Big Mistakes From Misguided Fund Choices

When I examine the statements and holdings of those who ask me for help, there is often a recurring theme. They have multiple mutual funds or ETFs that all do similar things with similar holdings. Their perception is “I am diversified.” That may be true, but the sad reality is that many funds have similar stocks in their top ten holdings.

For example, I think it is less than ideal to hold shares of ETF VTI plus shares of ETF VOO. VTI is “Vanguard Total Stock Market Index Fund ETF” and VOO is “Vanguard 500 Index Fund ETF.” Let’s say you put 50% of your money in VOO and the remaining amount in VTI. You haven’t really diversified your assets in any meaningful way. While no one I have helped has veered that far, there are often serious overlaps that create unnecessary long-term risk during bear markets.

Do you know the answer to this question: “What percentage of the S&P 500 is made up of the top ten stocks?” If you guessed 10% or 20% you are wrong. As of February 2026, the top ten stocks in the S&P 500 account for approximately 31% of the total index market capitalization. This figure highlights the significant weight that a small number of companies have in the overall index, which can heavily influence its performance. During bull runs this can be wonderful. During bear markets it can prove very disheartening.

How about this question: “What percentage of the Total stock market is made up of the top ten stocks?” As of February 2026, the top ten stocks in the total stock market account for approximately 32.4% of the entire market capitalization. I would argue that it makes more sense to hold shares of the Vanguard Total Stock Market Index Fund ETF (VTI) and avoid VOO altogether.

The total returns of the S&P 500 over the last ten years have been 256% according to Seeking Alpha. For VTI the total returns are 301% while VOO has returned 316%. While VOO has slightly higher returns, it also has far less diversification. VOO holds 517 positions and VTI holds 3,521.

Three Dividend Growth ETFs

The three that we own and that I recommend are SCHD, DGRO, and VYM. While there is some overlap in the top ten of these three ETFs, they are not the same. In fact, just comparing the number one company stock in all three will reveal a different company.

Finding Peer ETF Funds

While you can use Seeking Alpha to find peer stocks, for today’s example I will look at Seeking Alpha’s ability to reveal peer ETFs. The main menu has “Peers” as one of the options. Therefore, if you are considering ETF VYM, when you select Peers you will probably see HDV, DIS, DGRO, DVY, and SDY. All of these claim to be variations of the high dividend, dividend growth, or other dividend-producing investments.

Using this tool helps me notice some values that I want to see for any fund I purchase. Let me step you through the things I consider.

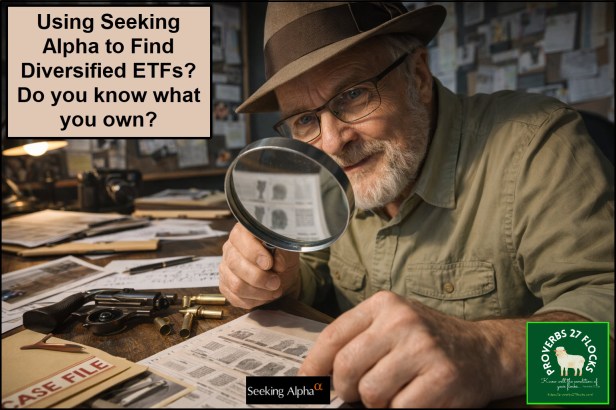

Fund Size, Expense Ratio, and Total Returns

For the most part, the larger the AUM (assets under management) the better. When it comes to ETFs, don’t chase the little guys unless you are focused on a sector or specialized fund. Also, expense ratios matter. If you can buy similar products and one is less costly, then don’t overpay. Finally, total returns over ten years are a good indication of the success of the fund manager.

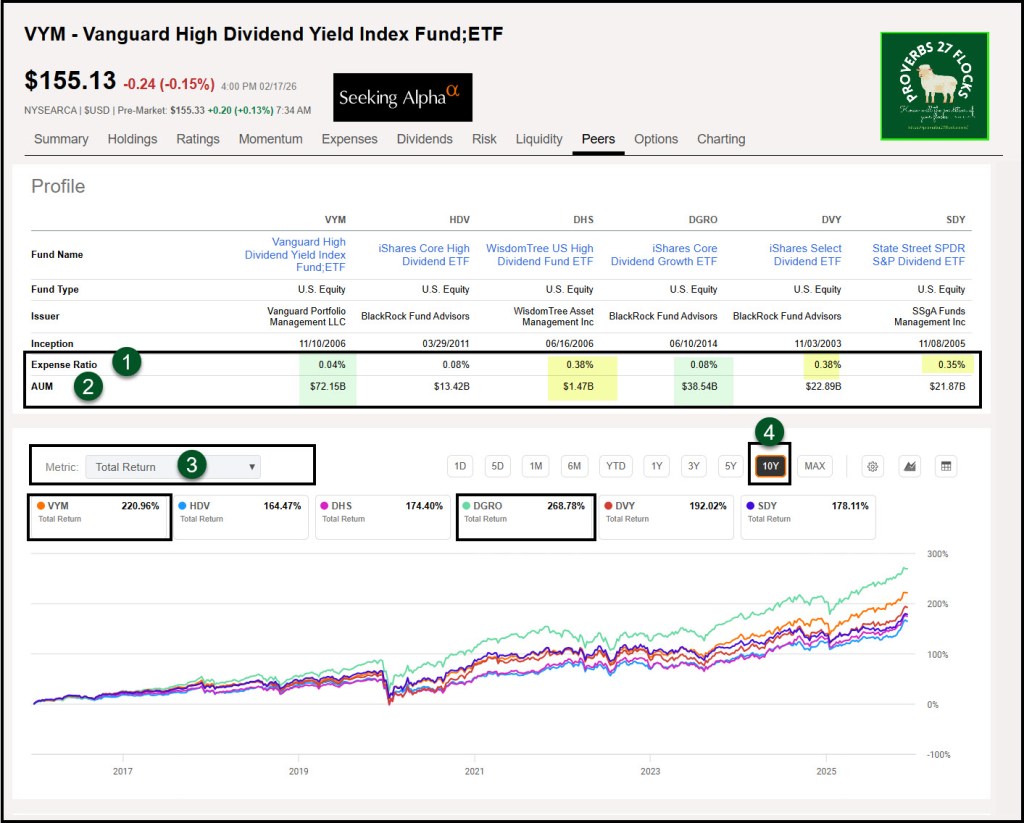

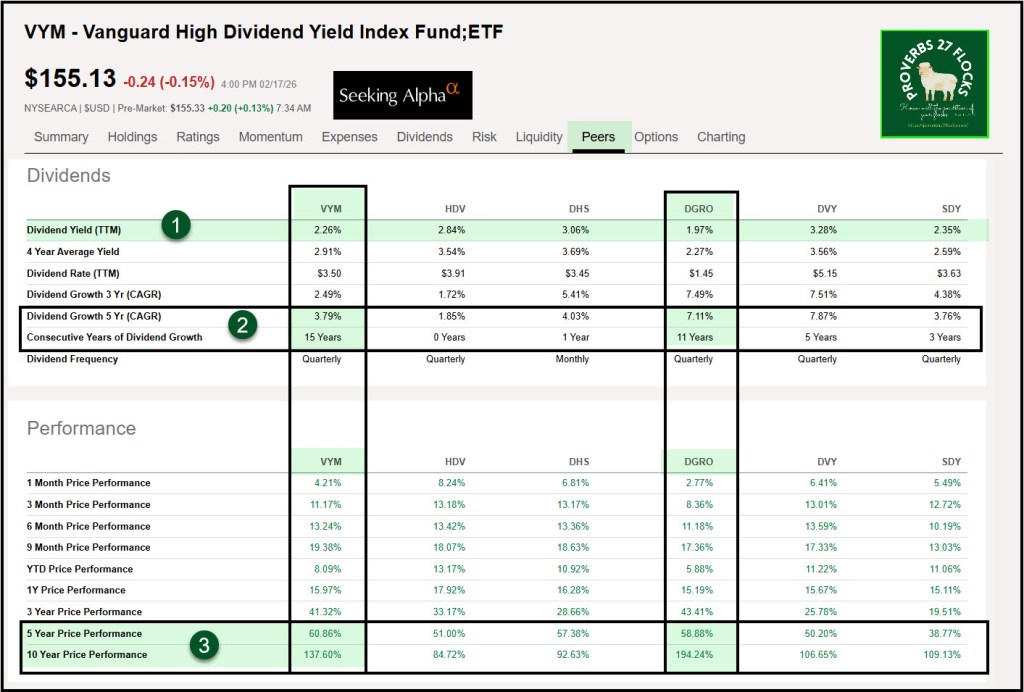

Price Returns

It is prudent to find funds with good price returns. Again, VYM and DGRO seem to offer better long-term prospects for those who want to see their account balance growing.

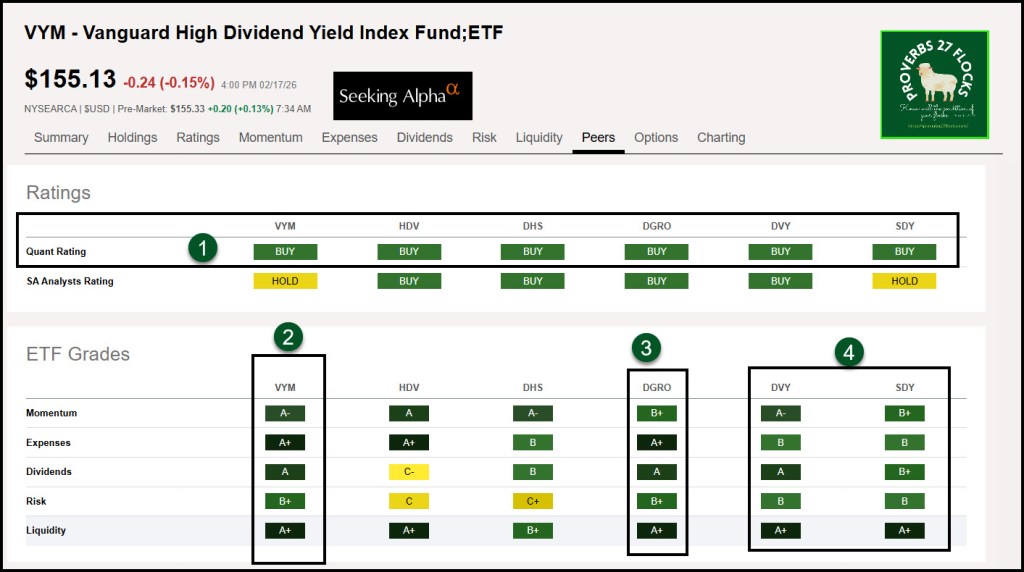

Ratings and ETF Grades

When is it wise to buy an ETF that has a low QUANT rating? For the average investor it is never wise. Therefore, all of the peer funds seem to be OK in that respect. However, when it comes to dividends and risk, I would be inclined to avoid HDV and DHS.

Dividends and Performance

You should expect dividend growth when you are investing in most dividend-producing assets. You should also see some history that says the dividend has been growing for at least five years. Seeking Alpha also makes it easy to see performance over several time periods.

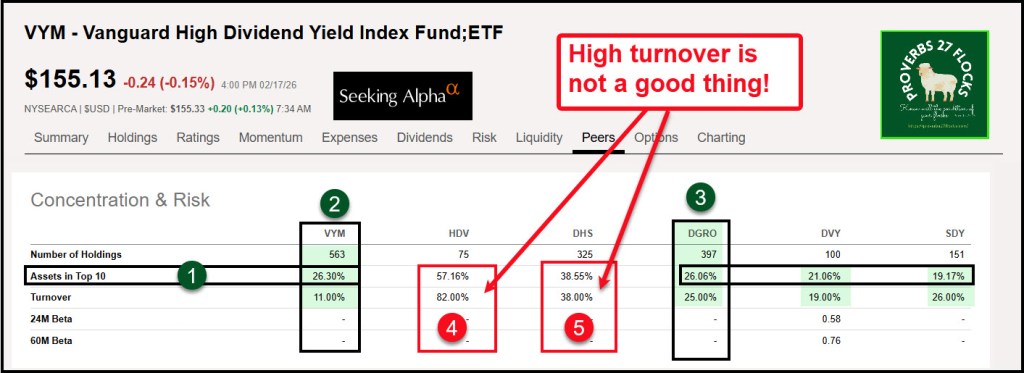

Concentration, Risk, and Turnover

If a fund has high turnover, it means the fund manager cannot seem to settle on a solid long-term perspective for how the fund should be structured. They are buying and selling at a frequency that increases costs and adds risk. HDV and DHS are clearly funds I would avoid.

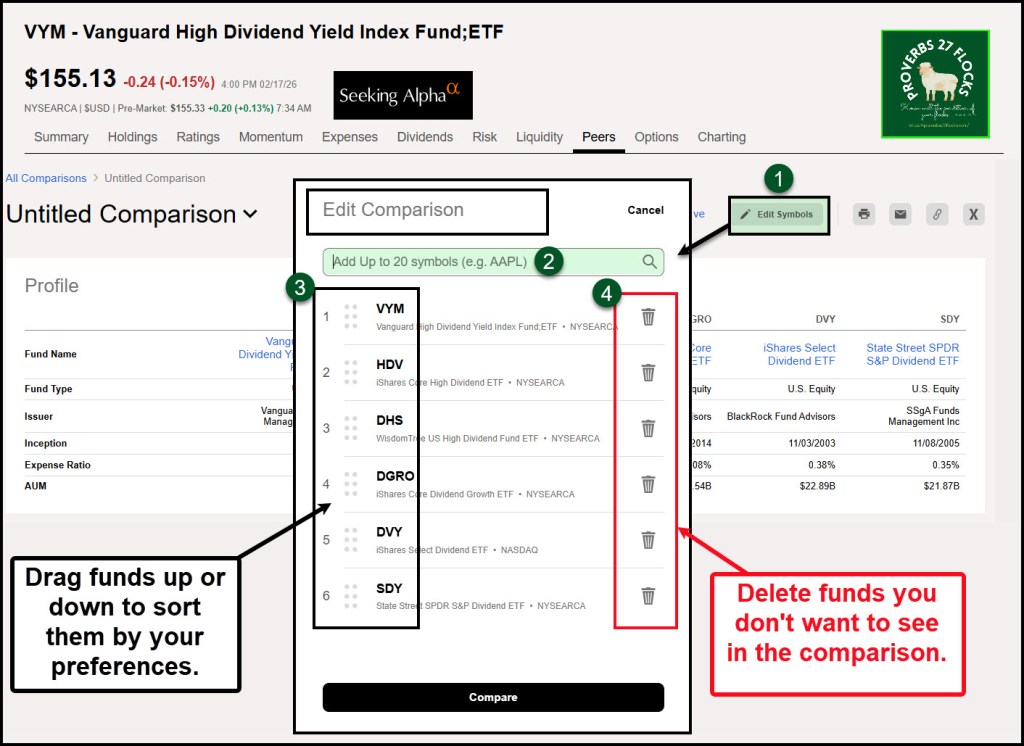

Edit the List of Funds

Finally, a feature I often use is to delete, add and sequence the list of funds. Why look at funds you dislike based on an initial view? Furthermore, if you save your list, you can then add other tickers that come to your attention in the future. For example, if you want to see SCHD in the list, just add it.

Rate Your Advisor

Let me encourage you to enter the funds your advisor recommends into the Seeking Alpha tool. I suspect that you will learn some things about the nature of the investments they recommend. IF you use Seeking Alpha to rate your investments it could change your view of your financial advisor.

Recommendations

I will continue to recommend VYM, SCHD, and DGRO until I find something better. I don’t think I will.

Seeking Alpha Subscription Information

Of all of the resources I use, the most helpful is Seeking Alpha. If you decide to explore a Seeking Alpha subscription, please use the following link. Seeking Alpha

SEEKING ALPHA INFORMATION AND SUBSCRIPTION

You can also scan this QR Code to get the same information.

Past performance does not guarantee future results, Seeking Alpha does not provide personalized advice, and it is not a registered investment adviser.

We accept advertising compensation from companies that appear on our site. This website represents my opinions, which may not reflect those of Seeking Alpha, and does not constitute an investment recommendation or advice.

If you have any questions or problems getting connected to Seeking Alpha, reach out to them with this email address: subscriptions@seekingalpha.com