Gladstone Investment Corporation

The idea of a Business Development Company is primarily one of outstanding income. The stockholder isn’t overly concerned about the price of the shares rising dramatically, as the reward comes in the form of dividends. This is certainly true of GAIN.

Cindie and I own a total of 4,700 shares of GAIN in our six Fidelity Investments accounts. With the announcement of a supplemental dividend of $0.70, this will give us an additional one-time income boost of $3,290.

Why Now?

This dividend is possible because GAIN sold one of their investments at a sizeable profit. There is always the potential for big supplemental dividends that don’t require selling GAIN shares to gain the profit from a successful GAIN investment.

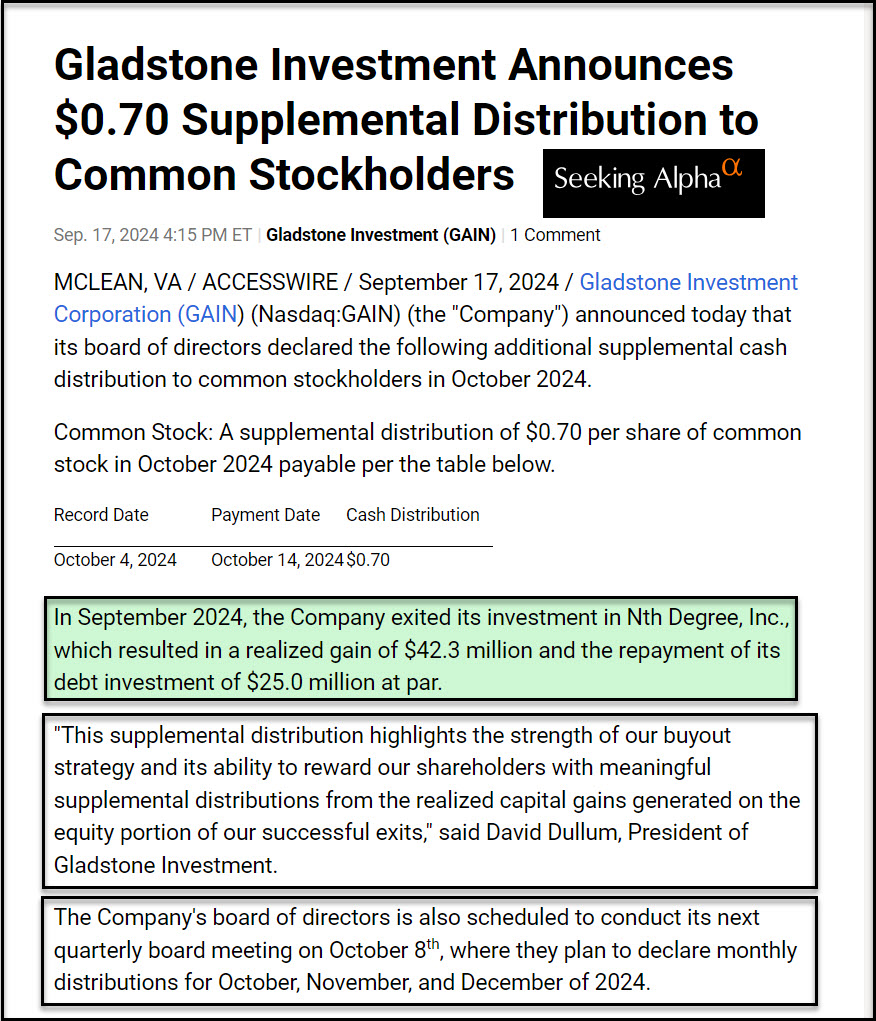

“With the sale of Nth Degree and from inception in 2005, we have exited 31 of our management supported buy-outs, generating significant net realized gains on these investments,” said David Dullum, President of Gladstone Investment. “Our fund strategy is to realize gains on equity, while also generating strong current income during the investment period from debt investments alongside our equity investments. This provides meaningful value to our shareholders with potential stock appreciation and dividend growth.” SOURCE: Seeking Alpha

GAIN currently has about 36.7 million shares outstanding. This means the total payout to shareholders will be $25,690,000. Is this affordable?

According to the filing from GAIN, “In September 2024, the Company exited its investment in Nth Degree, Inc., which resulted in a realized gain of $42.3 million and the repayment of its debt investment of $25.0 million at par.” Yes, this is both affordable and gives GAIN cash for new opportunities.

More From the Dividend Announcement

“This supplemental distribution highlights the strength of our buyout strategy and its ability to reward our shareholders with meaningful supplemental distributions from the realized capital gains generated on the equity portion of our successful exits,” said David Dullum, President of Gladstone Investment.” SOURCE: GAIN

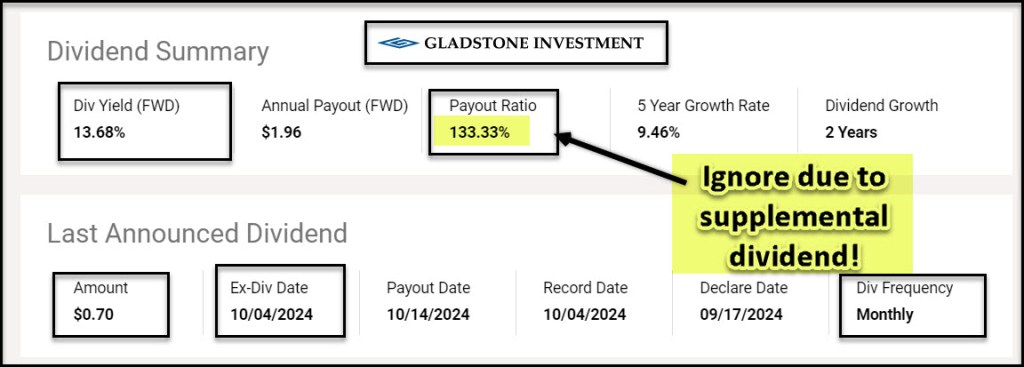

Also note that GAIN pays a monthly dividend of $0.08 per share. That means each share provides $0.96 in annual income. At the current share price of $13.55, the dividend yield for GAIN shares is 7.1%.

“The Company’s board of directors is also scheduled to conduct its next quarterly board meeting on October 8th, where they plan to declare monthly distributions for October, November, and December of 2024.” SOURCE: GAIN

QUANT Rating

The ratings are a strange mix. Most of the time I don’t like seeing a “SELL” rating for an investment. GAIN currently looks like a bad idea. Here are all of the current ratings.

Seeking Alpha Ratings Summary

SA Analysts Buy Rating: Buy 3.75

Wall Street Hold Rating: Hold 3.40

Quant Sell Rating: Sell 2.39

Why Sell?

The QUANT rating is made up of five factors: Valuation, Growth, Profitability, Momentum, and Revisions.

Factor Grades provide investors with an instant characterization of each stock. This makes it easy to find or rule out stocks based on your investment criteria.

Seeking Alpha grades each stock by five “factors” — Value, Growth, Profitability, Momentum and EPS Revisions. To do this, we compare the relevant metrics for the factor in question for the stock to the same metrics for the other stocks in its sector. The factor is then assigned a grade, from A+ to F.

There are two factor grades that have the most significance in my view. They are valuation and profitability. Growth is certainly going to be slow for GAIN. I don’t worry much about momentum, as investors are fickle beasts.

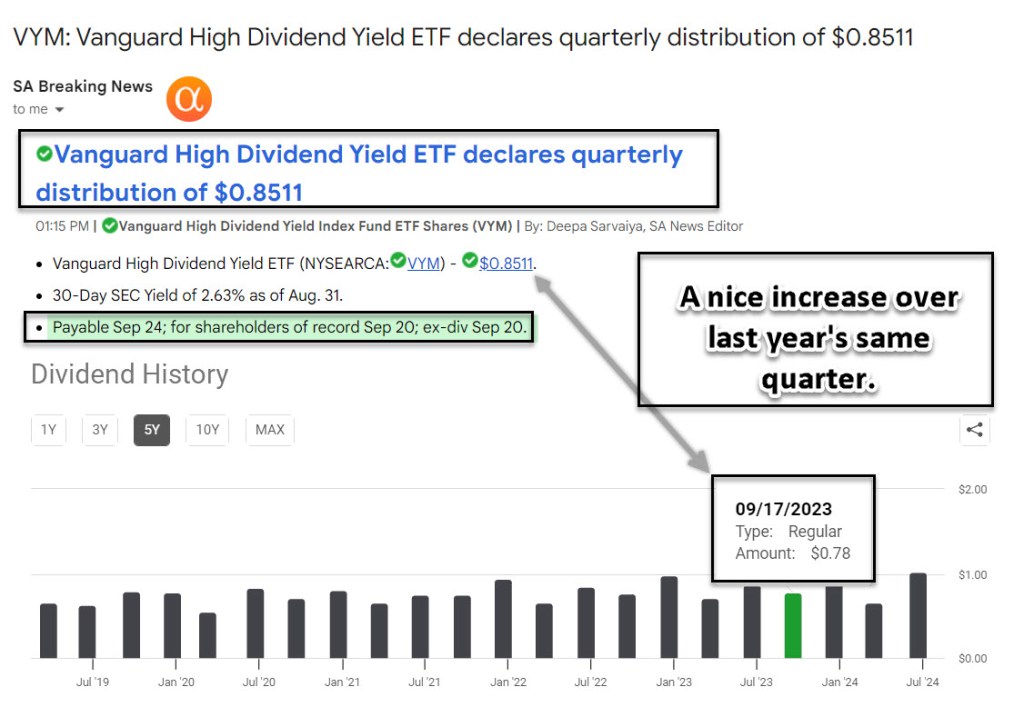

VYM Dividend Increased

As a side note, I see that VYM also announced their third-quarter dividend. It is too late to buy shares for this new dividend, as the Ex-Dividend date is today. However, as a long-term holding, VYM has proven to be a good way to have growing income.

GAIN Company Profile

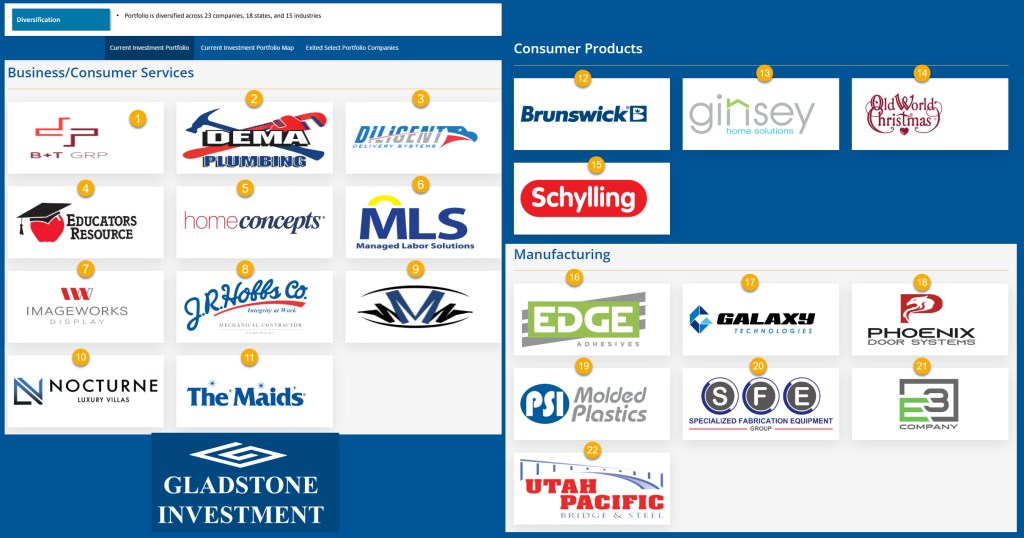

Gladstone Investment Corporation is business development company, specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options. The fund does not invest in start-ups. The fund seeks to invest in manufacturing, consumer products and business/consumer services sector. It seeks to invest in small and mid-sized companies based in the United States. The fund prefers to make debt investments between $5 million and $30 million and equity investments between $10 million and $40 million in companies. The fund seeks to invest in companies with revenue between $20 million and $100 million. The fund invests in companies with EBITDA from $3 million to $20 million. It seeks minority equity ownership and prefers to hold a board seat in its portfolio companies. It also prefers to take majority stake in its portfolio companies. The fund typically holds the investments for seven years and exits via sale or recapitalization, initial public offering, or sale to third party.

I don’t have GAIN. It looks good from here because of the dividends.

LikeLiked by 1 person