Thanks to Bill Times Three

One of my readers is very generous in his praise of my blog posts, but he is also very good and helpful in sharing his own discoveries. Recently, as a result of reviewing my blog post on December 9th, (Looking Back To Last Week and Forward Too) he told me that he thought I had missed an important piece of the puzzle in my spreadsheet. He was right.

Number One: The problem with my spreadsheet is that I neglected to include the extra deduction for those who are 65 years old and older. Rather than file the regular 1040 to the IRS, I get to file the 1040-SR. Those who are seniors get an extra deduction. Therefore, our standard deduction as a married couple filing jointly is $32,300. This is better than the youngster deduction of $29,200.

IRA Withdrawals – Number Two

Bill also shared the following wise insights: “You also understand mortality, in that when one of you passes away, the resulting income levels put you into a single’s tax bracket which makes taxes especially harder to deal with. Just look at the tables and ask yourself what you will be paying in taxes if one of you passes away.” He also said, “Roth money has a ten-year life span when you pass it on. And heirs will not have to pay those taxes.”

Let that sink in. While I may want to try to minimize the IRMAA, I also want to think ten years down the road. “The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums.” Source: SSA.GOV That is a way of saying if you make a lot of money, Medicare expects you to pay more of your share in the total cost of Medicare coverage.

If you are married and file jointly, then you may want to keep your AGI (Adjusted Gross Income) to less than or equal to $212,000. If you do this, you avoid the extra IRMAA. However, by going to the next bracket, (Greater than $212,000 and less than or equal to $266,000), you only pay an additional $74 per month per person for Part B coverage. That may seem like a lot until you think about the total taxes on a large traditional IRA balance. This year, as a result, I plan to get as close to the $265K AGI as I can without going over that amount. I will do it with another ROTH conversion.

To say it another way, I’m willing to pay more for Medicare now to save tax dollars down the road and to reduce my future RMDs.

Dinkytown.NET – Number Three

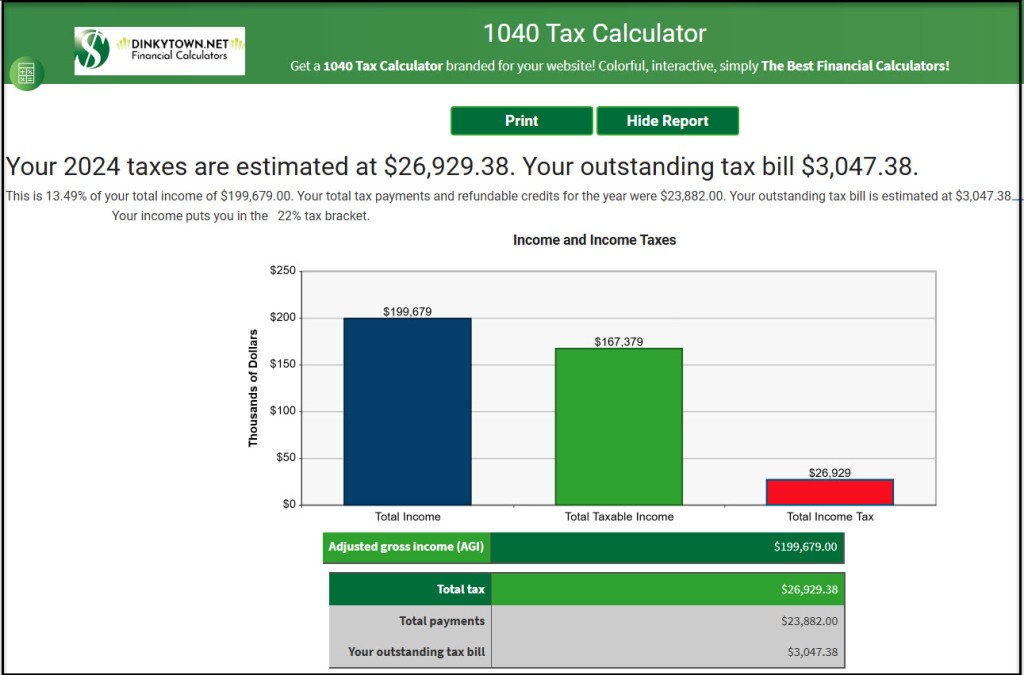

Bill went the extra ten miles. He took my data from the spreadsheet image and plugged it into the dinkytown.net website to get me a very good estimate on both our AGI and our estimated Federal income tax liability for 2024. The Tax Calculator is free, and it is a wonderful way to quickly estimate taxes by entering just a few numbers. I gave it a try. It was possible for me to get results in about fifteen minutes of my time.

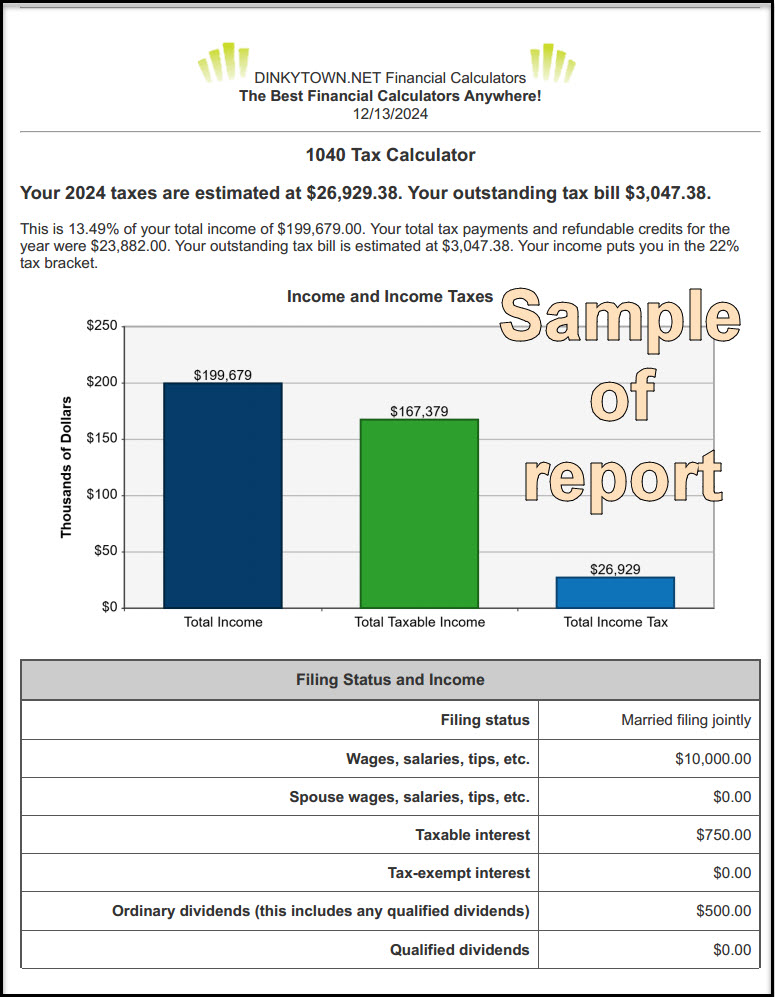

Dinkytown Report

The full report is six pages long. Here is a sample of page 1. Save yourself some time, even if you use a professional to prepare your income taxes and try this tool.

Thanks Bill! Your feedback and suggestions are a goldmine.

amazing information …one has to think about the wholistic picture rather than just what you own in your stock portfolio. Thanks for sharing!!

LikeLiked by 1 person

Who is Bill and how can I find him?

LikeLike

Bill is one of the readers of my blog. I don’t share personal information about my readers and I always try to ask their permission to quote from any email they send me. He is the one who helped me learn about a resource that I have found to be helpful for planning ROTH conversions and knowing the tax implications of those conversions.

LikeLike