Examining the Six UTMA Accounts

Although I do prefer dividend growth investing, the age of the investor does often help determine the best course of action for the types of investments one might choose. Our six grandchildren are young, ranging from elementary school, high school, and even one in college. I first started buying investments for our grandchildren in June 2015, so it is time to review my success and failures.

You might benefit from understanding my choices for our grandchildren. Even if you are significantly older, there are some takeaways that apply, I believe, to most investors regardless of their age.

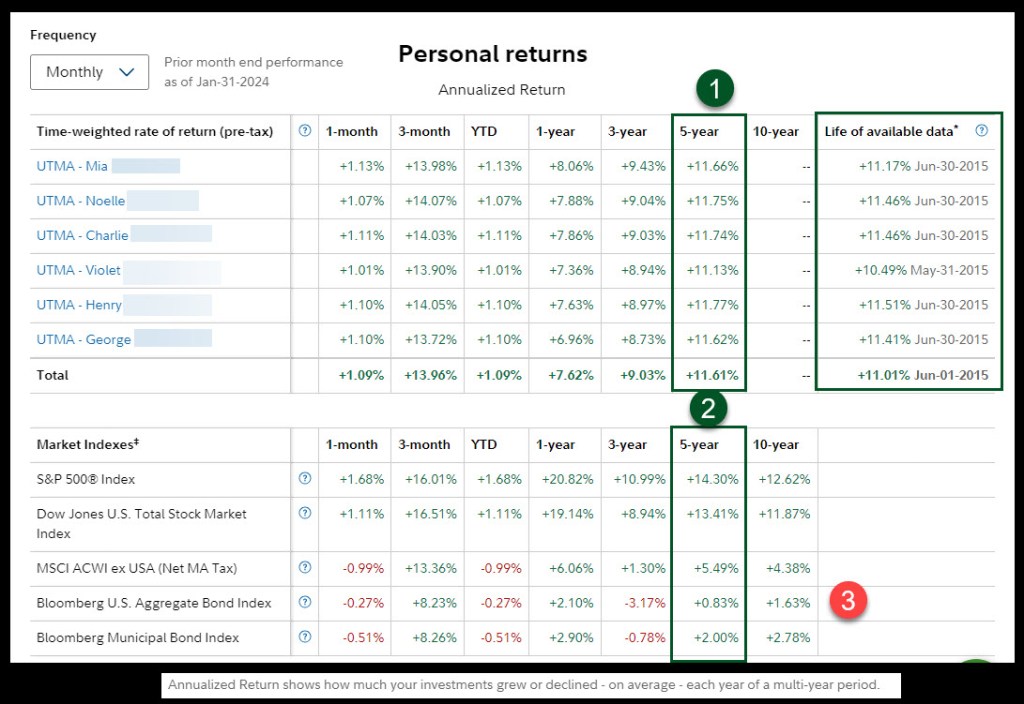

UTMA Returns

The good news is that I did not totally fail. The five-year returns average 11.6%. At that rate the accounts would double every six years, even if I added no additional dollars. The S&P 500 clearly beat those returns at 14.3%. However, I believe there is a day of judgment coming for that index, as far too many investments are focused on a very small number of very big companies.

Sector Investing in the UTMA Accounts

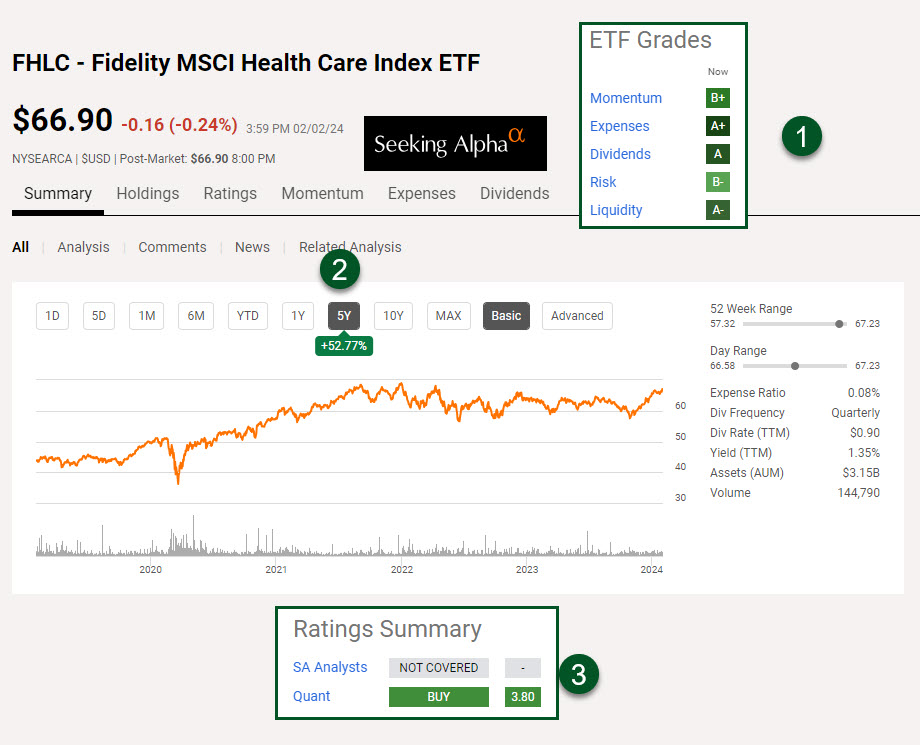

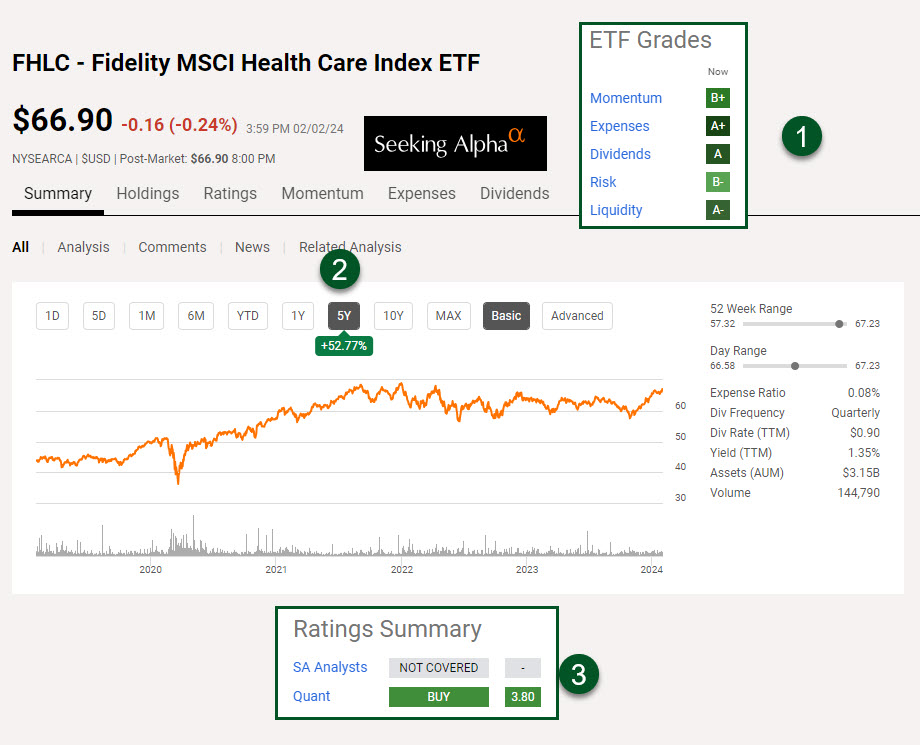

The current snapshot does not include every sector investment I bought, and then sold, in the UTMA accounts. Rather, it shows the two remaining sector investments. They are FTEC (Fidelity MSCI Information Technology Index ETF) and FHLC (Fidelity MSCI Health Care Index ETF). Both have unique characteristics I find encouraging for a long-term investor. Because FTEC did so well in the past, I sold some shares and invested more in DGRO for better diversification.

Here are two views of FTEC. Notice that there is a heavy concentration in just a couple of positions. This is a higher risk, but it makes sense for the long-term investor who is young. Microsoft and Apple aren’t likely to fail. However, even though FTEC holds 302 technology investments, the reality is that FTEC’s returns will be most impacted by the top ten investments which make up 62% of the total. Don’t miss that reality. It can make an investor very nervous during a recession or bear market.

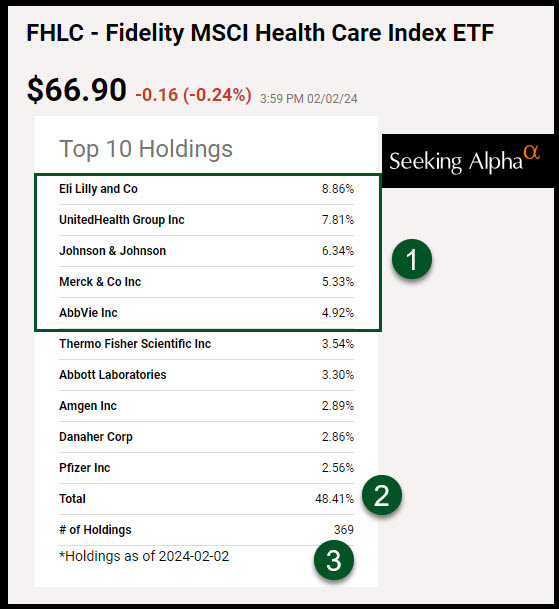

Here are two views of FHLC. It has 369 holdings, but 48.4% of the assets are in the top ten, including Eli Lilly, UnitedHealth Group, Johnson & Johnson, Merck & Co, and Abbvie. If the health care industry falls out of favor, this sector ETF might also experience some pain.

Where is Most of the Money?

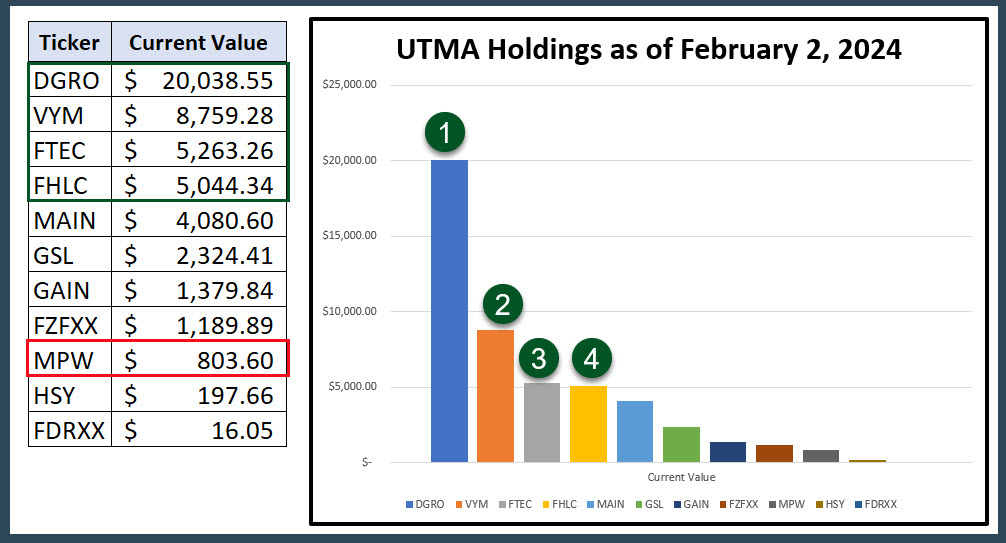

In the following graph it is obvious that DGRO is the largest investment. The $20K is spread across the six accounts. This is not a per-account view, but a summary of all six accounts. Notice that there are no bonds or bond ETFs and that I try to keep cash to a minimum. The largest portion of the account dollars are invested in four ETFs: DGRO, VYM, FTEC, and FHLC.

The HSY (Hershey) shares are only in one grandson’s UTMA account. He did a school report on Hershey, and I asked him if he would like to own a tiny part of the company. He did, so I purchased one share for his account.

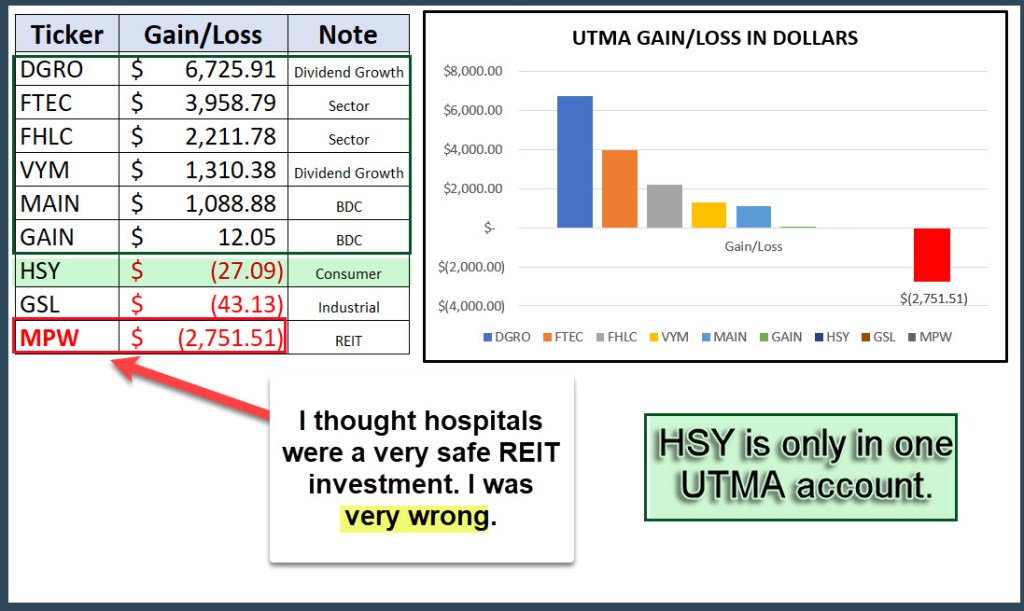

Here are two graphs. The first shows the total value of each holding. What it doesn’t show is the relative success of each holding. DGRO is up about 53%, FHLC is up 78%, and FTEC is up an astonishing 304%. This holding illustrates the potential boost you can see if you focus on the right sectors. VYM is only up around 16%, but it is a newer holding in the UTMA accounts.

MAIN, a BDC, is up around 35% and it pays a nice monthly dividend. Sadly, Medical Properties Trust, a REIT, is down 77%. Thankfully I did not put a lot of dollars into this hospital REIT, but the loss is painful.

Some Takeaways To Apply

I’m convinced that sticking to ETFs that offer dividend growth, low cost, and good diversification is the best long-term strategy. However, I think the information technology and healthcare sectors merit some consideration. I also think most investors who think they might live another ten years should avoid bonds and bond mutual funds or ETFs.

The other thing to learn is that even a good investment can sour. Medical Properties Trust is a good example. At this point I am content to wait to see if that REIT can recover some of its real value.

What is a UTMA Account?

“What Is the Uniform Transfers to Minors Act (UTMA)? – The term Uniform Transfers to Minors Act (UTMA) refers to a law that allows a minor to receive gifts without the aid of a guardian or trustee. Gifts can include money, patents, royalties, real estate, and fine art. “– INVESTOPEDIA

This is great idea and give of wisdom to your grandchildren. We plan to do the same in the near future. We usually give kids money for savings at birthdays. But this would have a more meaningful purpose.

Thanks,

LikeLiked by 1 person