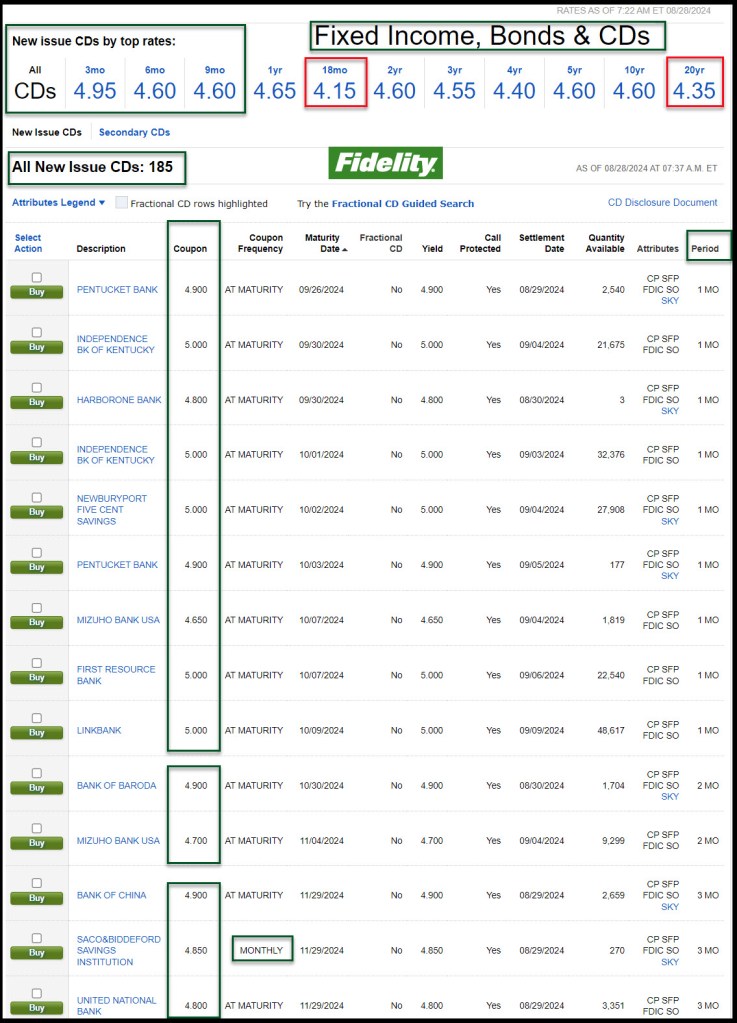

Expect CD Interest Rates to Drop

According to a headline from CNN, “‘The time has come’: The Fed just sent a crucial message about its next move.” The article goes into the details, but here is the thing that matters:

“Powell’s latest comments open the door wide open for the first interest rate cut since 2020, slated for the Fed’s upcoming policy meeting on September 17-18. Americans have already felt some relief thanks to tumbling bond yields, which move in anticipation of the Fed’s decisions on interest rates. Mortgage rates, which track the 10-year US Treasury yield, plummeted earlier this month.” – Source: CNN

Suggestion

If you have cash that is earning less than five percent (5%), it might be a good time to buy some 1-month, 2-month, and 3-month CDs. You might even want to go as long as one year at 4.65% interest. If you don’t act by mid-September, you may find the earnings you are getting on your CDs and money market funds declining. So, for example, I also expect the interest rate on money market funds like SPAXX and FDRXX to decline.

This shows the rates for CDs that are available from Fidelity Investments this morning. Why would anyone buy an 18-month CD? That is irrational.

The Alternative Is Dividend Growth

One of the reasons we currently have $125,000 in short-term CDs is that I want to have sufficient cash at all times for charitable giving, and for our 2025 RMD withdrawals. However, I doubt that I will be renewing any of them as rates fall. Rather, I will look at adding to our existing dividend growth investments.

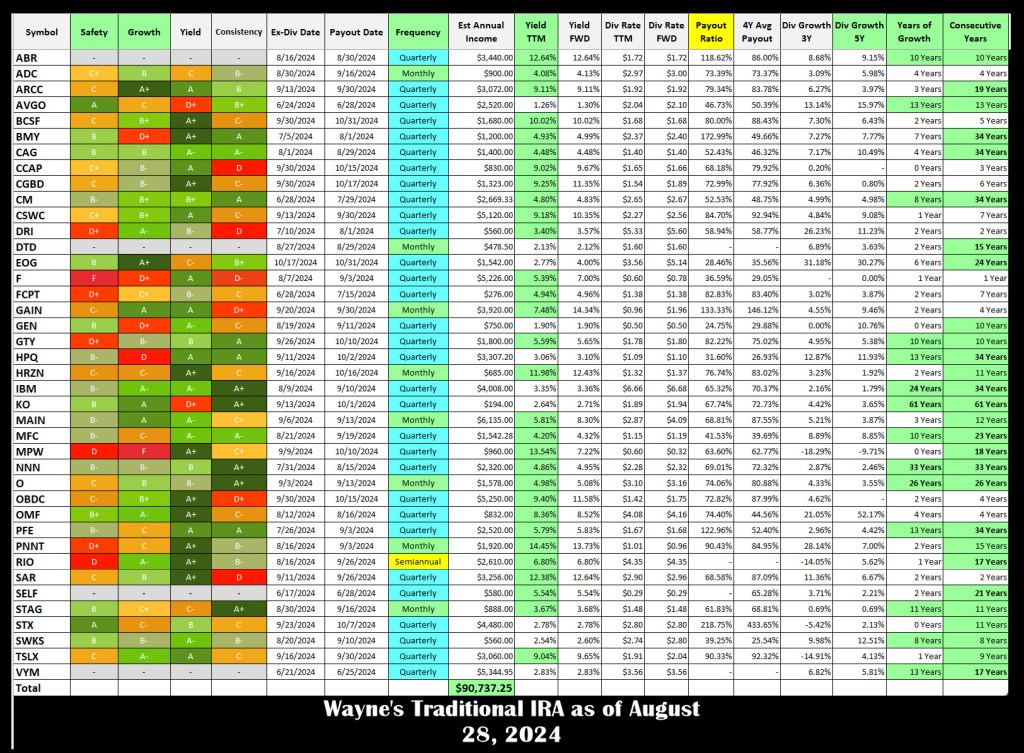

The following image is from Seeking Alpha. It is a summary of our dividend investments in my traditional IRA account. I removed all CDs, non-dividend stocks, and options positions from this table.

The columns of most interest to me are as follows: Frequency, Yield, Payout Ratio, the 5-year dividend growth rate, the years of dividend growth, and the consecutive years a dividend has been paid.

If you examine this table, you will see that I am far better off with dividend growth investments than I am with sticking with CDs for the long term. The cash from CDs will diminish in purchasing power if you hold them for longer than one year. In fact, in a high inflation environment, CDs fight a losing battle.

Wayne, is there any place in your thinking and strategy for Treasury Inflation Protected Securities (TIPS)? For whom or in what circumstance, might they be a reasonable investment?

LikeLiked by 1 person

Great question. I will respond to this question in a post in the next couple of days. I have another post that I hope to complete for tomorrow, so my view of TIPS will come after that. Thanks for asking.

LikeLike