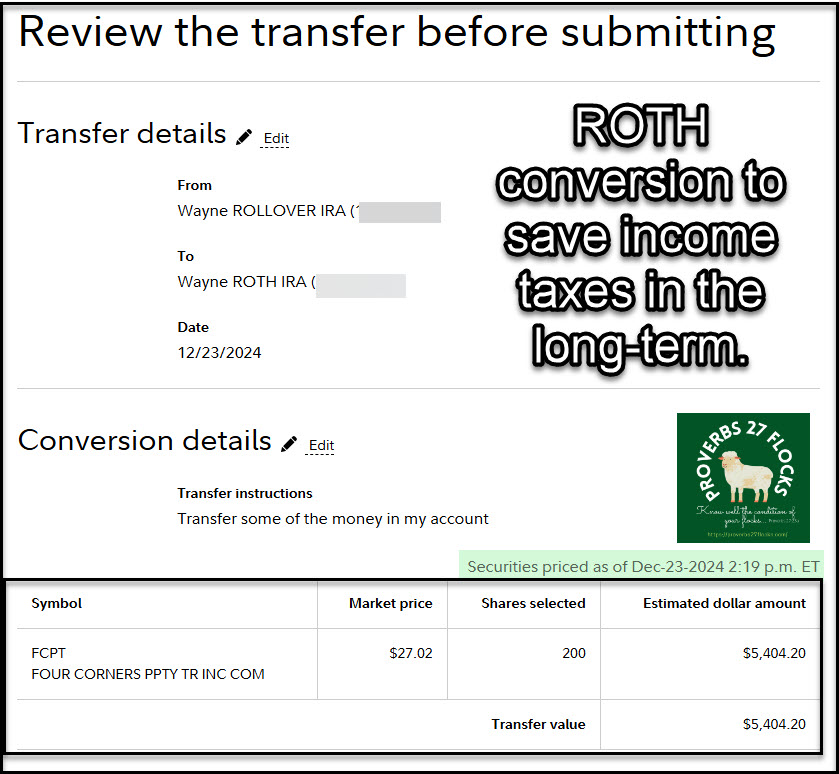

My two most recent conversions were for shares of CGBD and FCPT. Both pay a dividend. The total taxable portion of this ROTH conversion was about $9,000. Therefore, we owe income taxes on that amount.

Recommendation

Don’t be a procrastinator. If you own a traditional IRA, give serious consideration to doing ROTH conversions. This is something you can easily do without help from an advisor if you are a Fidelity Investment’s client. When you start the transfer, Fidelity guides you through the necessary steps.

hi, I’m 61 and plan on semi retiring at 62-1/2. I have a 401k that does not have an in service distribution option. How can a Roth help me, is it even an option? Don’t I have to star it before I retire? Can you give a little insight on Roth Ira’s

thank you

Merry Christmas

david

LikeLiked by 1 person

I rather doubt that you can do anything until you fully retire and roll your 401(k) into your own Traditional IRA Rollover. However, if your employer offers a ROTH IRA, you should consider doing ROTH contributions now rather than waiting for retirement. Furthermore, if there is a ROTH 401(k) option, see if your employer will let you convert some of your traditional 401(k) to a ROTH 401(k). I suspect they will say “no” but it never hurts to ask. You might also want to ask them to think more long-term about their employee benefits. Hope this helps.

LikeLike

Wayne…great advice…i was thinking of doing it next year but i will get it done yet this year. Thanks for the article and stressing the importance of getting it done. appreciate it and Merry Christmas to you and family!!

LikeLiked by 1 person