The Free Money Arrived

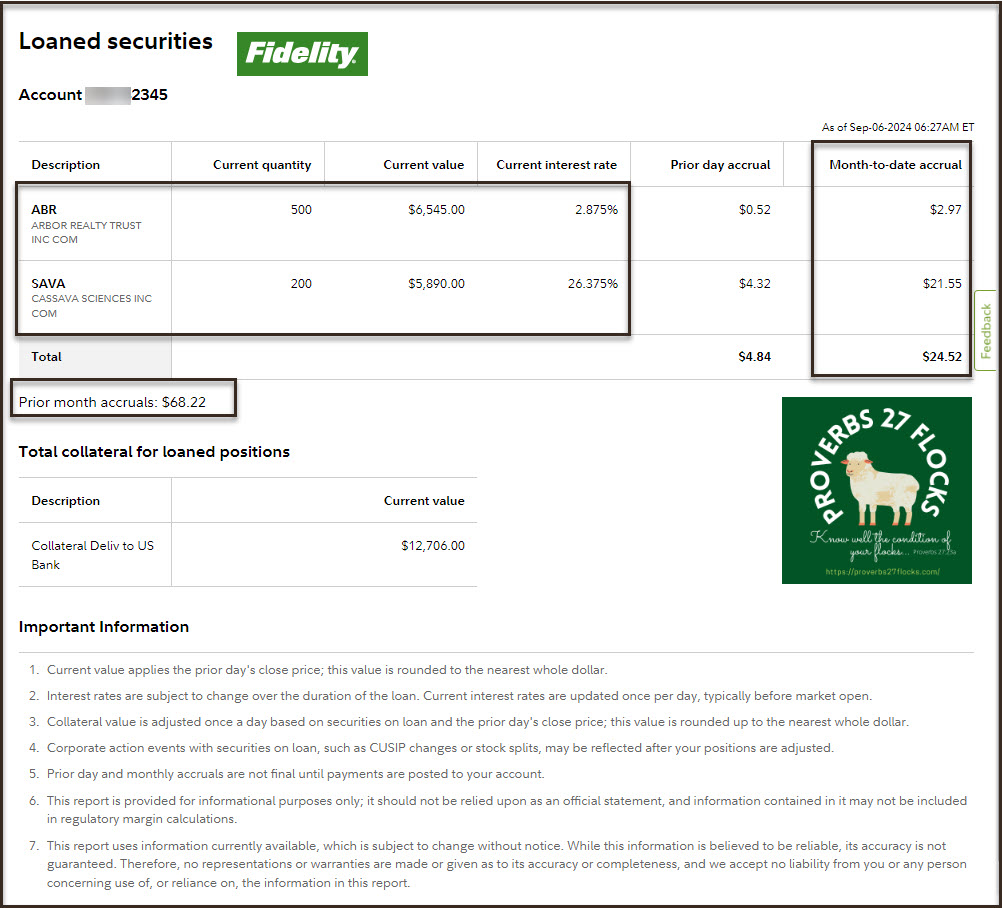

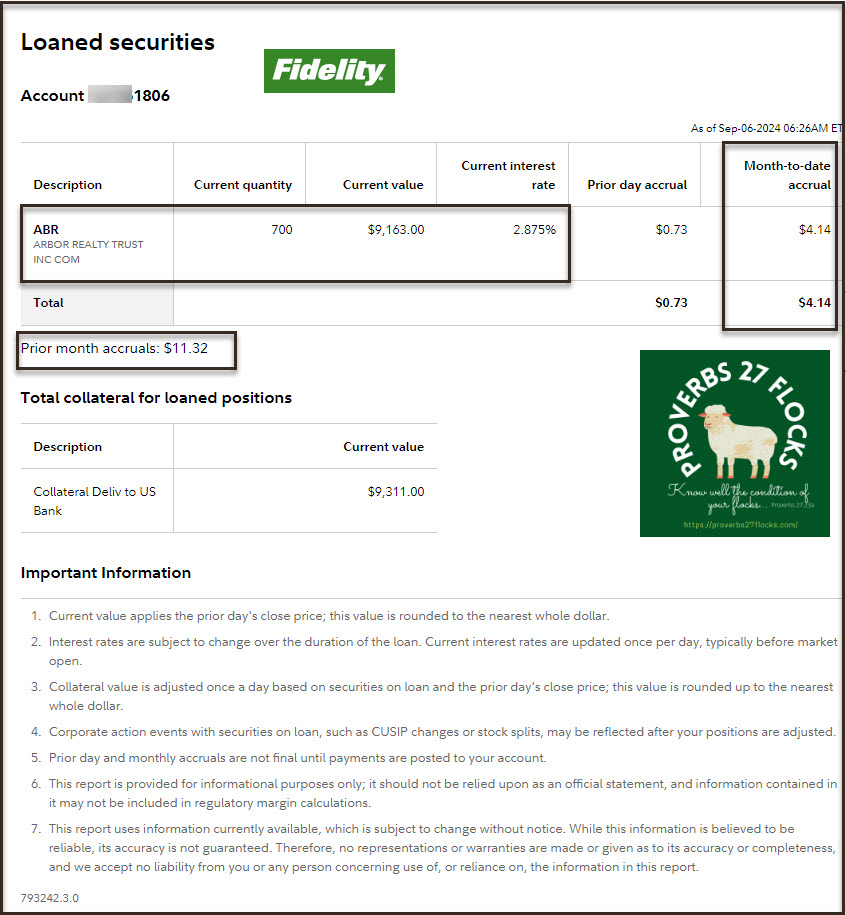

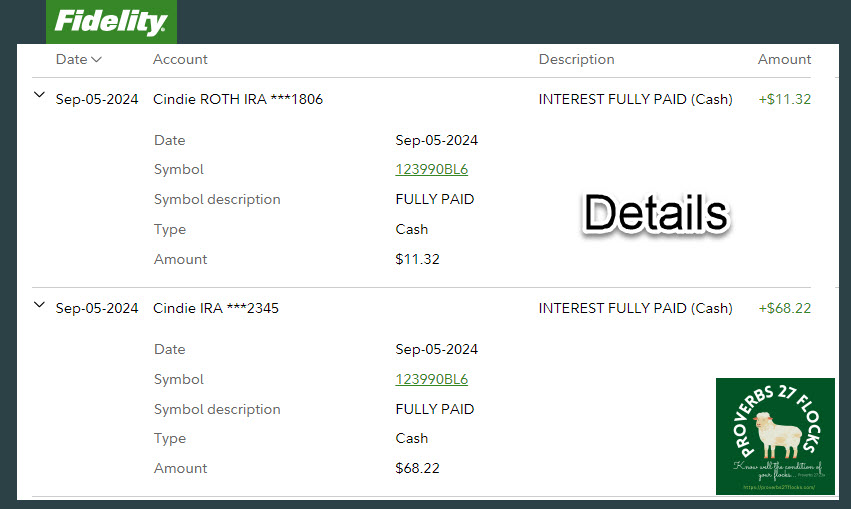

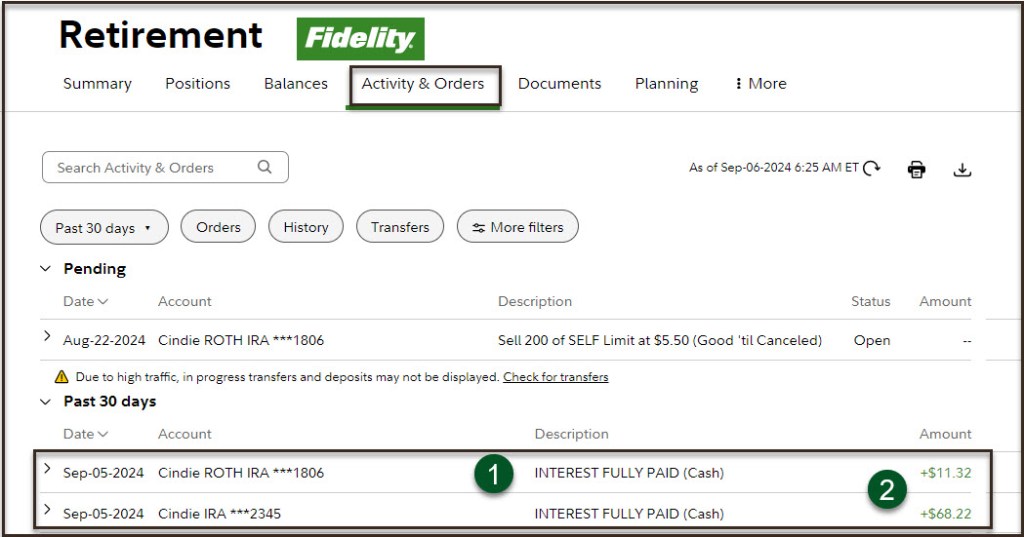

As promised, I want to provide an update about the income Cindie received for the loan of her SAVA and ABR shares on the Fidelity Investments website. This has been a successful addition to her income for August. She received $68.22 in her ROTH IRA and $11.32 in her traditional IRA. That is a total of $79.54 for the month. This is easy income.

Bear in mind that SAVA does not pay a dividend. Therefore, receiving interest on the shares while I wait for the final outcomes from SAVA’s Alzheimer’s drug development is an added plus. I can also trade covered call options on the SAVA shares.

As a reminder, participation in the FPLP does not hinder you from selling your shares or from trading a covered call option on your shares. I experimented with both, and the system seems to realize that you do have shares that can be traded, as Fidelity Investments promised.

Interest Rate Changes

The interest rate for both SAVA and ABR has been slowly falling. However, that matters little, as free income by doing nothing is free. I have yet to see a downside to the FPLP process.

My Next Steps

I am very tempted to turn on FPLP for my ROTH IRA and traditional IRA to see which stocks might qualify. I already know that SAVA is a likely candidate. However, it seems unlikely that MAIN would be, as it was listed in Cindie’s qualified stocks, but the shares were never loaned. I suspect it is because there are far more shares of MAIN available to the program than are needed for short sellers.

Next FPLP Post

Unless I see something of interest, I probably won’t say anything more about this program until I do a year end recap of investing income.

About SAVA and ABR

NOTE 1: Cassava Sciences, Inc., a clinical stage biotechnology company, develops drugs for neurodegenerative diseases. Its lead therapeutic product candidate is simufilam, a small molecule drug, which is completed Phase 2 clinical trial; and investigational diagnostic product candidate is SavaDx, a blood-based biomarker/diagnostic to detect Alzheimer’s disease. The company was formerly known as Pain Therapeutics, Inc. and changed its name to Cassava Sciences, Inc. in March 2019. Cassava Sciences, Inc. was incorporated in 1998 and is based in Austin, Texas.

NOTE 2: Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates through Structured Business and Agency Business segments. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities. In addition, the company offers bridge financing products to borrowers who seek short-term capital to be used in an acquisition of property; financing by making preferred equity investments in entities that directly or indirectly own real property; mezzanine financing in the form of loans that are subordinate to a conventional first mortgage loan and senior to the borrower’s equity in a transaction; junior participation financing in the form of a junior participating interest in the senior debt; and financing products to borrowers who are looking to acquire conventional, workforce, and affordable single-family housing. Further, it underwrites, originates, sells, and services multifamily mortgage loans through conduit/commercial mortgage-backed securities programs. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Arbor Realty Trust, Inc. was incorporated in 2003 and is headquartered in Uniondale, New York.