Another BDC with Supplemental Dividends

Three business development companies announced special dividends on November 5. The three were TSLX, CGBD, and BCSF. Here is another one: MAIN. MAIN is one of our top ten investments.

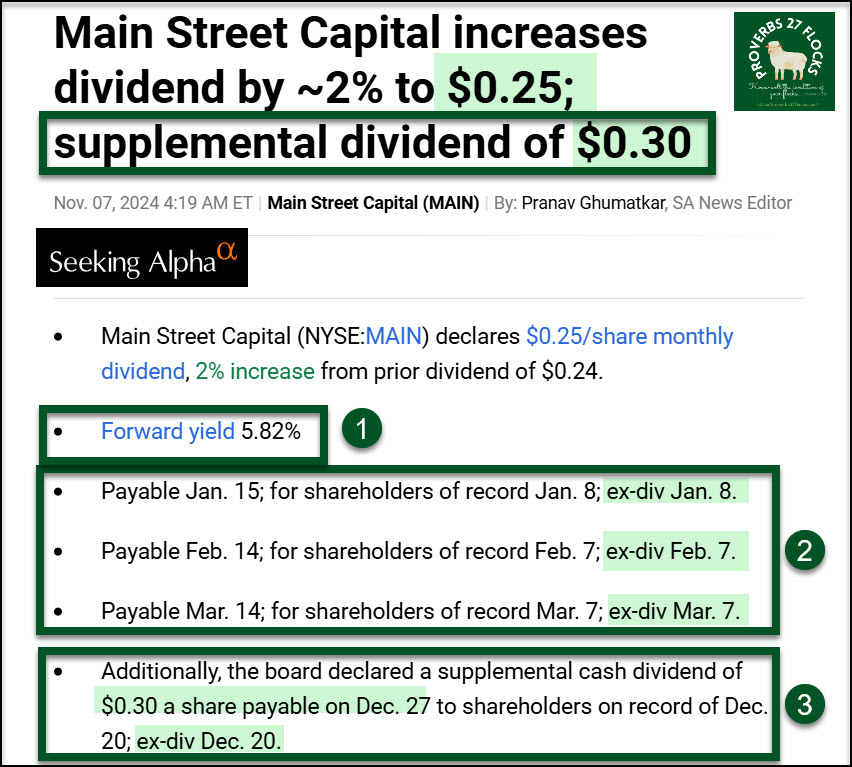

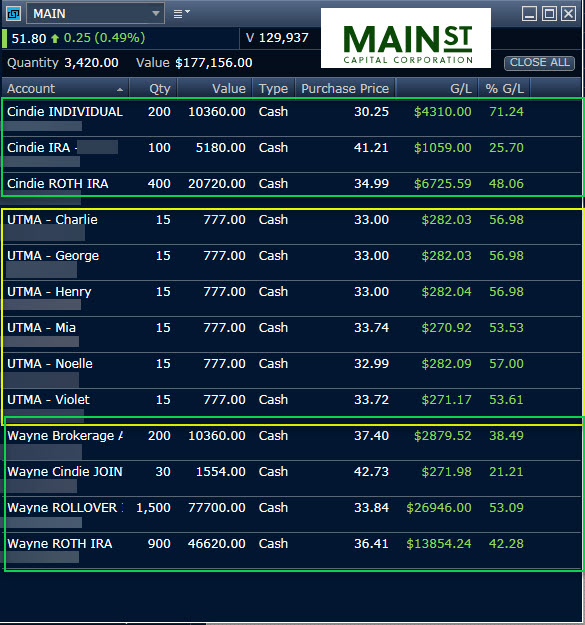

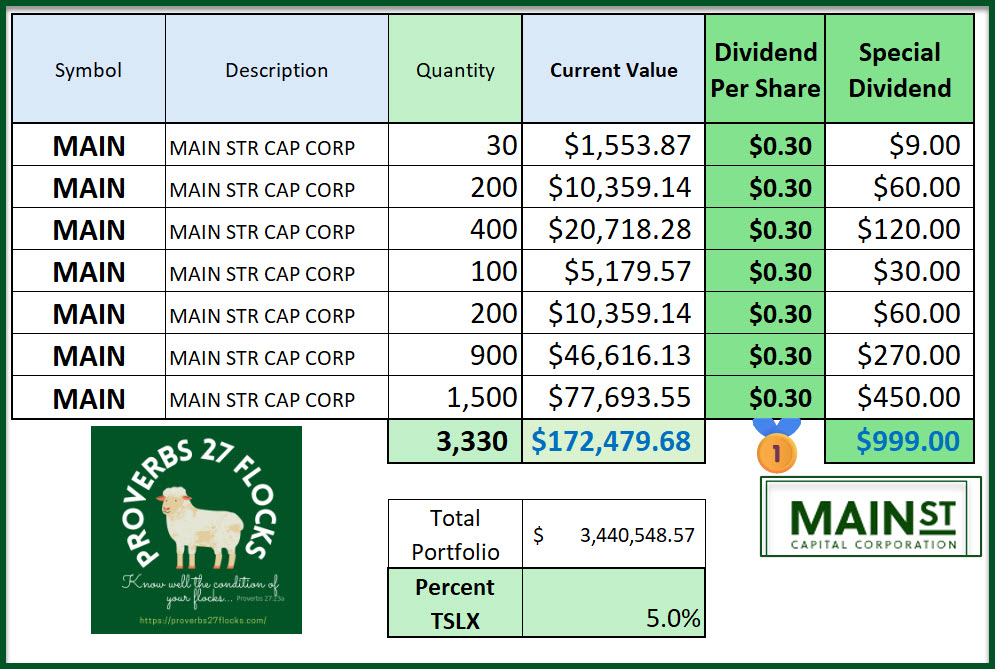

The email that Seeking Alpha sent out shows the next three monthly dividends, which are about a two percent increase and a supplemental cash dividend of $0.30 which will be paid before the end of 2024. Given our current holdings, we will receive an additional $999 on December 27, 2024. Let’s just say that is a great way to end the year.

BDCs and a New Administration

I am often asked in various surveys and by investors, “Do you plan to change the way you invest based on who wins the election or who won the election?” The short answer is “no.” The long answer is that I don’t buy investments and then sell them based on politics or what might happen due to government policies. There may be a few exceptions to that, but I see BDCs as a long-term optimism in the economy, especially for small businesses.

Does MAIN have any risks? Well, perhaps there are some risks, because every investment involves risk. However, when the shares dropped dramatically several years ago, I purchased shares for each of our grandchildren for their UTMA accounts. I am not disappointed that I did.

Furthermore, MAIN pays a monthly dividend as a reminder that there is no reason to panic sell just because everyone else is petrified.

StockRover View

StockRover has this to say about MAIN: “Main Street Capital Corp is an investment firm engaged in providing customized debt and equity financing to lower middle market companies and debt capital to middle market companies.” They go on to say, “The investment portfolio of the company is typically made to support management buyouts, recapitalizations, growth financings, refinancing’s, and acquisitions of companies that operate in diverse industry sectors.”

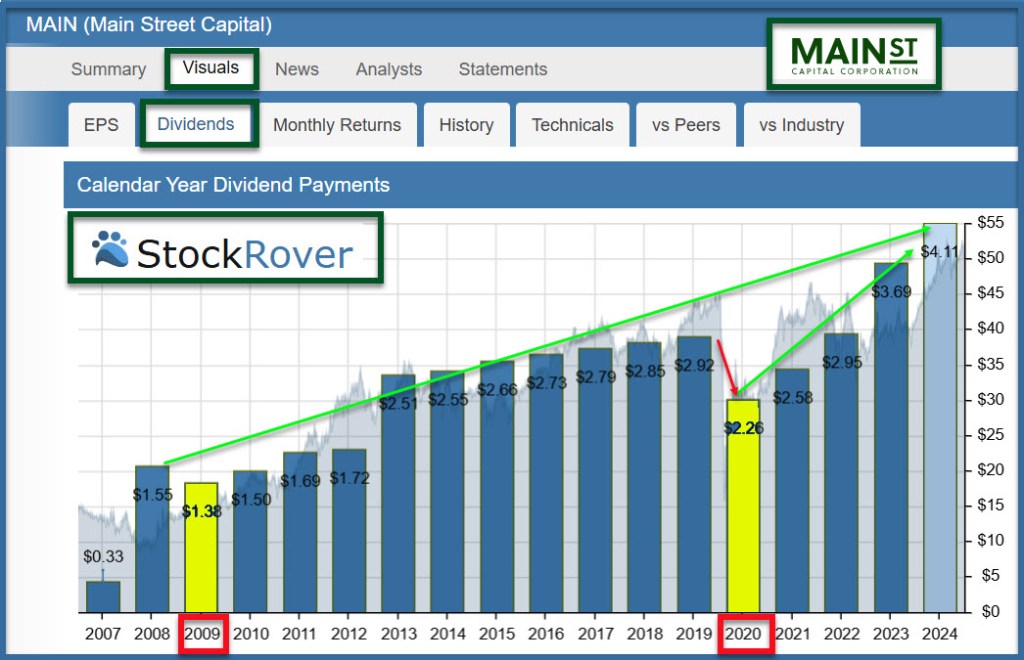

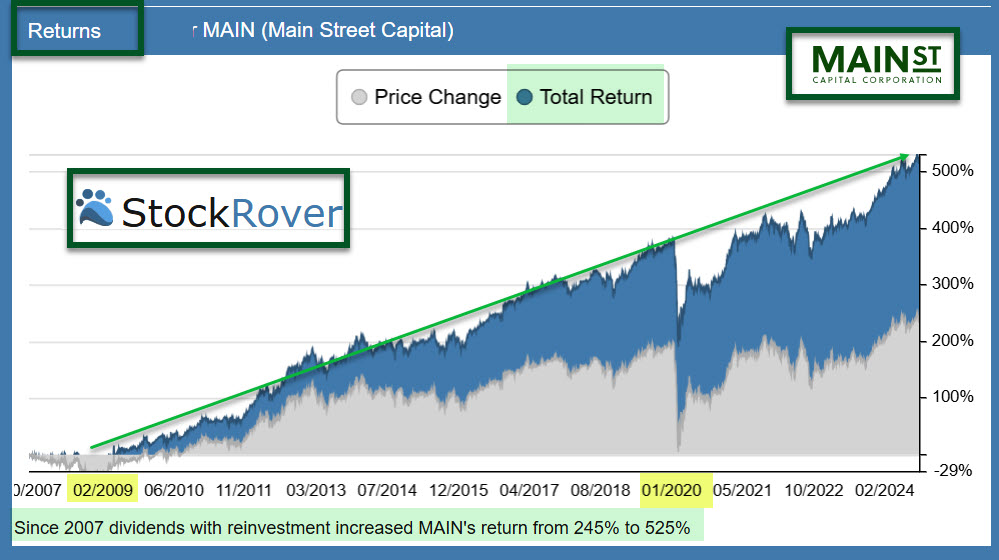

I like the dividend and returns graphs that StockRover presents. Here they are. Do you see the long-term story? Yes, there are bumps in the road caused by the financial crisis and Covid. But I see those as buying opportunities, not selling mandates.

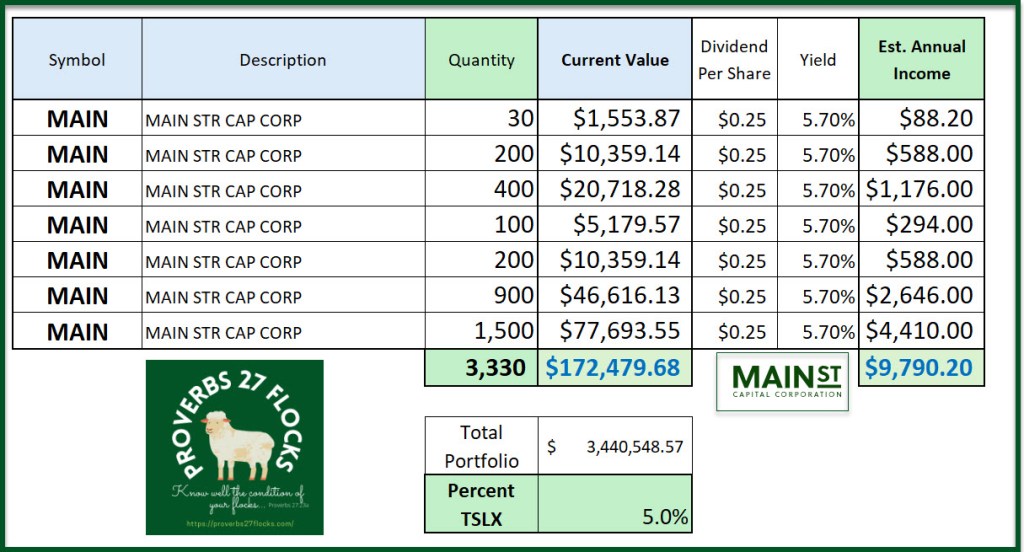

MAIN’s Monthly Income Is Grand

Well, actually it is almost ten grand for our accounts. The total income from MAIN is likely to be $9,790.20 during the next twelve months. I expect that number to be the worst-case scenario. I believe more dividend increases are likely during 2025.

Easy Income Strategy Reminders

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends (or be surprised by supplemental dividends.) Don’t build your spending projections on supplemental dividends but enjoy them when they come. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market.

Recommendations and Cautions

If you can only afford to buy one BDC, MAIN is one I would suggest you buy. If you want 100 shares, then start by buying ten shares each week for ten weeks. Try to buy the shares on a day when the price of the shares is down. The 52-week range of the price of MAIN shares is $40.25 to $52.62. The current share price as I type this is $51.95. Perhaps today is a good day to start because you would pay less than the $52.62.

If you have less than $200K, I suggest that you focus on dividend growth ETFs like VYM, DGRO, and SCHD. However, adding some BDC and REIT exposure is a good strategy, even if you have less than $100K in your retirement portfolio. You can then add shares as you deposit more funds to your accounts.

Hi Wayne…based on your recommendation i bought some MAIN and now can also add some of the BDC’s you mentioned. Thanks for these great tips!!

LikeLiked by 1 person