Only Four Pages Capture My Attention

Some people read zero pages of their investment statement. Many get their statement in the mail and don’t even open the envelope. They put it in a file, toss it on a stack of other “someday maybe” mail, or put it in a drawer of similar daunting financial documents. It doesn’t have to be that way and shouldn’t be that way.

If you are nearing retirement (like maybe in ten years or less) or if you are retired, there are four pages from our eighty-page November 2023 Fidelity Investments statement for you to consider. Each page can help you think through what you should do before year end and what you might want to consider doing in the next twelve months. In fact, if you already have a Fidelity account, then you probably have similar pages to review.

Why You Should Do This and What to Know

Every month I glance through my Fidelity Investments Statement. Our statement is 80 pages long and contains information about our seven investment accounts and one checking/cash account. Two of the accounts are traditional IRAs, two are ROTH IRAs, and the other four are taxable brokerage or money accounts. Reading 80 pages every month is not a good use of my time. But there is a good reason to read some of it.

There are two things you should look for in your monthly statements. You should look for motivations for you to stay invested. Then you should look for things that might be problem areas to address. This can be done in less than 10 minutes. Of course, you could spend more than 10 minutes, but I don’t see a need to do so.

Reasons to Stay Invested

There is no reason to invest if you don’t have a plan to spend or give away the results of your investing activities. If you are interested in income and if you want to see what your income is and potentially will be, the Fidelity Investments statement will help you understand this aspect of your investing life. This has value for both the retired individual and for someone who is trying to think about what their retirement income might look like down the road.

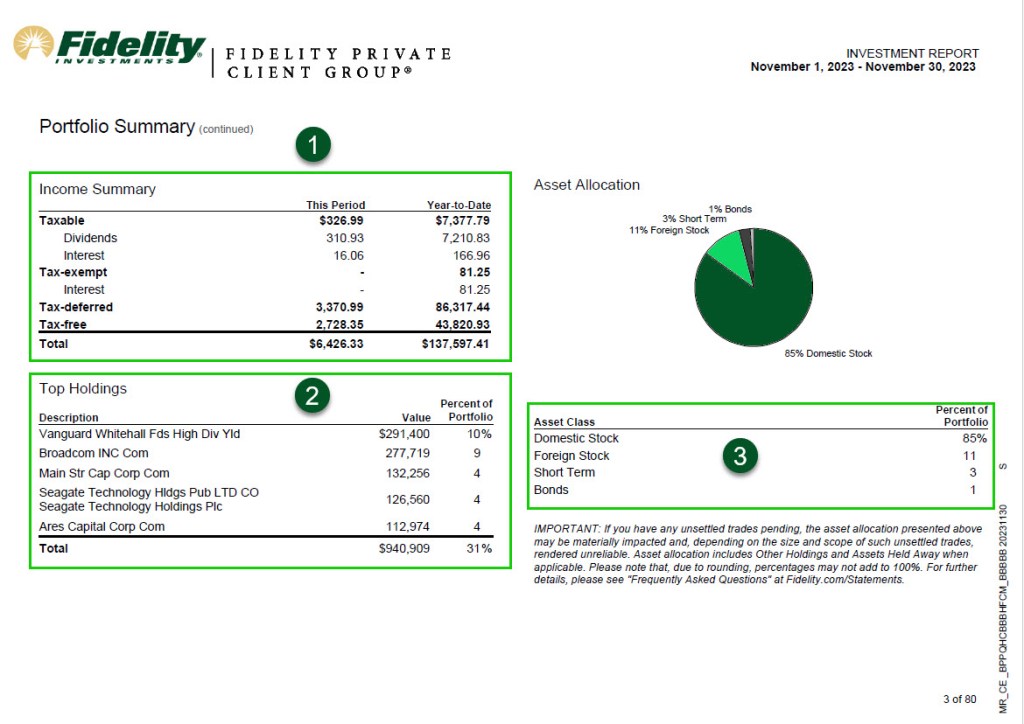

The First Page is Income, Top Holdings, & Asset Allocation

Page three of the 80 pages tells me how we have been doing with income from our investments (1). So this tells me we have already received $43,820.93 in tax-free income in our ROTH IRAs. This is spendable income if we withdraw it. This is, quite frankly, the best kind of income. But (1) also shows “Tax-deferred income.” This income is over $86K YTD, and if we withdraw it we will pay taxes on it.

The second section on this page is “Top Holdings” (2). Because I already talked about the risks in having 9% of our assets in AVGO (Broadcom Inc) stock, I won’t say anything other than this: if you see this on your own statement, and if the position is a single stock, you might want to do something to reduce your allocation to that investment.

The third section is “Asset Allocation.” It is obvious that I am a stock investor and that I do not have too many dollars in cash (Short term) or in Bonds. My goal is to make our investment dollars work for us.

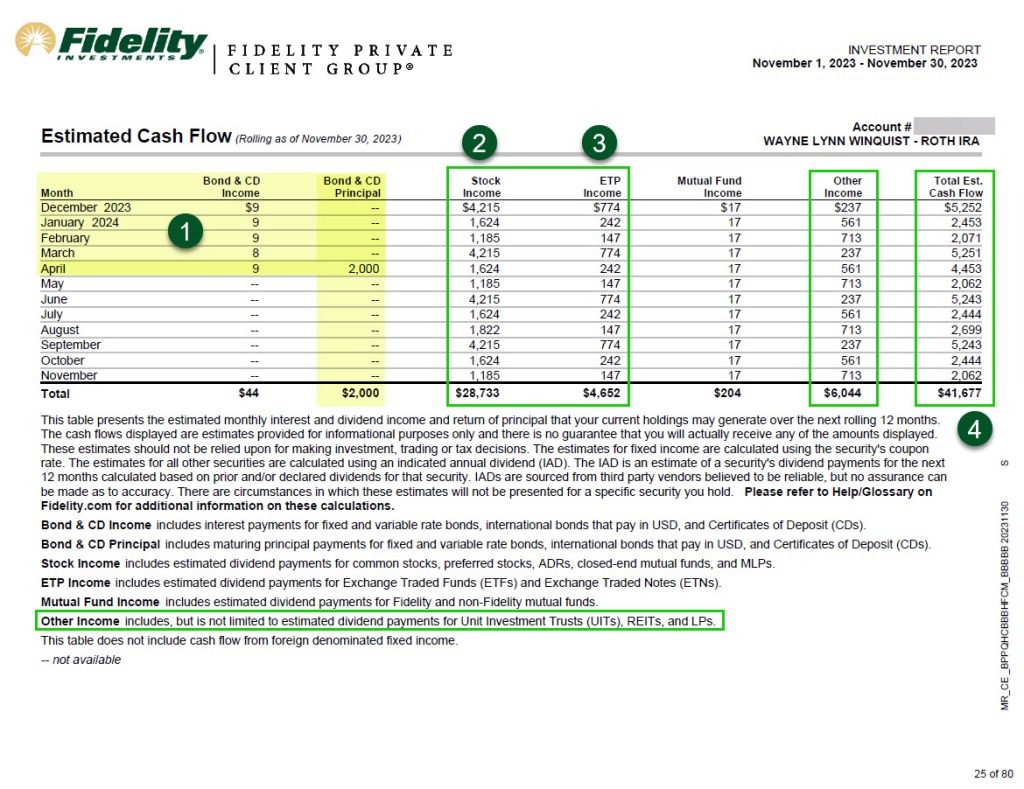

Page Two is My ROTH IRA Estimated Cash Flow

I have one CD in this account, (1) and it will give me about $9 per month in interest. Then, in April of 2024 the $2,000 principal will be returned to my cash account. Stock and ETP dividends make up the majority of our income (2-3) and the total income is expected to be $41,677 (4) during the next twelve months. In other words, the average monthly income is almost $3,500 per month that is tax-free. This makes for great potential for giving or sharing with others.

Page Three is my Traditional IRA Estimated Cash Flow

Obviously, because this is our largest account, and I have a dividend growth strategy, the bulk of the income comes from stock and ETP dividends. Most of this is from ETF funds like VYM. The total income will easily approach $80K over the next twelve months with the growing dividends (3).

This is important to know, as in 2024 I have to start taking RMDs. Required Minimum Distributions are taxable income for both federal and state income taxes. The good news is that the $80K more than covers the RMD, so I don’t have to sell any investments to meet the IRS obligations. Furthermore, because I am over 70.5 years old, I can give Qualified Charitable Distributions that meet the IRS obligation. As a result, I can give more because a QCD counts towards the RMD and it is not taxable.

So it is important to think about cash flow in retirement. Does the income from your investment mix meet the RMD need you might someday face when you are in your seventies? Plan for this wisely.

Furthermore, let me encourage you to do ROTH conversions of as much of your traditional IRA as possible. This will cause a tax obligation, but it will also create more income in your ROTH that will be forever tax-free.

Page Four is Our Fidelity Checking Account

I like being reminded that it was wise to move our checking/savings account to Fidelity Investments. In 2022 we got less than one dollar in interest from Wisconsin Bank and Trust. By keeping essentially the same balance at Fidelity, we have received $388.85 in interest and dividends thus far in 2023. Now that isn’t a lot of money, but $388.85 is much better than one dollar. This page makes me smile.

Don’t Ignore Your Statements

I don’t know where you are in your journey, but your statement should cause you to think long-term and it should help you plan for the day when you may not be able to work. What you do each month with your investment statement might inform the decisions you make before December 31 and what you do in 2024.

Something is Missing from the Fidelity Statement

One thing you won’t see in your Fidelity Statement is the drain on your investments from the ETF or mutual fund expense ratios. However, if you have been careful in your selection of these investments, you should not need to see the total cost of owning the ETF or mutual fund shares. For example, VYM has an expense ration of 0.06%. If the value of our VYM shares is $291,000, then our expenses for this ETF are $175 per year. This is insignificant compared to the estimated dividends of $9,145.50 per year. (Cindie and I own 2,730 shares of VYM at this time.)

i need help

I think a non relative used fidelity or used fidelity documents they found online to steal the life insurance my mother had named me as the beneficiary of. I am an only child. My moms so called best friends daughter lied to the state of California dept of vital statistics by saying that she was my money NIECE and she is not related by blood at all she is just my moms friends daughter and it seems to me that the only motive for lying about her relationship to my mom would be for one purpose, to steal money. I believe she used undue influence to gain power of attorney for her health care, and proceeded to force her to sell her home , put her in assisted living which she didn’t need, because I could have helped her but this happened during Covid and they were saying she couldn’t have visitors, she ended up in hospice? Hospice for a person who wants to live ? Then died within 6 months under suspicious circumstances, on thanksgiving day , and it was this person who reported my moms death and then claimed to be her niece, and then stalled me and the rest of my family from getting any information, until January of 2023 then told us about the life insurance which seemed different because she said it was fidelity and I received something in the mail but it looked suspicious like whoever sent it just copied and pasted stuff from Fidelity’s oine website and then perhaps uses a number spoofing app to make me believe it was legit. I’m pretty sure it was a 150,000 dollar life insurance policy thru her employer and her employer treated long term employees very well and wouldn’t have a cheap low policy of 25,000. I think she maybe said I was dead or unlocatable so that she could take the all of the policy for herself and then fake like she was the insurance company and give me and my daughter some ridiculous low amount to keep us from actually investigating so when I called to actually claim it after letting one year pass, because I have heard that if you’re a beneficiary you don’t have a time limit to claim on the policy .so I didn’t want to collect it until.i really needed it and then when I called to process my claim they said that I wasn’t eligible and that sounds extremely suspect to me, like I have probably been swindled and if it was a legit call I think it would have gone very differently. So what I need is some way to authenticate the phone numbers for fidelity or just an opinion if this sounds as suspect as I think it sounds. I am here only child and I am her only /heir/beneficiary. Please respond if you can

LikeLike