The “Why” is Always the Right Question

This is a follow-up on my previous post. One reader asked the fundamental question about every investment. If you don’t know the “why” then you don’t know the most important thing.

One of my readers asked me “Why do you like OBDC so much?” I will attempt to add some color to this specific investment’s appeal to my overall strategy. OBDC is “Blue Owl Capital Corporation.”

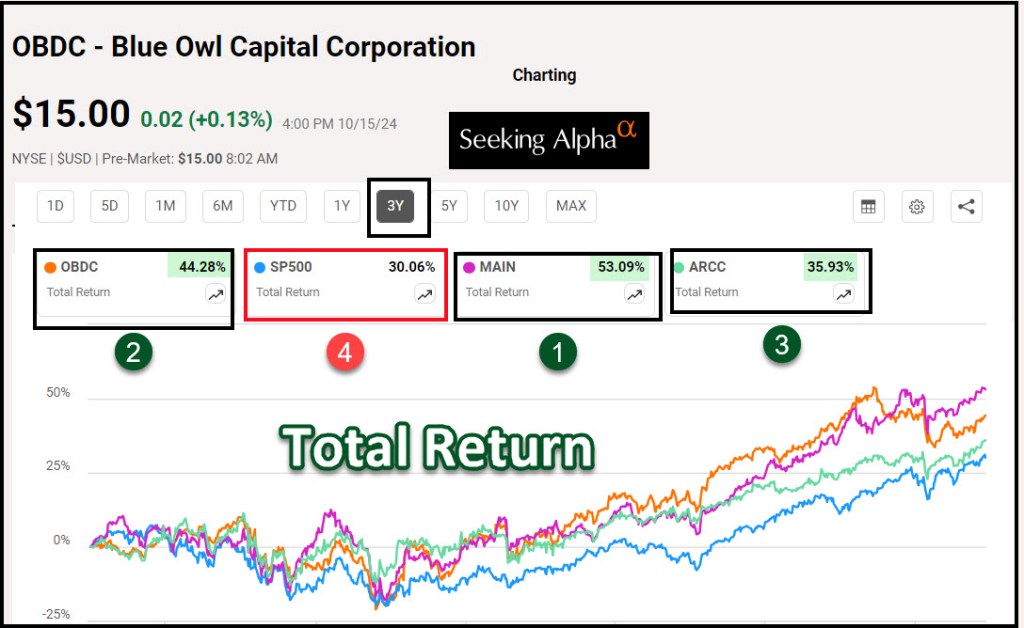

Three Year Returns

It is far to easy to look at a price returns graph and miss the big picture. If you compare price returns, you will miss out on the real returns. For example, using Seeking Alpha I compared OBDC, MAIN, ARCC, and the SP500. I used 3-year total returns due to the nature of OBDC’s relatively new arrival on the NYSE. This image helps one see the relative true investor returns.

My Returns

You have to buy investments at the right price and the right time. While I don’t always accomplish this, when I first looked at OBDC in July 2023, I thought investors were missing a huge value opportunity. These images show our investments in OBDC from Fidelity’s Active Trader Pro software. Always look to see if earnings support the dividend. Then enjoy the 9.73% yield. While it doesn’t appear that our returns are terrific, don’t forget we have been receiving regular and special dividends from our OBDC investment. We have received $10,399.50 in total dividends since September 15, 2023. Our 5,650 shares are paying us handsomely.

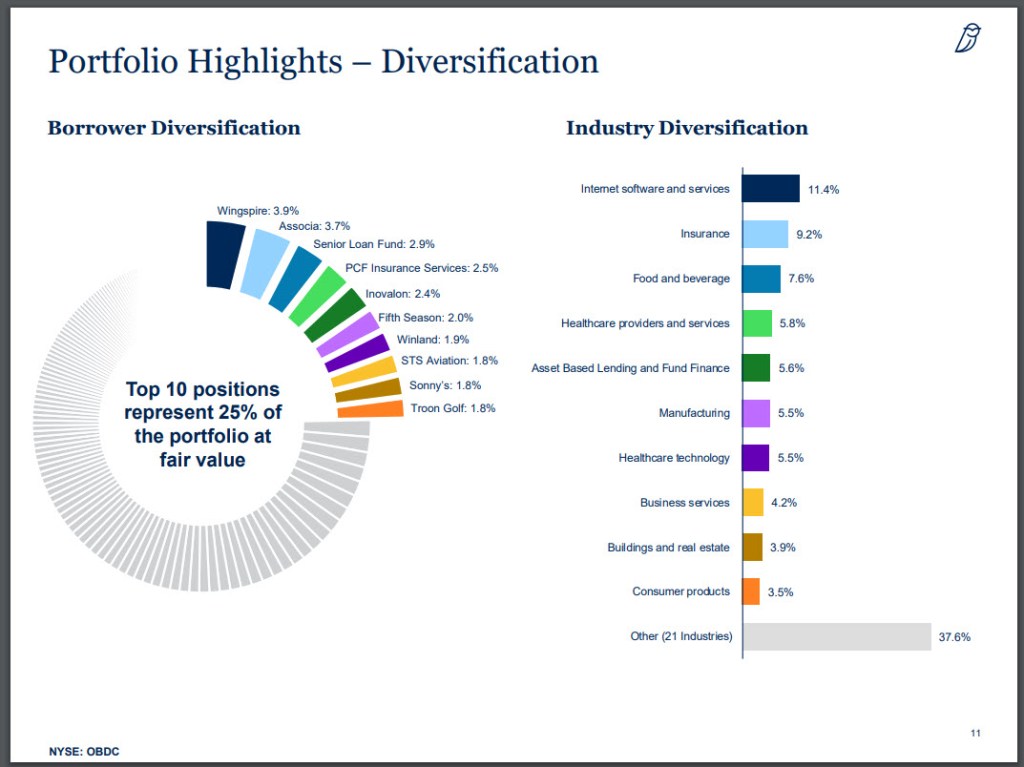

Borrower and Industry Diversification

One thing I always consider when looking at a BDC is both the nature of their investments and the diversification of their portfolio. OBDC is solid in this regard. The image is from their investor presentation from August.

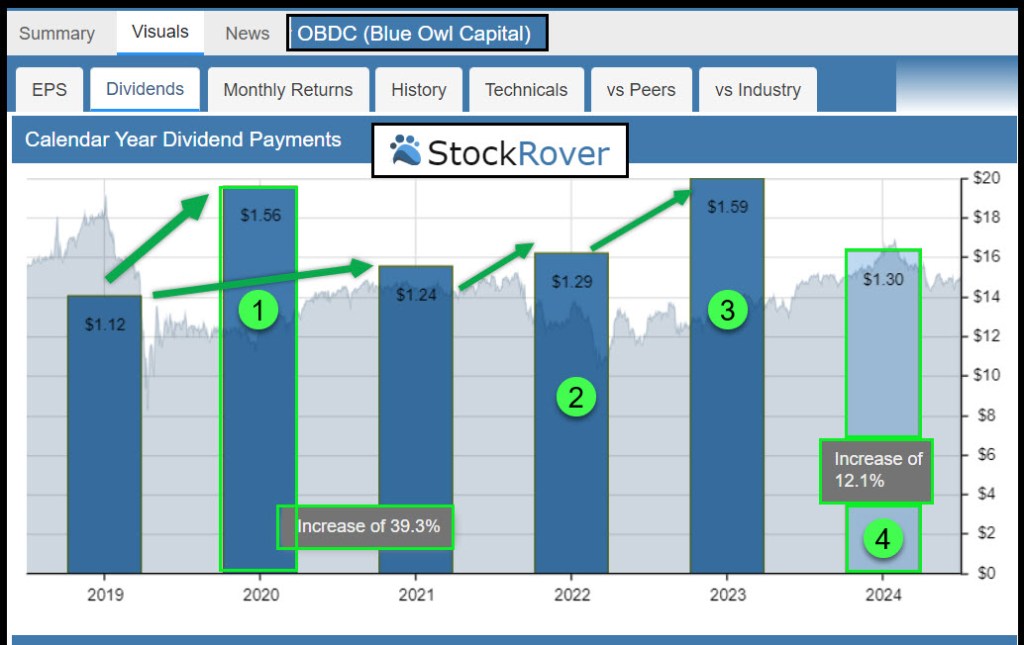

Dividend Behaviors

OBDC does not have straight line dividend growth. I can accept that. Here is an image from Stock Rover to help illustrate the variability and the growth of the dividends.

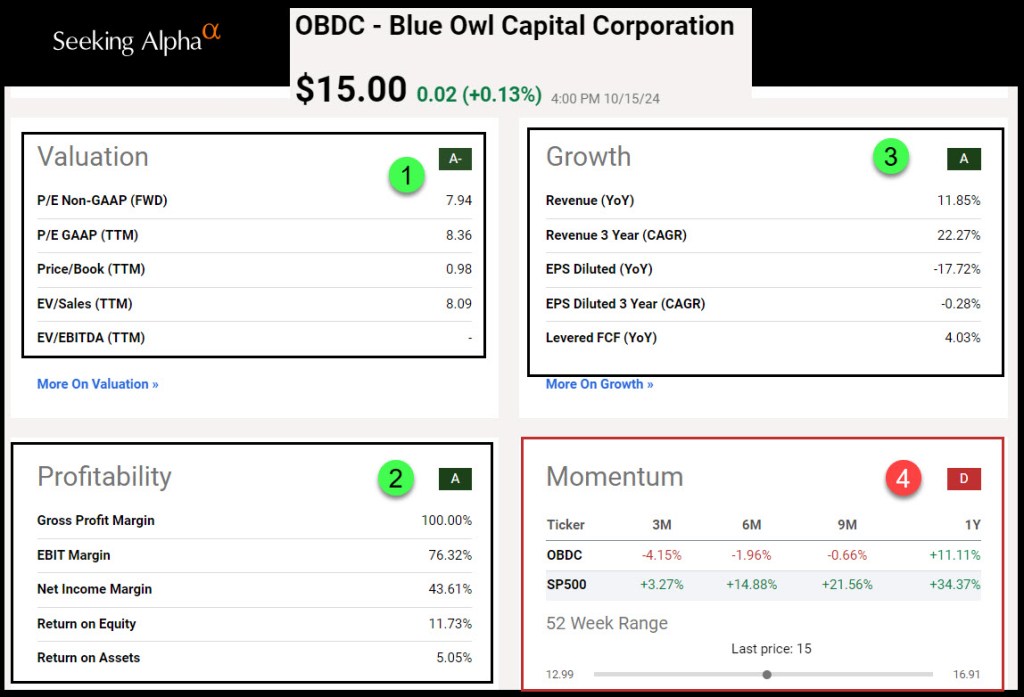

Valuation, Profitability, Growth, and Momentum

These are helpful for any investment. However, I don’t hitch my wagon to most investments based on momentum. If you look at the price graph for OBDC you will see it has peaks and valleys. Buy in the valley. Don’t chase the momentum.

Company Profile

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments. Within private equity, it seeks to invest in growth, acquisitions, market or product expansion, refinancings and recapitalizations. It seeks to invest in middle market and upper middle market companies based in the United States, with EBITDA between $10 million and $250 million annually and/or annual revenue of $50 million and $2.5 billion at the time of investment. It seeks to invest in investments with maturities typically between three and ten years. It seeks to make investments generally ranging in size between $20 million and $250 million.

Reminder for Newbies from Jerry

One of my readers, Jerry, rightly states what should be a basic part of analysis when considering investments that pay dividends. He said, “One more thing about BDC + REITs that you might want to pass on to your flock— one needs to check closely the history of dividend distributions over time as a prime factor for purchasing. Dividends should be steadfast or increasing, as yours are. Dividend history is easy to evaluate on Yahoo Financial, and other sources, stretching back to inception.”

You are absolutely correct Jerry. Time offers a perspective that tells us something about the management of a company or an ETF. One good quarter does not make a good investment and one bad quarter also does not mean an investment is inferior.

Dear Wayne, So, I understand you and your wife are on a trip…..perhaps a short note as to exciting things you are doing or noting would be of interest to your fans. Also, I do like trying new easy recipes when those are shared as well. Makes me wonder if the wife has some cookie recipes for us all as well. Yes, no financial/investing questions today. And if not for the flock you can send them to me the gander. Take Care, Bill Deany

LikeLiked by 1 person

I will share some pictures and some brief highlights. Love the idea of sharing our trip and some recipes. I love to bake, and my mom was a wonderful baker and my wife is a fine baker too.

LikeLike