If No Rebalancing, then What Did I Do?

In my previous post on this topic called “Balance is a Good Thing – Sometimes” I suggested that I felt the idea of rebalancing investments is not the best or first priority. The most important paragraph in that post was the following paragraph.

You should not just rebalance to rebalance. Rather, you should look at your investments from an investor’s point of view. Always ask the question, “Why did I buy this investment?” Then ask the question, “Does the original reason still stand?” If you don’t remember the reason(s) you bought an investment, then you don’t have a strategy or appropriate tactics.

If the answer to the second question is “yes” then you should not, I believe, sell the investment or investments only to buy something else. But there was another question I believe I answered.

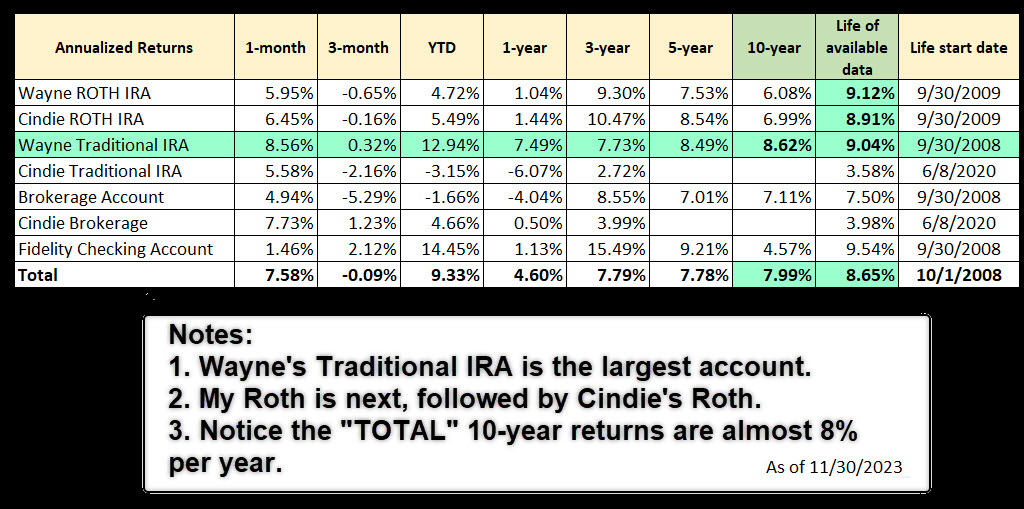

That critical question was: “Does Rebalancing Work?” The right answer is “Almost never.” I don’t rebalance. Even so, since 2008, considering that several years were terrible for investments, our largest account (my traditional IRA) has grown at a 9% rate. The next two largest are our ROTH accounts, which have had returns of 9.12% and 8.91%. This was accomplished using a dividend growth strategy and zero rebalancing.

So What Shall You Do?

Do you sometimes feel dizzy when you look at what is happening in the stock market? In this post I suggest what I believe are five far wiser and more helpful or beneficial investment practices that will allow you to maintain your balance. Don’t follow the crowd. Don’t rebalance just for the sake of rebalancing.

Top Five Practices to Remember – Number One

The first practice is to step back and do an objective assessment of your total portfolio. In this assessment you should consider estimated annual income (EAI) in the form of dividends and interest. Dividends should be the first priority. Interest on a CD or a bond rarely, if ever increases. Dividends, for many stocks and ETFs, can and do increase.

Therefore, if I bought quality dividend growth investments, the main thing I need to do is verify that EAI dividend growth is continuing. Perhaps I should sell one of the investments and buy more of another, but this is not really rebalancing. This is optimization of dividend growth.

Practice Number Two: Watch out for a Big Egg

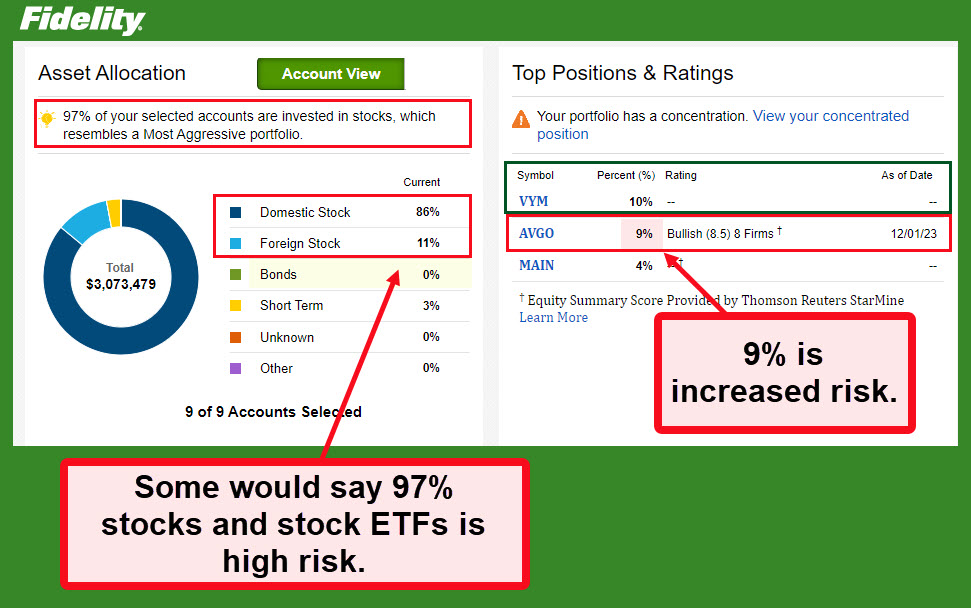

Look for individual investments (not ETFs or mutual funds, but stocks) that are now more than 5% of your total invested capital. At the present time one of my largest holdings in AVGO stock, which currently represents 9% of our total investments. VYM is 10% but that ETF has over 400 different companies within the ETF.

Now, Fidelity correctly warns, “Having too many of your eggs in one basket can increase the risk to your portfolio. In our opinion, a ‘concentrated position’ is any stock or fixed income issuer that makes up 5% or more of your portfolio. Sometimes concentrations like this can be unavoidable, like when an employer requires you to invest a certain portion of plan contributions in company stock. Other times, you may be concentrating positions intentionally. In either case, be mindful of the risk you’re assuming.”

AVGO currently pays me a dividend of $18.40 per share annually. I see no need to rush to sell shares. In fact, I have been selling covered call options on AVGO and it is very likely that I will lose 100 of my shares at the end of 2025. In the meantime I collect the dividends. If the share price drops, I can roll the covered call, perhaps a year from now.

Practice Number Three: Manage Expectations

There are times when an investment does not meet expectations. When that happens, it is best to sell the investment and put the dollars to work elsewhere. One common mistake, that even I make, is to hope that an investment will recover in time. Sometimes the wait is worth it. For example, my shares of AMD, F, and STX have struggled. Some would have sold and moved on. However, STX (STX is Seagate Technology Holdings plc) are up almost 53% YTD. All the while I collect STX dividends.

AMD (Advanced Micro Devices, Inc.) is up almost 90% YTD. I’m almost ready to restart trading options on AMD. Although AMD does not pay a dividend, the doom-sayers have been replaced by a different crowd: The buying crowd.

F (Ford) is down about 5% YTD. However, I have a long-term perspective for Ford, and they pay a dividend. We have been driving Ford Escapes since 2010, and I am very pleased with the quality of these vehicles.

However, there have been some non-dividend stocks I did sell. The reason is simple: I decided they weren’t going to recover. It was better to take the loss and reinvest the dollars elsewhere.

Practice Number Four: Reinvest

Reinvest the dividends that flow into your account. The hands-off method is probably best for those who don’t want to think about buying more investments with their dividends. If you own ETFs like VYM, DGRO, and SCHD, automatic dividend reinvestment probably makes sense. However, taking the AVGO stock mentioned above, I don’t want to invest in more shares of AVGO. I would prefer to have the dividends to either spend or reinvest elsewhere.

Practice Number Five: Add Cash

The last one requires another type of discipline. If you have cash arriving from work, or an inheritance, or from the sale of something you owned, I believe you should treat it like money you won in the lottery. In other words, you can rebalance by using new cash to buy investments that allow you to gradually change your mix of investments.

So What Shall You Do?

Here is the bottom line: Buy quality investments. Diversify wisely but don’t overthink it. Then just watch the crazy market and smile. Buy more shares when they cost less. Then, for the rest of you, ignore the market and get on with life.

Really good advice Wayne. My wife and I have taken all our little work related accounts that were “balanced”…they are now Invested

LikeLiked by 1 person

Thank you for all your information, great read. Quick question. You say you will probably have 200 shares of AVGO called away in what I assume was a covered call. In your previous posts regarding options, I believe you had recommended not setting the date too far out into the future. But on this contract it seems its two years away? Just a little confused as to why you entered this contract.

LikeLiked by 1 person

You are correct. Most of the time my approach is to avoid covered call options contracts that extend too far into the future. There are two AVGO calls that are currently set at December 19, 2025 for $760 and at February 16, 2024 for $1,000. When I did the first one, I had an ealier expiration date and an option contract price of $595. As the price crept up, I kept doing covered call rolls at higher contract prices and longer expirations until I got to $760. So I could have had my shares called away at $595, but decided it was worth the extra $6,500 I received by rolling the contract out and getting even more for my shares. In the meantime, I still collect the dividends.

For the $1,000 contract, the original contract price was $910. By rolling that one and then subsequent covered call contracts, I got the price for my shares up to $1,000 and received $3,785 for the effort.

In general, therefore, I don’t like longer contract horizons unless I can increase my potential profit from rolling the call forward at increasing contract prices.

LikeLiked by 1 person