A Dividend Increase is Tax-Free Income

When you invest in individual shares of a company like ABBV, bear in mind that you may also hold shares in your mutual funds or ETFs. If a dividend increase is announced, you should benefit from the increased dividend – not only in your shares of the stock, but also in the shares of any ETFs holding those company’s shares.

The good news is ABBV increased the quarterly dividend to $1.55. This is a 4.7% increase over the previous dividend. If the board of directors keeps the dividend at this level for the next four quarters, then my shares will earn $6.20 per share in dividends during then next twelve months. This is $3,100 in tax-free income.

Of course, if I also trade covered call options on the ABBV shares, that income is also tax-free. It is a win-win as long as my shares are not called away. I avoid this by setting the contract price high enough to usually avoid losing my shares while keeping the options income.

Easy Income is Designed to be Easy

A long-term investor might want to consider avoiding building bigger barns. Barns are only storage areas. ABBV is a barn, as are most growth stocks. Many investors buy investments so that they will have a bigger barn. I am more interested in the things a barn contains. By that I mean I am interested in the herd of cows and types of cows producing milk.

Dairy farming is not an easy job, but tending a herd of dividend-producing investments can be very easy. Wise herd managers buy investments including stocks, mutual funds, and ETFs with a history of increasing dividends. Then you sit back, and the milkman (Board of Directors and company employees) delivers refreshing results. Last year it was a gallon and this year it might be a gallon and another half-pint of cream on the top. Sometimes it includes a nice rich unexpected ice cream. That is how I view our investment in ABBV.

Dividends Plus Covered Call Options

In addition to the sweet dividend, I have been trading covered call options on my 500 shares of ABBV since June 2021. This has resulted in an additional $2,128 in tax-free income in my ROTH IRA. I have also received $8,432 in dividends since February 2020.

Metrics Matter

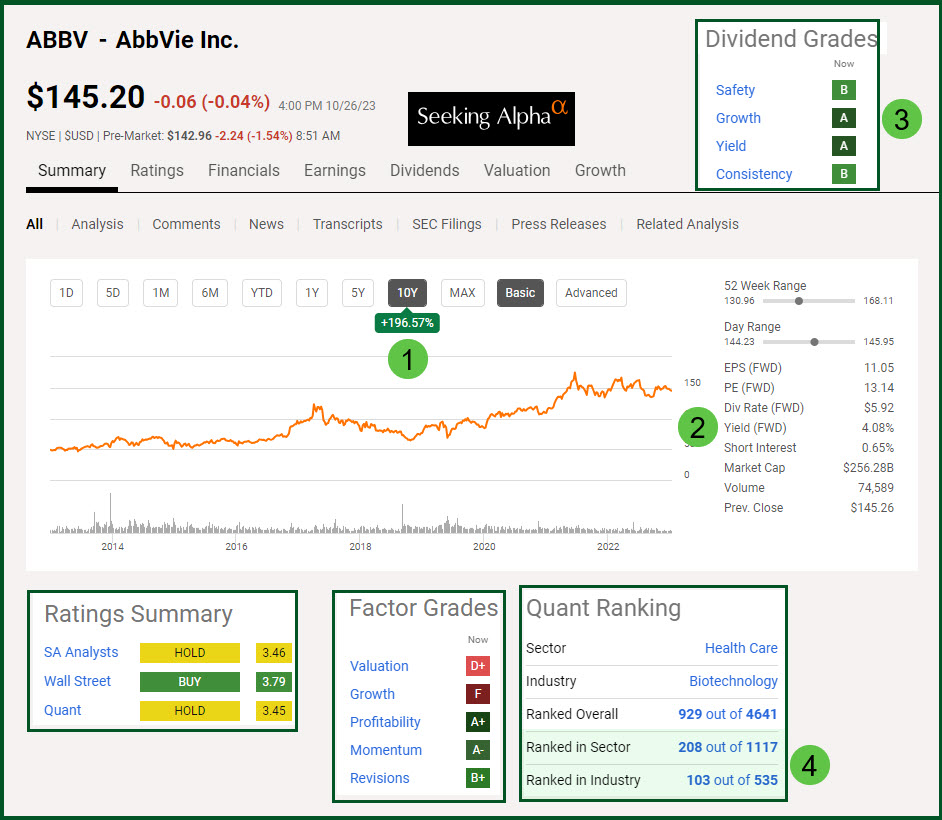

When I consider an investment to buy, or when I am trying to determine if I should add shares, I look at Seeking Alpha. The first image below is very important. While the yield is a nice number to know, I am more interested in the dividend payout ratio, the 5-year growth rate of the dividend, and the number of years the dividend has been increased. I consider a payout ratio of less than 50% to be ideal. Ten years of dividend growth is an indication that the company takes dividend growth seriously.

Wise investors are also interested in the overall growth of an investment. For the last ten years ABBV’s share price has increased 196.57%. I only wish all of my investments did as well. My actual gain is less than this, as I have not owned ABBV for ten years.

Another One Hundred Shares

I bought 100 more shares of ABBV for my traditional IRA this morning at a price of $138.85 per share. When the price of a good investment drops, I enter a buy limit order to see if I can add to my existing shares at a reasonable price. I think buying shares for less than $141 per share is a good idea. To get my shares for a good price, I entered a buy limit order for $140 per share. I was pleased to get the shares for less than my limit price. This adds more dividends and can also increase my covered call options trades.

If, for example, I were to enter a contract for November 3 with a contract price of $143, I might receive at least $100 as an options premium. If the shares would be called, I would also receive a profit of $143 minus the purchase price of $138.85. That profit would be about $415 which is a gain of almost 3%. Of course, if I lose the shares, I won’t receive the new dividend.

ETFs That Hold ABBV

One of the ETFs that holds ABBV shares is VYM. ABBV is in the top ten holdings of VYM with a total of 2.02% of the fund in ABBV shares. In addition, DGRO holds ABBV in the top ten with 2.66% allocated to ABBV. To sweeten the pot, SCHD has ABBV as the number two investment with 4.25% invested. Bear in mind, that if you hold shares of VYM, DGRO, and SCHD, you are holding a good chunk of ABBV as an investment.

In Conclusion

As always, mimicking my portfolio is not the best idea for every investor. However, if you want growing income in retirement, you may probably benefit from looking at your holdings from a dividend growth perspective. I think VYM, DGRO, and SCHD are the best way for most investors to gain exposure to ABBV. However, if you can afford to buy 100 shares of ABBV in a way that those shares are not more than 5% of your total portfolio, then you may want to buy shares around $140/share.

Think Very Long Term

Jesus said this: “’Take care, and be on your guard against all covetousness, for one’s life does not consist in the abundance of his possessions.’ And he told them a parable, saying, ‘The land of a rich man produced plentifully, and he thought to himself, ‘What shall I do, for I have nowhere to store my crops?’ And he said, ‘I will do this: I will tear down my barns and build larger ones, and there I will store all my grain and my goods. And I will say to my soul, “Soul, you have ample goods laid up for many years; relax, eat, drink, be merry.” Luke 12:15-19

God said this man was a fool. vv.20-21 “But God said to him, ‘Fool! This night your soul is required of you, and the things you have prepared, whose will they be?’ So is the one who lays up treasure for himself and is not rich toward God.”

Interesting read, thank you for sharing! what is your take on ABBV price drop on 10/27 to below $138? I’m assuming you wrote this article before the deep and I’m interested to know if you have any change on your strategy after the drop!

LikeLiked by 1 person

I bought 100 more shares. I was writing during the premarket trading and anticipated the price drop.

LikeLike