I Don’t Have to Knock or Call

If you were renting an apartment, or a storefront or warehouse space, and I called you or showed up on your doorstep to ask for your monthly lease payment, you would rightly tell me to get lost. You would tell me I am not the owner or the manager of the property. However, I can do this without talking to individual tenants.

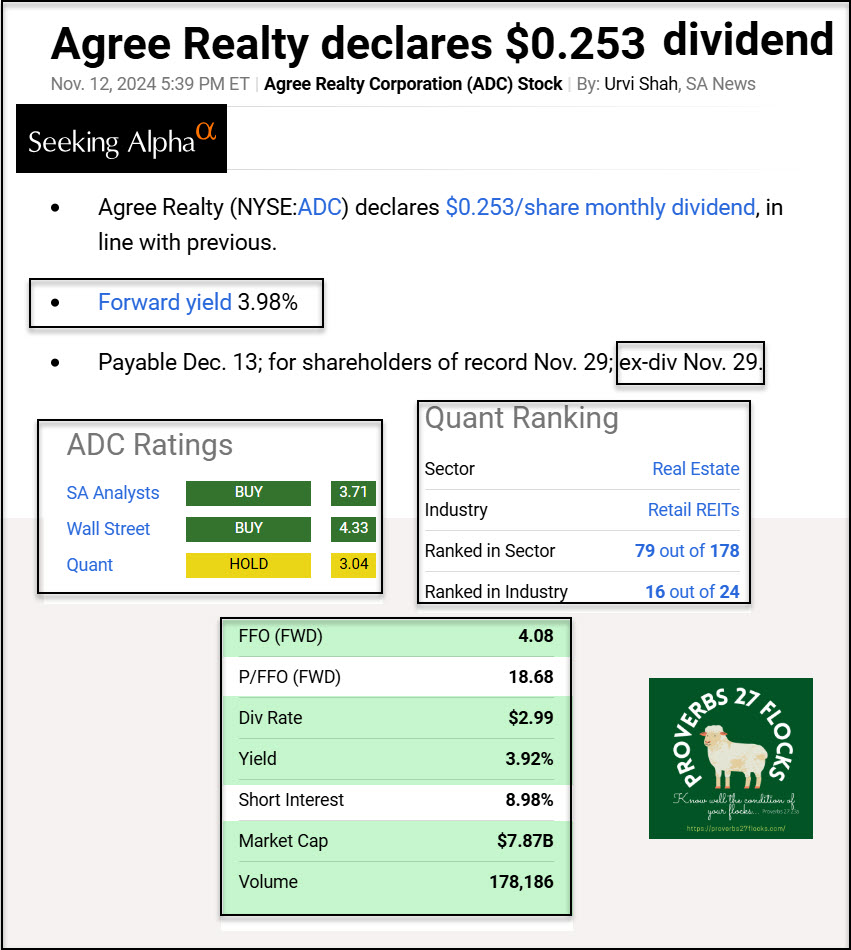

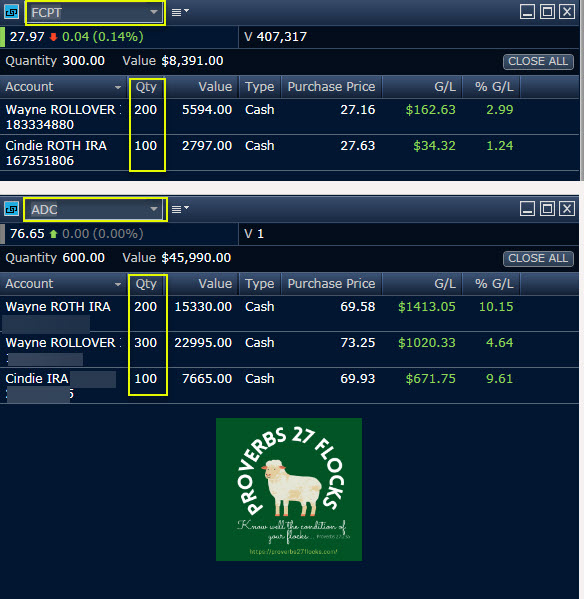

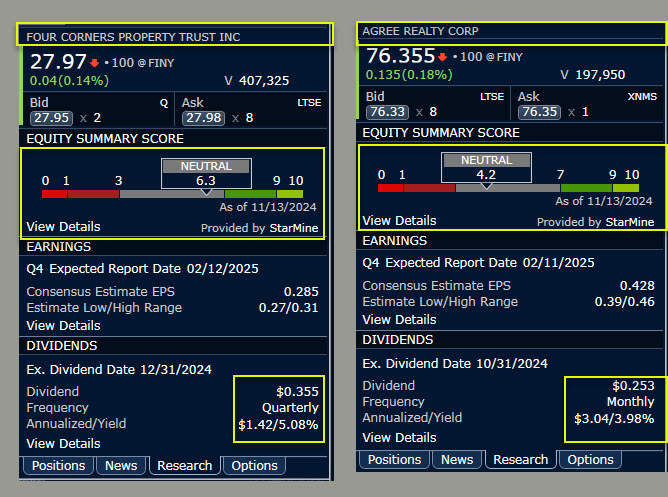

One of the benefits of REIT income is that I get paid every quarter and sometimes every month. For example, ADC (Agree Realty) pays me monthly, and FCPT (Four Corners Property Trust) pays quarterly. I don’t have to fix the property, unplug toilets, put on a new roof, pay for the property insurance, deal with property taxes, or even hound you if you are late with your rent.

Cindie Doesn’t Need Rental Properties

Furthermore, if something happened to me, and we owned rental properties, Cindie would have another long list of details and problems to care about. The kind thing for estate planning is to keep real estate complexity to a minimum.

YTD Dividends

So far this year FCPT has paid four quarterly dividends totaling $414. While this isn’t a huge amount, our total holdings of FCPT are rather small. On the other hand, YTD ADC dividends are $1,644.60. If you add the two together, you get over $2,000 in rental income for the year.

The amount of work to get this income: none. That is easy income.

By way of contrast, O, which also pays monthly, has delivered $3,118.20 in dividend income. STAG, another REIT, has paid $1,848.75 via monthly dividends. My point is that ADC, O, and STAG all contribute to monthly income that requires zero effort. In fact, these three contribute $664.38 in monthly income in our traditional and ROTH IRA accounts.

The best way to own rental property is to not own it.

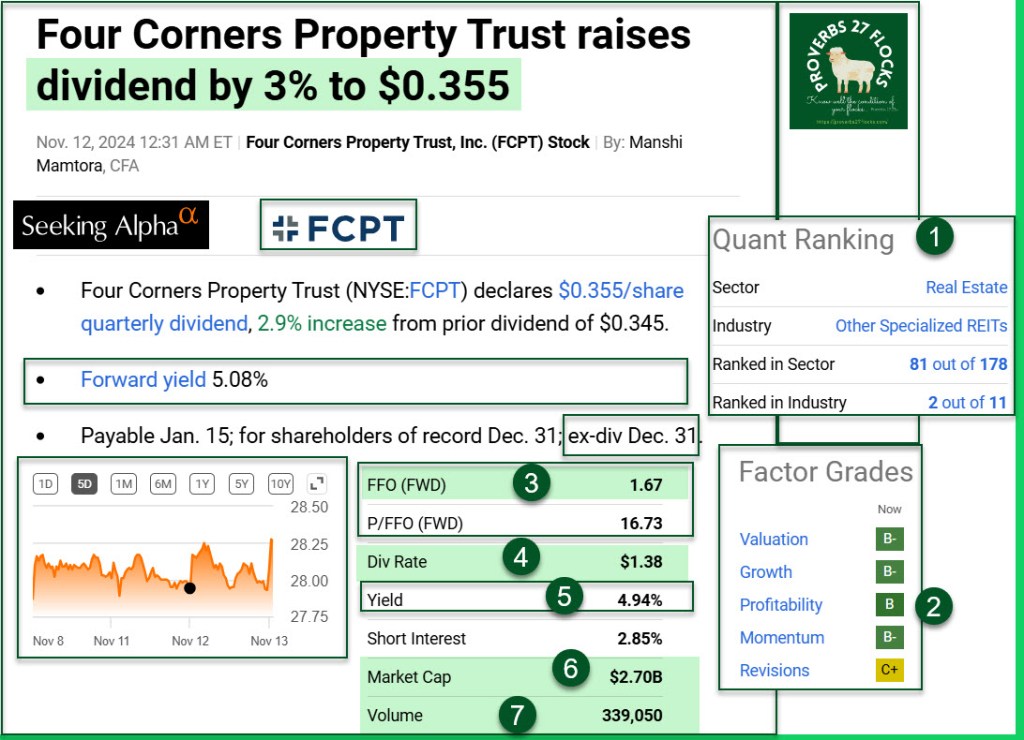

Why? Because I don’t have to raise the rent. The REIT does that for me. I may buy more FCPT shares, but I will do it before December 31.

Four Corners Property Trust raises dividend by 3% to $0.355: Four Corners Property Trust (NYSE:FCPT) declares $0.355/share quarterly dividend, 2.9% increase from prior dividend of $0.345. Forward yield 5.08% Payable Jan. 15; for shareholders of record Dec. 31; ex-div Dec. 31.

Business Description for FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties. The Company seeks to grow its portfolio by acquiring additional real estate to lease, on a net basis, for use in the restaurant and retail industries.

Some Seeking Alpha Articles about Real Estate Investing

Real Estate is best positioned to benefit from rate cuts, SA Sentiment poll shows – By: Jason Capul, SA News Editor

Why Buy Treasuries When You Can Buy Agree Realty? – “ADC offers a 4% dividend yield, a strong balance sheet, and a history of consistent shareholder returns, making it a solid long-term investment.”

Conclusion

If you want to buy real estate and take care of it on your own, please do so. There is certainly benefit if you buy low and can sell high at a later date. Just bear in mind how you deal with it in your estate planning. I’d rather have easy income.

Still own sava? If so, ouch this morning.

Sent from Yahoo Mail for iPad

LikeLiked by 1 person

Yes, unfortunately I do still own shares of SAVA. I entered the trade understanding it was a high risk investment, but the total dollars are not going to make an appreciable difference in my long-term results. I saw the news early this morning and anticipated the pain in advance. 🙂

LikeLike