Looking at Them Combined and Apart

This is a follow-up on a previous post. Two readers specifically asked to see more details behind our current BDC+REIT investments. I hope this helps.

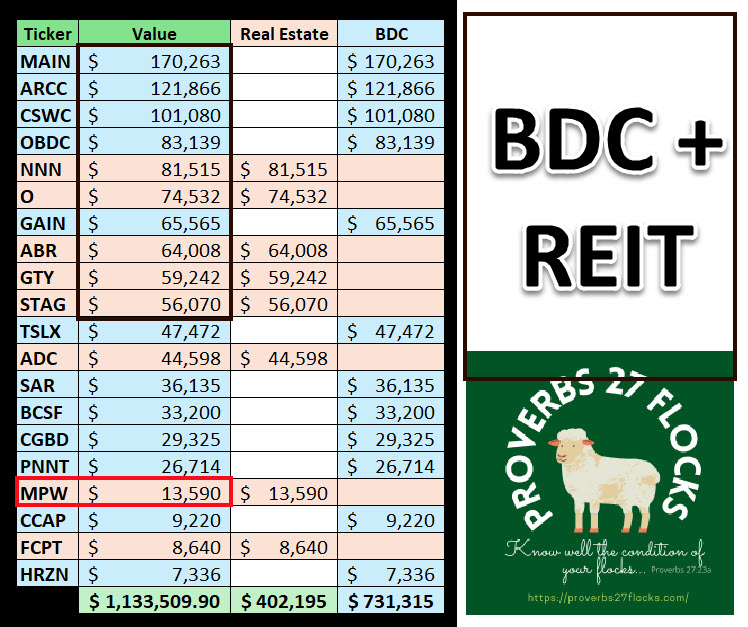

The Big Picture BDC-REIT

This image was sorted by value for all of our BDC and REIT investments. The top ten in this list are MAIN, ARCC, CSWC, OBDC, NNN, O, GAIN, ABR, GTY, and STAG. It is obvious that in our top five of this category, four are BDCs. I will admit to having a bias towards BDCs over REITs.

Notice that these investments total over $1.1M of our investment portfolio. MAIN is also one of our top ten investments when we look at all of our investments. Be cautious about MPW. It is struggling due to hospital bankruptcies.

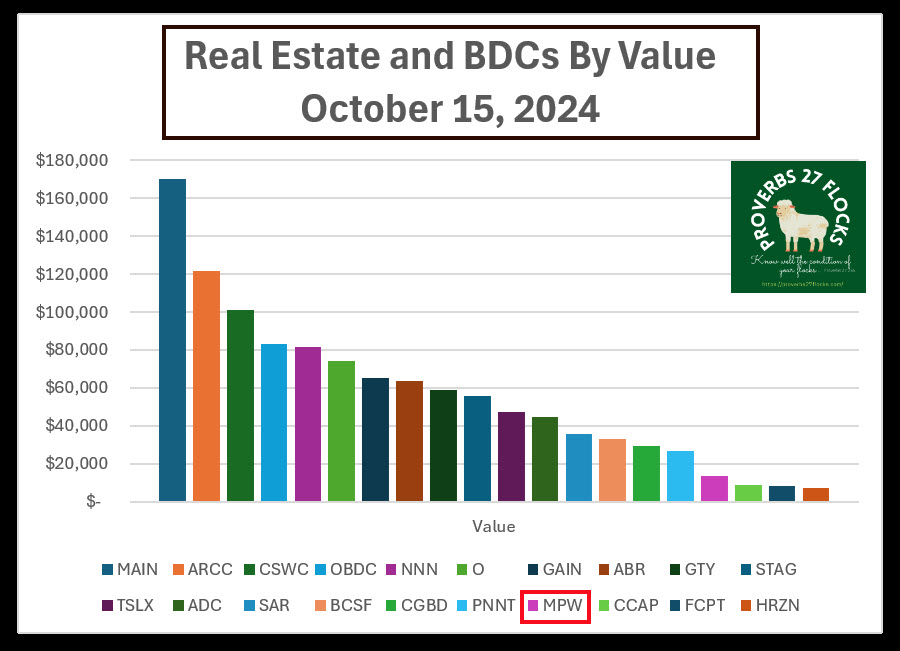

The Big Picture Graph BDC-REIT By Value

It is often helpful for me to look at our investments using a graph. This is the same information as the previous image.

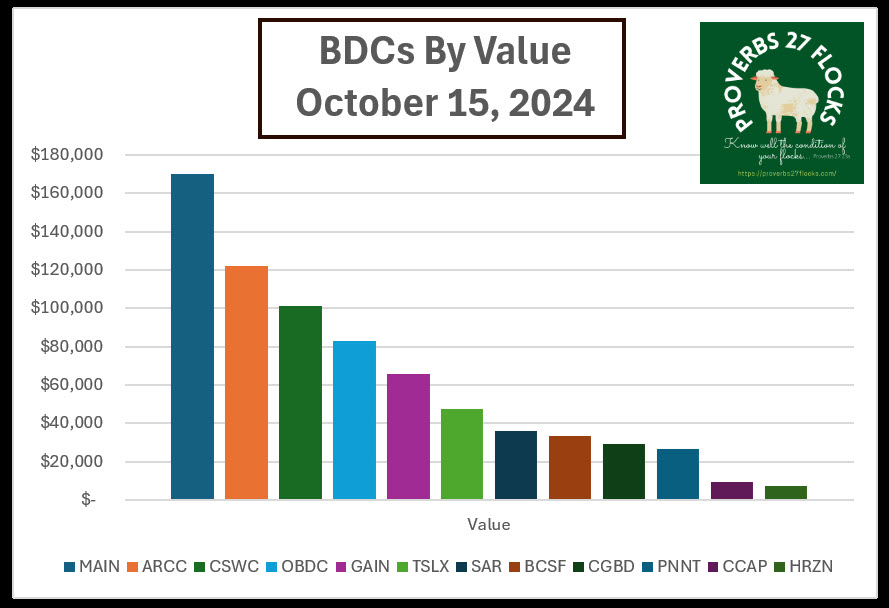

BDC Graph by Value

When we look at the BDC investments as a separate group, you can quickly see my bias towards MAIN, ARCC, and CSWC. Each of these is at least $100,000 in value. To put this in perspective, because perspective matters, our total investment portfolio is $3.5 million. Therefore, I have committed about 3.5% of our total capital for each of the top three. That means these three are about 10.5% of our total current investment base.

Please understand that you will rarely (if ever) find an investment advisor who would be willing to allocate that amount to BDC investments. One reason for this is that these are smaller businesses with a perception of higher risk. However, I don’t care much about the current swings in the price of BDCs. I’m interested in the income as a primary plus that requires little oversight on my part.

Also, it is very difficult to find an ETF that provides this level of income without a cloud of undesirable BDCs in the mix. I’ve looked and have yet to find one I would recommend.

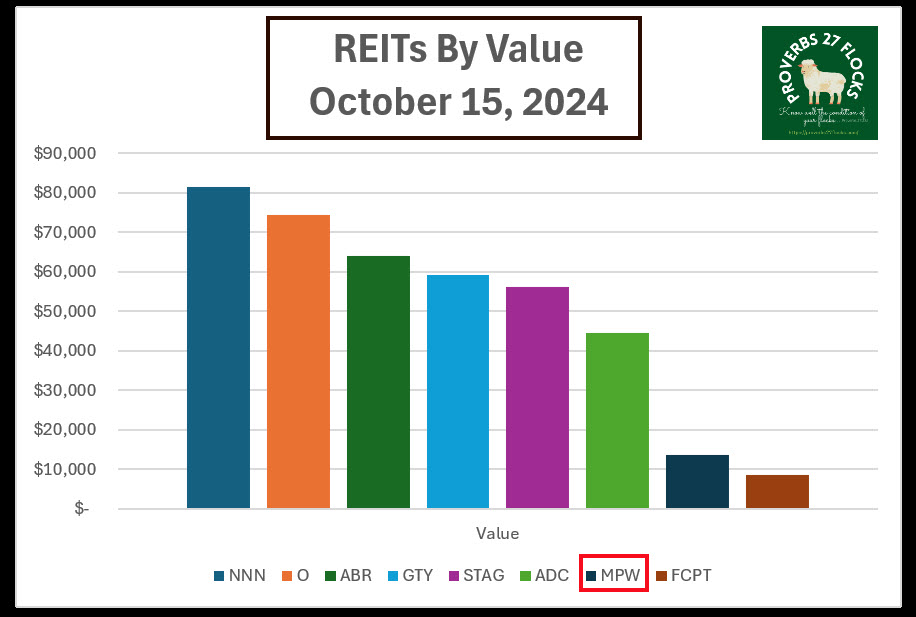

REIT Graph by Value

The top four REITS we own are NNN, O, ABR, and GTY. The total invested dollars in REITs is about $402K. This represents, in total, 8.7% of our total investment portfolio. Again, this is more than most financial or investment advisors might recommend. However, to put this in perspective, this is less than the current value of our Fitchburg home. Our Fitchburg home earns us $0 in income. The REITs bring in almost $24K in estimated annual income.

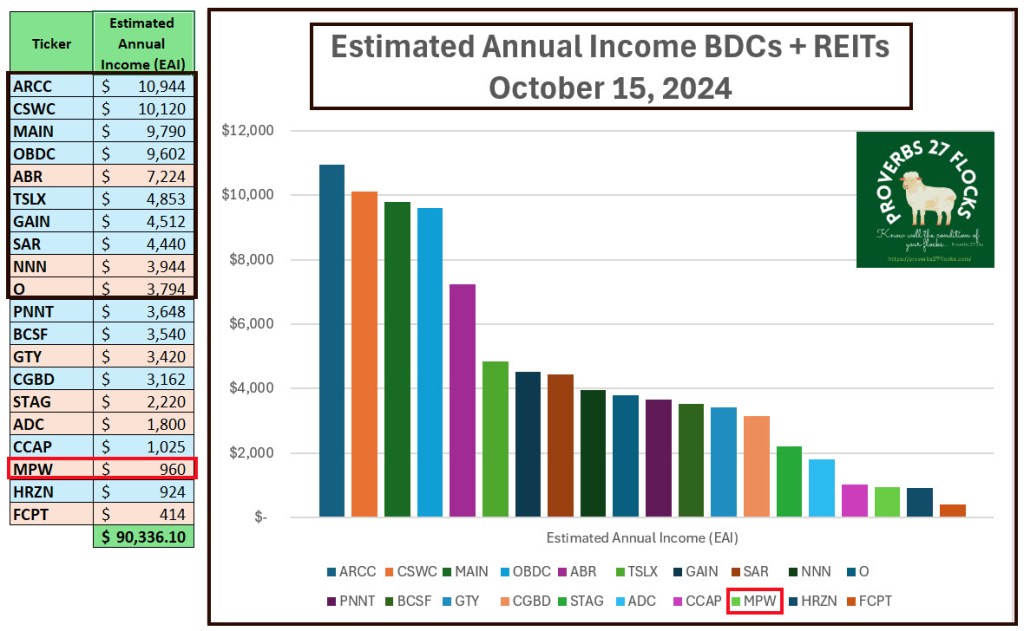

All BDC and REIT Income

The bottom line, for easy income, is a combination of diversification with solid, dependable income. This image shows income for all of the REITs and BDCs. Perhaps it is helpful to see that over $90K of our income is from these classes of investments. To put that in perspective, our total EAI from dividends is around $160K. Fidelity thinks I am a “most aggressive investor.” However, I beg to differ. It would take a major economic crisis (depression) or collapse of our economy to cause the BDC and REIT investments to become a Titanic catastrophe.

Stating this another way, our BDC+REIT investments are yielding 7.97% in aggregate. That is very high yield that is the result of the average investors’ fear of these sectors. However, this is far better than the yield on any cash we currently hold. This also boosts are overall yield, which is about 4.5% for the total investment portfolio.

We can live without the $90K. If it disappeared, we could continue to meet all of our living expenses from our Social Security income. Our goal is to be generous in our giving. $90K helps us continue our generosity.

Don’t Lose Sight of the End of Life

We believe and we know that it is important to lay aside treasure in heaven. Where our treasure is causes our hearts to be drawn. Jesus said this was so. My heart is drawn towards heaven. Why? Because that is where my Savior dwells, and that is where I am headed at the end of this brief life.

Reminder for Newbies

Don’t be greedy or foolhardy. Not all BDCs and REITs are a good investment. Also, most BDCs and REITs are value income investments. You should not buy them for growth, but for income. Remember to keep prudent allocations. Many investors would do well to start with ETFs like VYM, DGRO, SCHD, and DTD.

Hey Wayne — One more thing about BDC + REITs that you might want to pass on to your flock— one needs to check closely the history of dividend distributions over time as a prime factor for purchasing. Dividends should be steadfast or increasing, as yours are. Dividend history is easy to evaluate on Yahoo Financial, and other sources, stretching back to inception.

— Jerry Uhlman

>

LikeLiked by 1 person

Good reminder. I will include this in a post when I respond to another reader’s question.

LikeLike

Why do you like OBDC so much? Thanks

LikeLiked by 1 person

This is a good question. I will try to answer it in a separate post.

LikeLike

Thanks Wayne, that’s very helpful. There are also good yields to be had in energy- I’m relatively new to the blog so I don’t know if you’ve addressed this before, but why are you not so high on that sector?

LikeLiked by 1 person

Thanks for the question and feedback. I have added your question to my staging area for future blog posts.

LikeLike