Added 500 Shares

I increased my holding of HP Inc from 3,000 shares to 3,500 shares on Monday. At the same time, my covered call options for AMD and QCOM were called. That is a part of my overall strategy. I buy more speculative investments like AMD and QCOM so that I can sell options on them for “synthetic dividends.” It is immediate income that does not require waiting for a real dividend. Of course, AMD does not pay any dividends, so receiving a synthetic dividend is desirable.

Seeking Alpha Rankings and Ratings

Understand that most would view AMD and QCOM as growth stocks. HPQ, on the other hand, is a large-cap value stock. I still have more mid-cap and small-cap investments than the average investor, but I like the relative stability of the large-cap dividend growth investments like IBM and HPQ.

Fidelity Equity Summary Score

Although I don’t often make a buying or selling decision based on EIS, I think it can be a helpful second opinion. In this case, the analysts are “Very Bullish.” That means they think HP has room to grow in price appreciation.

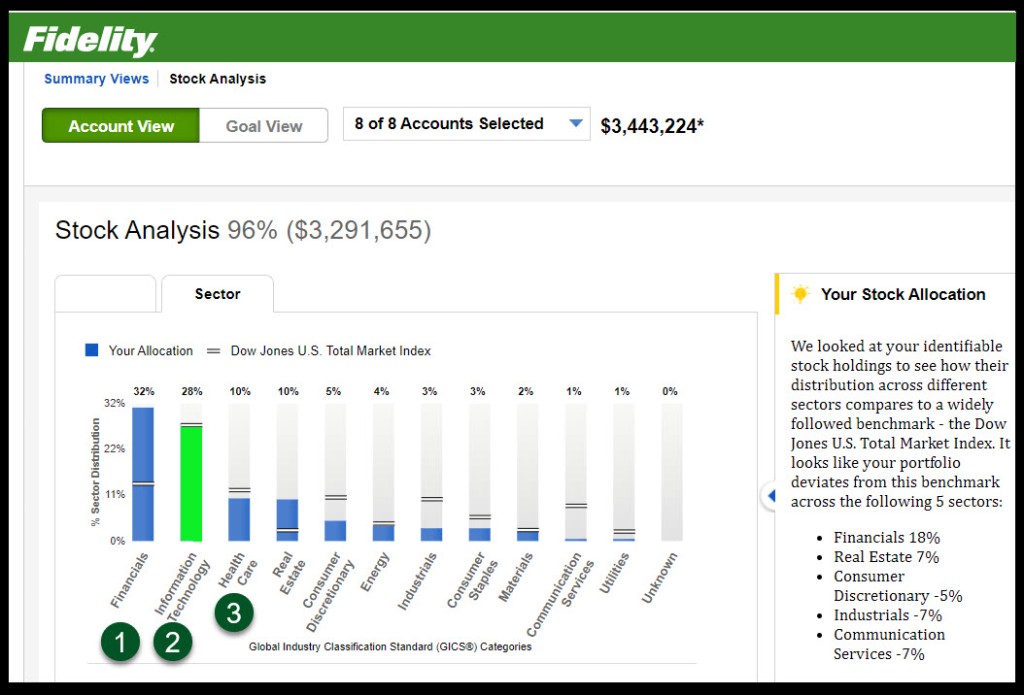

Technology in our Portfolio

Long time readers will know that I favor the financials (including BDCs), technology, and healthcare. I also hold more real estate than the overall market. I am not a big fan of utilities, communication services or industrials. That doesn’t mean I won’t buy investments in these sectors, and owning investments like VYM, DGRO, and SCHD does give me some exposure to just about every type of investment.

Company Profile

HP Inc. provides personal computing and other digital access devices, imaging and printing products, and related technologies, solutions, and services worldwide. The company operates through three segments: Personal Systems, Printing, and Corporate Investments. The Personal Systems segment offers commercial and consumer desktops and notebooks, workstations, commercial mobility devices, thin clients, retail point-of-sale systems, displays, software, support, and services, as well as hybrid systems, such as video conferencing solutions, cameras, headsets, voice, and related software products. The Printing segment provides consumer and commercial printer hardware, supplies, solutions, and services, as well as focuses on graphics and 3D printing and personalization solutions in the commercial and industrial markets. The Corporate Investments segment is involved in the business incubation and investment projects. It serves individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors. The company was formerly known as Hewlett-Packard Company and changed its name to HP Inc. in October 2015. HP Inc. was founded in 1939 and is headquartered in Palo Alto, California.

Suggestion

As always, I hesitate to tell you to buy HPQ just because I did. However, if you like to have an allocation to technology companies with dividend growth and a rational dividend payout ratio, then HPQ is worthy of consideration.

Full Disclosure

Cindie and I own 3,600 shares of HPQ as a long-term investment. Those shares are currently valued at about $114.5K. The next earnings date is May 29, 2024. The ex-dividend date is June 12, 2024. I may buy more shares before then.