The Example of My Parents

I don’t know when my father retired, and my mom never had a job outside of the huge task of taking care of a husband and four children. But I suspect that I retired before my dad did in terms of how old he was when he retired. I retired at age 62. I also don’t know how much my father and mother had in total when they entered “retirement” but I suspect it was more than we imagined based on their final estate and our mother’s desire to be generous to others.

“The Simple Numbers Behind a Lifetime of Financial Freedom.”

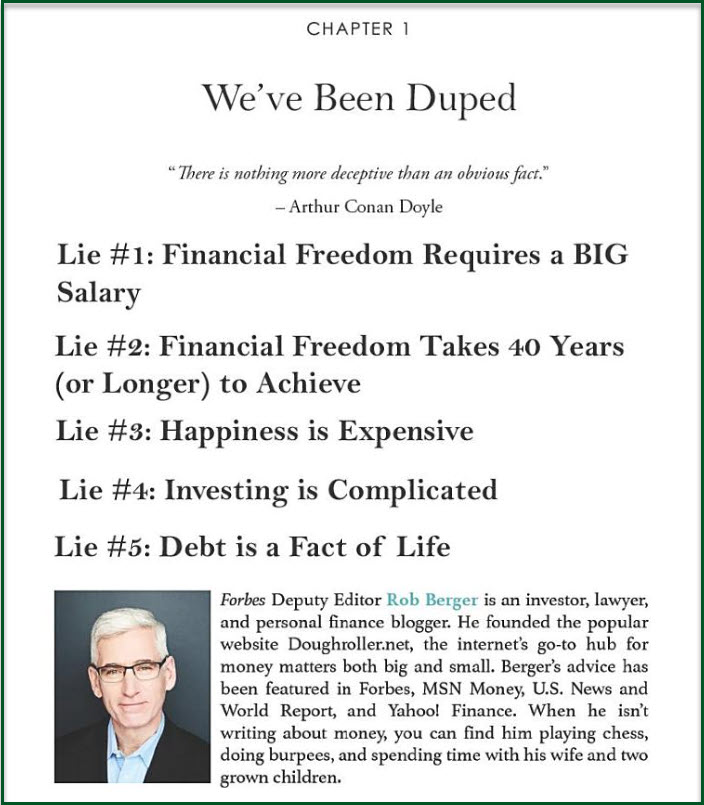

In the first chapter of Rob Berger’s book with the chapter title “We’ve Been Duped”, Rob lists five lies many people believe about investing. The first is that you have to have a large income to retire with a large nest egg. The second is that it takes a long time to build up a nest egg. The third is that life between day one on the job and the last day on the job is expensive because in order to be happy you have to have money to spend. The fourth is the lie that it is difficult to invest. The final lie is that debt is a fact of life. I agree with Mr. Berger about these insights and lies that are far too often accepted as true. I also agree with his observations and conclusions about all five points. I want to examine the first lie.

LIE: You have to have a large income to retire with a large nest egg.

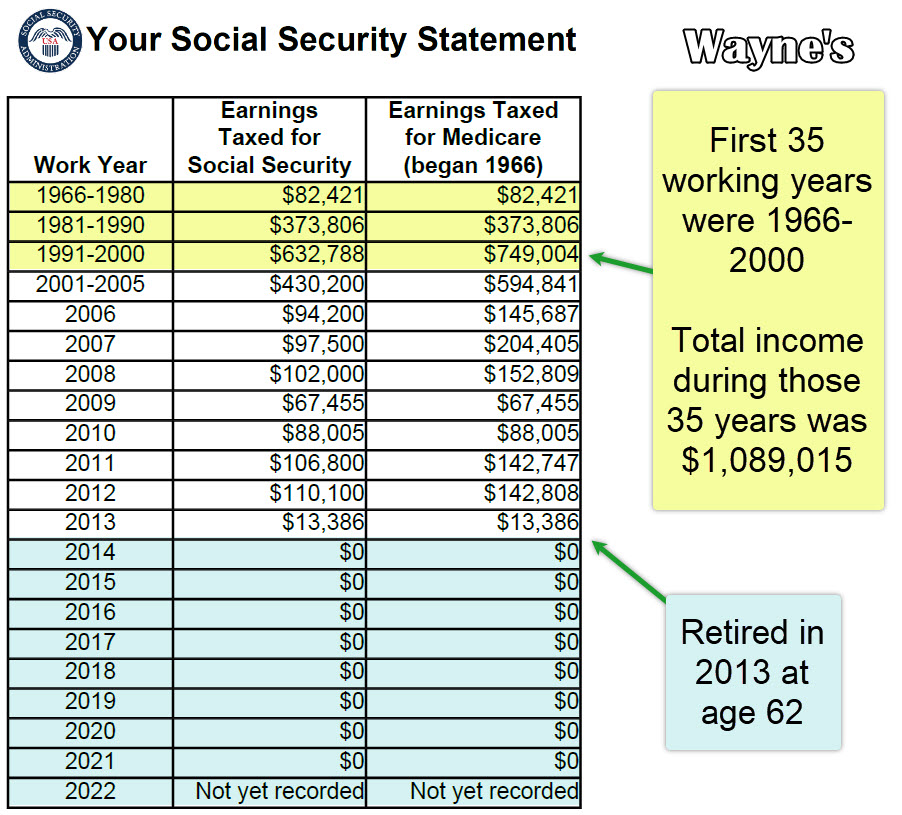

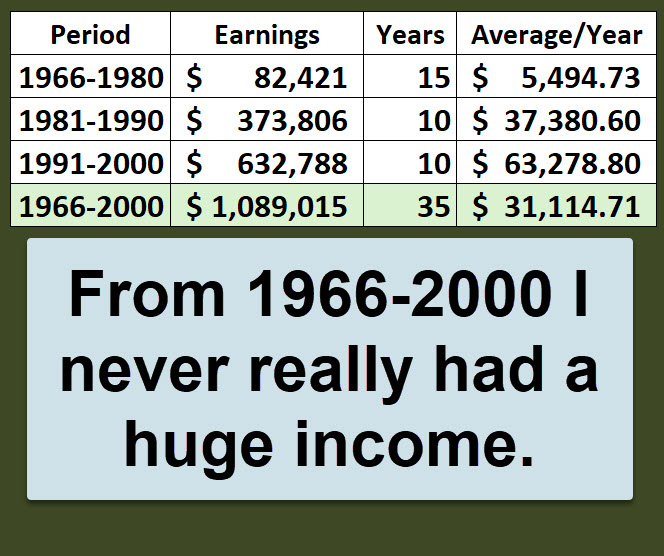

I know this is false from practical experience. For the first 35 years of my 47 years of working, I received income of just over one million dollars. However, remember that this was over 35 years. That means, on average, that I received an average of $31K per year. Rob Berger says it is more than possible to achieve $1M in a retirement account. This seems impossible.

He starts by saying: “Imagine somebody making $50,000 a year their entire adult life. Even if they saved 10 percent a year ($5,000), how could they ever become a millionaire? If they worked for 45 years, they would have saved $225,000. Sure, they may have invested their money and made some interest, but it couldn’t possibly take them from $225,000 to $1,000,000.” – from Retire Before Mom & Dad by Rob Berger

He goes on to say that by understanding compounding (and tools like the Rule of 72), you will exceed $1M if you save 10% of a $50K/year income.

The Berger Story is Our Story

During the first 35 years of my working life, I averaged less than $50K per year – $31K per year. But those early dollars grew in ways that most cannot imagine. If we only look at my traditional IRA, which is our largest account at Fidelity, the majority of the dollars are the result of the 401(k) I had at Universal Foods (UFC) until I left in mid-1999. That account is now over $2M in value, even though I have withdrawn a large amount of cash from that account and have also done large ROTH IRA rollovers from that account. The $2M resulted from systematic savings in the UFC 401(k).

Here is an image of my Social Security statement from 2022. Notice that it tells an interesting story about my annual income.

5 Hidden Costs of Fee-Only Advisors

There is an excellent video on YouTube by Rob Berger. In the video he exposes some financial/investment industry realities. It is worth watching. In summary, he talks about the following “hidden costs.”

- Advisor Fee – this can be a flat fee or a percentage of assets the advisor manages for you. If you pick the percent of assets approach, you will make your advisor very happy.

- Mutual Funds with high expenses.

- Should I pay off the mortgage, should I buy an annuity, should I start Social Security? Is there a conflict of interest because they are paid a percentage of total assets.

- Tend to overcomplicate the portfolio. 20+ funds or stocks.

- Offer financial planning. Do they give the time and attention to the planning?

I have seen number one (advisor fees), mutual funds with high expenses (number two) and overcomplicated portfolios (number 4) in most of the accounts I have reviewed for friends. These friends had an advisor they trusted, but they did not understand the fees and the amount they were spending to get only average results. I suspect that number three and five are also prevalent and costly hidden costs.

Fee-Only Fiduciaries

The frightening thing about most fees is that they are invisible to the investor. That doesn’t mean they are insignificant. It is not uncommon to see someone paying $5,000 per year for the help of a financial advisor. If you had to write a check to pay him or her $5K every year, would you start asking questions like, “What am I getting for this $5K?” That is one of the reasons most advisors don’t want you to know the total you are paying for their limited time and attention.

“Fee-only financial advisors are fiduciaries. They must make recommendations that are in your best interest. Yet those fee-only advisors who charge a percentage of the assets they manage for you are not conflict-free. In fact, the fee arrangement creates 5 hidden costs that you should be aware of before hiring an advisor.” – Rob Berger

This video is worth the time to watch and understand:

I’m interested in the author’s take on long time. I do believe it takes time, usually a long time, to build up a nest egg. I guess it depends on one’s definition of long. Decades. “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.” (Proverbs 13:11 ESV)

But now a question. I’m interested in replacing my Abbott Labs stock with another pharma company that pays a better dividend. I already own shares in ABBV, JNJ, and BMY. PFE, GSK, and GILD all seem to be facing some sort of legal issue. Or would it be better to simply hold my ABT.

LikeLiked by 1 person

I don’t dislike ABT, so I guess the question I would have is “do you need the yield or are you more interested in dividend growth?” The other thing I don’t know is how much you have allocated to each position you hold. I prefer fewer health care holdings with more focus. My largest holding in health care at this time is ABBV, but I do own a sizable long-term position in PFE. Lately all I have been buying is ABBV. If you have ABBV, JNJ, BMY, and ABT, and you don’t have one more heavily weighted than the others, perhaps you should just stay the course.

LikeLike