A Valid Question from a Reader

My first blog post in the “ROTH Conversion Strategy” series left a lot of unanswered questions. One faithful reader said, “I read your blog via email about Roth conversion, Higher tax bracket & IRMAA with great interest. I am still struggling to understand what the conclusion is.”

Indeed, there is still much to be said about this topic. Let me add something that might help explain why I think paying more tax now could make a difference for the long term.

I tend to think that Craig Wear is right when he says the “Biggest Roth Conversion Mistake” is to convert to the top of your current marginal tax bracket. He also suggests that the perfect candidates for a ROTH conversion are: 1) Those under age 59 with large non-IRA savings, or 2) those who are between the ages of 59-74, and/or 3) those who are 74+ and want legacy benefits. He goes on to say that those with at least $1M in pre-tax balances (non-ROTH IRA or 401(k) accounts) are likely to benefit the most from a long-term tax-avoidance strategy. I fall into groups number two and four and we have more than $1M in my traditional IRA account. I am still less than 74 years old, and I do want to minimize income taxes for my heirs.

The ABBV Reminder

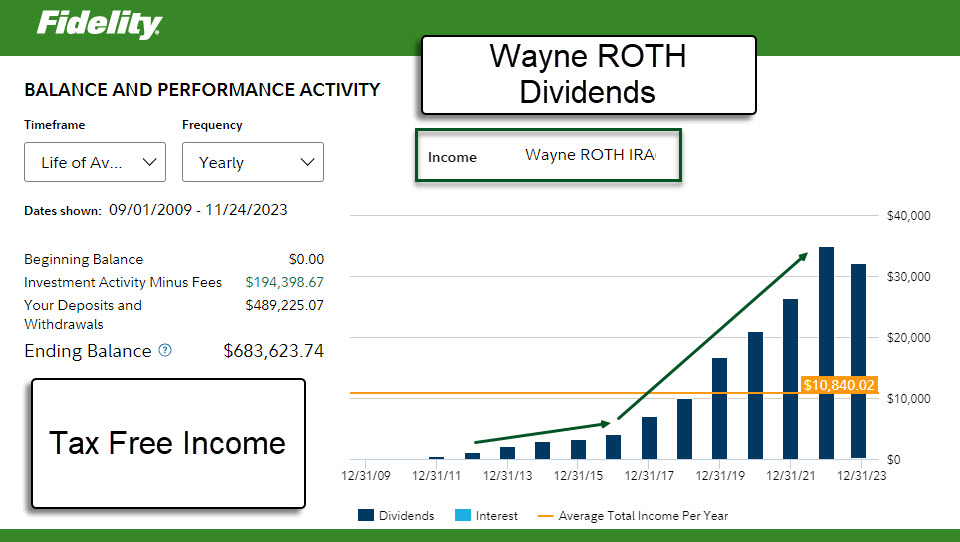

In my previous post I said that a fairly significant portion of my dividends moved from the traditional IRA to the ROTH IRA. Each year I can expect to receive in excess of $3,000 in dividends in the ROTH account from this stock alone. Therefore, rather than paying $480 more in income taxes if I withdraw the dividends at the normal income tax rate, I pay nothing. This is true year one and thereafter.

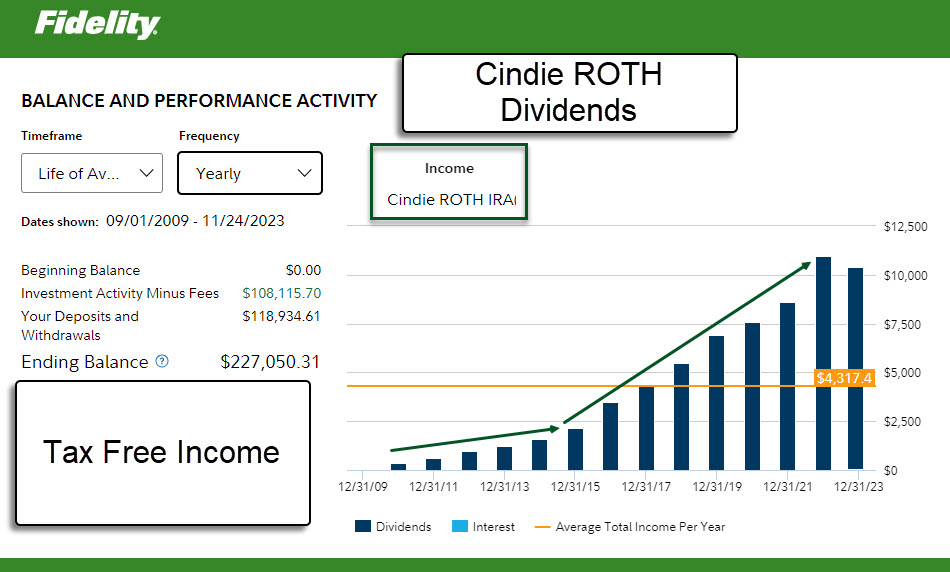

Let’s look at it another way. If the $42,857 of dividends in my ROTH IRA, and the $11,839 in my wife’s ROTH IRA were taxed at our normal income tax rate of about 18% (due to an even higher income tax bracket), we would be paying an additional $9,845 in Federal income tax if we were withdrawing those funds from a traditional IRA. This doesn’t include the additional $2,700 we would pay in Wisconsin State income tax each year. In other words, by having investments in the ROTH IRA, we avoid at least $12,580 in annual income tax.

This is a big part of the reason I am rethinking paying more for the Medicare IRMAA surcharge for some longer-term tax benefits.

The Big Pieces of the RMD Puzzle Target

I just looked at the performance of my traditional IRA over the last five years. It has grown by an average of seven percent. If that continues, and it is likely that it will, the RMDs will be bigger each year, not only because I am getting older, but because the account balance will increase quickly. So the RMDs plus the dividends are a huge incentive to continue ROTH conversions.

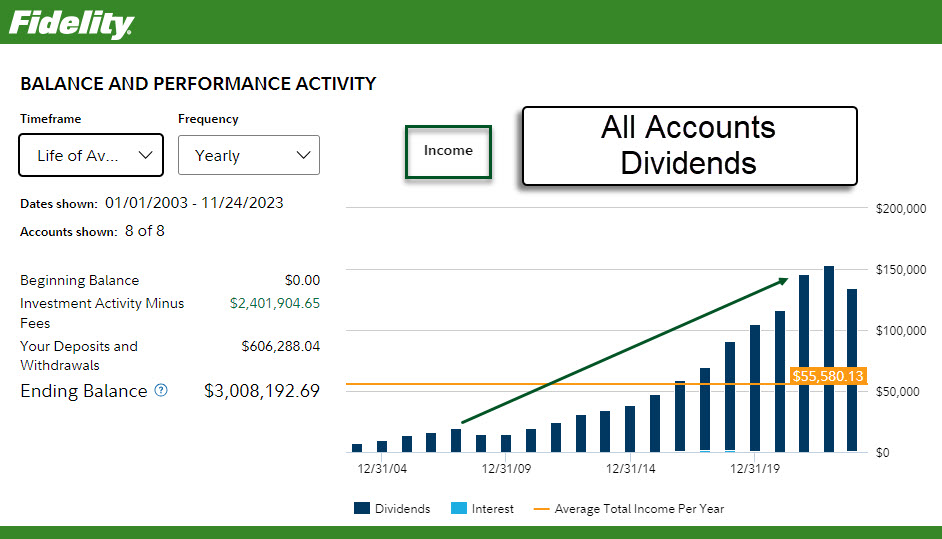

Dividend Growth is a Piece of the Puzzle

Furthermore, if you subscribe to my dividend growth strategy, then you know the dividends are also growing. Think, for example, what will happen if my current traditional IRA dividends grow 5% annually. If I do nothing, it is very likely that my current IRA dividends of $82,223.60 will grow to $86,000 next year, $90,600 in year two, $95,000 in year three, $100K in year four, and $105,000 in year five. The tax on $105K, if withdrawn, will be almost $19,000.

Gathering The Data – Step Two

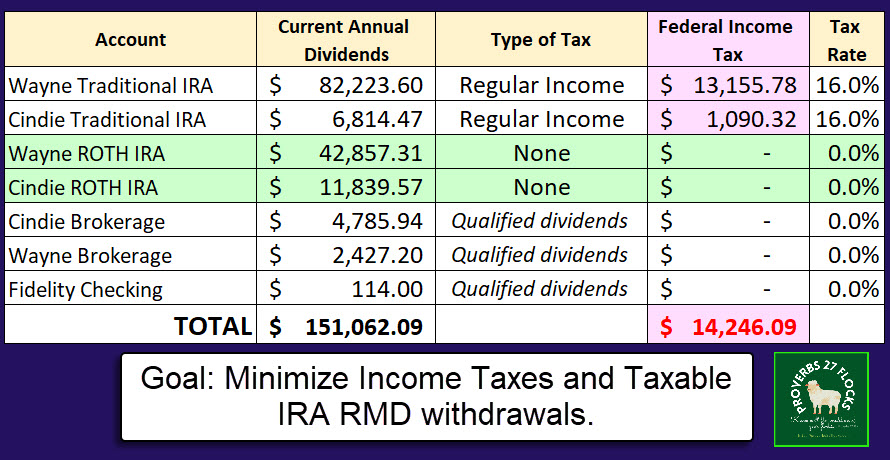

Here are the images of the dividend history of our largest account, our two ROTH accounts, our Fidelity checking account, and all accounts combined (this includes Cindie’s brokerage and traditional IRA accounts). The total is $151K. Most of this is coming from the traditional IRA accounts, which total about $1.95M in assets.

May I suggest that you do a similar analysis. If you would like to have a copy of my spreadsheet, send me an email, and I will send that sheet to you. If you enter your estimated annual income for each of your accounts, and update the “Tax Rate” column, you will get a rough idea of the tax costs associated with the various types of dividend-related investments you hold.

Conclusion and Suggestion

This year I have been withdrawing some of the dividends from my traditional IRA and Cindie’s traditional IRA. As a result, we are reducing our total account values. If I can be more aggressive with this, it will mean that my RMD will be lower, and this will provide additional opportunities for another ROTH conversion in 2024. No longer is the current tax bracket my first consideration.

Let’s face the facts. If you are required to have an RMD due to your age, then the RMD comes first. You cannot convert dollars or investments from the traditional IRA to the ROTH until AFTER you withdraw your RMD. This may put you into a higher income tax bracket. This might also result in a higher premium for your Medicare coverage. However, the long-term tax savings may be worth the short-term tax and premium payment pains.

As I continue my tax reduction journey, I hope to be able to explain what I did and why I did it. I also plan to share some links for various resources applicable for those who are interested in their own tax situation.

Hi Wayne, I read wit interest you thoughts on Roth conversions and make sense to me, and I can understand that moving your ABBV from TIRA to ROTH you move your future dividends to a tax free account, but you don’t quiet say the tax bracket you can live with in conversions. ere is the dilemma I have since I started collecting my RMDs

I normally end up every year with about 80K taxable income consisting of 50K SS and RMDs and 30K of CG, which puts me on the 12% bracket on the 50K income from SS and RMDs and 0% on my CG. So my tax obligation is 50KX12% = 6K. Now, if I decide to convert my 30K worth of my VZ stock from my TIRA then two things happen. my 30K conversion will be taxed at 12%, but at the same time my taxable income went from 80K to 110K which means it pushed the CG out of the 0% bracket and into the 15% bracket which means my 30K conversion was taxed at 27% plus another 5% for IL.

So, if you were in this situation do you think it;s still worth to convert???

Sorry for the long comment.

Thank you,

Jim

LikeLiked by 1 person

Good question. I sent you a reply via email. Hope it helps.

LikeLike

I’d love a copy of that spreadsheet you mention. Thanks.

>

LikeLike

I will send you an email with the spreadsheet attached. Wayne

LikeLike