More Dividend Announcements

Shortly after my last post two more dividend announcements arrived in my email. It felt like time to do a high-level review of our investments, including the top ten: VYM, AVGO, MAIN, STX, ABBV, ARCC, F, SPAXX, CSWC and IBM. If you look at the top ten at the end of this post you will see an ETF leads the pack, but technology, healthcare, consumer and BDCs (MAIN, ARCC, and CSWC) are also in the mix.

CSWC has had some positive news recently. Over the last twelve months CSWC is up 54%, and it is up about 15% YTD.

Top BDCs (Business Development Companies)

The top five BDCs across all of our accounts are MAIN, ARCC, CSWC, OBDC, and GAIN. MAIN is certainly my favorite. It pays a monthly dividend, which is a plus in retirement. Our total BDC investment value is just over $800K. If you compare this with our REIT investments, it is clear that I prefer BDCs over REITs.

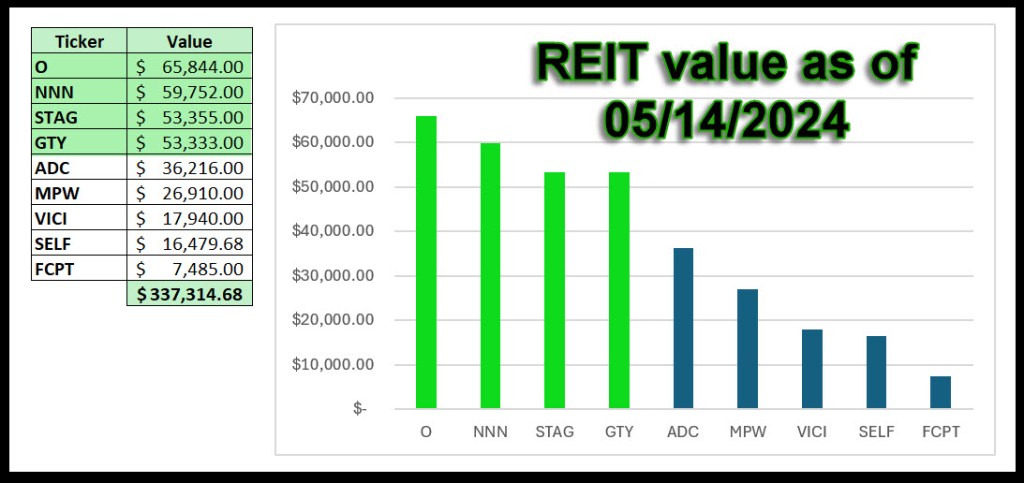

Top REITs (Real Estate Investment Trusts)

My top five REITs are O, NNN, STAG, GTY, and ADC. I have held O (Realty Income) for as long as I can remember. It also pays a monthly dividend. Our total investment in REITs is currently about $337k.

Two More Dividends

CSWC provided another nice surprise, as noted above. ADC also declared the normal monthly dividend. Since the beginning of May, therefore, announced dividends for our holdings have reached $15,833. It is a bit difficult to put this in perspective, as some of the dividends are paid quarterly and some are monthly. However, our total anticipated dividends for 2024 are about $157K.

The previous table is included along with “Table 2” with the updates from CSWC and ADC.

Easy Income Strategy Reminder

The goal of easy income is to have consistent and often increasing income that requires little or no effort. When I buy any position, whether it is a stock or an ETF, I want to see gradually increasing dividends. Sometimes good news comes in groups, but that is, admittedly, rare. It really depends on the makeup of your investment portfolio. The best thing about a long-term investment perspective is that it requires very little time, effort, or maintenance. I don’t have to day-trade, sell covered call options, or even think about the ups-and-downs of a volatile stock market. Here are our current top ten investments:

Recommendation

If you have less than $200K, I suggest that you focus on dividend growth ETFs like VYM, DGRO, and SCHD. However, adding some BDC and REIT exposure is a good strategy, even if you have less than $100K in your retirement portfolio. You can then add shares as you deposit more funds to your accounts. However, be careful about adding REITs to taxable accounts. It is better to own REITs in traditional or ROTH IRA accounts.

You have ABR in you BDC portfolio. I thought it was a mREIT and that’s where I have it positioned in my portfolio. Am I wrong? I know it’s on the “Dividend Contenders” list.

Fahshah from Fidelity Community Boards

LikeLiked by 1 person

I used Fidelity’s Active Trader Pro download and then to parse out the investments. Based on that, it is considered a “Financial” investment and “Financial Services.” That makes it somewhat like a BDC, but it also has REIT characteristics. It could go either way in my opinion. I saw it in the BDC list and decided not to move it.

LikeLike

OK, thank you for your reasoning. However, I’ll keep it with my mREIT allocation as that where I feel it belongs.

Fahshah

LikeLike