Finding the Truth

There is a retirement and investment struggle I often face when helping others understand their investments. I am currently helping one of Cindie’s relatives with some decisions regarding his current mix of investments. Some of them are at Fidelity Investments. That is good, because Fidelity does a nice job of helping him know what he has and they have the tools that make this easy.

Other brokers are not so kind. The list is endless, but one that I have seen more than once is Voya. Voya tends to make it hard to see things you need to see. Their statements tend to hide (or not reveal) important information like expense ratios, fees, and even ticker symbols. While many may not care, this is a sign that the broker doesn’t want you to be educated or informed. In fairness, Voya is not the only one that does this. I have seen this on many different statements.

Why Brokers Like to Hide Things

We can start with the most obvious. If you knew how much you were spending each year for “advice” and for “fund management” and for “account management”, you might be shocked. As I dig into the details, I am often saddened by the high charges coupled with low performance that some brokers provide.

There is a way to learn more about your investments, even if they try to hide the details. It takes a bit of work, but it is worth it.

Finding Answers

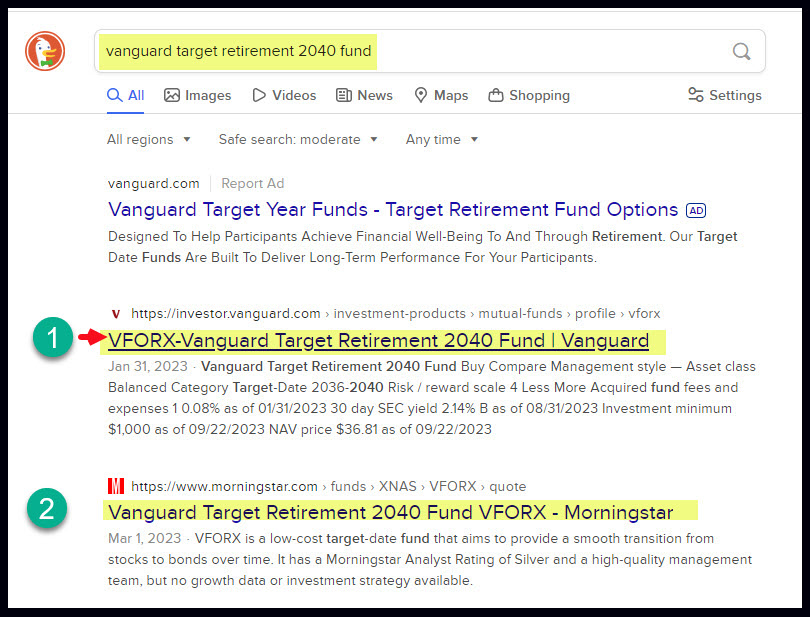

The easiest way I have found to get to the ticker symbol, is to look up the fund name from the statement using Google or DuckDuckGo. I prefer DuckDuckGo. In the case of the following statement, I looked for “vanguard target retirement 2040 fund.” How did I know it was “Vanguard?” Isn’t it interesting that the statement excludes that detail? Well, I knew the fund name because the gentleman I am helping downloaded the PDFs from the Voya website about each fund. The fund name is on the PDF.

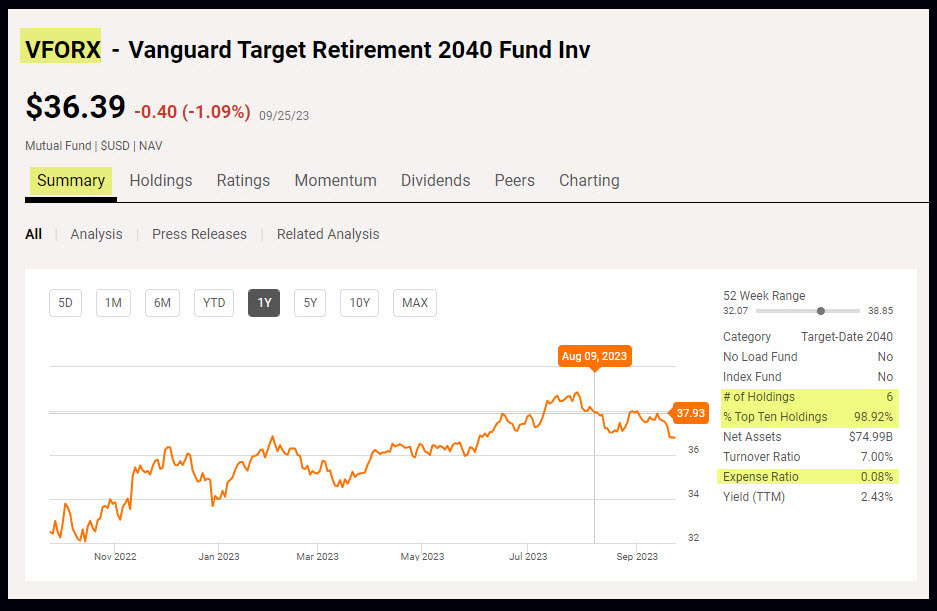

DuckDuckGo told me the fund ticker symbol is VFORX (Vanguard Target Retirement 2040 Fund Inv.) I then can enter that ticker symbol on Seeking Alpha to learn that this fund has an expense ratio of 0.08%, which is acceptable.

Then I am able to take a look at the top ten holdings in VFORX. There are only four holdings. They are: Vanguard Total Stock Mkt Index Institutional Pls (47.71%), Vanguard Total Intl Stock Index Inv (30.44%), Vanguard Total Bond Market II Index Investor (14.69%) and Vanguard Total Intl Bd II Index Insl (6.07%). In other words, this is a fund of funds and about 20% of the total holdings are bonds. Most of the bonds are government bonds.

The total 10-year return of this fund is 99.95%. That is also decent. However, there is another problem. Dividends are only paid annually. That is a really bad idea.

Why You Should Be Concerned

Do you see how much work I had to do to learn the basics about this fund? This is only the tip of the iceberg. While it may be true that most people wouldn’t even read their statements, it doesn’t give me confidence in a provider who doesn’t make it easier to understand the nature of their investments.

Recommendation

If you receive statements from your provider(s), read them. Look for the basics I have described. If they are obtuse and don’t tell you what you need to know, then I suspect they will want you to call them. Be careful, as they know how to answer without really answering the most important questions. How do I know this? Because I have helped others by asking those questions for them only to hear evasive and often double-speak answers.

When you have a FUND of funds isnt it true that in ur example of VFORX with only a ER of .08 there is also ER of the other funds that you need to figure into the cost of owning VFORX?

LikeLiked by 1 person

Yes, that is true. And that is another reason I dislike Target Date funds and other FOF’s. The layers make analysis difficult at best, and just plain impossible for the normal investor. Here is a link that may help other readers. Thanks for asking the question. https://www.investopedia.com/terms/f/fundsoffunds.asp

LikeLike