Wise Cash Allocation 1 of 3

Are You Tending Your Cash?

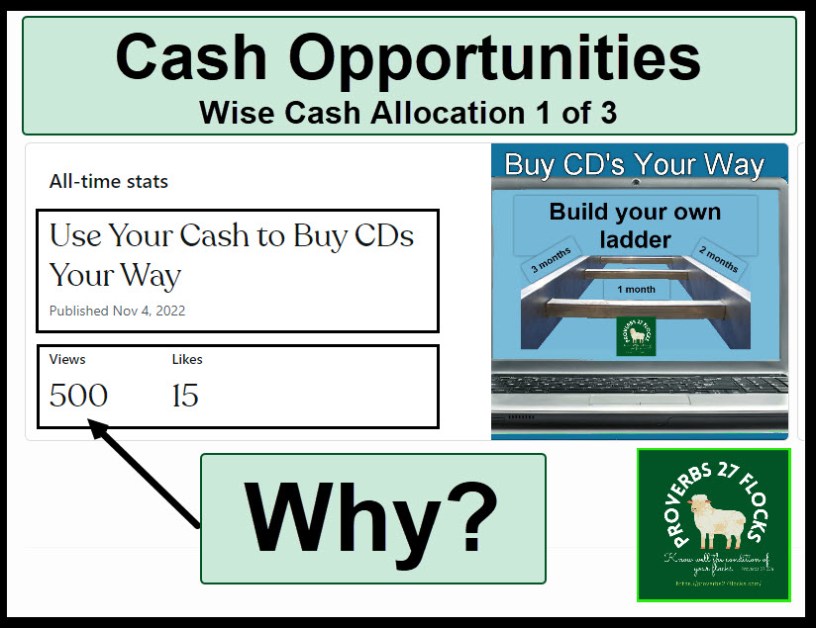

I am nothing short of amazed at the number of times I see people reading a post I wrote on 11/04/22. It was called, “Use Your Cash to Buy CDs Your Way – Build Your Own Short CD Ladder.” I think some of this is fueled by this: “The Federal Open Market Committee lifted its fed-funds rate by a quarter of a percentage point, to a target range of 5.25% to 5.50%. It’s the highest the target has been in 22 years.” SOURCE: Barron’s Review&Preview

As interest rates rise, it should become obvious to most thoughtful people that keeping your savings in a traditional bank is loaning money with little return. If your bank is offering you less than 4% interest on your savings, then you might want to move your checking and savings to a different bank or to a place like Fidelity Investments. In this three-part series you can learn more about how to store cash at Fidelity, some fundamentals about CDs, and how to create a CD ladder. If you are over sixty, you may already know most of this, but I hope to shed some light on the topic to help all of my readers.

In that earlier post I shared the steps you can use to buy CDs on the Fidelity Investments website. For this first post I want to talk about the “Fidelity® Cash Management Account.”

Fidelity® Cash Management Account (FCMA)

The FCMA is a one-size fits all solution for cash, direct deposit of your pay or Social Security income, bill payment, ATM access, CDs, paying income taxes, and check writing.

The FCMA features that help you spend and save include “No account fees or minimums”, digital wallet compatible, mobile check deposit, a secure debit card, ATM fees reimbursed globally, FDIC insurance on cash balances and competitive rates. Remember, your current checking account is probably paying you nothing. I have tried just about every feature including mobile check deposits, ATM withdrawals, check writing using checks connected to the account, and checks mailed to payees at no additional cost or postage. Much of the cash is FDIC insured, but some is set aside in a money market fund to gain more interest. Here is a link to Fidelity’s FAQs.

Why Keep Cash?

We all keep cash for various reasons. It is prudent to have an emergency fund and cash availability is great for paying bills or for gift-giving. Some want to build up cash to make a down payment on a home and others want to be able to pay cash for their next vehicle or home improvement. The FCMA can assist you in saving and pay you while you gather the dollars you need for each goal you want to achieve.

What is the Core Position at Fidelity?

Every account you open has a position called the “core.” This is where the money lands when you deposit a check, have your pay or Social Security direct deposited, or receive interest or dividends. The default choice is called “CORE**” and has the name “FDIC-INSURED DEPOSIT SWEEP.” The ** says the core contains the amount of uninvested cash which can be used for processing transactions. In other words, you can use this cash for anything at any time. You can buy CDs with the cash or buy shares of F, GAIN, or whatever you like.

The following image shows our current FCMA positions and balance. If you try to (1) change the CORE position to something else, you will find that there are no other choices. That is just a temporary problem. You can move some of your cash to a government money market fund like (2) SPAXX. This could be your “emergency” fund that will earn more income than the core account can earn. I called our FCMA “mySmart Cash Account.” When this image was taken our core account held $15,632.50, and those dollars are earning 2.57% interest. Fidelity manages the banks who hold the cash and you can see a list of them when you click on the CORE position. Here is the list: BANKLIST. (You have to be logged in to your Fidelity Account to see the list.)

The $3,500 in SPAXX is earning 4.75%. Bear in mind that SPAXX is not FDIC insured. However, I still think it is a low-risk way to earn interest and not lose your principal.

Are there other choices without FDIC Insurance?

I’m glad you asked. Our nephew Joe asked me where his cash should go in his FCMA. He said, “I’m also curious which core position is best for my Fidelity Investment accounts? FDRXX, CORE or SPAXX? Or are there other better options?”

There are three potential money market mutual funds that might make sense for your extra cash. They are SPAXX, FDRXX, and FZFXX. Each of these is similar, but FDRXX might be the best choice at the present time. However, you can also purchase CD’s that have no expenses or costs, and that can give you more than 5% interest. That will be the subject of the next post. I use SPAXX for my accounts, but I use FZFXX for the UTMA accounts.

Recommendation

Take a look at your bank or credit union statement. Do you like what you receive in interest? Are the CDs that your provider offers available in 1-month, 2-month, and 3-month durations paying at least 5%? Will they let you buy CD ladders using their website? If not, then you may want to consider taking the time to move to a better solution. Yes, I know there is some work involved, but your money should be working as hard as you do.

You may also want to go to my previous November 2022 post to learn more about CDs.

Do you still keep a small amount at a local bank so you can cash checks.

LikeLiked by 1 person

Yes, we have $200 at a local bank in a checking account. However, using the Fidelity iPhone (or Android) app, you can deposit checks much faster directly to the Fidelity Cash Management Account. I have done that multiple times. I am seriously considering closing the old-fashioned checking account. However, $200 is not that big of a deal, so having the ability to walk into the bank for other services is worth the small interest loss.

LikeLike