What About a TIP?

Neil Armstrong apparently said something about flying I find amusing. He said, “In flying, the probability of survival is inversely proportional to the angle of arrival.” He is suggesting that a decline of ninety degrees is a guarantee of death. The same is true, in a sense, with investing. Your greatest success is the result of not taking disproportionate risks.

When we go to eat at a restaurant, and when I have my hair cut, I like to leave a generous tip. Most of the time I just add it on the piece of paper used to record the credit card transaction. Sometimes, however, I will leave cash. In some rare cases I will hand the tip to the server and comment about the excellent and cheerful service.

While I cannot hand this tip to you about TIPS, I think I can offer some advice about TIPS as an investment. One of the easiest ways to know the quality of an investment is to understand what it looks like in aggregate. At the end of this post I provide that view.

The Reason for this Tip

One of my readers, Pete, asked this question: “Wayne, is there any place in your thinking and strategy for Treasury Inflation Protected Securities (TIPS)? For whom or in what circumstance, might they be a reasonable investment?”

In some follow-up emails, I asked some questions to understand more about his thinking. This was a helpful addition to his question: “Of course I like the idea of an investment guaranteed to keep pace with inflation. I Bonds do the same without any threat to the principal, so they may be a better way to go. The yields do vary as does inflation. Safety is the main attraction. These bonds provide a measure of ballast and security allowing me to take more risk with other money.”

My Initial Response After Some Research

Thanks for the explanation. I plan to write my post later today on this topic and share my thoughts. Your questions and feedback have been very helpful.

1) If the principal is not risked, it may still be a huge inflation risk depending on how “inflation” is measured. Anyone on Social Security should recognize that the government’s definition of inflation and the impact of real inflation on seniors is remarkably different. TIPS do a poor job of protecting against real inflation, in my opinion.

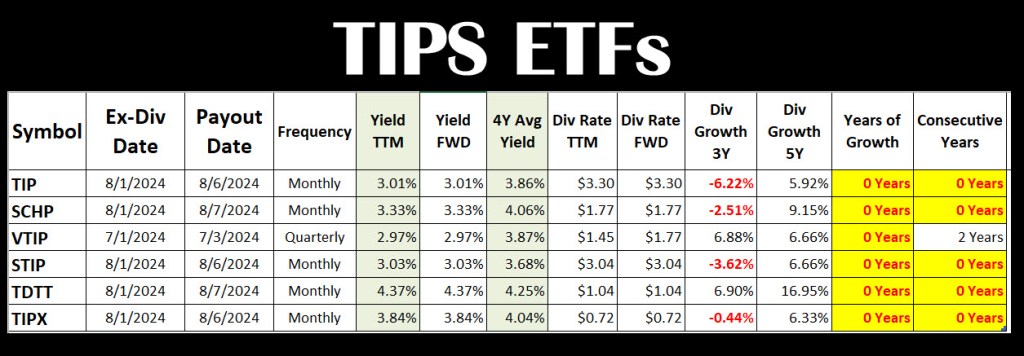

2) Do TIPS provide increasing income? That is very questionable. I’d rather have increasing income. Volatility can be “ignored” if the investments one buys are quality and diversified. TIPS appear to have an undesirable dividend pattern. An image from StockRover will help an investor see both the dividend pattern and the total returns. Again, I will share that image later.

3) What is real risk? Any protection provided by TIPS is based on (my opinion) a misunderstanding of the differences between risk and volatility. Far too many view the dips of the market as risk. It is only risk if there is no recovery. Historically there have been recoveries. If there was no recovery, then perhaps TIPS is the best way to go. But then perhaps an annuity would be better, and I really dislike annuities! 🙂

4) Finally, (and I hate to even say it!) I think an annuity with inflation protection might be a better choice. However, I dislike annuities as they are a high-cost solution to a problem that should be considered only after all other options have been exhausted.

There are Risks with TIPS

Investopedia provides some helpful insights about TIPS. First of all, “TIPS are issued with maturities of five, 10, and 30 years and are considered a low-risk investment because the U.S. government backs them. At maturity, TIPS return the adjusted principal or the original principal, whichever is greater.” In other words, if you put $1,000 in, you will either get the adjusted principal or $1,000. You won’t know what the adjusted principal is until five, ten or thirty years later. For people in retirement that sounds like quite a gamble to me. What is the S&P 500 thirty year return?

Investopedia continues: “TIPS are designed to protect investors from the adverse effects of rising prices over the life of the bond. The par value—principal—increases with inflation and decreases with deflation, as measured by the CPI. As mentioned earlier, when TIPS mature, bondholders are paid the inflation-adjusted principal or original principal, whichever is greater.” Don’t miss the “deflation” piece. That is a risk factor.

Thirdly, “Suppose an investor owns $1,000 in TIPS at the end of the year, with a coupon rate of 1%. If there is no inflation as measured by the CPI, then the investor will receive $10 in coupon payments for that year. If inflation rises by 2%, however, then the $1,000 principal will be adjusted upward by 2% to $1,020. The coupon rate will remain the same at 1%, but it will be multiplied by the adjusted principal amount of $1,020 to arrive at an interest payment of $10.20 for the year.” This sounds encouraging, but the increase in income of twenty cents is not because of an interest rate increase. It is only from inflation.

Finally, some bad news: “Conversely, if inflation were negative—known as deflation—with prices falling 5%, then the principal would be adjusted downward to $950. The resulting interest payment would be $9.50 over the year. However, at maturity, the investor would receive no less than the principal amount invested of $1,000 or an adjusted higher principal, if applicable.” Do you see the risk? It is real.

The CPI May Not Reflect Your True Inflation Rate

In another Investopedia article there is helpful information about the nature of the CPI and the purchasing patterns of seniors.

“There are reasons to believe inflation might be higher than official statistics suggest for older and even middle-aged Americans. These are also the groups more likely to buy TIPS. The CPI originally measured a fixed basket of goods. However, consumers often switch to cheaper new goods, making inflation numbers based on a fixed basket of goods too high. The Bureau of Labor Statistics (BLS) revised the CPI to include these substitutions.” They go on to say, ‘Many people tend to become more set in their ways as they grow older, which means they are less likely to switch to new goods. Some of this reluctance is simply logical, as they have less time to recoup investments in learning new ways to do things. It is precisely the retirees seeking to preserve income with TIPS who are least likely to make substitutions, so they end up with higher inflation.”

TIPS Prices Are Volatile

Again I quote from Investopedia: “Some have called TIPS the only risk-free investment because of their principal safety and inflation protection features. However, one of the major indicators of risk is price volatility, and TIPS often come up lacking in this department. The wild price swings seen in TIPS ETFs during the 2008 and 2020 stock market crashes show they are not nearly as stable as cash in the short run. What is more, TIPS with substantial accumulated inflation factored into their prices could lose a significant amount if a deflationary depression occurred.”

Investments in Aggregate

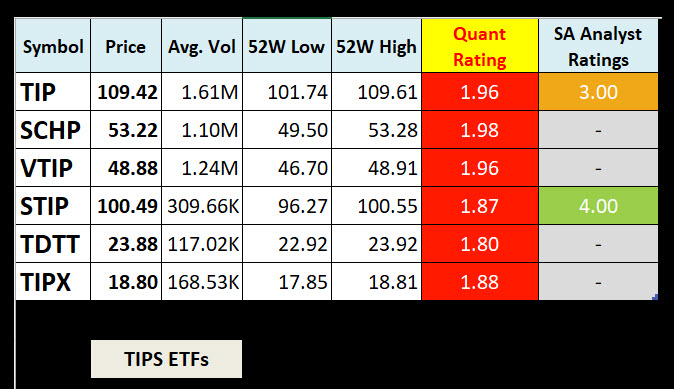

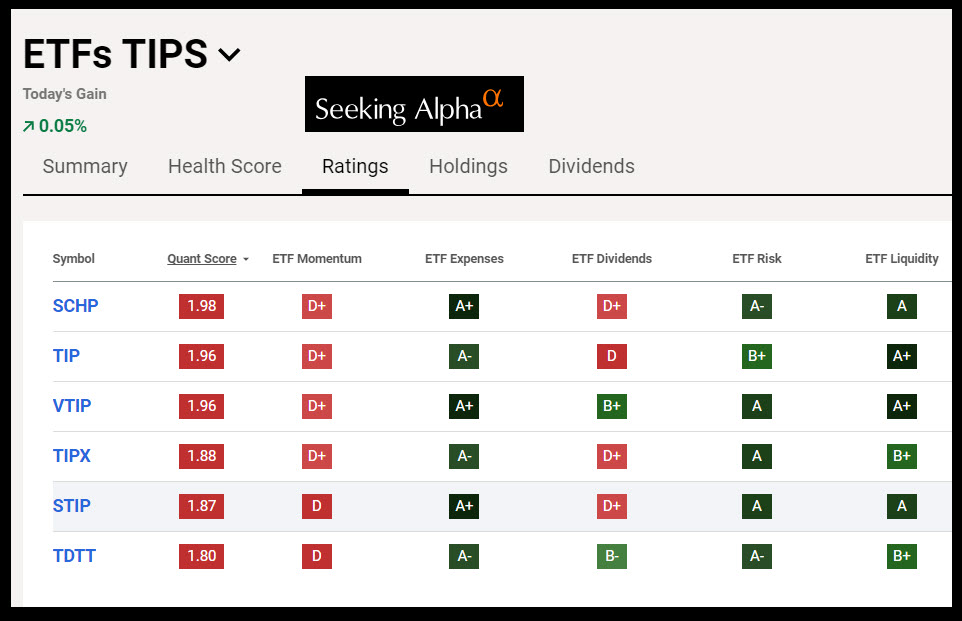

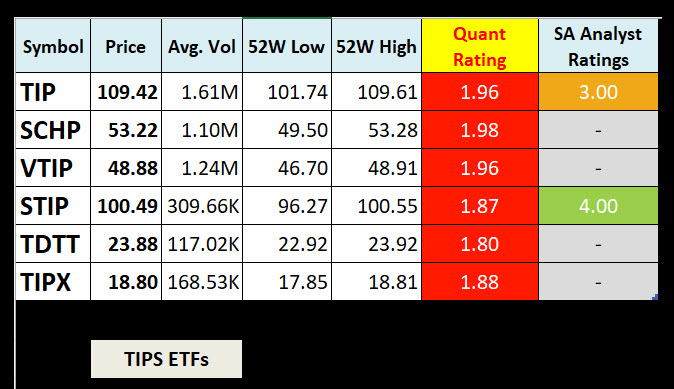

One way to understand a class of investments is to look at them in aggregate. For example, if I am interested in healthcare, technology, communication services, and utility companies, I look at mutual funds and ETFs to see how that asset class has performed over time. That would let me compare a 10-year TIPS with the ten-year history of an investment sector. Here is an image from StockRover about an ETF appropriately named TIP. TIP is the iShares TIPS Bond ETF.

As you can see, since 2007, the TIP return with reinvestment is 67%. That, dear reader, is simply awful. To put this in perspective, the return of FHLC (Fidelity’s healthcare ETF) has been 224% since 2013. Even a fund I don’t like (FUTY) which focuses on utilities, has gained 144% since 2013.

Weiss Ratings

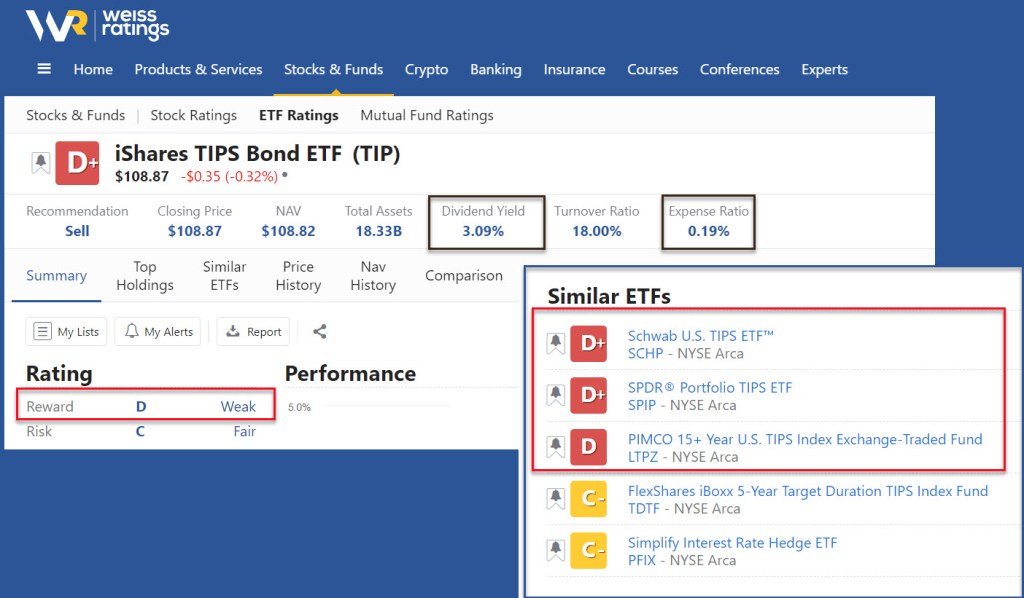

In addition to having a terrible yield on the investment, Weiss Ratings gives TIP a grade. You don’t have to think long and hard to see that I would not buy TIP.

Yield is Terrible

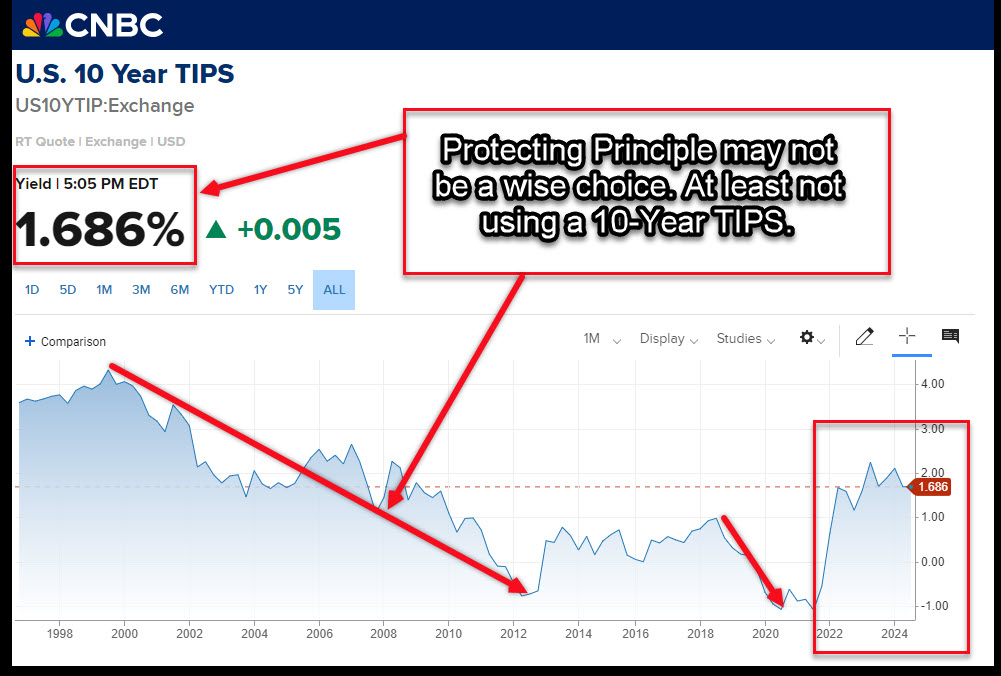

The yield on the U.S. 10-Year TIPS is awful. It is currently at 1.7%. While that is better than the S&P 500 (SPY) yield of 1.21%, the SPY ten-year return is 179%.

Why I Selected ETF TIP for the Illustration

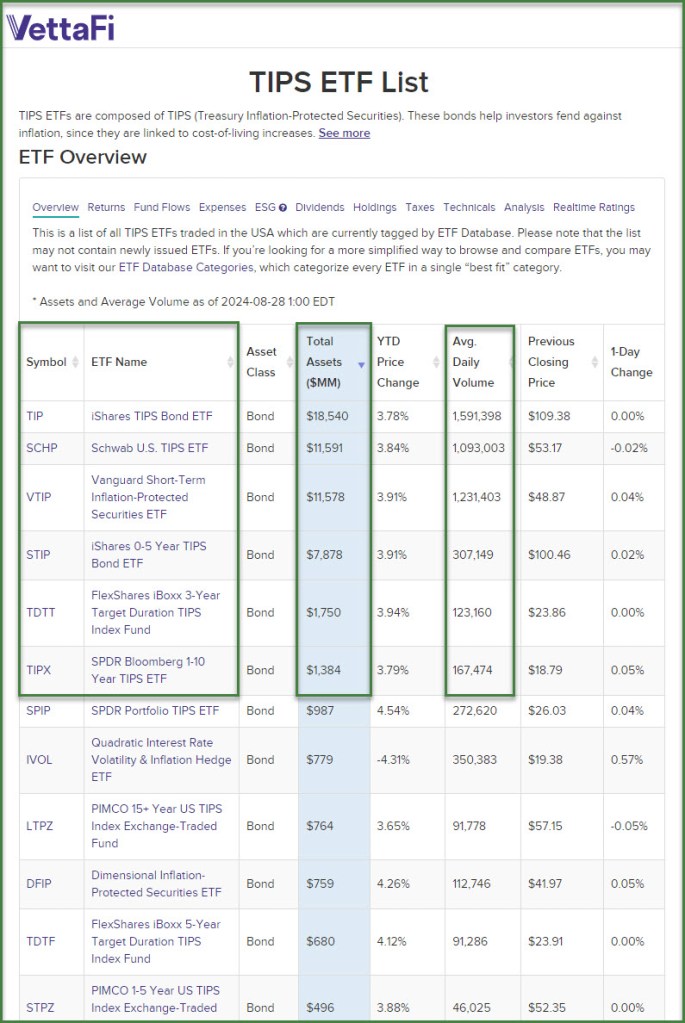

Because it is the leader in total assets. See this helpful website: ETFDB

Conclusion

TIPS join annuities, corporate bonds, physical gold, physical silver, collectible automobiles, and tulips as investments I would avoid. In fact, I think I would buy an annuity before I would invest in TIPS. However, if you know me, you know I won’t buy an annuity.

If You Still Want TIPS

Go to Treasury Direct, the government’s place to buy TIPS.

Thank you!

Pete

LikeLiked by 1 person

Just ran across this article.

https://humbledollar.com/2024/09/laying-down-a-floor/

LikeLiked by 1 person

Interesting article. However, I did not see anything compelling about TIPS that would alter my strategy. Thanks for sharing it.

LikeLike