Why Did I Review Walgreens Boots Alliance?

I have a subscription to the Wall Street Journal, Market Watch and Barron’s. None of these comes to our home in a paper format, as I learned several years ago that local delivery was a disaster. However, I have a one-year subscription with a monthly subscription price of $6.32 for all three. That makes it at least rational as a bundle.

Every Monday morning I take a look at Barron’s, but I only spend 5-10 minutes looking at three things: 1) Dividend increases for the previous week (table is called Dividend Payment Boosts), 2) The charts on the page called “Charting the Market”, and 3) the Preview page. Investing does not have to take a lot of time. I’d rather spend most of my time investing in the lives of others by teaching them the truths from God’s Word. Therein is eternal and lasting treasure to be found.

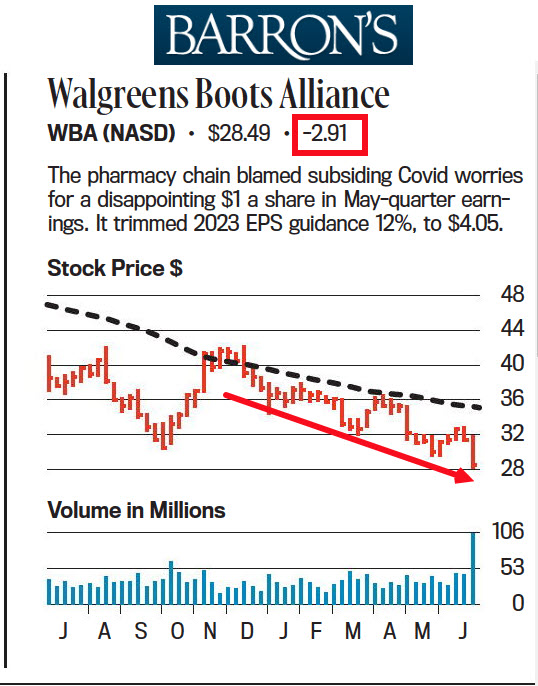

Charting the Market

The nice thing about “Charting the Market” is that it focuses on twelve different companies each week. The idea is to show major changes and trends in various businesses. I am looking for opportunities. Sometimes a stock is badly beaten down and that may present a buying opportunity. Sometimes a stock is on the rise, and that may be a different kind of buying opportunity.

Walgreens Boots Alliance’s Trend is Down

Although I no longer own shares of WBA, I have been in their stores. As many of my readers know, in some states Walgreens is located in highly visible locations. I usually see some cars in their parking lots, but the traffic (at least lately in the local stores) doesn’t seem to be encouraging. As a result, Walgreens needs to tighten their belts. I just read a story that said they were going to close 500 stores. That might be a good sign, but it also can mean that trouble is brewing.

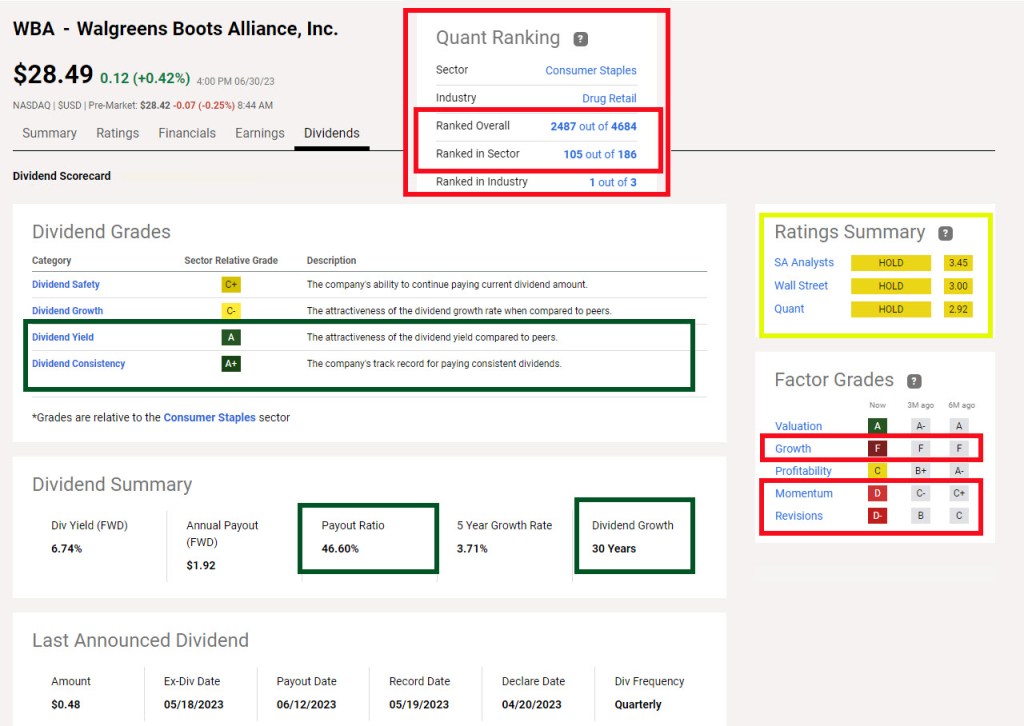

WBA’s Dividends

From a dividend history and dividend growth perspective, WBA is a decent investment. The dividend payout ratio is rational, and the yield is good. The five-year growth rate is acceptable, but not great. Part of this is due to the fact that earnings are not growing – they are declining.

Summary

For an investor with at least $250K in their retirement account, owning a small slice of WBA might be a good risk. Remember, the idea for a wise investor is to buy low and sell high.

Now we have to wonder, how low can it go? I wish I knew, but I will admit that I am now tempted to buy 100 shares or to sell a cash covered put option on WBA shares. If I sold one put option, that expires on Friday, July 7, I could get an immediate payment of about $27. Of course, if the shares drop to or below $28.50 at the market close on Friday, I am committed to buying one hundred shares of WBA for $2,850. Bear in mind, however, that my cost basis for the shares would be $28.23, because I earned $0.27 per share in selling the put.

Full Disclosure

Cindie and I do not own shares of WBA. However, I might trade options on WBA, and I will look for an opportunity to buy in the months ahead.

6.32$ for the bundle seems like a great deal. How did you get it?

LikeLike

I don’t recall if it was a mailing or an email. But it was a great offer so I decided to give it a try. I don’t read Market Watch, but I do scan Barron’s and the WSJ.

LikeLike