UTF, MRK, and PR for my ROTH IRA

Bought another 125 shares of UTF in little pieces as the price dropped. I now hold 325 shares for monthly income. I’m not buying CDs, so this is my proxy for cash. I’m not concerned about the price per share as long as the dividend is consistent.

I also bought 100 shares of MRK (Merck & Co., Inc.) to start a position. Paid $100 per share and will hold them for the long-term and may start trading covered all options. I think MRK is undervalued at the current price. I plan to purchase more shares over time. I bought 100 shares because each options contract represents 100 shares.

Finally, I started a position in PR (Permian Resources Corporation) of 50 shares at $13.95/share. My plan is to buy more as some dividends roll in during the balance of the month. I have very little in the energy sector except EOG, so this will be the start of beefing up my holdings in that sector.

PR is in the energy sector. Their specific industry is Oil and Gas Exploration and Production.

A Lesson in Cost Basis

Most people who invest know there are some numbers you should know. You want to know the price of the investment and compare that price to how much you paid for your shares. If you bought 100 shares of an investment for $5 (including any fees or commissions) and they are now worth $6, you have a gain of $1. Your cost basis is the $5. You paid $500 for your shares and they are now worth $600. If you sell your shares you will have a capital gain of $100.

If the stock is paying a dividend, and the dividend hasn’t changed over time, then your dividend yield on cost would be higher than your current yield. You are still receiving the same dividend, but as the price of your shares increases, the yield for new investors may seem less attractive.

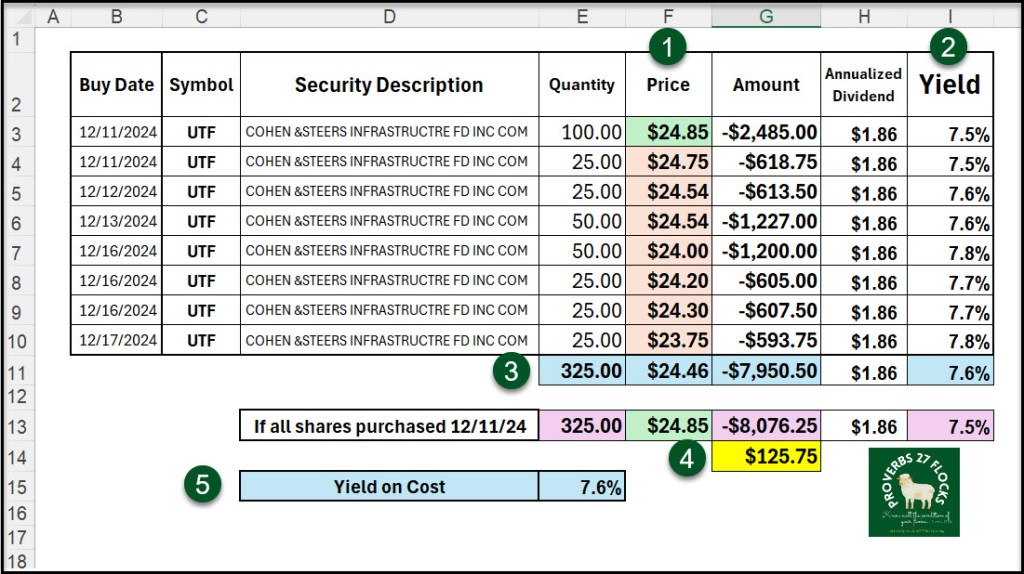

In the following image I show my purchases of the closed end fund UTF. Here is what we can learn from this image.

(1) My first purchase on 12/11 cost me $24.85 per share. Given the fact that the current annualized dividend is $1.86 per share, my yield on my cost for those shares was 7.5% (2).

(3) After seven more smaller purchases at lower costs, my total share count is now 325. Active Trader Pro shows me this without a spreadsheet. The average cost is now $24.46. Obviously, this is still larger than the current price ($23.58), so I have a loss on paper. If I sell my shares now, I will have a capital loss.

(4) By slowing adding shares, I have “saved” $125.75 over what I would have spent if I had purchased all 325 shares on 12/11. When an asset is out of favor, it often makes sense to slowly buy more if you want it to be an income-producing asset over the long-term.

(5) My average dividend yield on cost is 7.6%. This is true because as an asset falls in value, if the dividend does not decrease, your yield “increases.” That doesn’t mean I get more dividends, but that the same dollars invested today would earn a higher yield.

Cost Matters

Investors who are impatient can overspend for assets. While we cannot know if an asset will increase or decrease in value, it is generally prudent to buy your shares over time. Even as shares increase in value, there is wisdom in buying shares methodically over time. There is no need to be all-in on day one.

Thanks for the article! I have been holding over 1100 shares of KYN for a while. Has been a good investment so far with price appreciation over 40%, plus a nice dividend. I’ll have to see how UTF and KYN compare.

LikeLiked by 1 person