Reasons for Buying

There is no way to know what will happen in the stock market today, tomorrow, next week, next month or next year. Therefore, many only hold cash and cash-like investments. There are many ways to look at the investment landscape and I prefer to take a long-term view. That doesn’t mean that I don’t buy some investments for short-term gains. So far this month I have purchased dividend growth investments (NNN, VZ), speculative investments, and “safe” investments like CDs.

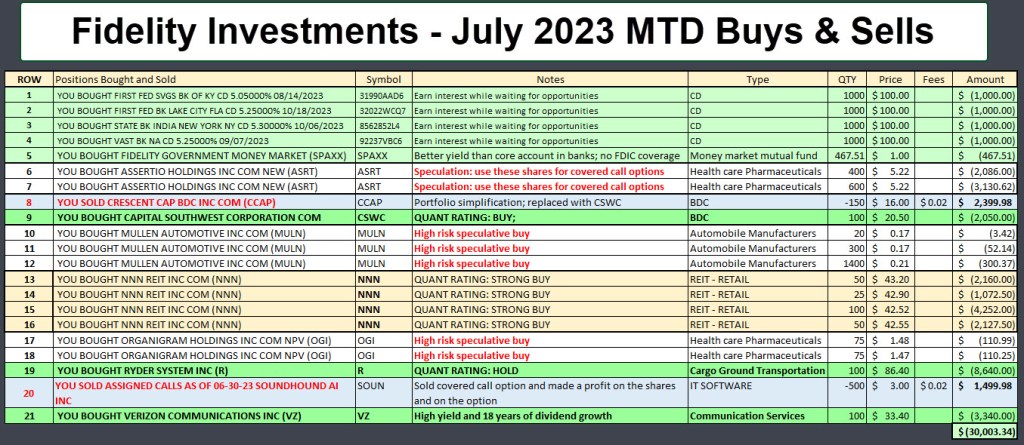

The Total List

What is shown here is a complete list of my buys and sells. These are all of the transactions for all of the accounts I manage. In some cases the dollars committed are relatively small (MULN and OGI) and in other cases, the risk is higher because more dollars are involved (ASRT, NNN, R, VZ). The problem with this view is that you cannot really know what my thinking is.

For example, why did I use $9,612.00 of our cash to buy 225 more shares of the REIT NNN? Why did I purchase four CDs? What is the reason to buy 100 shares of R and of VZ?

The Reasoning

You certainly don’t have to agree with my reasoning, but the following image helps separate the various buys into categories and also provides some notes that you may find helpful. The average reader of my blog probably should not buy shares of ASRT, MULN, or OGI. I have a very large number of shares of ASRT, and I bought many of the shares for a very good price. If I sold today, my profit would be substantial. However, I like to trade covered call options on my shares.

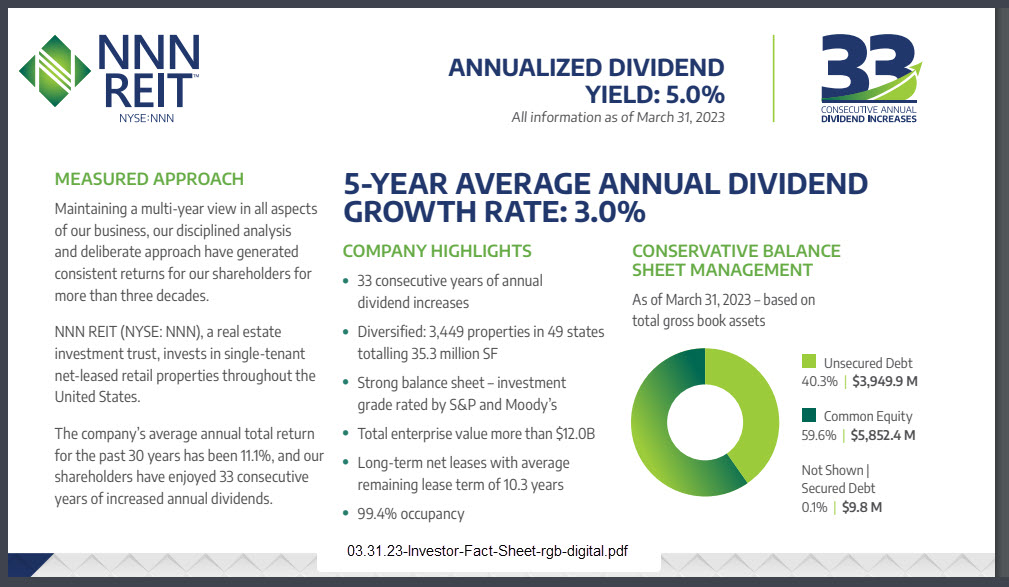

NNN Facts

Sometimes even Seeking Alpha (and Fidelity Investments) presents questionable data. Here are some images that show the Seeking Alpha view of dividends. But note the reality from the investor relations Fact Sheet. The Fact Sheet is correct. I believe Seeking Alpha is not properly representing what it considers to be “Special” dividends. The Special dividends were regular dividends. That causes their web site to misrepresent reality.

Recommendation

If you understand REIT investing, then starting a position in NNN might be a good thing for your investment portfolio. I recommend holding NNN in a traditional IRA or a ROTH IRA. The best place to own the shares is in a ROTH IRA. The reason is simple: to avoid income taxes on the dividends.

Full Disclosure

Cindie and I own substantial amounts of ASRT, CSWC and NNN shares. I think they are both good long-term positions for dividends in retirement.

In the REIT sector I own LAND & PCH as inflation hedges. I own RNP, AVB, O, and RITM. Would NNN add additional diversification? If added it would be a very small position.

LikeLiked by 1 person

There are some similarities between O and NNN. I hold both of them. I would sell LAND and I am not a fan of REIT ETFs. RNP, in my opinion, is a very weak choice. It has a lot of junk REITs in its holdings. It has 340 holdings, but over 30% of the assets are in the top ten holdings. They seem to be so vanilla that I don’t know why they offer value to a REIT investor. I have yet to see a REIT ETF that makes any sense whatsoever.

LikeLike

You previously recommended O, GTY, Stag. Is NNN in addition to these or in place of one of them?

LikeLiked by 1 person

I will continue to hold O, GTY, and STAG. So NNN is one other Retail REIT that has characteristics similar to O. I already held shares of NNN and added to the total share count. There are other REITs in our accounts as well. It would be hard for me to pick just one. However, these four are certainly in my vision to add more shares.

LikeLike