Special Can Be Delightful

Sometimes “special” is not a good thing (from a purely human perspective). For example, a child with special needs means that they usually have physical impairments or various disabilities. Special needs children face more intense challenges than their peers. That doesn’t mean they are less valuable, but certainly the challenges the parents and the child face are often daunting.

There are times, however, when “special” when connected to the word “dividends” is a delightful combination. “A special dividend is a non-recurring distribution of company assets, usually in the form of cash, to shareholders.” – Investopedia

It is also true that “Most companies don’t make more than one special dividend in their history.” – Investopedia. TSLX, Sixth Street Specialty Lending, Inc., has been an exception.

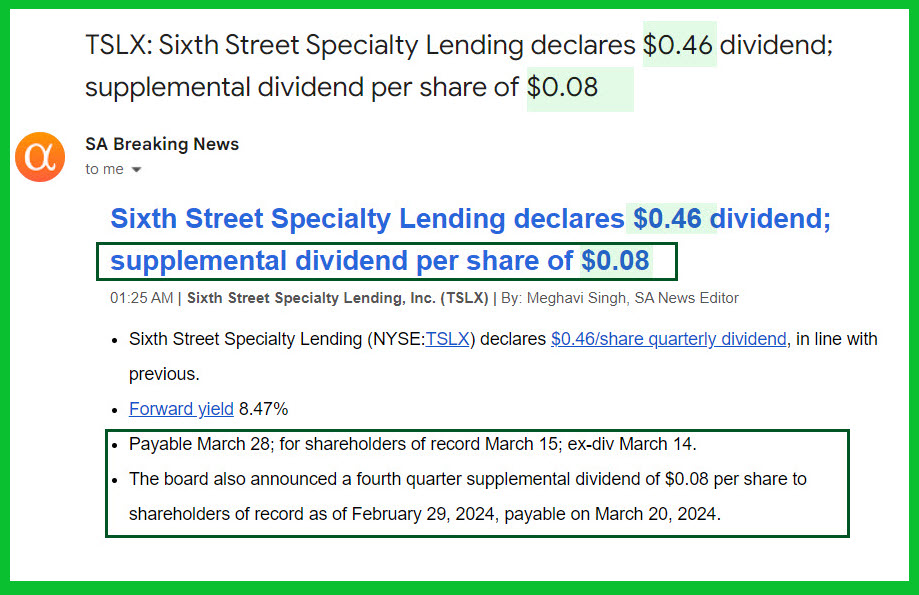

A New Special Dividend for TSLX

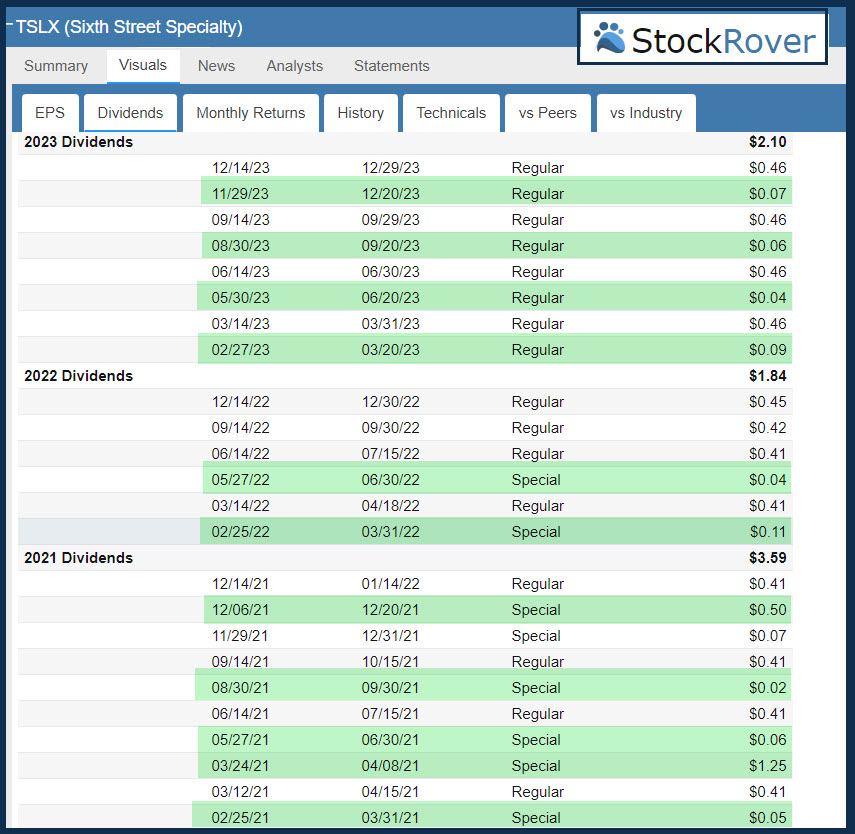

In addition to the normal quarterly dividend of $0.46 per share, TSLX is paying a special dividend of $0.08 per share. This is a unique situation, as TSLX has had more than its share of special dividends in the last three years. As you can see in the following table, there have been eleven special dividends in the last three years. (Seeking Alpha has some of the flagged as “Regular” dividends in error.)

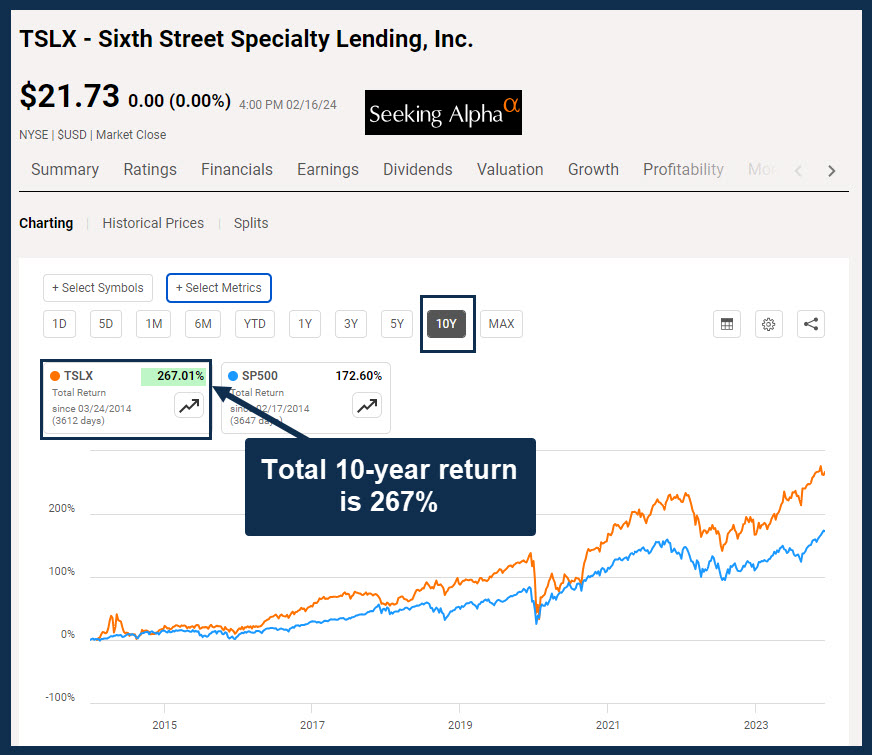

Total Returns Are Excellent

It is a mistake to look at the price returns for TSLX. If you do that, you will conclude that TSLX is a poor long-term investment. However, if you include total returns in the analysis, you will see that the ten-year returns are 267%, which is far better than the S&P 500’s ten-year returns of 173%.

Revenue and EPS

It isn’t usually prudent to buy an investment with declining revenue or earnings per share. TSLX is not in decline. Year-over-year EPS are increasing on a comparable quarter basis. It looks like there might be a slight decrease in EPS for 2025, but that is not a big worry from my perspective.

Stock Rover Graph

The Stock Rover dividend graph might cause some investors concern. 2021 was a very good year for dividends, and then it would appear that dividends were considerably less in 2022 and 2023. However, it is only because of the special dividend payments. It is better to focus on the quarterly payments. If you look at the previous table above, you will see that the regular dividend was $0.41 in 2021, even more in 2022, and then $0.46 in 2023. Even without the special dividend there is dividend growth.

Portfolio Diversification

When you purchase shares of a BDC (Business Development Company), you are not just investing in the success of the BDC. Underlying the BDC are loans to other private and publicly-traded companies. The following shows a few of the companies in the TSLX investment mix from their investor web page.

Company Profile

Sixth Street Specialty Lending, Inc. (NYSE: TSLX) is a business development company. The fund provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity with a focus on co-investments for organic growth, acquisitions, market or product expansion, restructuring initiatives, recapitalizations, and refinancing. The fund invests in business services, software & technology, healthcare, energy, consumer & retail, manufacturing, industrials, royalty related businesses, education, and specialty finance. It seeks to finance and lending to middle market companies principally located in the United States. The fund invests in companies with enterprise value between $50 million and $1 billion or more and EBITDA between $10 million and $250 million. The transaction size is between $15 million and $350 million. The fund invests across the spectrum of the capital structure and can arrange syndicated transactions of up to $500 million and hold sizeable positions within its credits.

Recommendation

TSLX is not the only BDC in our portfolio. TSLX is classified in the “Financial” sector and they are in the “Financial Services” industry group. Other Financial Services investments we hold include ABR, ARCC, BCSF, CGBD, CSWC, GAIN, HRZN, MAIN, OBDC, OMF, PNNT, and SAR. MAIN is our largest BDC holding. Therefore, if you want to enter the world of BDCs for your investments, think diversification. Don’t buy just one. If your portfolio is at least $250,000, then it might be a good income strategy in retirement to own shares of two or three different BDCs.

Full Disclosure

Cindie and I own 2,200 shares of TSLX as a long-term investment.

Thank you again for this. I own ARCC, MAIN, OWL, OBDC. And I agree about diversifying into more than one.

LikeLiked by 1 person