Measuring Dividend Growth Performance

In my previous post about the 2nd quarter, I noted that some want to measure performance against an index like the S&P 500. While theoretically there is nothing wrong with that, it usually falls short when you enter your retirement years. If you go with the traditional “rebalancing” stock/bond approach as you age, then you will have more-and-more bonds in your portfolio. It is extremely unlikely that you can keep pace with the S&P 500 because bonds have underperformed the stock market in the long haul.

Most advisors will add more bonds to your investment portfolio, and therefore less allocation to investments like SPY (SPDR® S&P 500 ETF Trust), or IVV (iShares Core S&P 500 ETF or VOO (Vanguard S&P 500 ETF.)

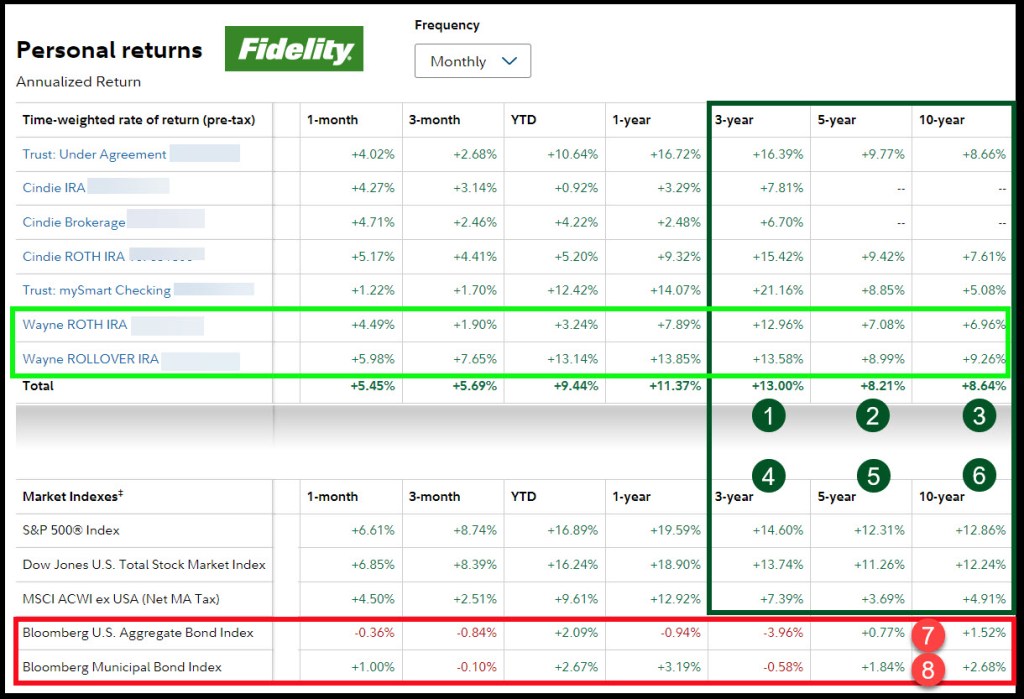

How do I know bond-holders will underperform? A simple way is to go to Fidelity’s PERFORMANCE tab to see your investment performance for three, five, and ten years. If you look at the right three columns, you can see the performance is 13%, 8.21%, and 8.64%. If we look at the same time periods for the S&P 500, the values are 14.6%, 12.31%, and 12.86%. Some might rightly argue that I am underperforming the S&P 500. But that is because I have a mix of investments that give me substantial income.

Furthermore, I am seeing performance that easily beats the MSCI ACWI ex USA international index. The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets countries (excluding the US) and 24 Emerging Markets countries. With 2,308 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. The ten-year return of that group is 4.91%. It is true that I hold some foreign investments, like TD, CM, ASX and STX. These, however, pay dividends. I would argue that the average investor does not need to have foreign stocks or ETFs in their portfolio.

If you examine the returns of both Bloomberg bond indexes, you should weep. These produce income and little else. Furthermore, these do not offer dividend growth and are high risk solutions when interest rates are rising.

Measuring Using Dividend Growth

In my previous post for Q2, I showed the trajectory of dividend growth from 2003-2023. Because that is my focus, it makes sense to measure success by answering this question: “Did my dividend income grow during Q2, excluding special items?” Special items would include things like Ford’s special dividend of $0.65 per share in March on top of the regular $0.15 quarterly dividend. That is not likely to be repeated this year. Therefore, I only expect to average $11,000-12,000 per month in 2023 dividends without that exceptional, one-time dividend.

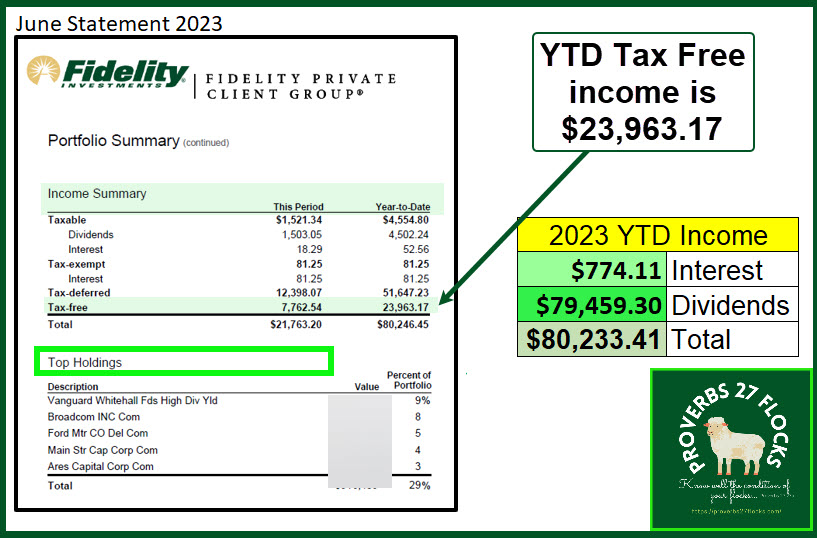

Start By Understanding Tax-Free Income

The best kind of income is tax-free income. The reason is simple, for every dollar of tax-free (ROTH IRA) income we receive, we can spend the full dollar. With withdrawals from our traditional IRAs, on the other hand, every dollar is only worth about eighty cents, assuming I manage our income wisely. YTD 2023, we have received almost $24,000 in tax-free income. Take advantage of any opportunities you have to grow tax-free income using ROTH 401(k)s or ROTH IRAs. This includes converting IRAs to ROTH IRAs in a tax-wise manner.

YTD 2023 Options income was $38,404.77. This is in addition to interest and dividend income. Some of this income is tax-free as well. Specifically, $14,364 has been option income in my ROTH IRA and Cindie’s ROTH IRA. The beauty of having a ROTH IRA is magnified if you take the time to learn how to trade covered call options on positions in your portfolio. I share this aside to help you see that our total income from our investments is over $118,000 in six months. To make it sweeter, tax-free income, therefore, was over $38,000. Don’t miss this opportunity to add income in retirement.

EIS Investment Second Quarter Summary

June 2023 income was $21,763.20, as compared to March 2023 dividend income which was $28,414.09. The reason for the “decline” is simple: There was a special dividend for the Ford Motor Company in March. Another special dividend is not expected from Ford.

Nevertheless, the total YTD income from dividends now stands at $80,246.45. Therefore, the average monthly income for the first half of 2023 is $13,374. What makes this even better is that YTD tax free income from our ROTH accounts is now at $23,963.17, which is $3,994 per month. In other words, that is about one third of the total income.

By way of reminder, my best months are always March, June, September, and December. Other months have monthly payments and some quarterly dividends from a couple of investments. I will continue to be 98-99% stocks and equity ETFs. There is no reason to seek a false shelter in cash or bonds.

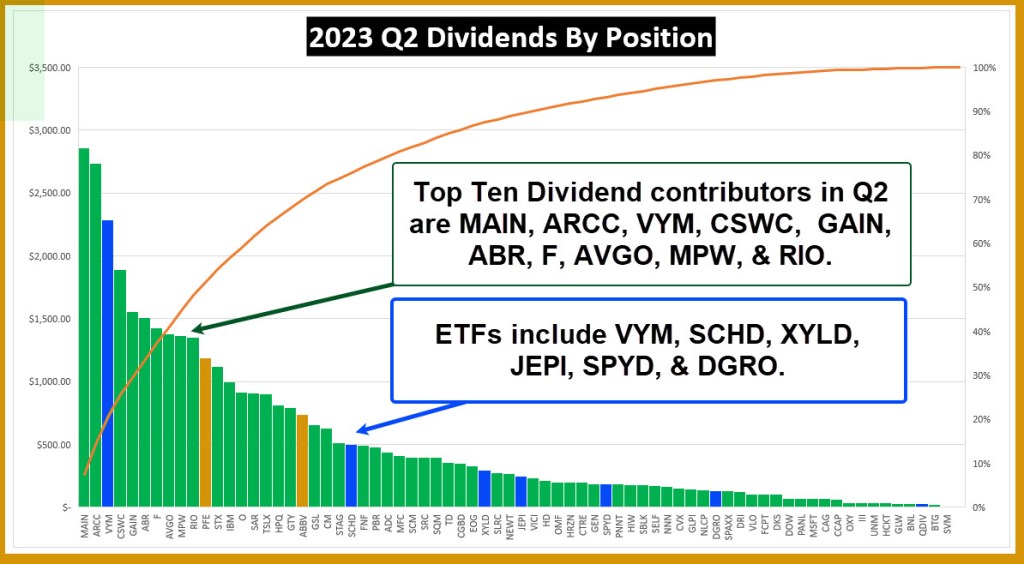

Which Stocks and ETFs Paid Dividends?

The top ten sources of income were MAIN, ARCC, VYM, CSWC, GAIN, ABR, F, AVGO, MPW, & RIO. What you should notice is diversification. VYM is a diversified ETF. The top 20 include technology, BDCs, REITs, health care, auto manufacturing. A word of caution is in order again. There are some positions that face higher risk, including MPW. Don’t just copy me if you don’t understand the potential risks associated with hospital REIT investing.

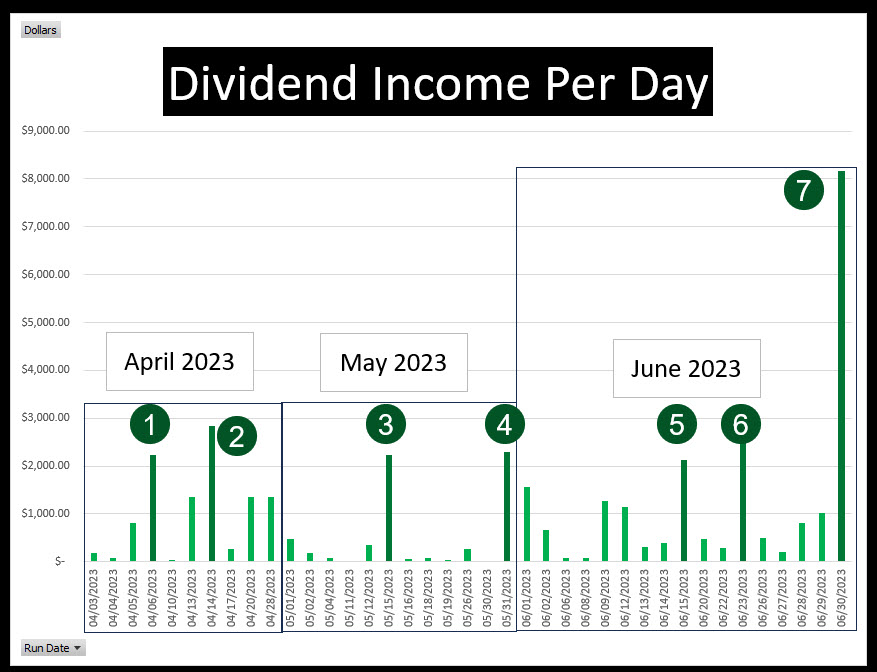

Dividend Income By Day

If you have dividend income, you may, for the most part, only see dividends from many stocks and ETFs on a quarterly basis. One of the reasons I prefer to add individual stocks is that I can create income many more times during a three-month period. For example, in April 2023 there were ten days that had dividends. There were twelve in May, and seventeen in June. In the following graph there are two obvious realities. The first is that there are seven days when the dividend income exceeded $2,000. The second is that the last day of the quarter was a really big payout.

While a wise retiree does not need to have daily income, if they have and stick to a budget, receiving income more frequently has an advantage. The advantage is that when income arrives it can be put to work or used for charitable purposes.

YTD Income By Type

Admittedly, some of my income is not “easy” in that I have to spend a couple of extra hours each week to enter covered call options trades. However, this is an opportunity that many miss. After I learned how to trade options, I realized that it really is not as difficult or complicated as it might seem.

June 2023 Dividends Top 25 positions Table

Another way to look at our investments is to see where most of the total is allocated. At the present time, VYM, AVGO, F, MAIN, ARCC, PFE, HPQ, STX, IBM, and AMD are our biggest investments. AMD does not pay dividends. Therefore, even though I am a dividend growth investor, I do hold positions that do not pay dividends.

In the top 25 there are two positions that do not pay dividends. They are AMD and TSLA. However, I can trade options on this type of investment and make income without selling my shares – unless the options are called. Also remember that I could increase my dividends by selling this type of investment and reinvesting the dollars in VYM, SCHD, or DGRO.

What Should You Do?

Let me strongly suggest that a goal statement is important. A strategy to achieve the goal is also prudent. Your strategy does not have to focus on dividend growth, but I would say it should be anti-bond and anti-annuity. There are exceptions to this “rule”, as there are some who might benefit from tax-free bonds and others who might need an annuity for specific reasons. However, the vast majority of investors would do well to avoid or minimize putting money into annuities and bonds.

Full Disclosure

I have no plans to sell any of our investments. Some investments, like TSLA, will be called away at a profit. Those profits can be used to buy other investments.

I am a new reader of your blog. Saw your comments in the WSJ. Deeply appreciate your eternal perspective. Maybe you mention this somewhere, but what is your total value of your investable funds? I’m 58 and manage just a little over $700,000. Obviously I’m not seeing the monthly income your accounts produce, so just wondering. Thank you.

LikeLiked by 1 person

I will send you an email with some additional information. Thanks for reading. Yes, I am more interested in eternal investments and want to keep an eternal perspective in the investments I make in time and dollars.

LikeLike