A Review

One of my post popular posts, sadly, is “Use Your Cash to Buy CDs Your Way.” Now I’m glad that many are reading it, but it makes me a bit sad to see that is the focus of so many. There is certainly a place for CDs in a total investment portfolio, but it should be for emergency savings and short-term needs, not as a main strategy.

If you don’t have a long-term strategy, then you are probably settling for returns that are far less than you deserve. You should also be thinking about growing income, and CDs are rarely a good way to do that, when you factor inflation into your thinking. That is why I am a dividend growth investor.

What CDs I Purchase

The banks in our area do not have acceptable CD rates. Therefore, I buy CDs in all of our accounts at Fidelity Investments. I don’t want any CD that is longer than 12 months, and most of the CDs I have purchased are for one, two or three months. Our total investment in CDs is $13,000, so you can see I don’t use them as a main way to gain income. However, it makes more sense to buy some short-term CDs for cash that will be needed in the next twelve months but that won’t earn as much using money market funds like SPAXX or FDRXX.

It is generally unwise, I believe, to purchase longer duration CDs given the reality that the Federal Reserve has been raising rates. Some might object saying, “But they will lower rates someday, and I want to have some CDs with higher yields when that happens.” I would argue you are thinking with a short-term mindset, not a long-term income growth perspective.

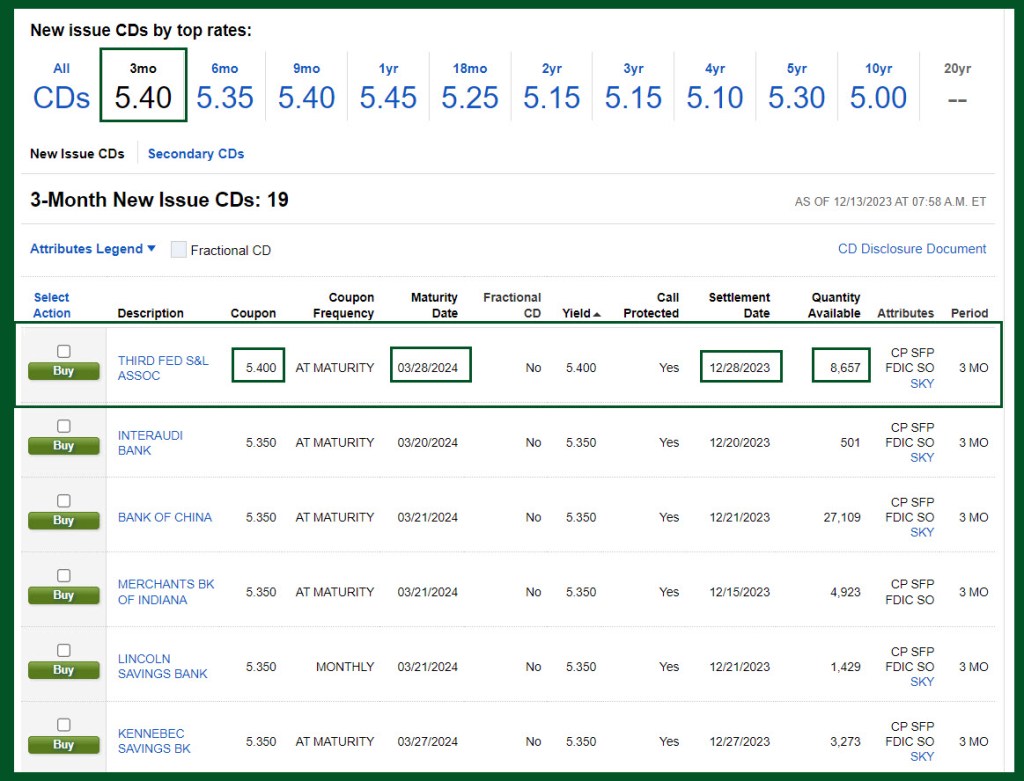

Current CDs on Fidelity Investments

The next two images show some highlights from Fidelity’s CD choices. I generally dislike CD Ladders, as the normal choices include CDs that have a one-year duration. It is far better to buy your own CDs and create your own “ladder” of CDs that expire gradually over time.

I also suggest that you do not automatically renew your CDs. If it is indeed a short-term parking lot for your cash, then autorenewal is behaving like it is a long-term strategy.

Cindie’s CDs

One final word of caution for the nervous readers. If you buy a CD for $1,000 and then you see it drop to $999.54 (as in the following real-life example), don’t be alarmed. That has no bearing on the value of your CD at maturity. That is only the amount someone else is willing to pay you to buy your CD. If you hold the CD to maturing, you get your $1,000 back and the interest.

Suggestion for Those Who Focus on CDs

When you read my blog and look at all of the different types of posts, you probably find it overwhelming If you want to focus, scroll down, and look on the right side of the page for Categories called “Dividend Growth” and “Easy Income Strategy.” I also have some categories called “Top Five Investments” and “Top Ten Investments.” Those are for those with a long-term strategy.