Illinois, Missouri, Tennessee, Arkansas, Mississippi, and Louisiana

In many of my posts I suggest that investing in dividend growth ETFs like VYM, SCHD, and DGRO is a useful part of my easy income strategy. But those ETFs miss some opportunities. For example, you won’t find a heavy allocation, if any, in the real estate market or in business development of micro-cap companies.

We are on a nice vacation, but I want to continue to write as time permits. Saturday, we left Wisconsin and drove to Springfield IL. After a good night’s rest, we were blessed to be able to worship the Lord in a Baptist church in Collinsville IL. We then drove south, with some delightful stops along the way, finally arriving in a city just south of Memphis. After checking into our hotel, we went to the Longhorn Steakhouse that was about a half mile from the hotel

The income to pay for fuel, snacks, hotel rooms, and delicious meals comes primarily from dividends. Some of those dividends are monthly.

My “formula” is that investing in BDCs plus REITs is a great way to have “Easy Monthly Income.”

Why REITS and BDC Investments?

There are many risks with small companies. There are also many risks in the ownership of real estate. If you think about hurricanes, earthquakes, massive fires, and tornados, then recent news brings many of the woes in California, North Carolina, and Florida. Many homes and businesses are a total loss, and many of the owners had no flood insurance or inadequate insurance. As a result, their “investment” is no longer a good one. There are, however, ways to play in the world of small businesses and real estate with far less systemic risk.

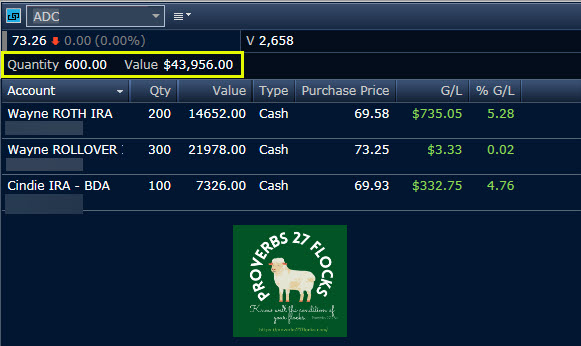

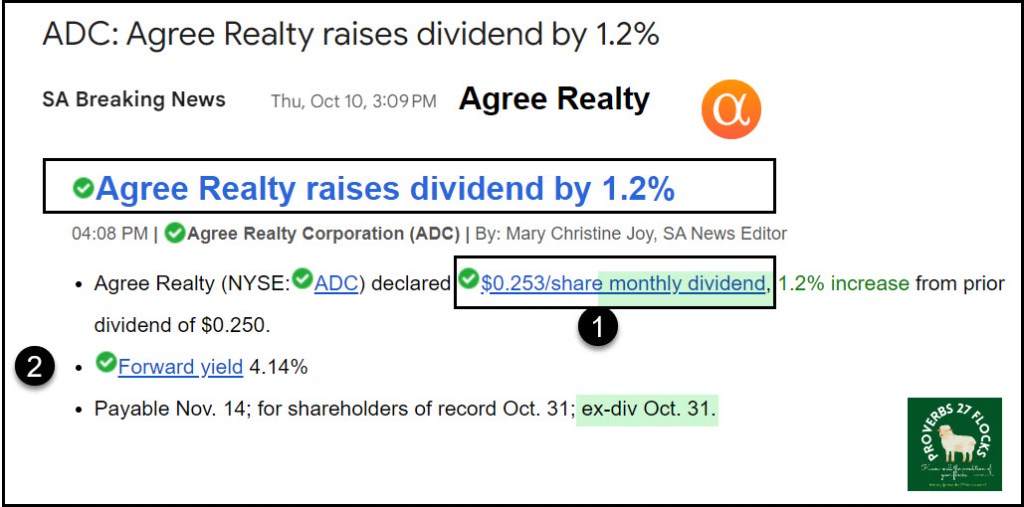

A REIT gives me broad ownership of many properties across wide geographies. Therefore, an investment like ADC (Agree Realty Corporation) makes sense to me. ADC pays a monthly dividend as well.

Agree Realty Corporation is a fully integrated real estate investment trust (“REIT”) primarily focused on the ownership, acquisition, development and management of retail properties net leased to industry leading tenants. The Company was founded in 1971. As of March 31, 2024, the Company owned 2,161 properties, with a total gross leasable area (“GLA”) of approximately 44.9 million square feet.

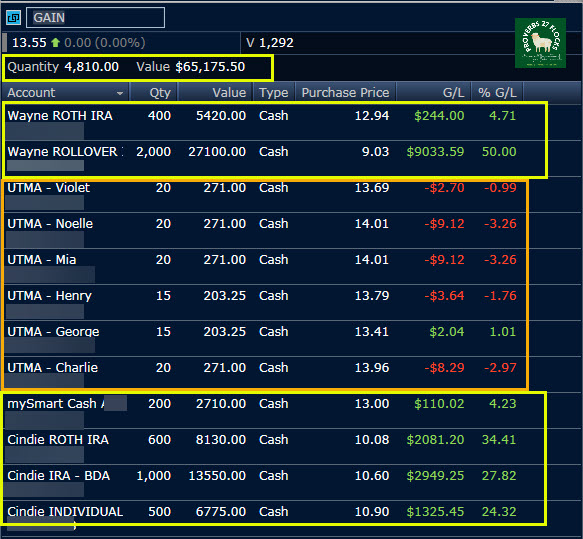

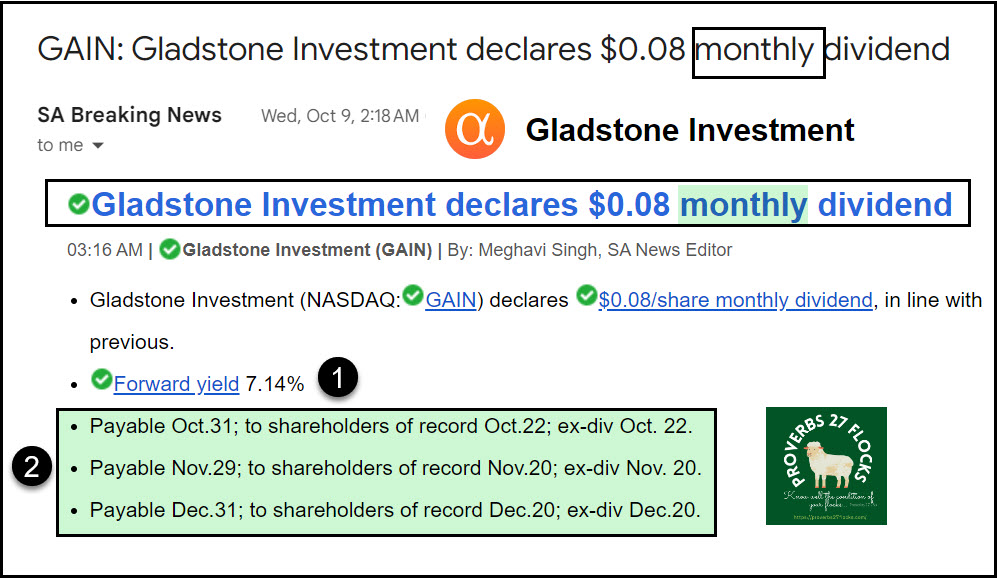

For business investments, a BDC gives me great diversification into many small businesses. GAIN (Gladstone Investment), for example, is a good BDC that pays a monthly dividend, just like ADC. Gladstone Investment Corporation is business development company, specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options. The fund does not invest in start-ups. The fund seeks to invest in manufacturing, consumer products and business/consumer services sector. It seeks to invest in small and mid-sized companies based in the United States. The fund prefers to make debt investments between $5 million and $30 million and equity investments between $10 million and $40 million in companies.

Caution and Question

Not all BDCs and REITs are a good investment. Also, most BDCs and REITs are value income investments. You should not buy them for growth, but for income.

Perhaps in a future post I will list all of our REIT and BDC investments sorted by total investment dollars. Are any of my readers interested in that?

I for one am interested. And I’ll go first. Not sorted in any way but here are the REITs I own: BNL, CHCT, OHI, VNQ, O, RITM, RNP, LAND.

And here are the BDCs I own: ARCC, OBDC, MAIN, CSWC.

LikeLiked by 1 person

I am interested as well! I also have those BDCs Pete, plus GAIN and PNNT (based on Wayne’s recommendations). Some overlap with the REITs also, plus a sizeable position in SPG.

LikeLiked by 1 person

I’d like that also.

LikeLiked by 1 person