Sand is an Underappreciated Ingredient Gem

Sand can be used for so many different things. It is impossible to count all of the sand on all of the beaches of the world or in all of the world’s deserts. As children we played with sand. We built castles with sand. Silica, according to Wikipedia, is the “major constituent of sand.” Of course, there are different kinds of sands, including the white sands and black sands that I saw in Hawaii. Sand is so common that we forget how many uses we have found for this common particle. It is a building block.

The Companies that make stuff to make stuff for other stuff

Sometimes we forget that there are investment opportunities at the beginning of a building process. Many people recognize Dell, Microsoft, Apple, Ford, Tesla, IBM, and Hewlett-Packard. The stuff they make we use. That stuff is built using parts provided by other manufacturers. And the stuff those other manufacturers create is made by companies that create stuff from other stuff. One link in this chain in the semiconductor equipment manufacturer. Silica is an important ingredient, but it takes specialized equipment to make something of this common ingredient. Who makes this equipment? Semiconductor equipment manufacturers are a part of this chain.

What is a Semiconductor Equipment Manufacturer?

“The process of manufacturing integrated circuits is so complex that it could involve more than 50 different pieces of semiconductor equipment from the time silica is used as input to grow ultrapure ingots where wafers are taken from to the time integrated circuits built from these wafers are shipped to the customers.” Let this sink in: “fifty different pieces of semiconductor equipment.” Think of the inventions and the inventors. Think of the precision that is needed to build my Dell laptop, my iPhone, and my new Ford Escape.

“Equipment used in semiconductor manufacturing may be classified into three categories, namely, wafer fab, assembly, and test/back-end equipment. Obviously, this classification follows the three major semiconductor manufacturing processes, i.e., wafer fab, assembly, and test.” – From https://www.eesemi.com/semicon_eqpt.htm

Ticker Symbol KLAC Profitability

I don’t remember how I learned about KLAC. I was probably looking at other semiconductor stocks when I first realized I knew nothing about KLAC. After some research, I purchased my first 100 shares in 2017 for $90.80 per share. The second hundred was purchased in early 2018 for $122.10 per share. Thus far I have received $1,767 in dividends from my shares. But that is only part of the story. Those shares are now worth 117% more than what I paid for them. In other words, my original $21,295 investment has grown to $46,336.

Wallmine Screening

Many tools can be used to find similar investments. I use Seeking Alpha, Fidelity and Wallmine. Here are some of the companies similar to KLAC using Wallmine’s tool.

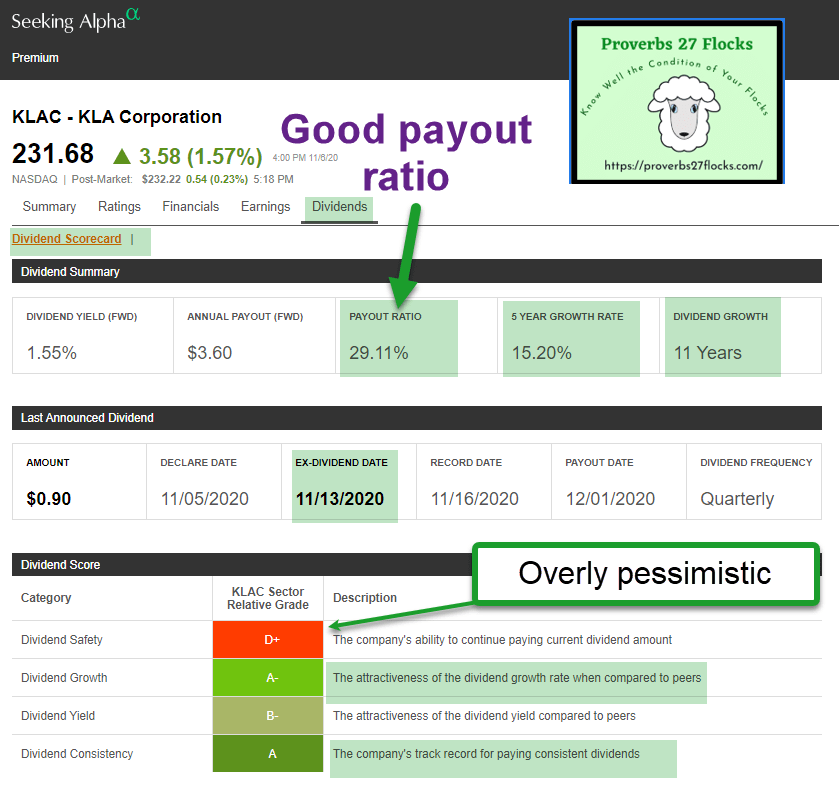

Seeking Alpha Dividend Results

As always, I am interested in the dividend payout ratio, the dividend growth, and the dividend history. Seeking Alpha makes that a simple exercise. KLAC shines as a good dividend growth investment.

When to Buy KLAC

The best time to buy KLAC is during a dip. If you are interested in KLAC, then you should set a Fidelity price alert that is lower than today’s price. Then watch for an opportunity to buy some shares. Because it is an expensive stock, start with 10 shares. Then add to those shares on the dip.

If you are an ETF investor, then the Invesco Dynamic Semiconductors ETF (PSI) might be a useful way to get into this sector. Another is XSD – SPDR S&P Semiconductor ETF.

Full Disclosure

Cindie and I own 200 shares of KLAC as a long-term investment.