Never Get Tired of the Different Flavors

I like potato chips. They aren’t good for me, but I like them. I like chips with ripples, sour cream and onion, barbeque, and chips with extra pepper. I like sweet potato chips too.

I also like the Financial Sector. It is a place of many dividends and many different flavors. Today’s flavors are CCAP, SAR, FNF, and MFC. The first two are BDCs. FNF is an insurance company (Property and Casualty Insurance), and MFC is a Canadian Life and Health Insurance company.

Easy Income Strategy Dividend Announcements

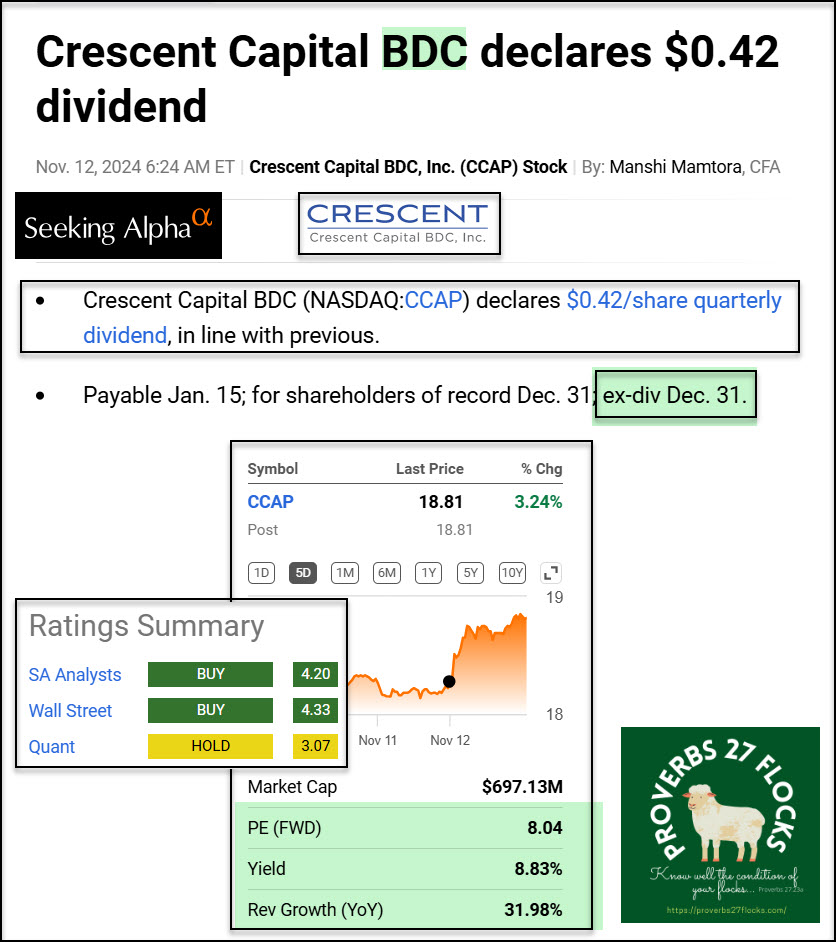

CCAP announced a regular quarterly dividend of $0.42 per share. I own 500 shares of CCAP in my ROTH IRA.

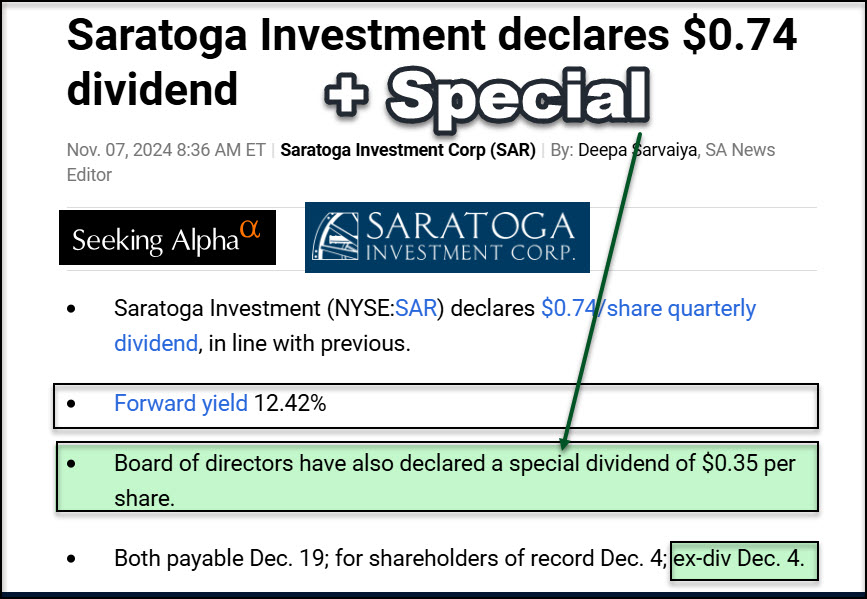

SAR announced a $0.74 per share dividend and sweetened the deal with a special dividend of $0.35 per share. The ex-Dividend date for that one is December 4. Cindie and I own 1,500 shares of SAR worth about $37K.

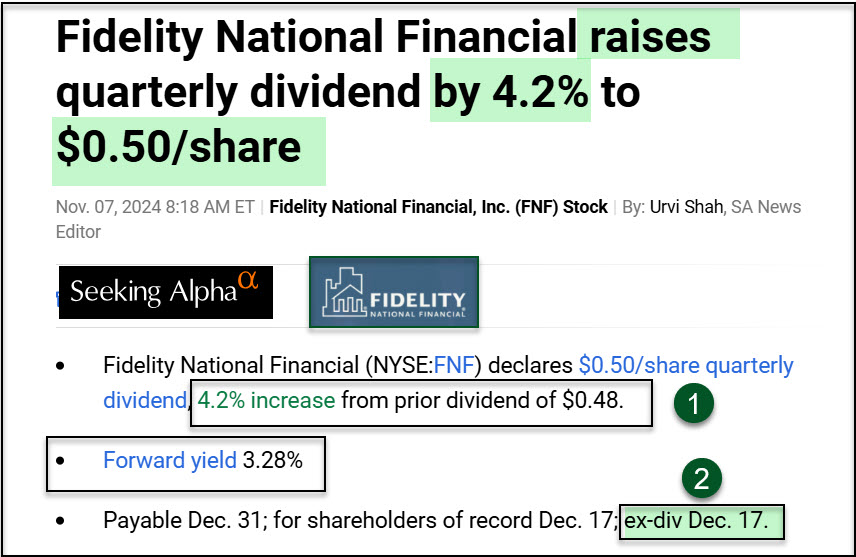

FNF also announced a dividend of $0.50. That is a 4.2% increase over the previous dividend of $0.48 per share. Cindie and I own 1,100 FNF shares that are worth about $67K.

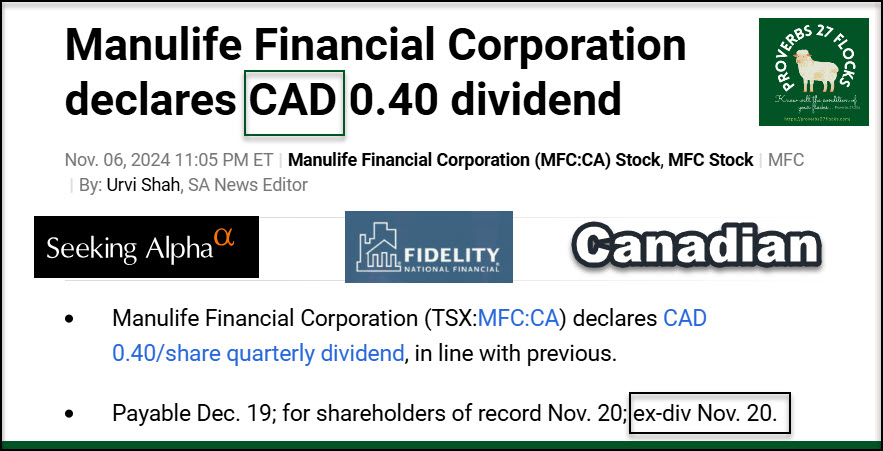

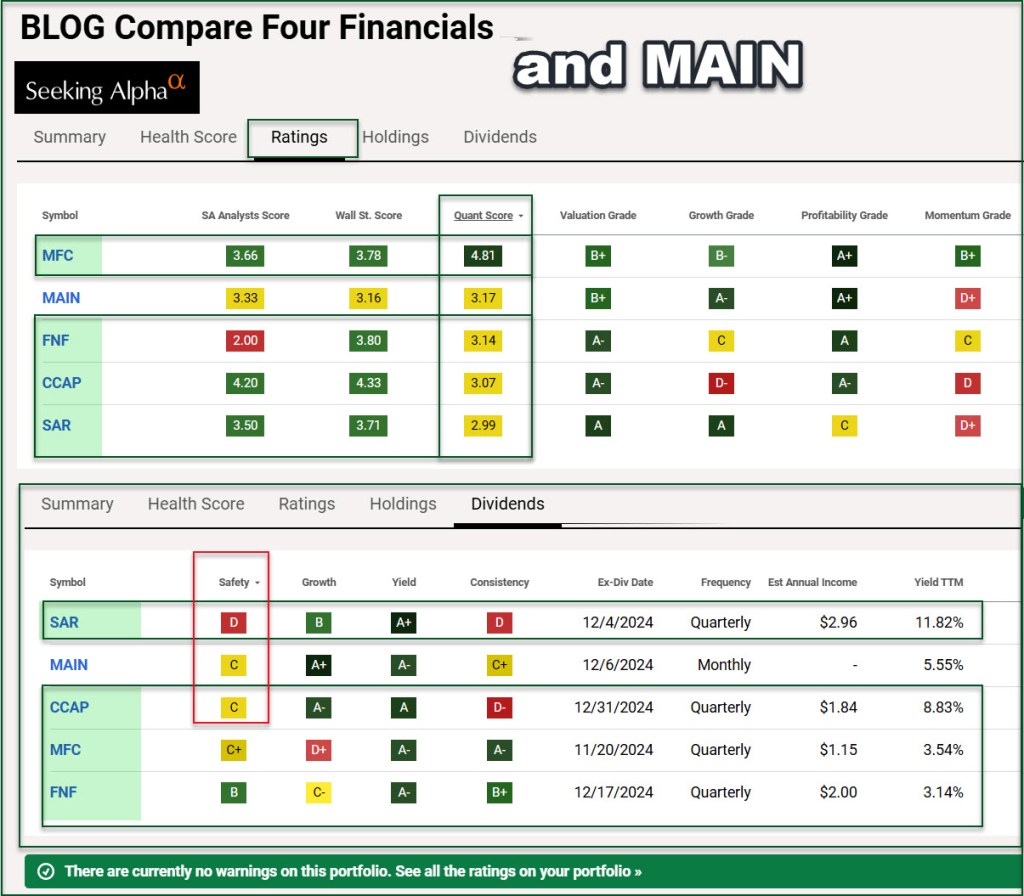

Lastly, MFC announced a dividend in Canadian dollars of $0.40 CAD. That stock has the best QUANT score of the four.

Options Contracts for FNF

I have ten covered call options contract on my 1,000 FNF shares. If the shares reach $65 per share by December 20, 2024, my shares will be called away. I will be happy with the profit. Cindie has a similar options contract on her 100 shares as well.

Using Seeking Alpha To Compare the Four

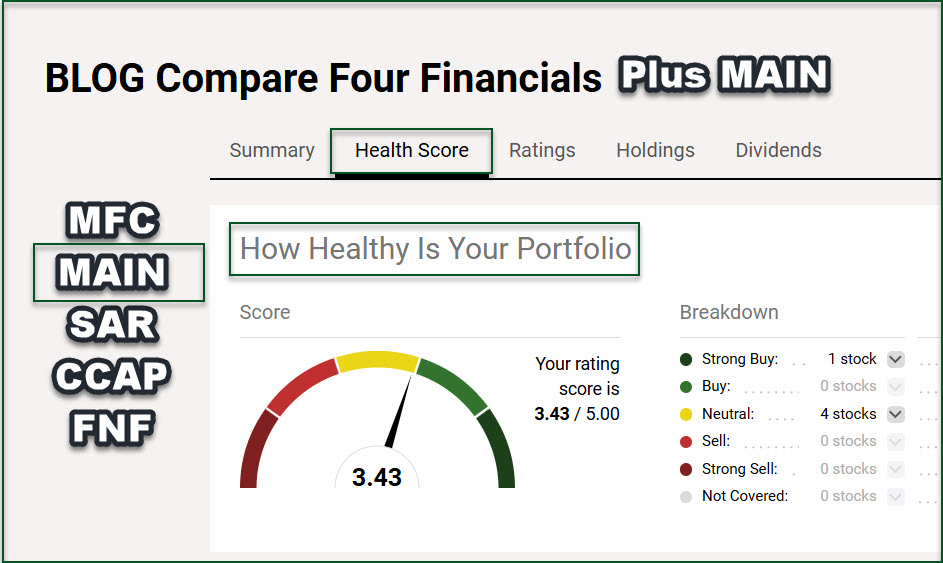

Seeking Alpha makes it very easy to compare ratings and dividend characteristics of various investments. I entered the ticker symbols for these four, along with MAIN, to compare the five. I had to add MAIN because one of the comparison tools requires five stocks to make the comparison work.

Comparing the “health” of an investment is always a wise practice. I added MAIN to make this tool work on Seeking Alpha.

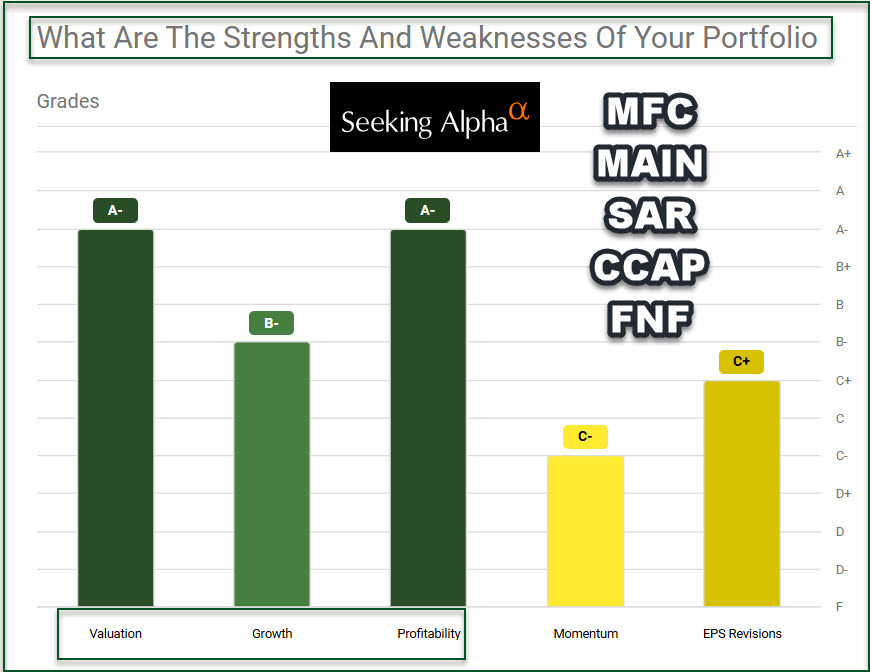

Comparing the QUANT scores and dividend safety is also a good discipline.

CCAP At A Glance

It is also prudent to look at a BDC’s diversification. CCAP has good diversification and is focused on first lien investments. They have 183 portfolio companies. This is almost (but not quite) like a small cap ETF that focuses on BDCs.

Recommendation

As always, diversification is crucial as you build your investment portfolio. I personally like investments in the financial sector. However, don’t forget that a meal is made of more than just chips. Therefore, adding technology, health care, real estate and other sectors to your portfolio gives you a more balanced portfolio diet.

Note: Some of my investments are higher risk. Be careful about buying investments like CLF, SMCI and MPW.

Hello Wayne I always look forward to reading your posts. Yesterday you added to AbbVie. I agree. I know you hold Pfizer and I am looking to build a larger position but it seems to go nowhere. Do you think at this price it is a good time to average in. Thank you

LikeLiked by 1 person

My wife and I hold 3,400 shares of PFE and I am sorely tempted to buy more. One of the things I do while I wait is to sell covered call options on my shares. I currently have an open covered call contract on my 1,500 IRA shares with a contract price of $32. The contract expires December 20. At the current price I would be tempted to sell cash covered put options with a contract price of $26. PFE has weekly options, so I just might do that for November 15th’s contracts. I would trade five contracts for 500 shares. If the share price dropped to or below $26 at Friday’s close, I would have 2,000 shares of PFE in my traditional IRA.

LikeLike