Wealth is a Gift From God For Giving

If you only look at the dividend graphs in Part 1 of this third quarter review, you should still ask the question, “But what has happened to your total assets?” Has your flock increased? Do you have more in the herd? These are valid questions. The best way to answer is to be a bit more transparent than my parents were about their wealth.

Here is the reality. In the past when a person’s wealth was measured by the number of sheep, goats, cattle, and servants, it was very easy to see who owned what and how much they owned. Today our sheep and goats are hidden in a field (Fidelity Investments) no one can see. I want to give you a look at our fields and see them as lambs of value. Wealth is in your hands for a purpose. Don’t lose sight of this as you think about wealth.

Measuring Wealth in King David’s Day

A lamb has value, and the value depends on weight and various market conditions. According to the USDA, “A lamb weighs about 120 pounds and yields approximately 60 to 72 pounds of retail lamb cuts, which include bone and fat.” According to a February report, “Slaughter weight lambs in the 110- to 130-pound category increased from a weekly average of $97 per hundredweight to $140 by the year’s end (2022).” If we assume I own a 120-pound lamb, it might be worth at least $120 walking around. But the finished products from the lamb are worth even more. Therefore, a flock of 1,000 lambs could be worth $120,000.

In the time of King David, wealth was seen in the size of a flock. There was, in David’s pre-king days, a man who had a business in Carmel. “The man was very rich; he had three thousand sheep and a thousand goats.” (1 Sam. 25:2) So, this man was easily worth at least $360,000 in sheep alone. In 2 Chronicles 30:24 King Hezekiah and the princes were clearly wealthy men: “For Hezekiah king of Judah gave the assembly 1,000 bulls and 7,000 sheep for offerings, and the princes gave the assembly 1,000 bulls and 10,000 sheep.” There is a distinct difference between the rich man in Carmel and King Hezekiah. It wasn’t just the size of their flocks and herds.

Nabal’s Folly Should Not Be Repeated

The goal of this post, therefore, isn’t to boast or to create envy. Our largest “expense” is charitable giving (followed by taxes) because God gives us everything we have. We are not really the owners. We are servants. We don’t want to be fools like Nabal in 1 Samuel 25. Marshall Segal wrote a helpful article about Nabal’s folly.

“Nabal had built the bigger barns. He embodied the fool’s anthem: ‘Soul, you have ample goods laid up for many years; relax, eat, drink, be merry’ (Luke 12:19). And what does God say to that man? ‘Fool! This night your soul is required of you, and the things you have prepared, whose will they be?’ (v. 20). To which Jesus adds, ‘So is the one who lays up treasure for himself and is not rich toward God’ (v. 21). And being rich toward God typically means being generous toward someone else. It means laying up treasure for others, meeting their needs at our (sometimes significant) expense. Godly husbands are givers, like our Father, not keepers or takers.” – From: The Successful and Worthless Husband – Five Marks of Foolish Men; Article by Marshall Segal, Staff writer, desiringGod.org

As Dave Ramsey often proclaims, “Live like no one else today, so that you can live and give like no one else.” If we heap up wealth for ourselves, we are fools. But if we are frugal, wise, and generous with what God has put in our hands, then he often does bless and provide in ways we might never imagine. Don’t misunderstand me. I am not suggesting a prosperity gospel. What I am saying is wise living can result in rewards both in this life and in the life to come.

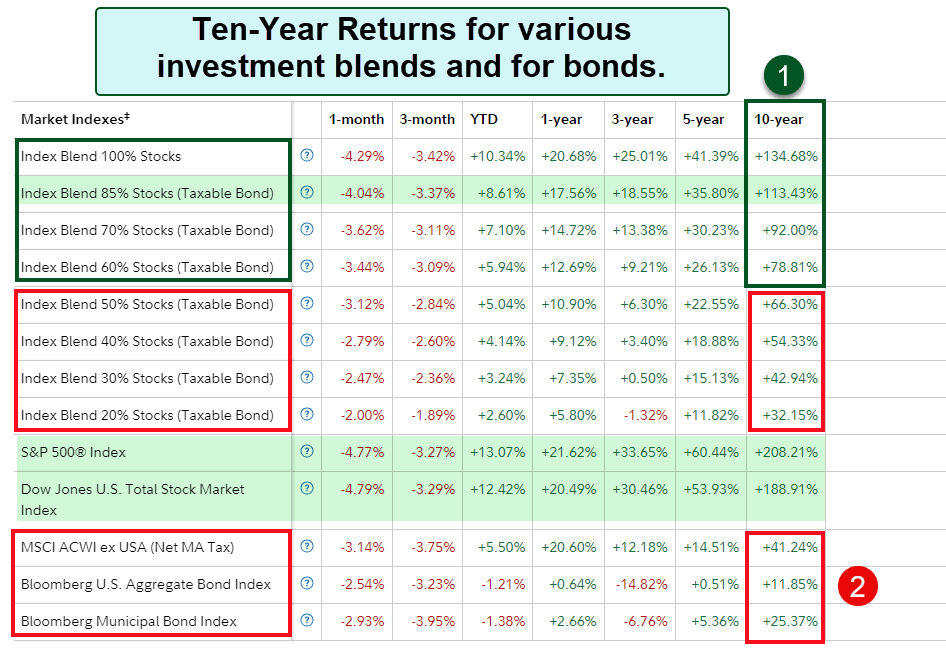

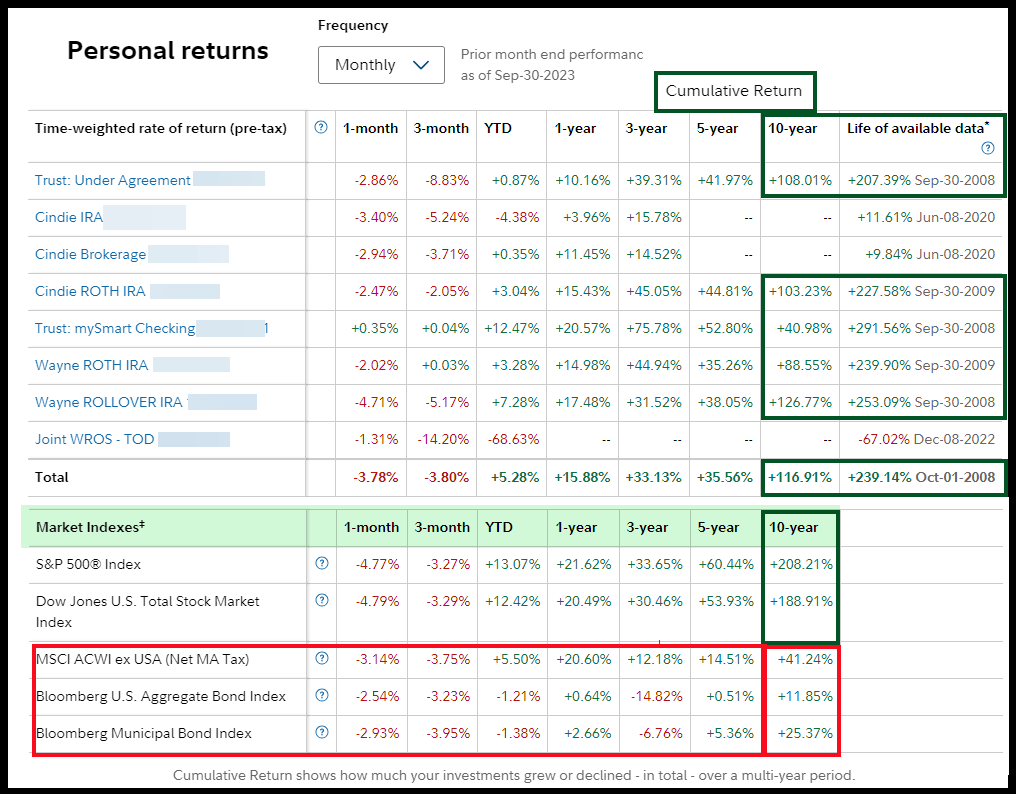

Cumulative Ten-Year Returns

If you look at cumulative ten-year returns (the growth in our flocks and herds), the best way to view this is to remember that anything less than 70-90% in stocks means your investment strategy is too risk averse. For this image, the more you take the “safe” road (investing more in bonds) the less your returns will be. If you do feel an urge to have a mix of stocks and bonds, then perhaps an index blend of 85% stocks and 15% bonds might give you some relief from the days when the market is volatile or bearish. In general, I like to see my ten-year returns at least above 80%.

The S&P 500 index might seem attractive, but you can rarely get income (milk, wool, new lambs) from this type of index sufficient for your retirement years. For example, the IVV iShares Core S&P 500 ETF has a current yield of 1.55%. If you sell the shares when the market is up, and buy some CDs for 5% interest, then the S&P 500 index approach might work for you. I prefer a constant stream of growing dividends, so I don’t have to sell my shares to get the desired income.

If you take the bond (2) approach, then just know you are accepting current income at the expense of long-term returns and future income. Annuities and bonds sound like a good income idea until you look at the cumulative returns. Your flock will remain somewhat the same over time.

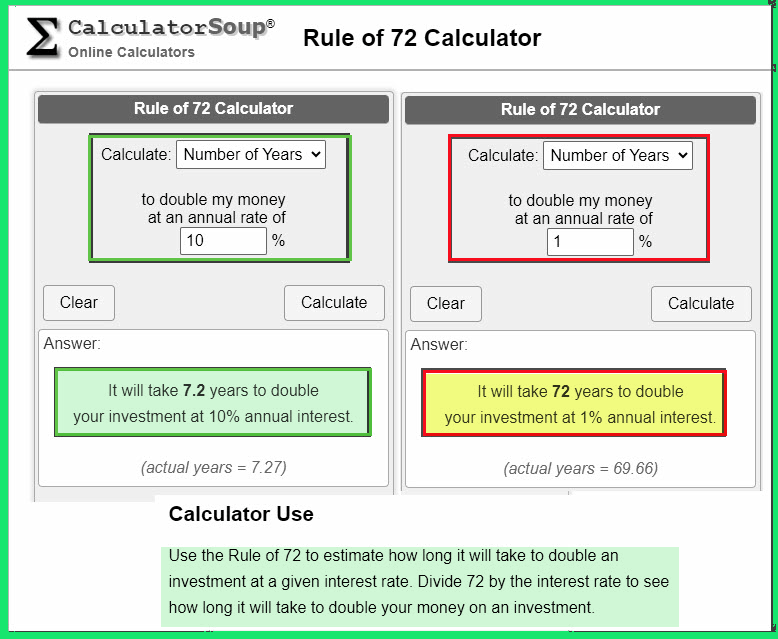

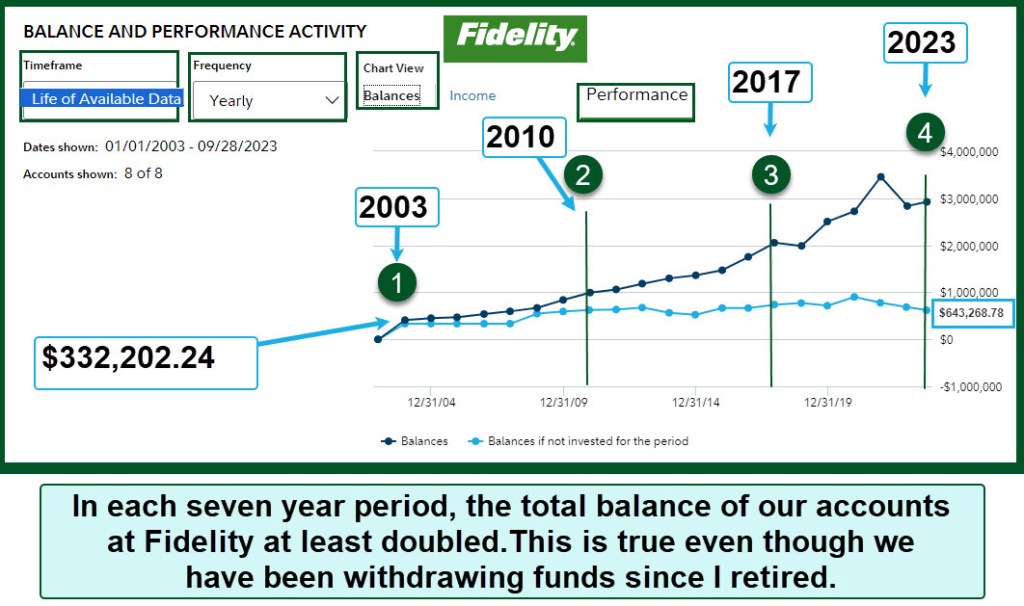

Doubling Effect of the Rule of 72 Illustrated

The Rule of 72 is a simple way to know what one dollar might be worth in the future based on the return on an invested dollar. A dollar invested at 1% interest for ten years won’t be worth much. In fact, it will take about 72 years to double my dollar to $2.00 if I accept 1% interest.

If, however, I am willing to invest in an investment that grows by 10% per year, then it will be possible for the same $1.00 to grow to $2.00 in 7.2 years. That may not seem like a big deal until you make the number bigger. If, for example, you have $350,000 invested at 10%, you can reasonably expect your account balance to grow to $700,000 in 7.2 years, and then to $1.4 million in another 7.2 years. You don’t have to be a financial or investing genius to make this happen.

Our Accounts 2003, 2010, 2017, and 2023

In 2003 the total assets in our Fidelity account were about $332K. The light blue line shows the results of additional deposits and withdrawals over the next twenty years. Therefore, if we had just put the money under a mattress, our total balance today would be about $643K.

We certainly continued to work and contributed to ROTH 401(k) accounts, and we also contributed to our Fidelity ROTH IRA accounts when we had earned income. Whenever we left an employer, we rolled the 401(k) assets into our ROTH IRA accounts.

Given the poor interest rates available for cash from 2008-2022, there would have been fourteen years where playing it safe with $500K would have been a very risky approach. Even with only 2-3% inflation, the $643K would have far less purchasing power.

Using my “Easy Income Strategy” our assets more than doubled from 2003-2010, and then doubled again from 2010-2017. Since I retired over ten years ago, we have been taking withdrawals of dividends. Nevertheless, the total account balance has doubled in the 2017-2023 timeframe.

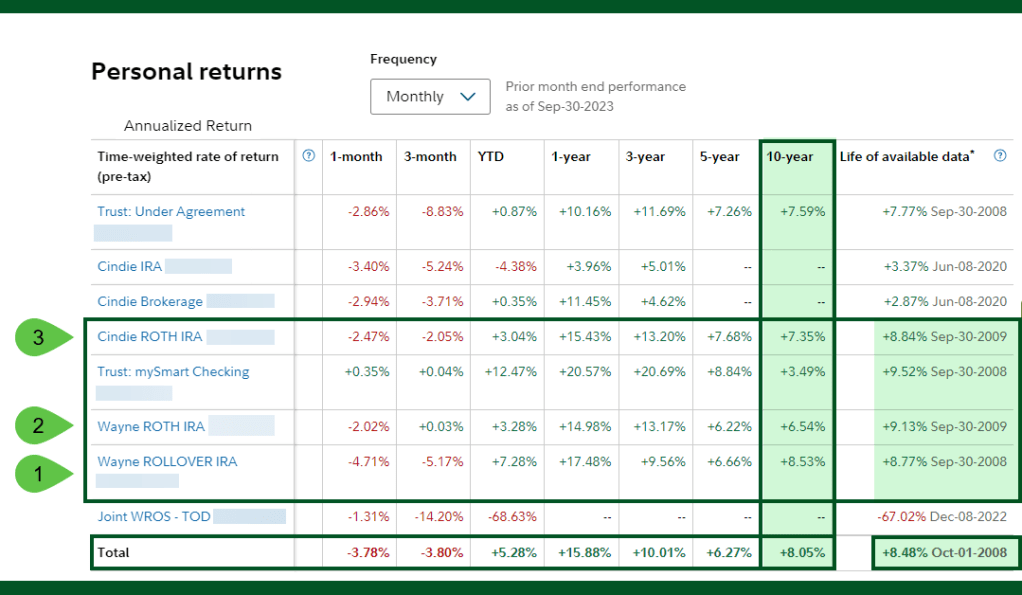

Personal Returns

Three accounts make up the most significant portion of our investments. They are (1) my traditional rollover IRA from Universal Foods Corporation, (2) my ROTH IRA which includes rollover funds from a ROTH 401(k), and (3) Cindie’s ROTH IRA. Because I did not change my investing behaviors until 2009, it is important to look at the “Life of Available Data” column. Excluding the smaller brokerage accounts, our average annual return on our investments is about 9%. This would not be true if I had kept our investments in bonds or bond-like investments.

Cumulative Personal Returns

My fifteen year returns in my traditional rollover IRA since September 2008 are 253%. While that is not the same as a similar investment in the S&P 500, it is more than sufficient for our needs and for our charitable giving. My goal has never been to beat a market index. However, I understand the power of investing in quality stocks and equity ETFs like VYM, SCHD, and DGRO. Therefore, I am satisfied with our returns because they provide income without selling our investments.

2023 YTD Summary

The dividend growth has been acceptable, even during a year when the market has been extremely volatile. In addition, staying with a long-term strategy that seeks asset appreciation of 8% or more is a good way to build wealth. However, don’t wait until you are nearing retirement to set a strategy and think about the Rule of 72.

This image shows the long-term impact of my investing strategy. We actually gained more from our dividends than we did from the change in the market value of our investments. During the last eleven years of my “retirement” we have been able to withdraw $1.4 million for various purposes. According to my records, at least $645K was charitable giving. Other large portions were used to pay our property and income taxes. God has provided and we trust in him, not in our retirement accounts.

Wrapping It Up

Marshall Segal also reminded us of this: “We’ll also be measured by how we treat the people in our lives — the wife beside us, the children behind us, the neighbors next to us, the church family around us, the people who look up to (and maybe even report to) us. Men don’t often die wishing they had put in a lot more hours at the office or made a harder run at that promotion. They very often die wishing they had prioritized the people who were waiting at home or sitting in the next pew. Strive, by the grace of God, to be your most fruitful where it matters most. Don’t be known first and foremost by how you work and what you have, but by how you love and what you give.”

Here is my fear: I fear my blog posts help some achieve wealth without true wealth towards God. A focus on temporary wealth is a path to everlasting loss, not of everlasting wealth. Be careful how you manage your flocks and herds and how you view them.

Well done and well doing Wayne. Managing assets (as well as other talents) well for giving, living and passing on is honoring to God.

LikeLiked by 1 person

God is worthy of the glory. Thanks for the encouraging words.

LikeLiked by 1 person

Wayne – Thanks for the transparency. It’s hard not to notice the very large deposits that have also been made over the last 20 years…

LikeLiked by 1 person

Fidelity seems to view “deposits” differently than you or me. Some of what is a “deposit” is really just a transfer from one account to another. At least that is what I think is happening based on the history of the data and my other records that show the real deposits. The actual additional funds were the transfers of 401(k) assets from former employers to Fidelity. That does muddy the waters, as those accounts also grew while they were in the 401(k) accounts. So, like most data, there is some fuzziness to the big picture because of the way the data came into Fidelity from external and internal sources. However, staying the investing course can really make a huge difference.

LikeLike

Another complicating factor is that I have done many IRA to ROTH conversions. When I do this, it looks like a withdrawal from the traditional IRA and a deposit to the ROTH. I time the conversions when the asset values are low, so as to get a tax advantage. Then the asset can grow in the ROTH. Again, this can make the deposit numbers a bit more fuzzy.

LikeLike

Okay, thanks!

LikeLike